Save With American Express Twitter and Facebook Offers

Update: Some offers mentioned below are no longer available. View the current offers here.

American Express loves to engage with its customers on social media, and Amex cardholders can save a lot of money by taking advantage of the company's ongoing promotions like Sync on Twitter and Like Link Love on Facebook. To take part in these deals, simply connect your Amex card with your Twitter or Facebook account, then follow the American Express Twitter feed or like the Amex Facebook page to see offers. In order to receive discounts at participating merchants, write tweets on Twitter that include designated hashtags, or on Facebook, just click to add the offers to your card.

Sync on Twitter

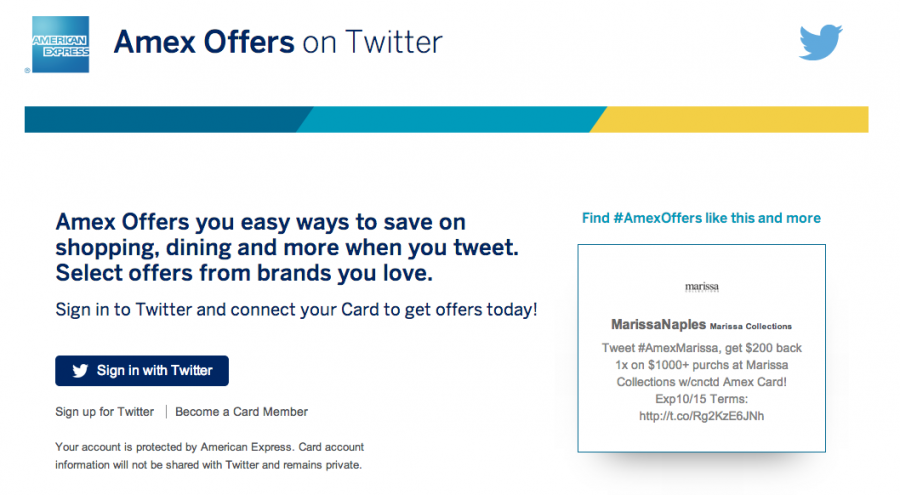

This promotion's web page has a button that directs you to sign in with Twitter and sync your card. According to the general terms and conditions of the card-sync promo, you can only link one eligible card to your Twitter account; American Express Corporate and prepaid cards (with the exception of American Express Serve Cards) are not eligible.

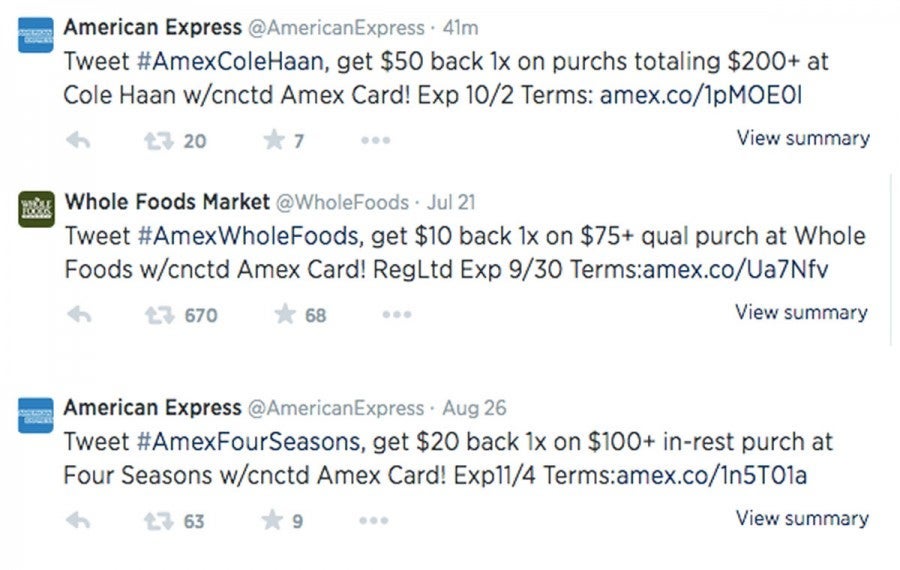

Merchants participating in this promotion range from clothing lines to grocery stores, hotels, fast food chains, florists and more. Here are some examples of Amex sync offers from Amex's Twitter feed, including $50 back on a $200+ purchase at Cole Haan, $10 back on $75+ worth of groceries at Whole Foods, and $20 back on an-restaurant spend of $100 or more at Four Seasons Hotels:

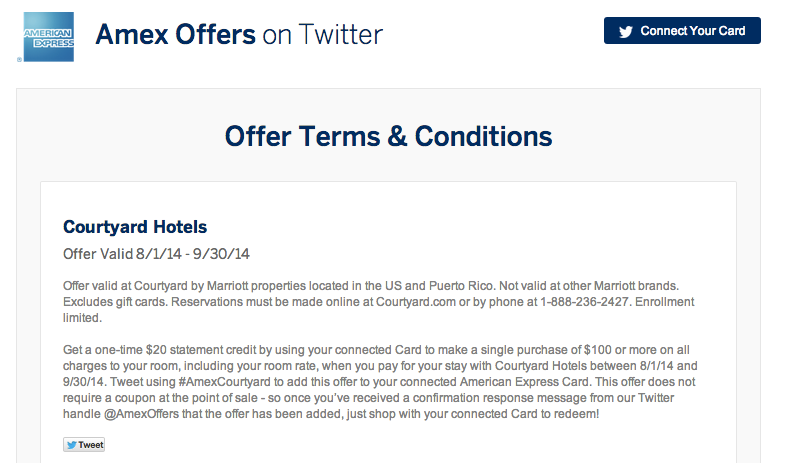

Click on the corresponding link for each offer (for example, the offer from Courtyard Hotels pictured below) and you'll be shown the offer's specific terms and eligible dates, and a handy "Tweet" button will allow you to create an automatic tweet directly from the offer's page:

When you use an offer's corresponding hashtag on Twitter, you'll get an @ reply from Amex telling you that you've been enrolled and are either eligible for the offer, or the offer is no longer available. Once you've made a qualifying purchase with your synced card, you'll be issued a statement credit within 90 days.

Like, Link, Love on Facebook

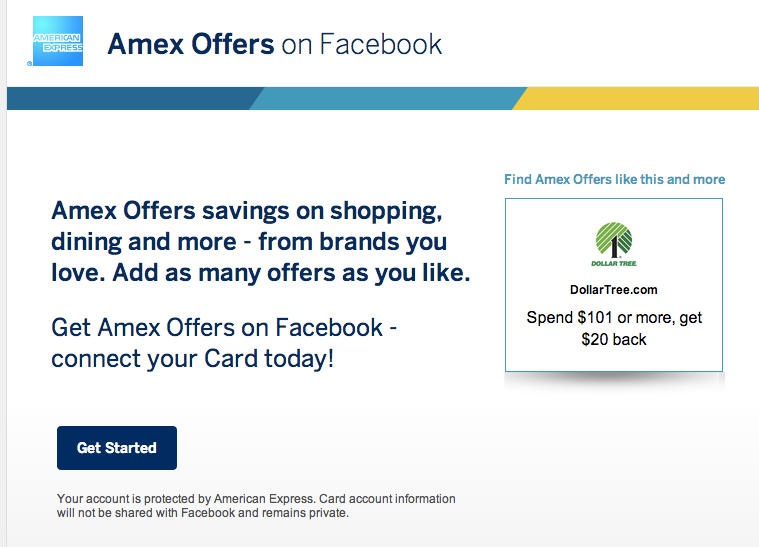

Similar to Amex's Twitter card-syncing offers, Amex's "Like, Link, Love" Facebook promotion invites you to link one eligible Amex card to your Facebook account by clicking a button on the promo's home page called "Get Started."

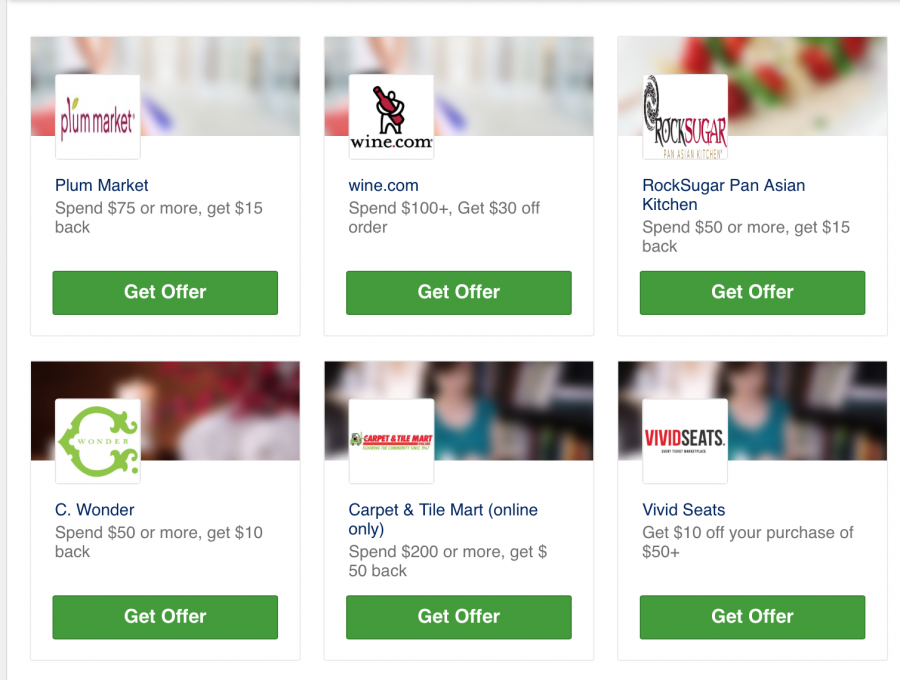

Linking you card to your Facebook account gives you access to a special "Like, Link, Love" tab within Amex's Facebook page, which lists discounted offers from many of the same Twitter-participating merchants, such as Whole Foods and Dollartree.com. You access these point-of-sale offers by clicking an "Add to Card" button on each specific offer and following any other provided instructions. For instance, some local offers will require you to "check in" via Facebook Places.

Sign Up for Some Pretty Decent Deals

These Amex Twitter-sync and Facebook-link offers represent savings of up to 25% on purchases you might be making anyway, especially if you're loyal to a variety of major brands and services.

I'm signed up via my Platinum Amex and the TPG Twitter and TPG Facebook accounts so that I can keep track of these discounts, and would encourage you to sign up today to score some deals for yourself.

Have you taken part in either Amex deals on either Facebook or Twitter before? Which offers have you synced to your card?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app