Quick Points: Maximize Priority Pass benefits by labeling your cards

Editor's Note

Many premium travel rewards credit cards come with a Priority Pass membership that gives cardmembers access to over 1,300 airport lounges worldwide.

What's sometimes forgotten, though, is that not all Priority Pass memberships have the same benefits. Some provide unlimited visits, while others do not include access to non-lounge airport venues and perks, such as airport restaurant credits.

Plus, guesting privileges can vary from one membership type to the next. All this said, if you have Priority Pass membership from more than one credit card, it's important to keep track of your Priority Pass cards so you don't incur any unexpected charges.

Since all Priority Pass cards look the same, there's no easy way to tell them apart and distinguish which one came with which of your credit cards. Luckily, there's a simple solution: label them.

Label your Priority Pass cards

The easiest way to tell your Priority Pass cards apart is by labeling them.

Since the card is black, your best option is to either make a note on the signature box on the back of the card or add a small sticker. If you prefer to use the digital card, you can take a screenshot of the QR code and add a note to it, or add the issuing bank's name to your Priority Pass username (i.e. RyanAmex).

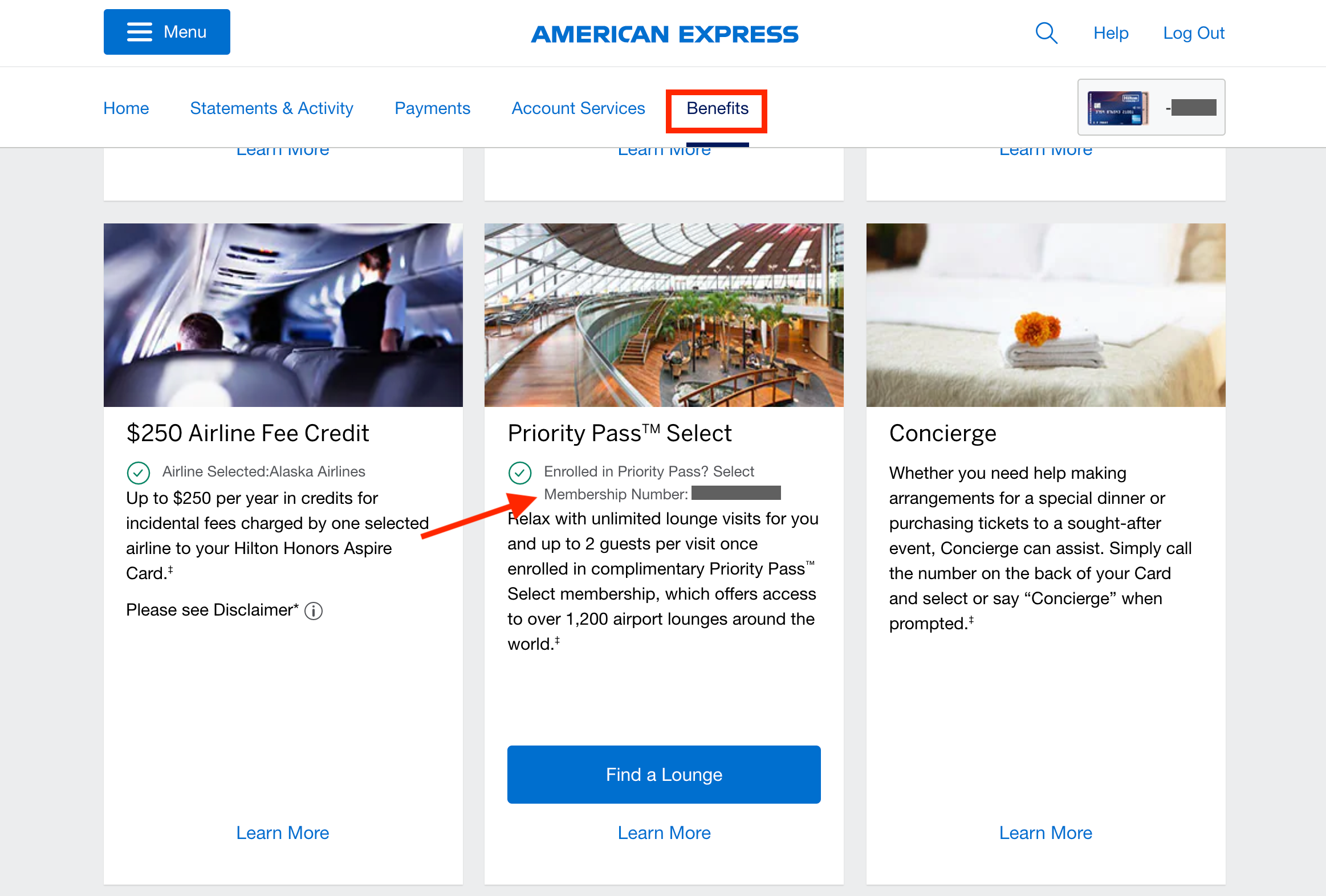

If you've already confused your cards, you should be able to find your Priority Pass membership number via your online credit card account or by calling your bank.

Priority Pass membership rules vary from one credit card to the next, so you'll want to review your card's benefits guide for full details. However, as a general rule, you'll want to note that American Express and Capital One cards that offer Priority Pass memberships exclude the restaurant benefit. This benefit is also excluded from the Chase Sapphire Reserve®'s (see rates and fees) Priority Pass membership.

Most cards offer up to two free guests per visit, though some cards allow you to bring unlimited guests. If you accidentally use the wrong card, you might be charged $35 (or more) per guest.

Remember, stacking multiple Priority Pass memberships at one lounge to bring in extra guests typically isn't allowed.

Bottom line

Priority Pass is a useful benefit that comes with many top-of-the-line travel cards. If you have Priority Pass membership through multiple credit cards, keeping track of what benefits come with each membership is important. That way, you won't face unnecessary or unexpected charges on your travels.

If you don't already have a card that offers a Priority Pass membership in your wallet, check out this guide for our favorite cards that offer Priority Pass.

Related: Is this the best Priority Pass lounge in the country?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app