Earn Up to 100,000 United, American & Delta Miles With Fidelity Brokerage Accounts

Update: deal is now for 50,000 miles.

If you've got cash to invest, you can rack up a ton of frequent flyer miles by opening Fidelity Brokerage accounts. I've been meaning to research this ever since I left Morgan Stanley and now completely manage my investments, especially since I no longer have any restrictions about outside brokerage accounts that are in place at many financial firms.

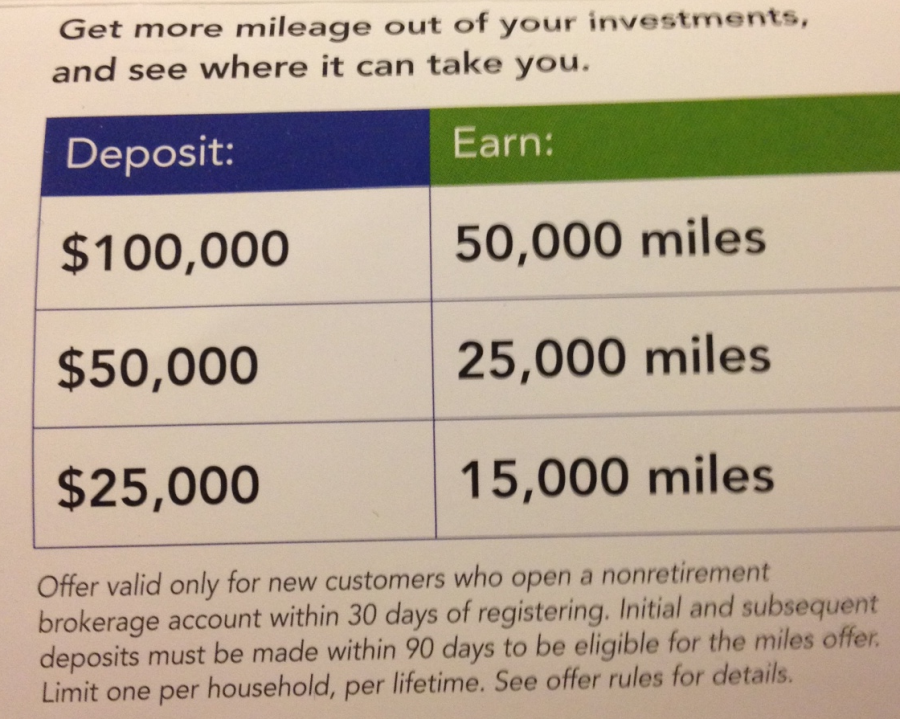

Coincidentally, a couple weeks ago I received a flyer in the mail from Fidelity offering me up to 50,000 United miles if I created a brokerage account with them. 15,000 miles for depositing $25,000, 25,000 miles for $50,000 and 50,000 miles for $100,000.

After researching the rules and costs of doing such a transaction, it seems like a pretty good deal if you are eligible and have the funds. In fact, after researching and reading this Flyertalk thread, you can actually get either 50,000 United or American miles plus 50,000 Delta miles. The United and American offers are for new account holders only, but Delta is for new and existing Fidelity account holders. Read this post by HikerT (who is also a TPG blog reader and can hopefully chime in if anyone has questions).

United account registration

American account registration

Delta account registration

I value United miles the most so I just signed up for that and deposited $20,000 and will cycle in the rest of the money once my account is verified. You have 30 days from registering for the promotion to fund the account, so I'm not too worried about timing.

Later this week I'm going to sign up for a Delta account as well. I don't want to do them on the same day just in case they see it as a duplicate account registration.

Once your account is verified, you can deposit and withdraw until you hit the $100,000 mark. It doesn't have to be $100,000 all at once - you could do it in $20,000 cycles depositing and withdrawing - all that matters is that $100,000 is deposited into the account in the required time period. Read through the Flyertalk thread to see how people have managed it on small budgets - of course this is much easier if you can just deposit in lump sums and the miles generally post much quicker than 8 weeks.

I recommend reading through the complete rules before you do this. I'll update with my experience once my miles (hopefully) post! To me, 100,000 miles is worth about $2,000 so I'm looking forward to doing this promotion - especially since it does not count as a hard inquiry on your credit - only a soft inquiry so they can verify your identity.

United promotion T&C:

Only prospective customers who currently do not have a Fidelity retail account are eligible. This promotional offer is limited to one per household and per lifetime of the individual(s) named on the Fidelity account. Only individual or joint Fidelity Accounts are eligible. The promotion is not available for business accounts, trust accounts, retirement accounts including, among others, Fidelity IRA, Roth IRA, SEP and SIMPLE accounts; 401(k) and 403(b) workplace retirement plans; fiduciary accounts (including custodial accounts and estate accounts); college investment trust accounts; 529 college savings plan accounts; annuities; Fidelity accounts managed by Strategic Advisers, Inc. (for example Portfolio Advisory Services); and clients of registered investment advisors working with Fidelity Investments. Offer not valid for government officials, candidates for federal, state or local office, or union officials or employees, non-U.S. residents or persons and members of their immediate families and households affiliated with or employed by FINRA or its member firms, Fidelity or its affiliates, a securities exchange or its members, or the media. Public officials or candidates for office may be subject to state or local gift laws.

Transferred assets will be valued, for the purposes of determining eligibility for this promotional offer, at the close of business Eastern time on the business day or next business day, if on a weekend day or holiday, following receipt by Fidelity Investments of the assets into the account that is eligible for the promotional offer. Funding must come from an external, non-Fidelity source via any standard monetary transfer method (a standard Transfer of Assets form, check, electronic funds transfer, ADM deposit, etc.). Please allow eight weeks from the opening and funding of the eligible account, with the qualifying dollar amount of assets, for United MileagePlus or OnePass miles to be credited to your MileagePlus or OnePass account. Your Fidelity account must remain open with the qualifying funding for six months from the date that the qualifying assets are first received in the eligible account.

New accounts must be opened within 30 days of registering for the offer. Additional deposits to the eligible Fidelity account may earn you a higher mileage award provided such deposits result in the cumulative deposits in the account being at or above the next eligibility tier (up to a maximum of 50,000 miles). Initial and subsequent deposits must be made within 90 days of Fidelity account opening.

MileagePlus or OnePass miles are redeemable miles and do not count toward elite status. All United MileagePlus and Continental OnePass program rules, respectively, apply to MileagePlus and OnePass program membership, miles, offers, mile accrual, mile redemption, and travel benefits. To review the rules, please visit www.united.comThis content will appear in a pop–up window. and click the MileagePlus tab or go to the Frequent Flyer section of Continental.com. United, MileagePlus, and the United logo are service marks or registered service marks of United Airlines. Continental, Continental Airlines, OnePass and any other names or marks of Continental Airlines referenced on this Web site are service marks or registered service marks of Continental Airlines, Inc. Unless otherwise indicated, all service marks, trademarks, and logos, whether registered or not, as well as trade dress, located at the Web site are the sole and exclusive property of Continental Airlines, Inc.

United Airlines and Continental Airlines are not responsible for goods or services offered by Fidelity. United Air Lines, Inc. and its affiliates are not broker-dealers and do not offer investment advice or financial planning services. United and Continental receive compensation for introducing Fidelity to their customers. Fidelity Investments makes no representations or warranties regarding MileagePlus or OnePass program membership, offers, mile accrual, mile redemptions, or travel benefits.

Fidelity Investments is not affiliated with United Air Lines and Continental.

[card card-name='Gold Delta SkyMiles® Credit Card from American Express' card-id='22034414' type='javascript' bullet-id='1']

TPG featured card

at American Express's secure site

Terms & restrictions apply. See rates & fees.

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.