Air India Flying Returns: How to earn and redeem points, elite status and more

Air India is refreshing its identity. It has placed a massive aircraft order, rolled out new crew uniforms, adopted a new aircraft livery and begun installing refreshed seats.

Alongside a new website, the airline has also revamped its Air India Flying Returns loyalty program. Here's what you need to know about the updated Air India Flying Returns program.

What is Air India Flying Returns?

Air India Flying Returns is the loyalty program for Air India. You can earn and redeem reward points within the Flying Returns program and earn tier points toward elite status.

Air India is a Star Alliance airline, so you may be interested in its loyalty program even if you don't frequently visit India or fly on Air India.

Related: The best ways to fly to India with points and miles

How to earn Flying Returns points

Within the Air India Flying Returns program, there are two types of points: reward points and tier points. You can redeem reward points for award flights and upgrades, while tier points are what you need to earn Flying Returns elite status.

Reward points expire 24 months after you earn them, but you can extend the expiration date of all your reward points each time you fly on a paid flight operated by Air India.

Earn reward and tier points on Air India flights

You can earn reward and tier points on Air India flights. You'll earn reward points as follows on Air India flights:

- Red elite members: 6 reward points per 100 Indian rupees (about $1.20)

- Silver elite members: 8 reward points per 100 Indian rupees

- Gold elite members: 9 reward points per 100 Indian rupees

- Platinum elite members: 10 reward points per 100 Indian rupees

Plus, you'll earn 2 bonus reward points per 100 Indian rupees when you book using the Air India website or mobile app. You also earn 6 tier points per 100 Indian rupees spent on Air India flights regardless of your Flying Returns elite status tier.

Earn reward and tier points on Star Alliance flights

You can earn reward and tier points when you fly in eligible fare classes on Star Alliance airline partners. You'll earn reward points based on your flight distance and fare class, as shown on the partner airlines page. You'll also earn 1 tier point per 2 reward points when flying on Star Alliance partner airlines.

Other ways to earn reward points

You can also earn reward points (but not tier points) with select partners. Here's a quick overview:

- Air India credit cards: Residents of India can apply for an Air India credit card that earns reward points. There aren't currently any cobranded Air India credit cards available to U.S. residents.

- Convert transferable points: Some banks within India allow cardmembers to transfer rewards to Air India. However, Air India isn't a transfer partner for major U.S. transferable reward currencies.

- Stays: Several regional hotel brands and properties in India let Flying Returns members earn 5 to 20 reward points per 100 Indian rupees spent on stays.

- Car rentals: Three lesser-known car rental companies — Bookairportcab.com, Discover Cars and Zoomcar — let Flying Returns members earn 5 to 10 reward points per 100 Indian rupees spent.

- Experience and lifestyle purchases: Several merchants, including Antara River Cruises and Sherpa, let Flying Returns members earn 5 to 25 reward points per 100 Indian rupees spent. Meanwhile, one merchant offers a much lower 5 reward points per 4 euros (about $4.27) spent.

Unfortunately, most of these other ways to earn reward points won't help travelers who don't spend extensive time in India. Some are inaccessible if you aren't eligible for credit cards issued by Indian banks.

Related: Staying at the only Category 1 Park Hyatt: My review of the Park Hyatt Chennai

Air India Flying Returns elite status

The Air India Flying Returns program has four tiers, including an entry-level Red tier with no requirements. To reach the other tiers, you must meet specific requirements for tier points or flights with Air India and its Star Alliance partner airlines over the last 365 days.

Once you meet the requirements for a new elite status tier, you'll enjoy its benefits for one year. After that point, you'll be downgraded based on your activity within the last 365 days.

Qualification requirements for each Flying Returns elite status tier are as follows:

- Red: No qualification requirements

- Silver: 15,000 tier points (with at least 4,500 tier points on Air India) or 30 flights (with at least four flights on Air India)

- Gold: 30,000 tier points (with at least 9,000 tier points on Air India) or 60 flights (with at least eight flights on Air India)

- Platinum: 45,000 tier points (with at least 13,500 tier points on Air India) or 90 flights (with at least 12 flights on Air India)

The primary benefit of Flying Returns Red status is the ability to earn and redeem points. Here's a look at the primary benefits you can expect at each Flying Returns elite status tier above what you'd get at the previous tier:

- Silver: Star Alliance Silver status, 50% off on standard seats on domestic Air India flights, one upgrade voucher for a domestic Air India flight, priority check-in and boarding, less expensive change fees on domestic Air India flights, the ability to check 10 kilograms (about 22 pounds) more on Air India flights where the free baggage allowance uses a weight-based system and priority waitlist clearance

- Gold: Star Alliance Gold status, lounge access with one guest, free standard seat selection on Air India flights, two upgrade vouchers for domestic flights, Fly Early benefit on domestic Air India flights, the ability to check 20 kilograms (about 44 pounds) extra or one piece more on Air India flights and Star Alliance partner flights, one free change per ticket on domestic Air India flights up to 24 hours before departure (and on international Air India flights up to 72 hours before departure) and less expensive cancellation fees for domestic Air India flights

- Platinum: free seat selection on Air India flights, three upgrade vouchers for domestic flights, two free changes per ticket on Air India flights up to 24 hours before departure and waived cancellation fees on domestic Air India flights

If you don't frequently fly on Air India, the primary benefit of status will be the Star Alliance status you can get. However, you must reach Gold for Star Alliance Gold status before seeing any significant benefits.

Related: This 232-year-old fort is part of Hyatt's luxury Alila brand: Here's why I loved my stay

How to redeem Flying Returns points

You can redeem Flying Returns points for Air India flights, Star Alliance partner flights and upgrades on Air India flights.

Redeem points on Air India

You can redeem points for flights or upgrades on flights Air India operates. I haven't found an award chart for flights or upgrades, but you can check the rates for specific routes using the Flying Returns points calculator.

Here's the award flight and upgrade rates I found using the calculator for a few one-way routes (the calculator wouldn't give me the award cost for premium economy or business awards on these routes):

- Mumbai to Jaipur, India: 6,000 points for a Value economy award flight, 8,000 points for a Prime economy award flight and 12,000 points to upgrade from economy to business

- Mumbai to Delhi, India: 5,000 to 7,500 points for a Value economy award flight, 9,500 points for a Prime economy award flight and 15,500 points to upgrade from economy to business

- Bengaluru to Delhi, India: 7,800 to 8,000 points for a Value economy award flight, 12,000 points for a Prime economy award flight and 23,000 points to upgrade from economy to business

- Delhi to Chicago: 65,000 points for a Value economy award flight, 84,000 points for a Prime economy award flight, 42,000 points to upgrade from economy to premium economy and 110,000 points to upgrade from economy to business

- Delhi to San Francisco: 77,000 points for a Value economy award flight, 103,000 points for a Prime economy award flight, 47,000 points to upgrade from economy to premium economy and 108,000 points to upgrade from economy to business

Redeem Flying Returns points on Star Alliance partners

Air India claimed all Star Alliance partners would be bookable online when the revamped program launched in early April. However, the Air India website still notes that you can only book award flights operated by United Airlines, Lufthansa, Air Canada, Singapore Airlines, Air New Zealand and Austrian Airlines online. You must call to book award flights operated by other Star Alliance airlines.

You can only book one-segment awards on Star Alliance airlines, and there's no published award chart for Star Alliance partners. Instead, Flying Returns members are instructed to enter their flight details into the points calculator to see award rates. However, each Star Alliance partner route I entered into the calculator gave me a "No routes found" error.

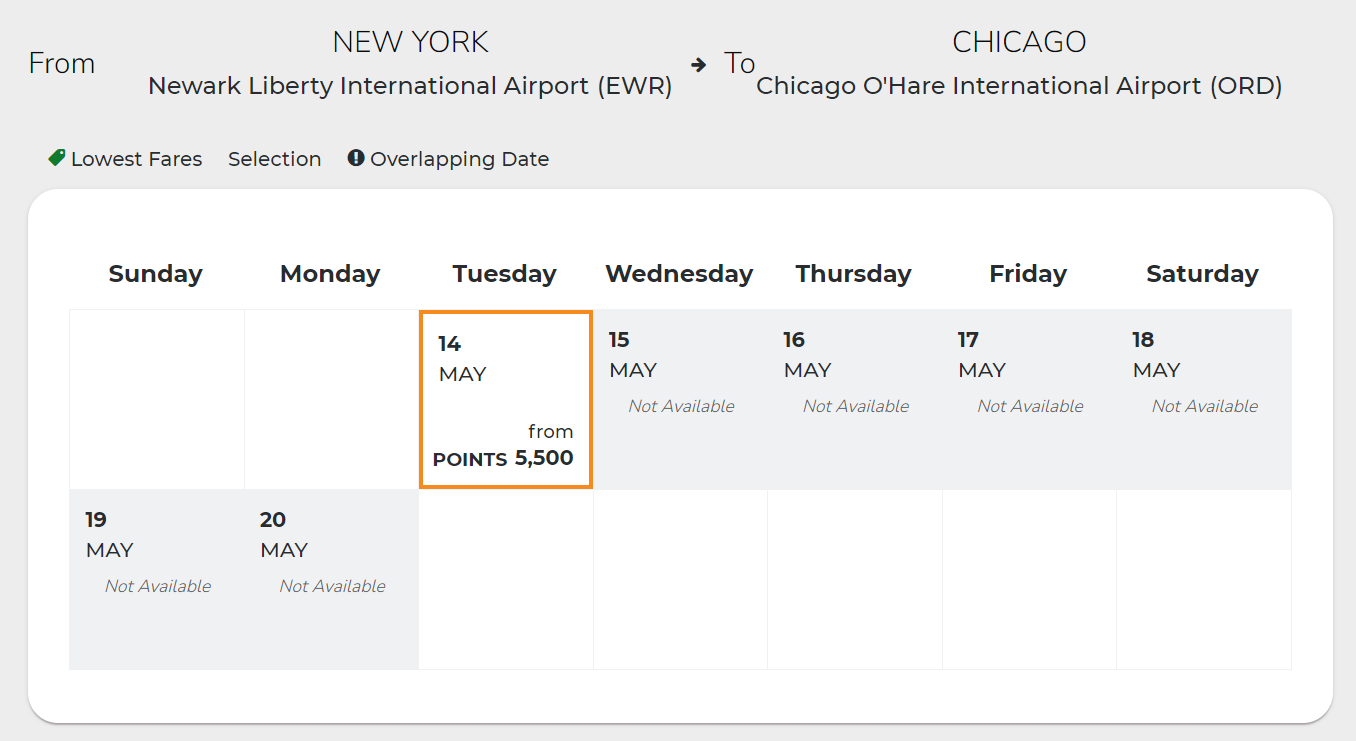

Undeterred, I headed to the award booking tool and found I could book an economy award flight from Newark Liberty International Airport (EWR) to Chicago's O'Hare International Airport (ORD) on at least one date for 5,500 points. I don't have 5,500 points in my account, so the website wouldn't let me see the taxes and fees on this award.

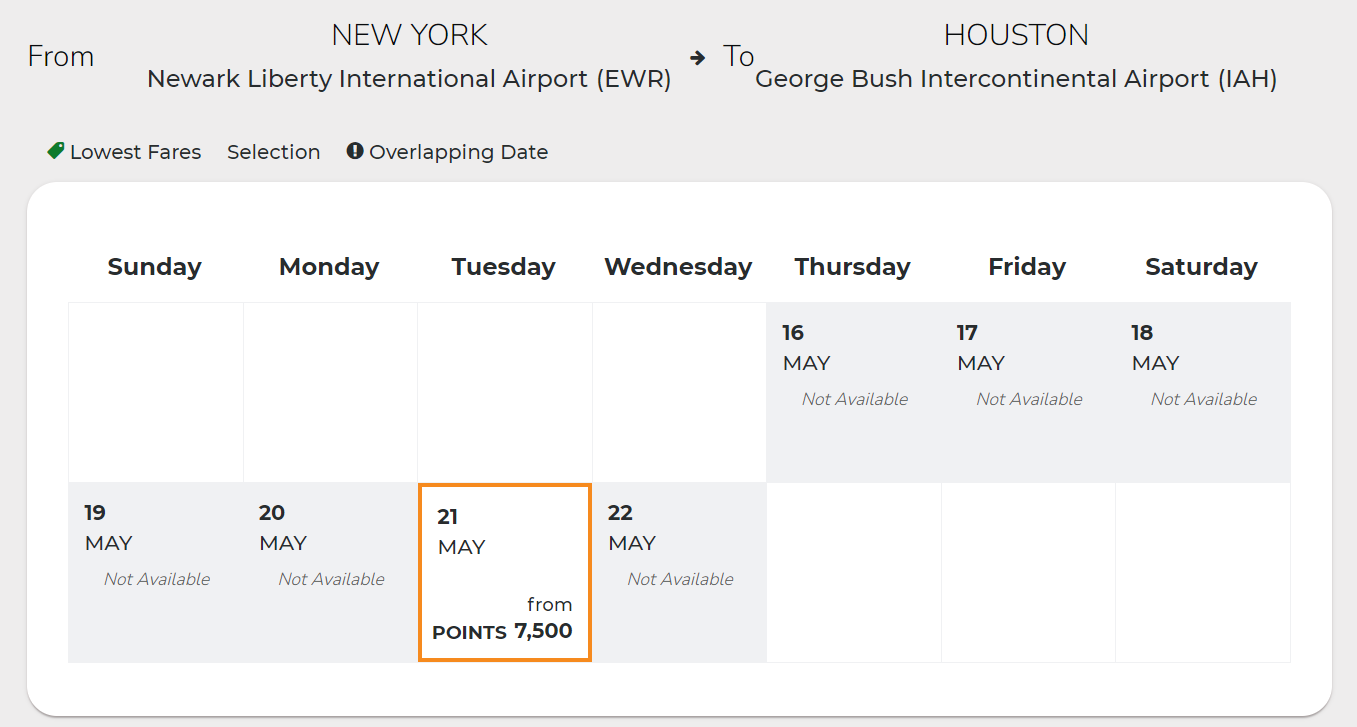

I also found a date on which I could book an economy award flight from EWR to Houston's George Bush Intercontinental Airport (IAH) for 7,500 points.

You can also redeem Flying Returns points for upgrades on Star Alliance flights. However, with the points calculator not working for Star Alliance partner routes and without a potential flight to update, I couldn't see the upgrade rates.

Related: The best websites to search for Star Alliance award availability

Best credit cards to book Air India flights

Out of the cards available to U.S. residents, you'll want to use some of our best cards for airfare when booking Air India flights. My favorite is the Ink Business Preferred® Credit Card (see rates and fees), which offers 3 points per dollar spent on purchases in select categories, including travel (on the first $150,000 spent in combined purchases each account anniversary year), trip delay protection and delayed baggage protection.

If you aren't eligible for a business credit card, here are some of the best personal cards and what they earn on flights:

- The Platinum Card® from American Express: 5 points per dollar spent on flights booked directly with airlines or through American Express Travel® (on up to $500,000 on these purchases per calendar year, then 1 point per dollar)

- Chase Sapphire Reserve® (see rates and fees): Earn 8 points per dollar spent on purchases through Chase Travel℠, and earn 4 points per dollar spent on flights and hotels booked direct.

- American Express® Gold Card: 3 points per dollar spent on flights booked directly with airlines or through American Express Travel

- Citi Strata Premier® Card (see rates and fees): 3 points per dollar spent on air travel

- Chase Sapphire Preferred® Card (see rates and fees): 5 points per dollar spent on flights purchased through Chase Travel and 2 points per dollar spent on other travel

These cards are great regardless of whether you're booking a paid flight or an award flight. Remember that it may be worth using a card with a lower earning rate if it offers better travel insurance benefits, especially in cases when you're only paying the taxes and fees for an award flight.

Related: The best credit cards with travel insurance

Bottom line

Air India didn't have the best reputation historically, as covered by TPG contributors in past stories about a honeymoon disaster and a horrendous transatlantic flight. Thankfully, it seems the airline and its loyalty program are improving, even though its points calculator and award search aren't as functional as I'd like.

Air India says it may add transfer partners and credit cards for U.S. residents in the future. But until then, there's little reason for most travelers based in the U.S. to utilize Air India Flying Returns.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app