Wells Fargo Enters Travel Credit Card Space With New Propel Cards With American Express

Update: Some offers mentioned below are no longer available. View the current offers here.

Wells Fargo is one of the "big four" banks in the US, alongside JP Morgan, Citi and Bank of America. All three of its other competitors have hefty travel credit card products, but Wells Fargo has lagged behind in that department, until recently when they launched two new credit card products aimed at getting a piece of the lucrative travel credit card market. While it is nice to see more competition in the marketplace, these cards have a bit of catching up to do before they can start ousting juggernauts like the Chase Sapphire Preferred and Citi AAdvantage cards, but still- it's good to see Wells Fargo get in on the action!

Wells Fargo teamed up with American Express to launch the premium Wells Fargo Propel World and the base level Wells Fargo Propel 365. While American Express is helping issue the cards, they will not earn points in the Membership Rewards program and instead will accrue into Wells Fargo' own loyalty program.

The Propel World is definitely geared towards travelers with travel bonus categories, no foreign transaction fees, Chip and Signature Preferred and $100 in yearly airline rebates, yet also comes with a hefty $175 annual fee, which is waived the first year.

40,000 bonus points after spending $3,000 in the first 3 months

3X points on airline purchases when purchased from the airline directly

2X points on hotel purchases when purchased from the hotel directly

1X points on all other purchases

$100 airline incidental fee allowance (good for lounges, checked bag fees and onboard meals and entertainment)

Chip technology

No foreign currency conversion (transaction) fees

Luxury hotel program (offering upgrades, early check-in, late check-out and other perks, when available)

Premium concierge service

The Wells Fargo site did not specify if the chip technology is chip-and-signature or chip-and-PIN, but a quick call confirmed that it is Chip and Signature Preferred. This will allow you to use both PIN and signature platforms while abroad.

The second card, the Propel 365 is geared more towards everyday use:

20,000 bonus points after spending $3,000 in the first 3 months

3X points at US gas stations

2X points at US restaurants

1X points on all other purchases

No foreign currency conversion (transaction) fees

Luxury hotel program (though not offering the same upgrades like the Propel World) and 24/7 concierge services

Annual fee of $45 waived the first year

On both cards, the points never expire as long as you keep your card open and you can receive 10%, 25% and up to 50% relationship bonuses (more on that later) by maintaining a qualifying Wells Fargo consumer checking or savings account or PMA Package (which is all of your Wells Fargo assets linked together). Both also offer similar purchase protections, such as emergency assistance, extended warranty and warranty protection.

Worth It Short-Term?

Depending on how you choose to leverage the points, it could be a very lucrative card. With the 40,000 point sign-up bonus, that would be worth at least $400 in statement credits. If you are booking a lot of your own travel, or have a job that allows you to book your travel on your personal card, you can really start to rack up the miles with the 3X points on airline and 2X on hotel purchases. With the $400 in statement credits, plus the $100 airline incidental credit and the annual fee waived in the first year, it does look attractive, if used correctly. While Wells Fargo values the points at 1 cent per point, this FlyerTalk thread has people claiming they were able to redeem at up to 1.5 cents per point, making the 40,000 sign-up bonus plus the $100 incidentals credit potentially worth up to $700 in value!

Cons

If you like the flexibility of transferring points to airlines and hotels, sadly Wells Fargo points are not transferrable to partners, like with the Chase Ultimate Rewards and the American Express Member Rewards. It is a cash back style earning more along the lines of the Barclaycard Arrival and Capital One Venture Rewards Credit Card.

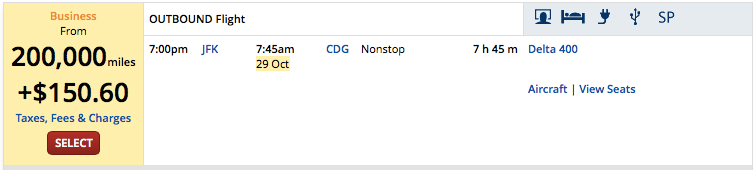

Redeeming for premium cabin travel can be quite expensive. I ran a sample itinerary for October 28th - November 4th from JFK to Paris, business class, non-stop. Redeeming miles on American Airlines would cost you 220,000 miles + $150.60 in taxes/fees and Delta would cost you 200,000 miles + $150.60 in taxes/fees. Now, to purchase the same seat on both American or Delta would cost you $6,136.10, meaning you would need about 410,000Wells Fargo points to pay yourself back (at the max 1.5 cents per point that people have experienced when redeeming for flights) to book that same flight! Note: flight redemptions with Wells Fargo allow you to earn miles and elite miles, unlike traditional airline award redemptions.

Keep It Past The First Year?

This card can be beneficial if your looking to quickly take a couple hundred dollars of any upcoming travel, but one of our most common questions is, "Is this card worth it in the long run?" One of the biggest ways it could be worth it is with these cards are the relationship bonuses, but it isn't easy to earn the max 50% bonus. Having a Wells Fargo consumer checking or savings account earns a 10% annual bonus, a Wells Fargo PMA Package earns a 25% annual bonus and a Wells Fargo PMA Package exceeding $250,000 or a Wells Fargo Private Banking PMA Package earns a 50% annual bonus. First, you must keep the card open for a minimum of 13 months to receive the bonuses. The bonus points from each month remain pending and are deposited into your account in the 13th month and that same month, each year, from then on. In essence, this means you have to pay the annual fee before receiving bonus points.

Will the relationship bonus negate any annual fees? Not accounting for potential bonus spending categories (such as the 3X airlines earning and 2X hotel earning), simply earning at the base of 1 point per dollar, you would need to earn a bonus of 4,500 points for the Propel 365 and 17,500 points for the Propel World to break even. This means, if you happen to have $250,000 or more in a Wells Fargo PMA Package (or open one and put that amount in) or have a Private Banking PMA Package, you would need to spend about $35,000 per year on the Propel World or about $9,000 per year on the Propel 365 to receive a 50% bonus that would make the annual fee worth it, but always take into account that there are opportunity costs to putting lots of spend on these cards and not maximizing other potentially lucrative category bonuses.

It seems that the card will be most beneficial in the short-term but that there are other cards out there that are more lucrative for the long-term points earning. To check out other fixed-value point credit cards, check out this post.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app