TrueBlue deals: Spring flights to Mexico, Caribbean for as little as 4K points one-way

If you're in the market for a warm-weather destination in the final weeks of winter or plotting a spring break trip, you may want to check your stash of JetBlue TrueBlue points.

JetBlue is offering some pretty intriguing late winter and early spring deals to places like Mexico, the Caribbean and Central America.

In some cases, you may be able to find a one-way flight to a destination like Cancun, Mexico, or Aruba for as little as 4,000 TrueBlue points.

You may need to act quickly: Some of the best award availability — at least at this price point — falls over the next couple of weeks.

In fact, if your weekend plans this weekend are free, you may be able to snag a last-minute ticket to somewhere warm ... and near the ocean.

Deal basics

Airline: JetBlue

Routes: New York to various destinations in Mexico, the Caribbean and Central America

Travel dates: February through March, April or May, depending on the route

How to book: Directly with the airline

Advice for this deal

In keeping with the nature of dynamic pricing, JetBlue's award pricing fluctuates from one day to the next and from one route to the next.

However, what we found are TrueBlue prices that are generally trending in the 4,000- to 7,000-point range one-way.

Most of the availability is for the New York City area, though if you live in New England or South Florida, you may want to plug in some destinations out of JetBlue hubs Boston Logan International Airport (BOS) or Fort Lauderdale-Hollywood International Airport (FLL) and see what you can find.

Specifically, in New York, the best deals seemed to be out of John F. Kennedy International Airport (JFK) and Newark Liberty International Airport (EWR), so if you're open to flying from either, just put "New York City" as your origin instead of a specific airport.

Finally, because this deal is fairly widespread, we recommend casting a wide net and plugging in various destinations JetBlue serves in Mexico, the Caribbean and Central America to see what appeals to you.

Sample flights

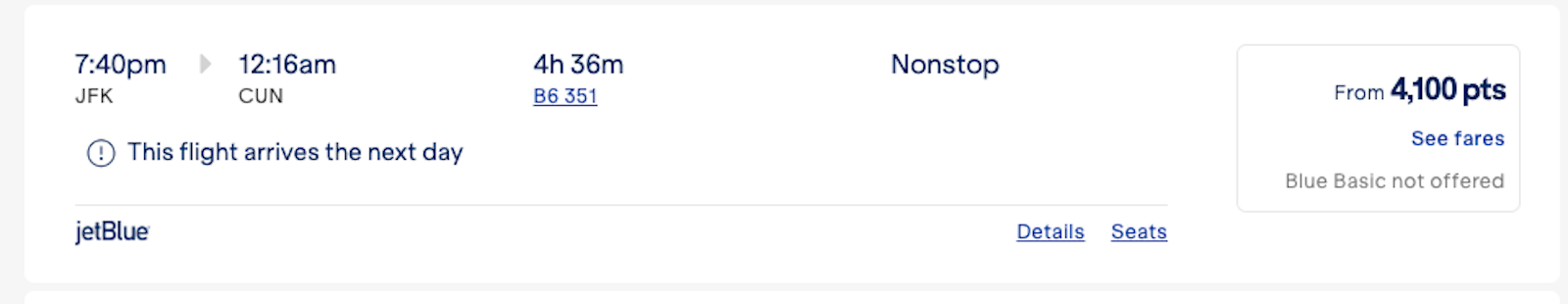

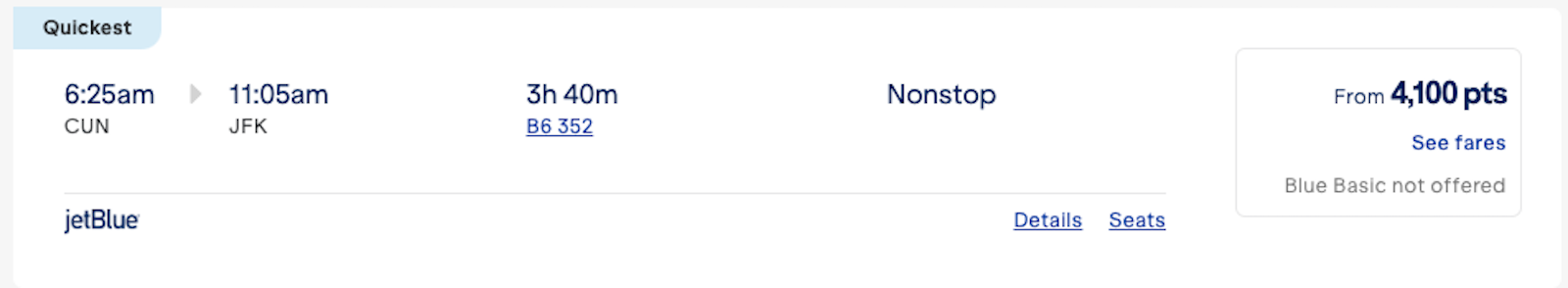

Here's an example of a round-trip flight from JFK to Cancun International Airport (CUN) in early March that's currently available. It's priced at 4,100 TrueBlue points in each direction.

TPG values TrueBlue points at 1.4 cents per point, so the value of that 8,200-point round-trip itinerary is around $114.

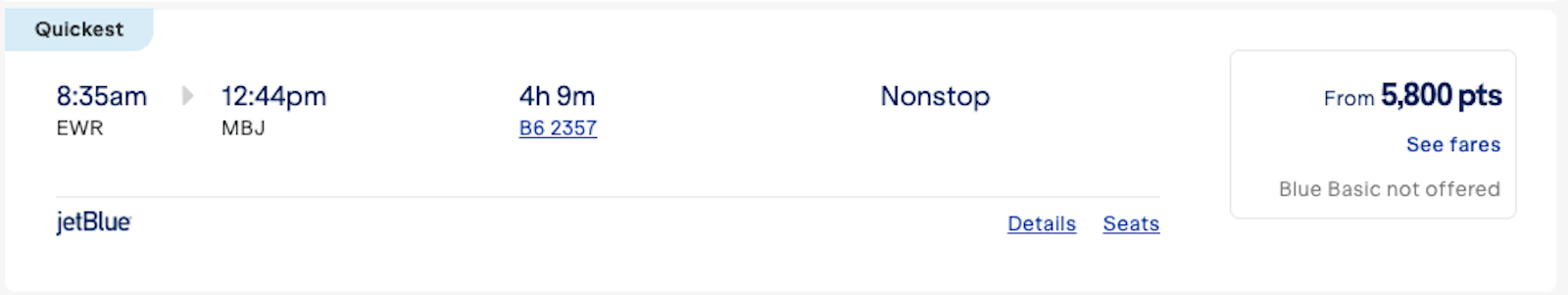

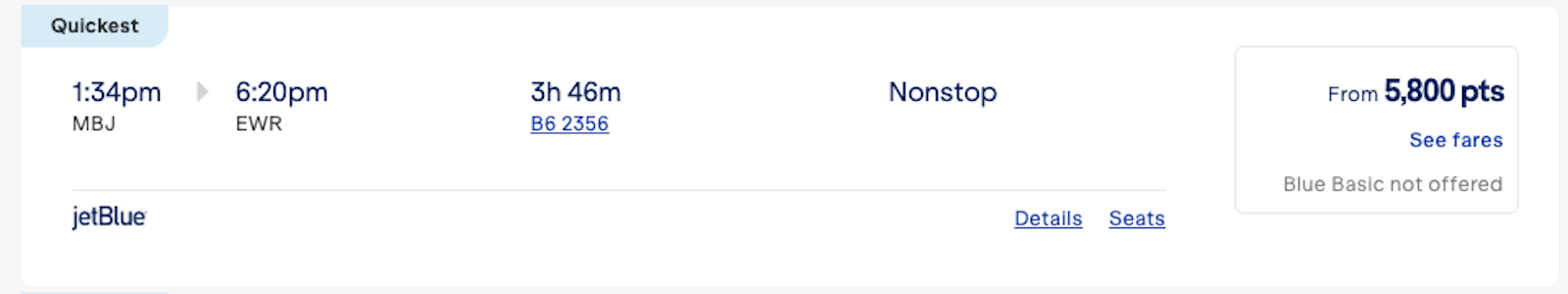

Considering Jamaica? Here's one-way pricing out of EWR to Sangster International Airport (MBJ) in Montego Bay starting at 5,800 points.

That comes to 11,600 points round trip.

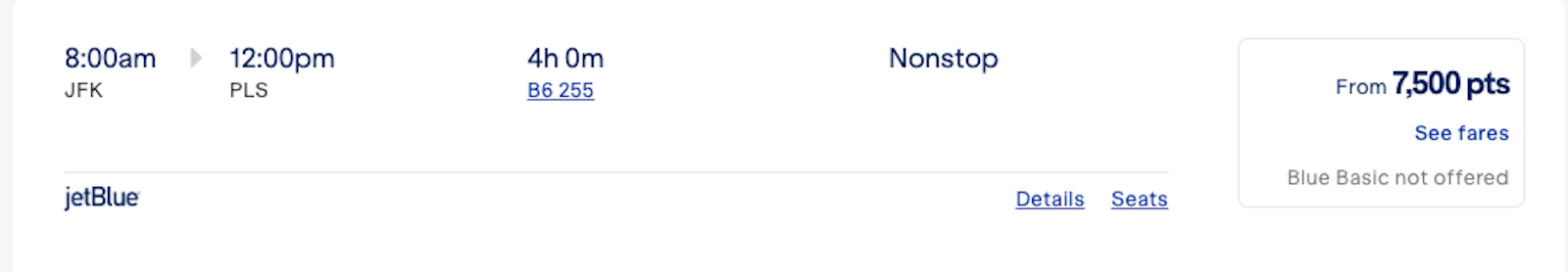

You can also score a one-way flight from JFK to Providenciales International Airport (PLS) in Turks and Caicos for only 7,500 points.

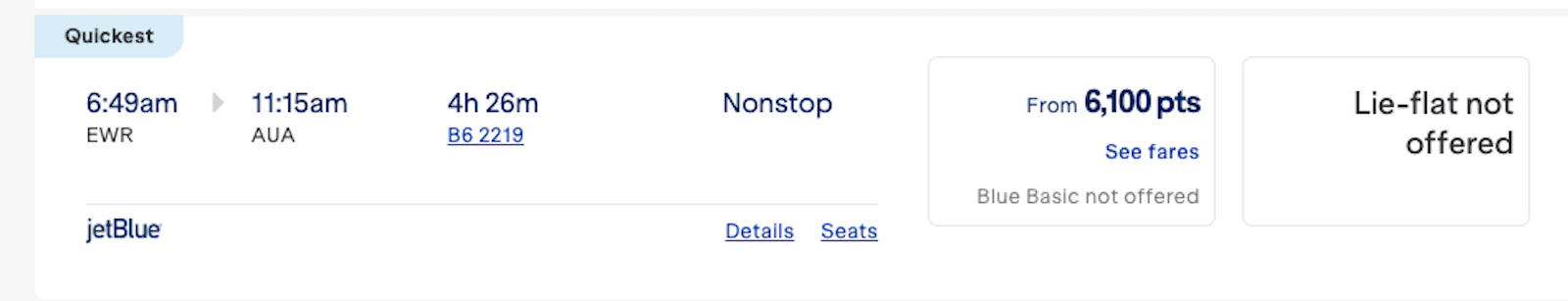

And for 6,100 points, you could fly nonstop from EWR to Queen Beatrix International Airport (AUA) in Aruba.

Keep in mind that with JetBlue, the prices for the outbound and return trips are priced separately, so you may find the award pricing is higher on the return trip or vice versa.

Deals to Europe and in Mint

In addition to warm-weather, spring break-type destinations, you may want to run some searches for JetBlue's slate of transatlantic flights.

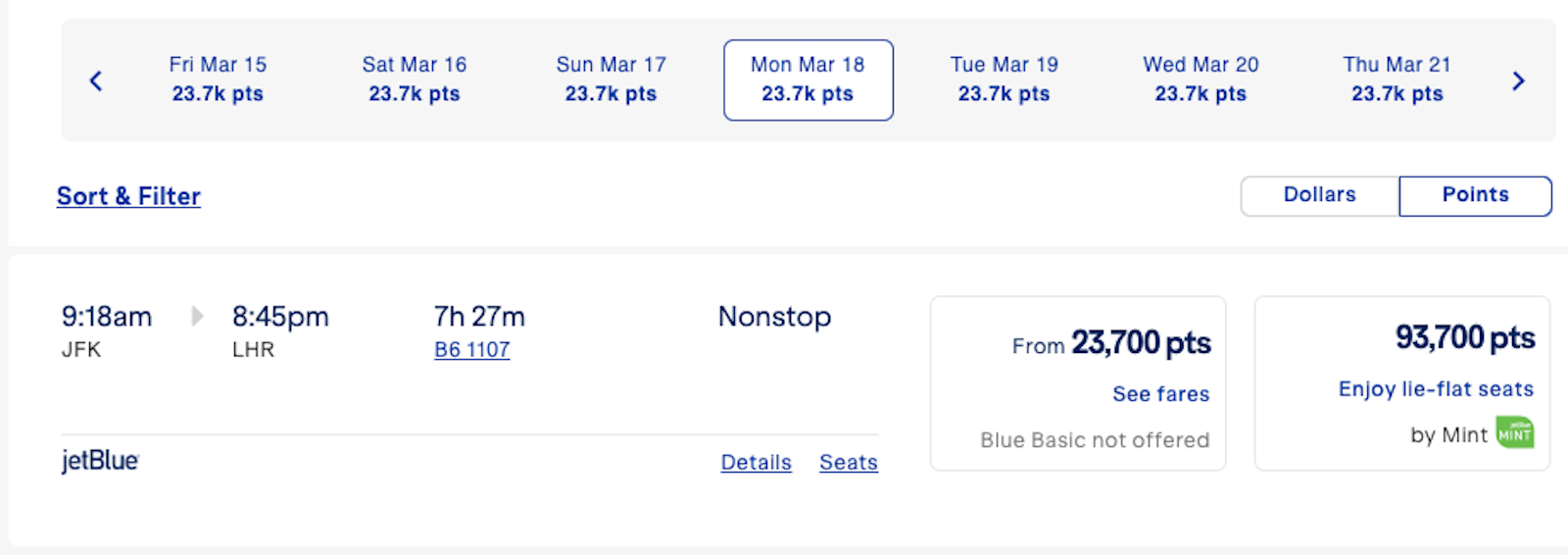

Here's a one-way option from JFK to London's Heathrow Airport (LHR) for next month for 23,700 points. Comparatively impressive is the 93,700-point one-way pricing in JetBlue's lie-flat Mint cabin.

Again, be sure to check the pricing in both directions before you get your hopes up too high.

Maximize your purchase

Though you'll pay for the bulk of your purchase with TrueBlue points, you will have to pay the taxes and fees.

If you book this deal, use a card that earns bonus points on airfare purchases. Frequent JetBlue flyers can use the JetBlue Plus Card for 6 points per dollar spent on eligible JetBlue purchases, the JetBlue Card for 3 points per dollar spent on eligible JetBlue purchases or the JetBlue Business Card for 6 points per dollar spent on eligible JetBlue purchases.

Otherwise, try The Platinum Card® from American Express (5 points per dollar spent on airfare booked directly with the airline or through American Express Travel®, on up to $500,000 on these purchases per calendar year, then 1 point per dollar), the Chase Sapphire Reserve (see rates and fees) (8 points per dollar on all Chase Travel℠ purchases and 4 points per dollar on flights booked directly through the airline), the American Express® Gold Card (3 points per dollar spent on airfare when booked directly with the airline or through amextravel.com), the Chase Sapphire Preferred Card (see rates and fees) (2 points per dollar spent on travel) or Citi Strata Premier® Card (see rates and fees; 3 points per dollar spent on air travel).

The information for the JetBlue Plus Card, JetBlue Card and JetBlue Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

If you're itching to plan a late winter or early spring getaway and have been waiting for the right opportunity to use some TrueBlue points, now may be your opportunity.

Hop on the airline's booking site, and run a few searches for February, March or even April and May to some destinations in Mexico, the Caribbean and Central America you've been hoping to visit. You may be able to find a redemption for just a few thousand points each way.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app