What are award travel blackout dates — and how do you avoid them?

If you're a regular TPG reader, you know that collecting and redeeming travel rewards can be the most powerful strategy to deeply discount your upcoming travels.

The arch nemesis of a points and miles enthusiast is blackout dates. They can render the rewards you earn with your travel credit cards absolutely useless, turning a pennies-on-the-dollar trip into a wildly exorbitant affair. Fortunately, there are tricks to combat blackout dates. Here's what you need to know to have the most success when booking award travel.

What are travel blackout dates?

In short, blackout dates are specific periods in which you're unable to earn or redeem airline miles, hotel points, vouchers, etc. for travel. They most typically apply to travel promotions such as flash sales, restricting you from traveling during peak season dates.

Related: Your ultimate guide on how to search award availability for the major airlines

Blackout dates are actually becoming a thing of the past. Most major airline and hotel loyalty programs no longer enforce blackout dates, allowing you to redeem rewards for virtually any airline seat or hotel room available. Even if a "saver" award (the cheapest price) is no longer available, you can often still use rewards. You'll just pay an astronomical price.

Another trick these programs use to foil your award travel is known as "capacity control." Seemingly arbitrarily, an airline or hotel may only release a specific number of saver-level awards at a time — even if there's availability. This will result in either sky-high award prices or a complete inability to book an award. The dates on which loyalty programs do this are almost never publicly listed, so it's difficult to know when it's happening to you.

Airline award blackout dates

The major U.S. carriers, such as American Airlines, Delta Air Lines, United Airlines, Alaska Airlines, Southwest Airlines and Hawaiian Airlines, brag about their lack of blackout dates when traveling on their own metal. If there's a seat available, you can book it with points or miles.

That doesn't mean it'll be cheap, though. For example, a business-class flight on United Airlines might cost as little as 80,000 miles or as much as 200,000 miles. If you need the seat, it's nice to at least have the option of redeeming rewards — even if it's a rip-off.

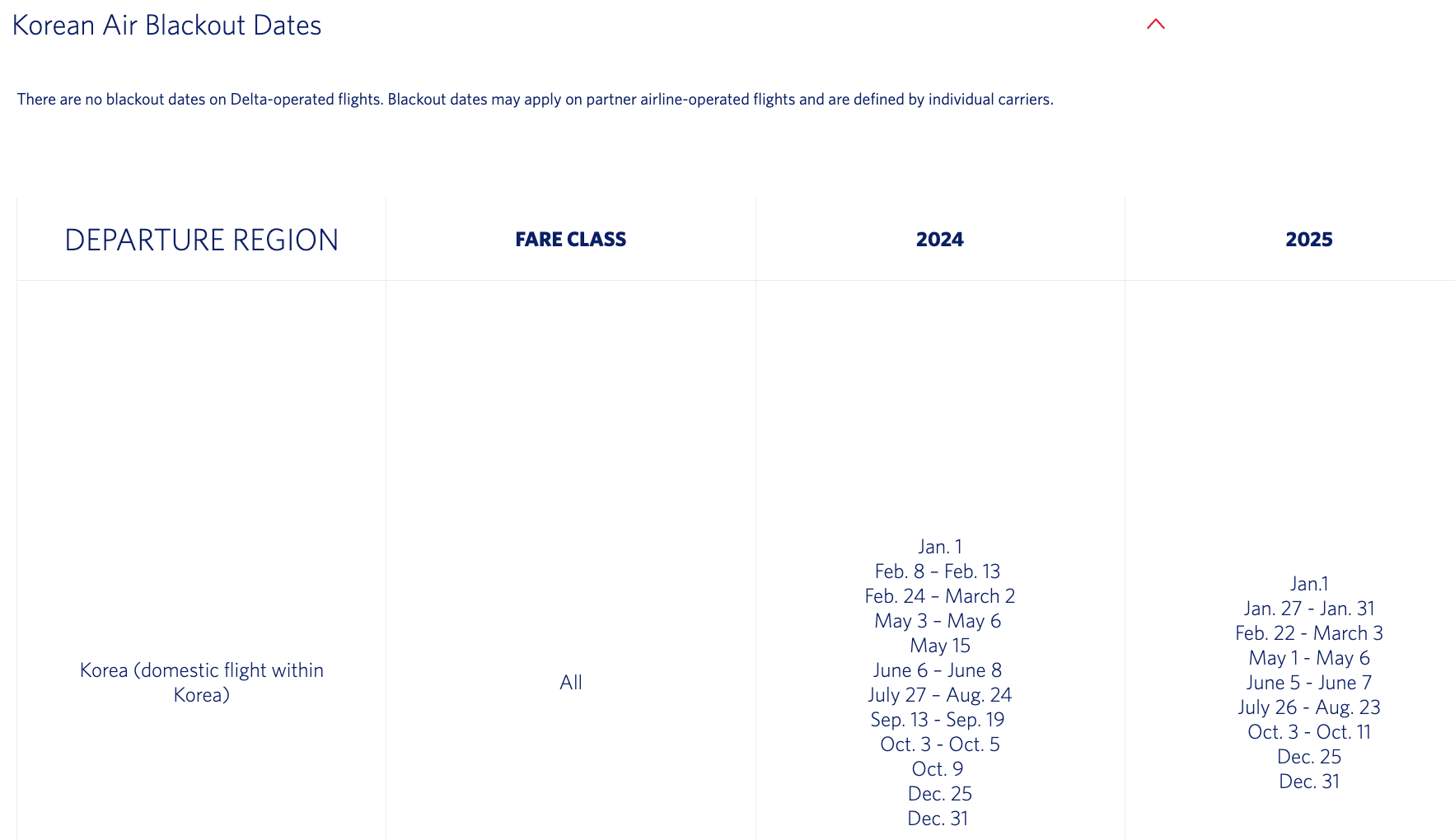

There are some exceptions to the no blackout dates tradition. JetBlue publishes a sizable list of blackout dates for using travel certificates on select routes. Also, redeeming miles on select Delta partners, such as Korean Air, may be subject to blackout dates on specific routes.

Hotel award blackout dates

Similar to airline programs, hotel programs like Hilton and Marriott generally allow you to reserve just about any room available. But unless there are standard rooms (often the lowest room category), you'll pay out the nose.

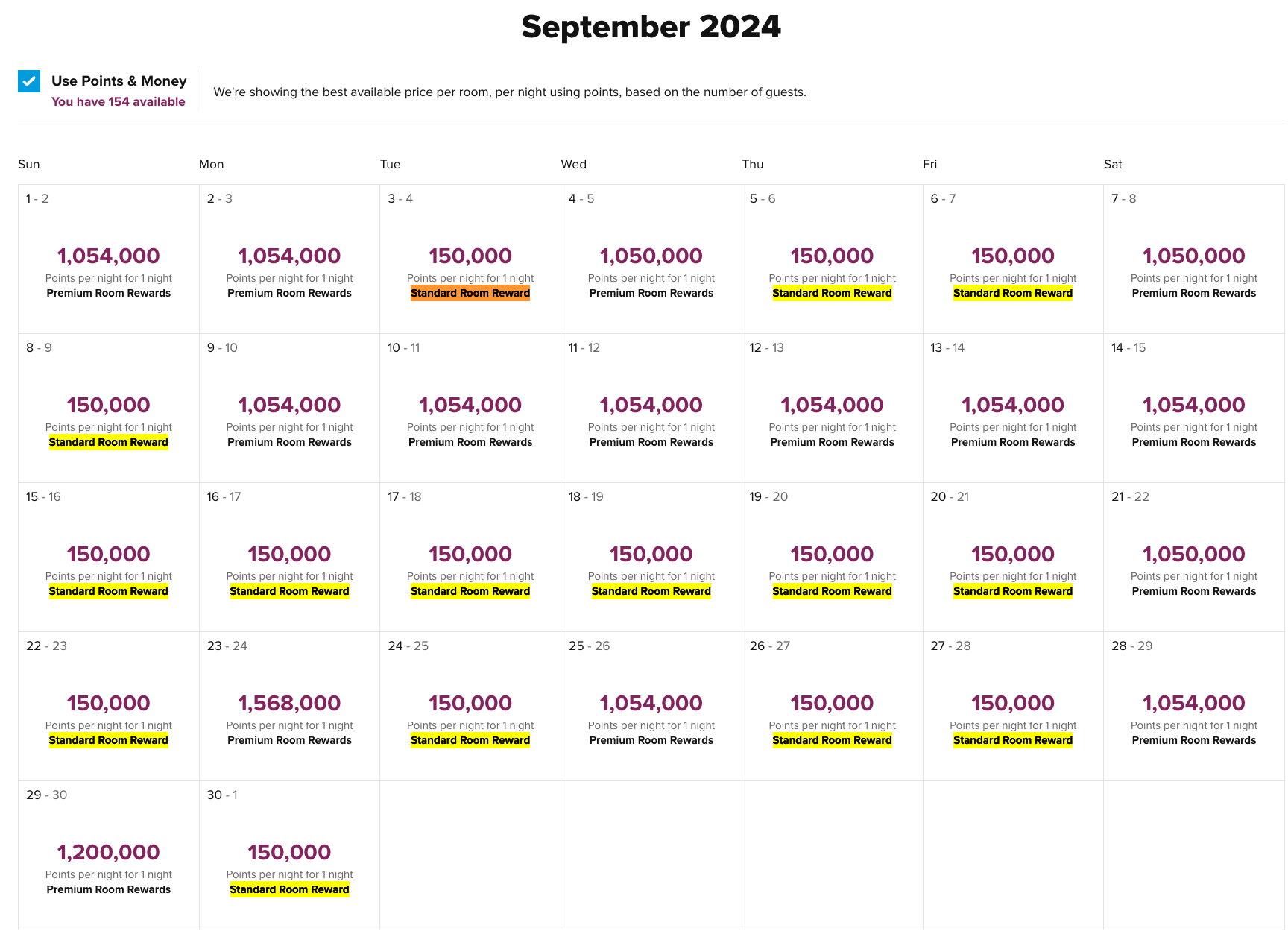

Below is the award calendar of the Waldorf Astoria Maldives Ithaafushi for fall 2024. Standard rooms cost 150,000 points (which sounds like a lot, but rooms here sell for over $2,000 per night). If standard rooms aren't available, you can opt to book a more premium room, all of which are going for over 1 million points per night. So, while it's technically possible to book these rooms, it's a bad, bad deal.

Related: Book low-end or luxury hotels to get the best value from your points

Other programs, such as Hyatt and IHG, also claim not to operate with blackout dates. However, they may only allow you to use points for select suites. In other words, the hotel may have plenty of standard rooms available — but none may be eligible for award stays.

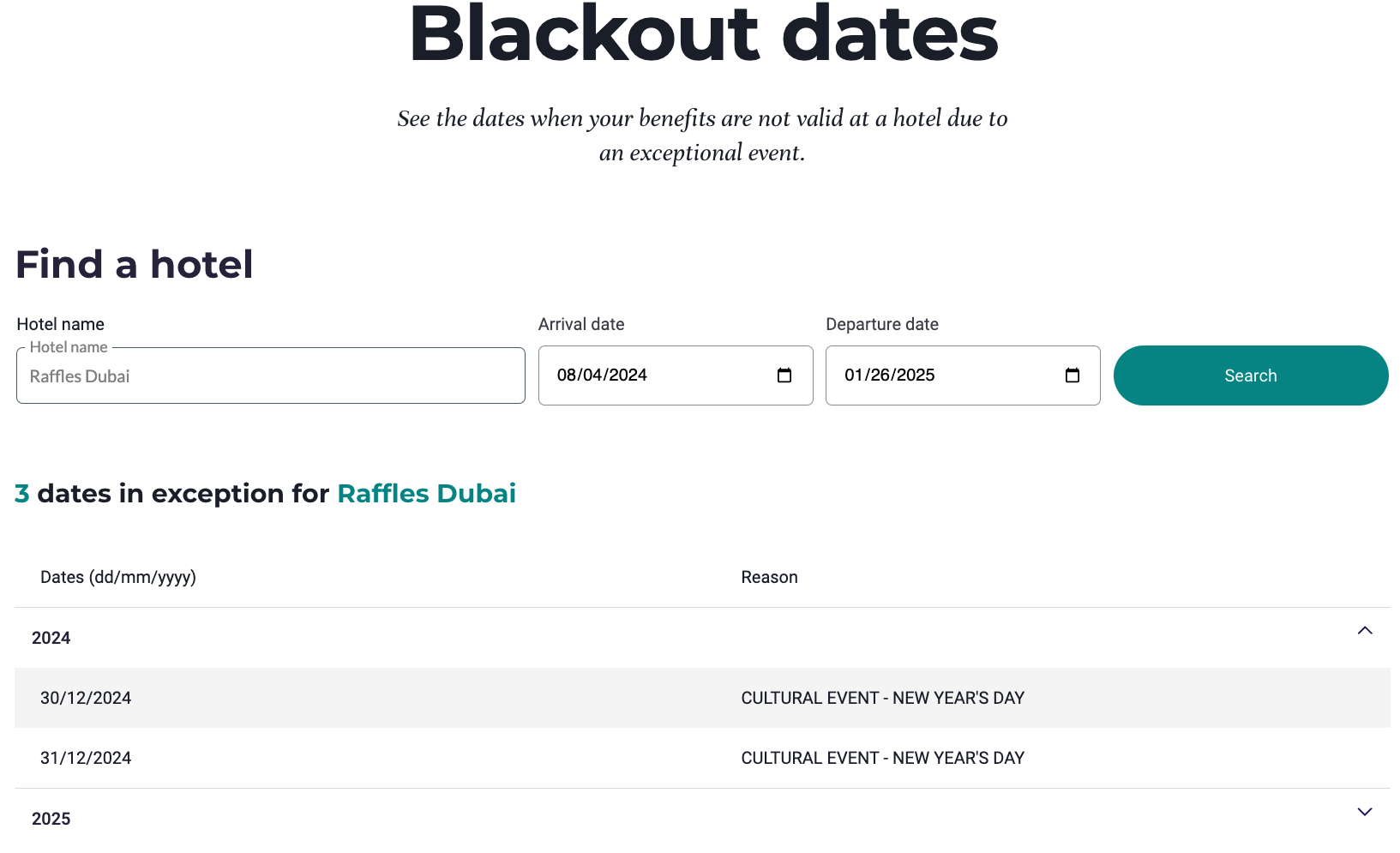

Beyond these, Accor and Wyndham both stipulate that you may be subject to blackout dates that vary by property.

How to avoid blackout dates

The most obvious solution to sidestep blackout dates is to keep your travel dates flexible. In fact, this is the single best quality an award traveler can have. If your vacation is flexible, you can search for prices months at a time to find the best deals — potentially saving tens (even hundreds) of thousands of points, depending on your itinerary.

A hotel-specific trick is to toy with the length of your stay. For some aggravating reason, some hotel brands (looking at you, Hilton and Hyatt) may not display standard rooms unless you're staying a specific amount of nights. If you can't seem to find the dates you're looking for, try extending your stay by a day or two (or three). You may find that standard rooms that you can book with points magically appear. You'll then have to contact the hotel to get the unwanted nights removed.

But perhaps the single most foolproof method for conquering blackout dates is by redeeming Capital One miles at a fixed value of 1 cent per mile to offset paid travel. Buy your airfare or hotel stay with your Capital One miles-earning credit card, such as the Capital One Venture Rewards Credit Card. You'll have 90 days from your purchase date to redeem your miles for travel-related purchases.

Related: How to find hotel award availability: Use these tricks during your search

Bottom line

Blackout dates are the bane of every award traveler. Fortunately, they're becoming less common.

Over the years, travel programs have vastly expanded the ability to book flights and hotel stays with rewards. However, in many cases, they charge exponentially more to book the last available seat or room.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app