Can you pay taxes with a credit card?

Editor's Note

Have you thought about paying for your taxes with a credit card, but weren't sure if that was a smart move or not? On one side, charging your taxes to a rewards credit card could mean you earn cash back, points or miles toward travel.

On the other hand, depending on the amount of taxes you charge to a card, you could incur hefty service fees.

Taxpayers must file their yearly returns and pay any tax due by April 15.

If you pay quarterly taxes, your next three quarterly tax payments look like this:

- Tax payments for Jan. 1 to March 31 are due by April 15

- Tax payments for April 1 to May 31 are due by June 15

- Tax payments for June 1 to Aug. 31 are due by Sept. 15

Although you'll usually get dinged with service charges and other fees for using a credit card to pay your taxes, it may still be worthwhile for a few reasons.

For instance, you might need to hit a minimum spending threshold to earn the welcome bonus on a new card. Or, you may want to score a spending-based perk, such as elite qualifying miles with an airline card or a free night certificate with a hotel card.

You may also have a card offering a 0% annual percentage rate on purchases for a certain period, so you have some breathing room to pay off your tab.

Here's what you need to know about paying your taxes with a credit card.

Different ways to pay your taxes

If you owe taxes to the IRS, you can choose from several payment methods. Most people opt for one of the following:

- You can make a direct payment from your bank account, and the IRS won't charge any extra fees for this type of payment.

- You can wire the money from a bank account, although this option usually incurs a fee.

- You can mail a check or money order to the IRS without any fees, aside from postage and possibly the money order (depending on where you get it).

If you need more time to pay your taxes, you can file for an extension with the IRS or set up an installment agreement with a payment plan. You will, however, be expected to pay penalties and interest on that payment plan.

You can also pay your taxes with a debit card. While the fee is minimal, you generally won't earn valuable travel rewards or cash back unless you have a debit product that earns rewards.

Fortunately, the IRS lets you pay your tax bill with a credit card through several third-party payment processors.

But be warned: These companies can — and usually do — tack on their own fees to your payments. You can see a list of these companies and their convenience fees on the IRS website.

Related: If I cash out my points and miles, do I have to claim it on my taxes?

The cost of paying taxes with a credit card

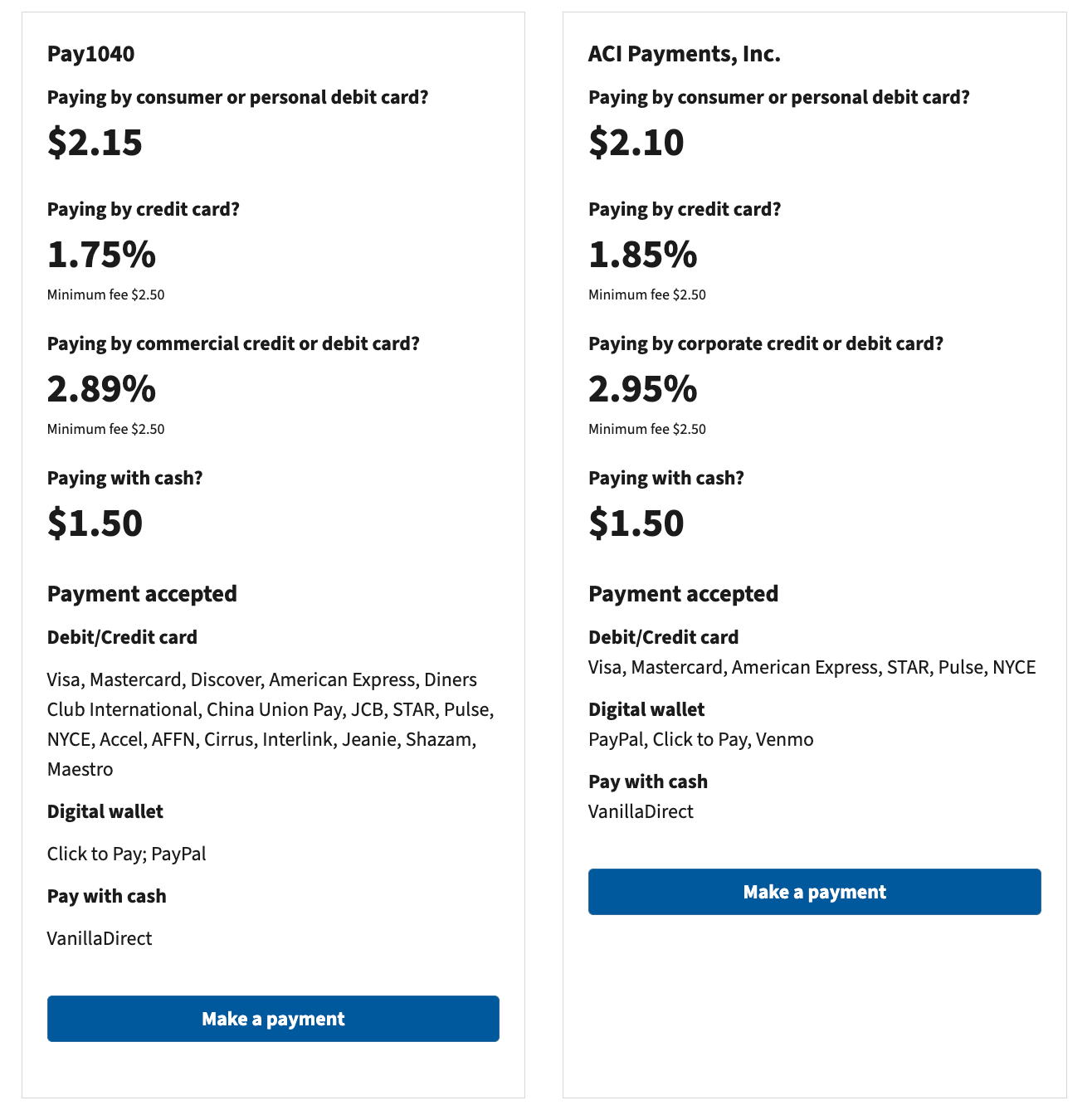

When you use a credit card to pay your taxes, the fee is calculated as a percentage of the amount paid. There are two payment processors the IRS uses for taking credit card payments: Pay1040 and ACI Payments, Inc.

Currently, those fees range from 1.75% to 2.95%. So, if you owe $10,000 and want to pay via credit card, you'll be on the hook for an extra $175 to $295 in fees, depending on the service you use.

*Despite Pay1040 showing a 1.75% fee on the IRS.gov website, the 1.75% processing fee applies only to consumer Visa and Mastercard payments. If you use a business credit card or a personal or business Amex card, you will be charged 2.89%.

Former TPG credit cards writer Chris Nelson tested this in 2024 with his Chase Sapphire Preferred® Card (see rates and fees) and was shown a 1.75% processing fee. When he tried using his The Business Platinum Card® from American Express as well as his American Express® Gold Card, he was shown a 2.89% fee.

If you want to pay with a business credit card or an Amex card, it's best to use ACI Payments Inc., as you will be charged a processing fee of 1.85%.

Just keep in mind that some TPG readers have reported that ACI Payments, Inc. does not accept business cards when they're used to pay personal taxes.

Related: Are your credit card rewards taxable? Here's why you're receiving 1099s in the mail

Reasons to pay your taxes with a credit card

Despite those surcharges, there are plenty of reasons why paying your taxes with a credit card can make sense.

First, doing so can help you earn valuable rewards and give you more time to pay off a high tax bill if you have a 0% APR offer on a new card or are targeted for a no-fee, pay-over-time plan.

However, if your purchase is subject to normal credit card interest rates, you should strongly consider other options, as paying your purchase off over time could be exceedingly pricey.

Here are some instances where it does make sense to use a credit card for your taxes.

Earning a big welcome bonus

Many rewards cards extend welcome offers worth hundreds (and sometimes over $1,000) in cash back or tens of thousands of points if you spend a certain amount on your new card within a specific time frame.

The single most significant reason to use a credit card when paying a sizable tax bill is that you can earn a high number of points from one of these offers. That's because the value of the points you earn can help offset the cost of fees for using your card for your taxes.

Some rewards cards have especially high minimum spending requirements for earning a bonus, so a tax payment might be just the thing to put you over that threshold.

Before you choose to pay your taxes with a credit card, make sure you can pay your card balance off in full. If you don't, you can get hit with interest charges and late fees that quickly wipe out the value of any rewards you might earn.

Accruing 20% to 28% interest on your credit card bill will easily negate a 3% to 4% return on spending through the points you earn.

Meet a credit card spending threshold

Many credit cards offer benefits that trigger after you reach a particular spending threshold. These might be based on the calendar year or your cardmember anniversary, but in either case, making large tax payments could help you earn these rewards when that amount of spending might be out of range otherwise. For example:

- Spend $15,000 on eligible purchases with the Hilton Honors American Express Surpass® Card in a calendar year to earn a free night reward.

- Earn an additional free night award good at any Category 1-4 property after you spend $15,000 on your World of Hyatt Credit Card (see rates and fees) every year after your cardmember anniversary.

With perks like this, putting your taxes on the right credit card can help you earn valuable extras like a boost toward elite status, free night awards and more.

Spend toward elite status

Several credit cards allow you to boost your elite status — or earn status outright — through spending on a credit card. Putting a large tax payment on one of these credit cards could help you, such as the following:

- United℠ Business Card (see rates and fees): Earn 1 Premier qualifying point for every $20 in card spending on up to 4,000 PQPs in a calendar year. This can be applied to Premier 1K elite status.

- Citi / American Airlines credit cards: Earn 1 Loyalty Point per eligible dollar spent on these cards, boosting your elite status through credit card spending.

- Atmos™ Rewards Summit Visa Infinite® Credit Card: Earn 1 status point per $2 spent. You only need to spend $20,000 annually on this card to earn Atmos Rewards Silver status.

- World of Hyatt Business Credit Card (see rates and fees): Earn five tier qualifying night credits for each $10,000 spent on the card, which will help you attain elite status with World of Hyatt.

- World of Hyatt Credit Card: Receive five tier qualifying night credits each year you hold the card, plus earn two additional tier qualifying night credits for each $5,000 spent on the card.

Use multiple cards to maximize earnings

If you have a large tax bill, you don't have to spend the entire amount on one credit card.

The IRS page explaining credit card payments says you can only use debit or credit cards to make up to two payments per tax period (year, quarter or month, depending on the type of taxes you're paying), but that means you could use two different cards to make two different payments.

For example, say that you have a $28,000 tax payment due. You could apply for both the The Business Platinum Card from American Express and the Ink Business Preferred® Credit Card (see rates and fees).

By putting $20,000 within three months of approval on the Amex Business Platinum Card, you'd have spent enough to earn its 200,000-point welcome offer.

Plus, since the purchase is more than $5,000, you could earn 2 points per dollar spent (up to $2 million of these purchases per calendar year, then 1 point per dollar spent thereafter), which means you'd earn 40,000 points on the purchase itself.

Then, you could charge the additional $8,000 balance due (within three months of approval) on the Ink Business Preferred and earn its 100,000-point welcome bonus and an additional 8,000 points for the spending itself (1 point per dollar spent on everyday purchases).

In this scenario, you'd end up with more than $6,000 in travel rewards, according to TPG's February 2026 valuations. (These figures don't take into account the points you'd earn on the fees you are charged for paying your taxes with these cards.)

Buy some extra time to pay your taxes

One of TPG's 10 commandments for earning credit card rewards is never to pay interest charges. It's paramount that you never bite off more than you can chew.

When paying your taxes with a credit card, note when the first day of your new statement period begins on the card you want to use. This way, you may have up to 30 days until your statement closes and nearly 60 days until you must pay off your balance in full.

Some credit cards even offer 0% APR for an introductory period on new purchases, which can provide 12 to 18 months of interest-free payments on your tax bill. You must pay off the entire balance in full before the promotional period ends, or you risk high-interest charges.

Finally, be sure to check your eligibility for a pay-over-time installment plan, as issuers sometimes provide introductory offers. This could be a great way to finance a large tax bill over time without incurring massive interest charges.

Related: A comparison of the top 'buy now, pay later' services — and what to watch out for

The downside of using a credit card to pay your taxes

Despite the benefits listed above, using a credit card to pay your taxes can be a reckless strategy, as the interest rate on most rewards credit cards can severely hurt your finances should you have to pay it.

If you don't have a no-fee, 0% APR option and cannot pay your statement balance in full after charging your taxes to a credit card, you should reconsider using a credit card to pay your taxes.

Instead, consult your tax professional about your options. The IRS offers payment plans with lower interest rates than most credit cards.

Plus, it's worth noting that all of the cards included in the Bilt 2.0 suite — the Bilt Blue Card (see rates and fees), Bilt Obsidian Card (see rates and fees) and Bilt Palladium Card (see rates and fees) do not earn points on tax payments.

Related: Earn points, miles and cash back while doing your taxes

Bottom line

With the April 15 tax filing deadline approaching soon, paying your taxes with a credit card can be a lucrative way to earn points and miles as part of a large welcome offer.

Having a 0% APR card may also give you more time to pay off a higher tax balance without worrying about high credit card interest rates, but make sure you do your own math to ensure the benefits you receive are worth the cost.

The last thing you want is to be stuck paying back your taxes on top of sky-high credit card interest.

Related: The best credit card welcome offers available this month

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app