Last Call to Take Advantage of the Alaska Airlines-American Airlines Partnership

In case you missed it, Alaska Airlines and American Airlines are breaking up. After 18 years together, the two formerly close partners are deciding to go their separate ways. While there's nothing that you can do to save the relationship, there are three actions points/miles enthusiasts and airline elites should consider before the changes kick in on January 1, 2018:

1. Devaluation of the Alaska Airlines award chart for AA flights

This is the big hit for us miles and points collectors. Alaska awards on American Airlines flights are being "harmonized" with what American Airlines is charging for these award flights. We've had nearly two wonderful years since American Airlines' last AAdvantage award devaluation where we've been able to book American Airlines award flights with Alaska miles at pre-devaluation rates. That's ending January 1, 2018.

Most of the changes are bad:

| Travel between Continental US or Canada and: | Award type | Book by December 31, 2017 | Book on or after January 1, 2018 | % Increase |

|---|---|---|---|---|

Asia Zone 2 | First Class | 67,500 | 110,000 | 63% |

South America Zone 1 | First Class | 40,000 | 55,000 | 38% |

South America Zone 2 | First Class | 62,500 | 85,000 | 36% |

Europe | First Class | 62,500 | 85,000 | 36% |

Caribbean | First Class | 40,000 | 52,500 | 31% |

Mexico | First Class | 40,000 | 52,500 | 31% |

Central America | First Class | 40,000 | 52,500 | 31% |

Asia Zone 1 | First Class | 62,500 | 80,000 | 28% |

Asia Zone 2 | Business/First Class | 55,000 | 70,000 | 27% |

Asia Zone 1 | Business/First Class | 50,000 | 60,000 | 20% |

South America Zone 2 | Business/First Class | 50,000 | 57,500 | 15% |

Europe | Business/First Class | 50,000 | 57,500 | 15% |

South America Zone 1 | Coach | 17,500 | 20,000 | 14% |

Europe (Off-peak) | Coach | 20,000 | 22,500 | 13% |

Asia Zone 1 | Coach | 32,500 | 35,000 | 8% |

Asia Zone 2 | Coach | 35,000 | 37,500 | 7% |

But there are some awards that are going to be cheaper if you book after January 1, 2018:

| Travel between Continental US or Canada and: | Award type | Book by December 31, 2017 | Book on or after January 1, 2018 | % Decrease |

|---|---|---|---|---|

Continental US/Canada | Business/First Class | 32,500 | 25,000 | 23% |

Hawaii | Business/First Class | 47,500 | 40,000 | 16% |

Caribbean | Business/First Class | 30,000 | 27,500 | 8% |

Mexico | Business/First Class | 30,000 | 27,500 | 8% |

Central America | Business/First Class | 30,000 | 27,500 | 8% |

Check this article for details of how these rates compare to the current AAdvantage award chart and which routes you might want to book before the changes.

Action item: Search for and book some last-minute awards before the old American Airlines award charts are history.

2. Select preferred seats for 2018 flights

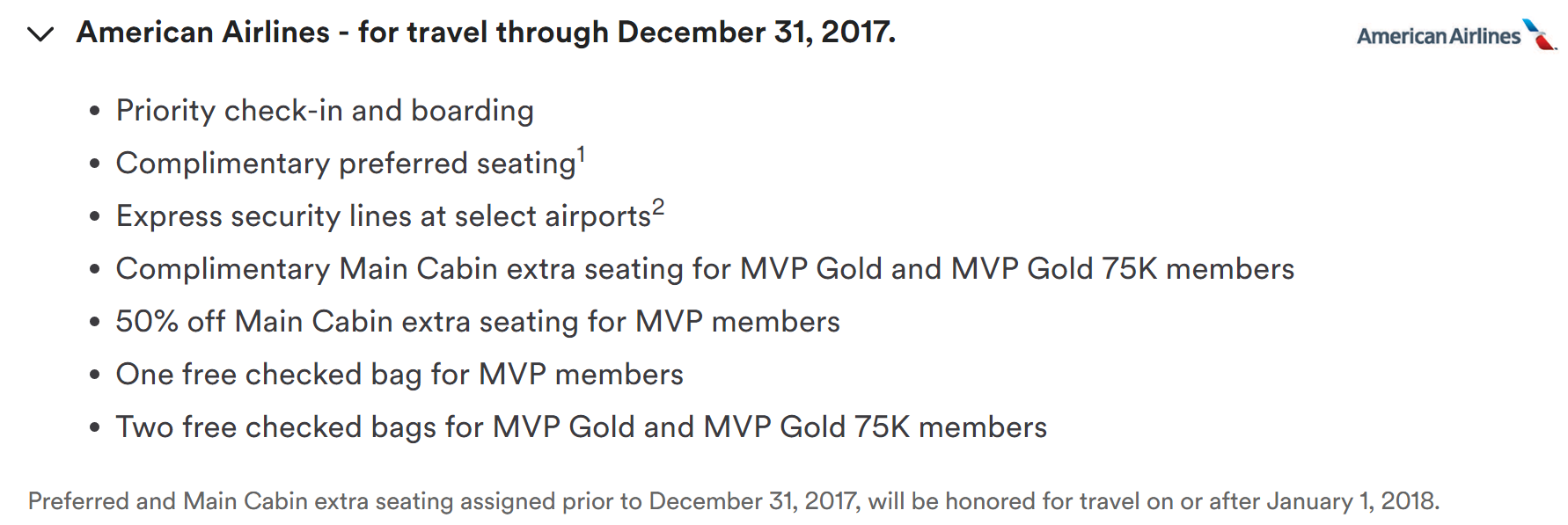

Reciprocal elite benefits between Alaska and American are ending December 31, 2017. That means Alaska elites no longer get priority check-in, priority boarding, free preferred or Main Cabin Extra (MVP Gold and MVP Gold 75K) seats and free checked bag(s) on American Airlines flights. Similarly, AAdvantage elites won't get priority check-in, priority boarding, preferred seating and two free checked bags on Alaska flights.

Unfortunately, most of these elite benefits have a hard December 31, 2017 cutoff, meaning these benefits won't apply to 2018 flights no matter when the flight was purchased.

However, there's one benefit that you can lock in now for travel in 2018: preferred seating. As part of the divorce papers, the terms specifically state "Preferred and Main Cabin extra seating assigned prior to December 31, 2017, will be honored for travel on or after January 1, 2018." That means you have just one more week from today snag those seats for 2018 travel.

I just went through this process for an upcoming Alaska award flight booked with AAdvantage miles. I needed to call American Airlines reservations for the Alaska confirmation number. Once armed with this information, I was easily able to select preferred seats on my Alaska flight.

Action item: American/Alaska elites should check your 2018 flight bookings and select preferred seats for free while you still can.

3. Check where your 2018 flights are crediting

Another hard cutoff relates to crediting flights. Effective for flights starting January 1, 2018, you'll get zero AAdvantage credit for Alaska-marketed flights. You can still earn AAdvantage credit for Alaska-operated flights, but only if you booked the American Airlines codeshare. The easiest way of telling which you have: pull up your flight confirmation and see which airline's flight number appears. If it's an Alaska flight number, that means it's Alaska-marketed and won't earn any AAdvantage miles.

The reverse is nearly true. Alaska Mileage Plan members won't get any credit for American Airlines-marketed flights - unless it's an international flight. As Alaska doesn't have intercontinental flights, they're fine with partnering with American Airlines for these flights.

Action item: check your 2018 flight bookings and make sure that you're crediting the flights to the right program.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app