4 reasons to get the Apple Card

Editor's Note

So, sure: The Apple Card isn't exactly a rewards behemoth.

After its 2019 launch, we bemoaned its limited perks, lack of a sign-up bonus and overall failure to meet expectations after CEO Tim Cook called it "the most significant change in the credit card experience in 50 years."

That said, I wanted to check it out on my own and applied on a whim. I find myself — a credit card novice but a TPGer nonetheless — using the card regularly.

Here are four reasons why the Apple Card might be right for you, too.

The information for the Apple Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Simple earning

It took me mere minutes to apply for the Apple Card on my iPhone, and I've been glad ever since that the card's rewards structure is just as simple.

With the Apple Card, you earn 3% cash back on all Apple purchases (including tech products, App Store purchases and other services such as Apple Music and Apple TV+), plus a number of specific merchants. These include:

- Ace Hardware

- Duane Reade

- Exxon

- Mobil

- Nike

- Panera Bread

- T-Mobile

- Uber

- Uber Eats

- Walgreens

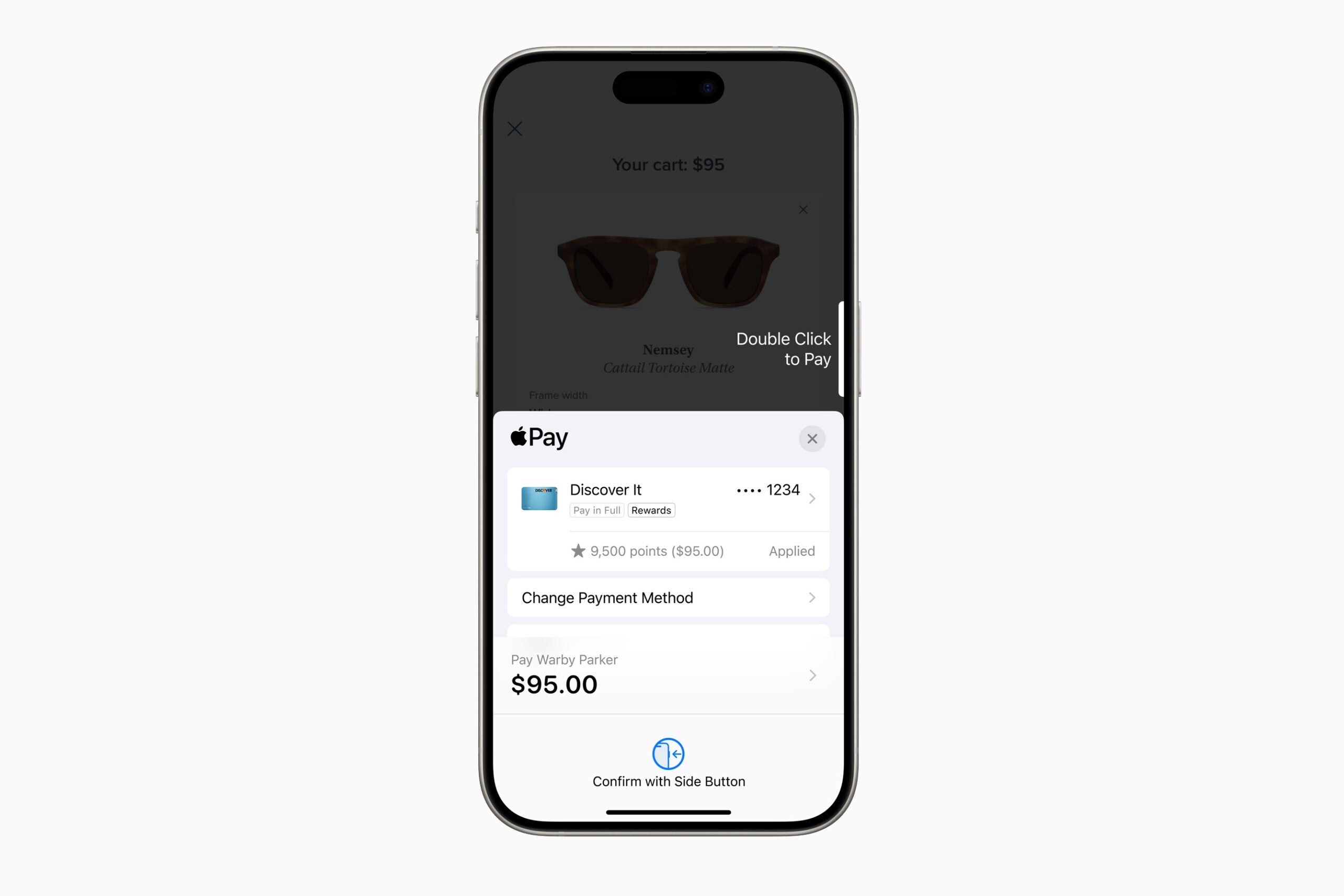

You'll also earn 2% cash back on all purchases made with Apple Pay and 1% back on everything else.

As an Apple loyalist and Panera addict, I enjoy the 3% cash-back categories — but the 2% back with Apple Pay is the real winner for me. Nearly every purchase I make online can be made with Apple Pay, and while our review noted that this card is "best suited for those who live in urban areas," I find that more and more in-store retailers are offering Apple Pay no matter where you find yourself.

The card's Apple Pay Family feature allows two partners to merge credit lines and form a single co-owned account. Both co‑owners can view and manage the account, see each member's activity and set limits on participants' spending.

Instant rewards

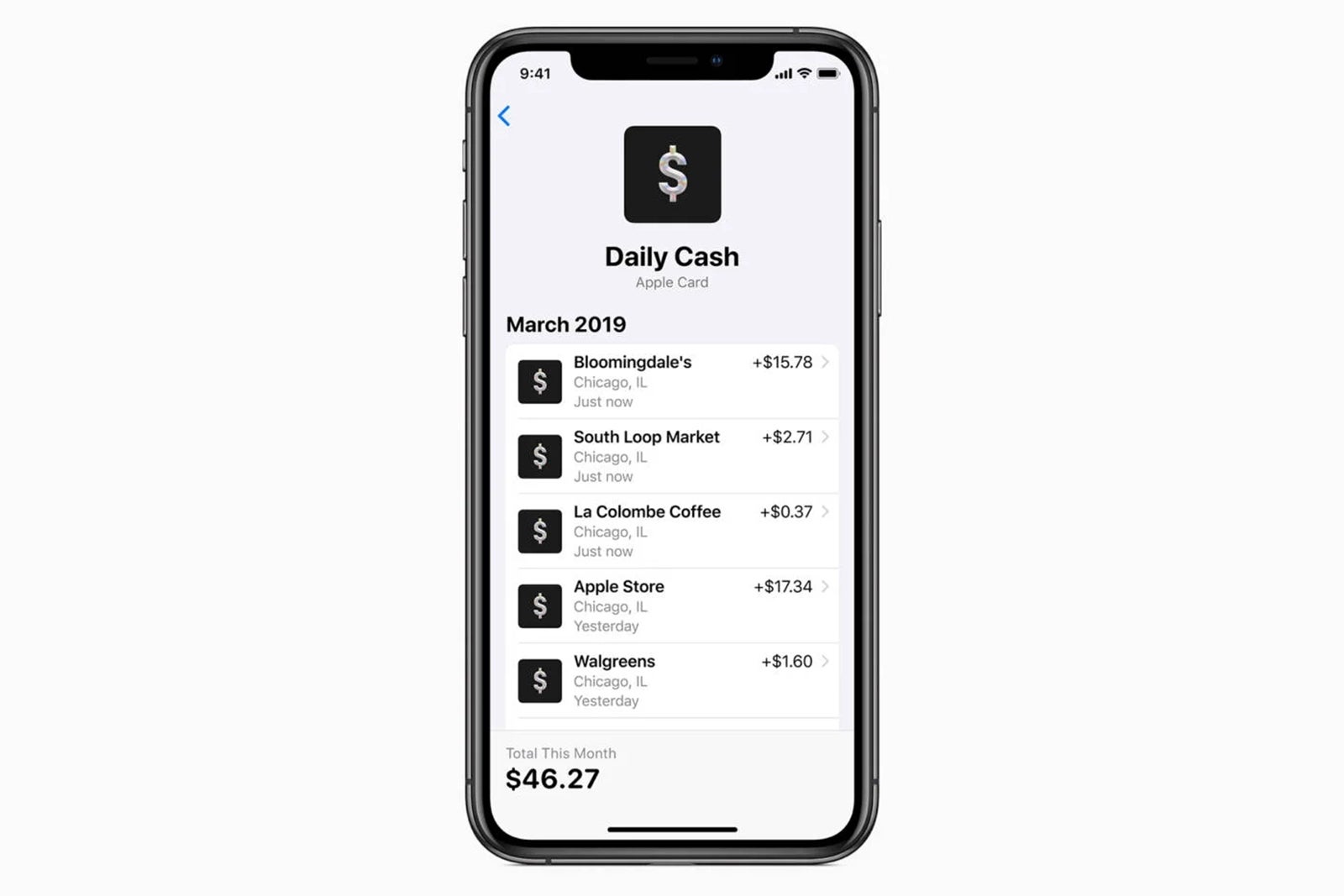

The Apple Card's Daily Cash system is built for the era of instant gratification.

Rather than waiting until the end of a billing cycle to post accrued monthly earnings, customers who use the Apple Card will see cash-back totals daily, allowing you to use it instantly. I still enjoy saving up my cash back, but it's nice to get regular reminders about how much you earned the previous day.

Your Daily Cash will also earn interest as it's automatically deposited into a high-yield savings account from Goldman Sachs, helping your rewards grow over time.

The interface is built by Apple, meaning it's simple and easy to use. Through your Wallet app, you can see previous monthly statements, make a payment, check your available balance and more.

Daily Cash and a clean, integrated interface are welcome changes from issuers who offer monthly cash back and clunky third-party apps.

Zero fees

The Apple Card has absolutely no fees attached. That means no annual, over-the-limit, foreign transaction or late fees. As the card page promises, it truly has "No fees. Not even hidden ones."

Aside from the obvious fact that it's cheaper, I also enjoy the wall-to-wall simplicity of Apple's approach here. Just sign up in minutes, earn easy cash back with Apple Pay and don't worry about fees attached to traveling abroad, going over your limit or even making a late payment.

If you're a points and miles pro, maybe none of this is a big deal to you. But as someone still new to the space, I enjoy the peace of mind that comes with the Apple Card.

Advanced privacy

And maybe the most important feature of all: The Apple Card goes above and beyond its competitors to protect your privacy and prevent fraud. Most banks don't just make money from fees and finance charges — they also profit from your personal information.

Consider Bank of America's U.S. consumer privacy policy, which details the many ways it puts information about a customer's creditworthiness and their transaction history in the hands of a wide range of other companies. Other banks, such as Chase and Citi, have similar policies.

Apple says that Goldman Sachs, its partner for the card, will not share or sell your data to third-party companies.

As for fraud prevention, the physical card has no card number, security code, expiration date or signature — just your name and a chip. To access those card numbers when making a purchase online, cardholders need to pull up their card in the Wallet app. Additionally, the Apple Card features a "one-time unique dynamic security code" that changes after each purchase you make, adding another layer of protection against fraud.

Bottom line

Like most rewards cards, the Apple Card is what you make of it. It doesn't offer the most lucrative rewards structure, but if you're an Apple loyalist or want a helpful introduction to the credit card world, it could be a fit for you.

With a simple earning structure and no fees, the card is Apple to a T: streamlined, elegant and designed for the most positive user experience possible.

To learn more, read our full review of the Apple Card.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app