Savvy Saturday: How to follow Dave Ramsey's famous envelope system and earn up to 5x points with every purchase

Update: Some offers mentioned below are no longer available. View the current offers here.

Editor's note: Some travel cards come with perplexing benefits that are tricky to maximize. This article is part of a series that shows you unique, fun and unintended ways to use your credit card benefits. If you've got any questions or have an example of a surprising way to maximize a credit card perk, tweet us @thepointsguy, message us on Facebook or email us at info@thepointsguy.com.

Dave Ramsey does not like credit cards.

The personal finance expert and radio host's reasoning is relatively sound. If you've got a tendency to overspend or impulse buy, routinely bewildered as to how your monthly credit card statement is so astronomical, credit cards might not be for you. That goes doubly for travel credit cards, as they tend to have very high interest rates that can hamstring you if you carry a balance.

If you're responsible with your credit, though, travel credit cards are akin to Willy Wonka's golden ticket to free travel. These cards come with such high interest rates precisely because their benefits are so good.

However, there's a simple way to help yourself stay within budget by adopting Dave Ramsey's famous envelope system — and you can earn a ton of credit card points while you're at it with the best rewards credit cards.

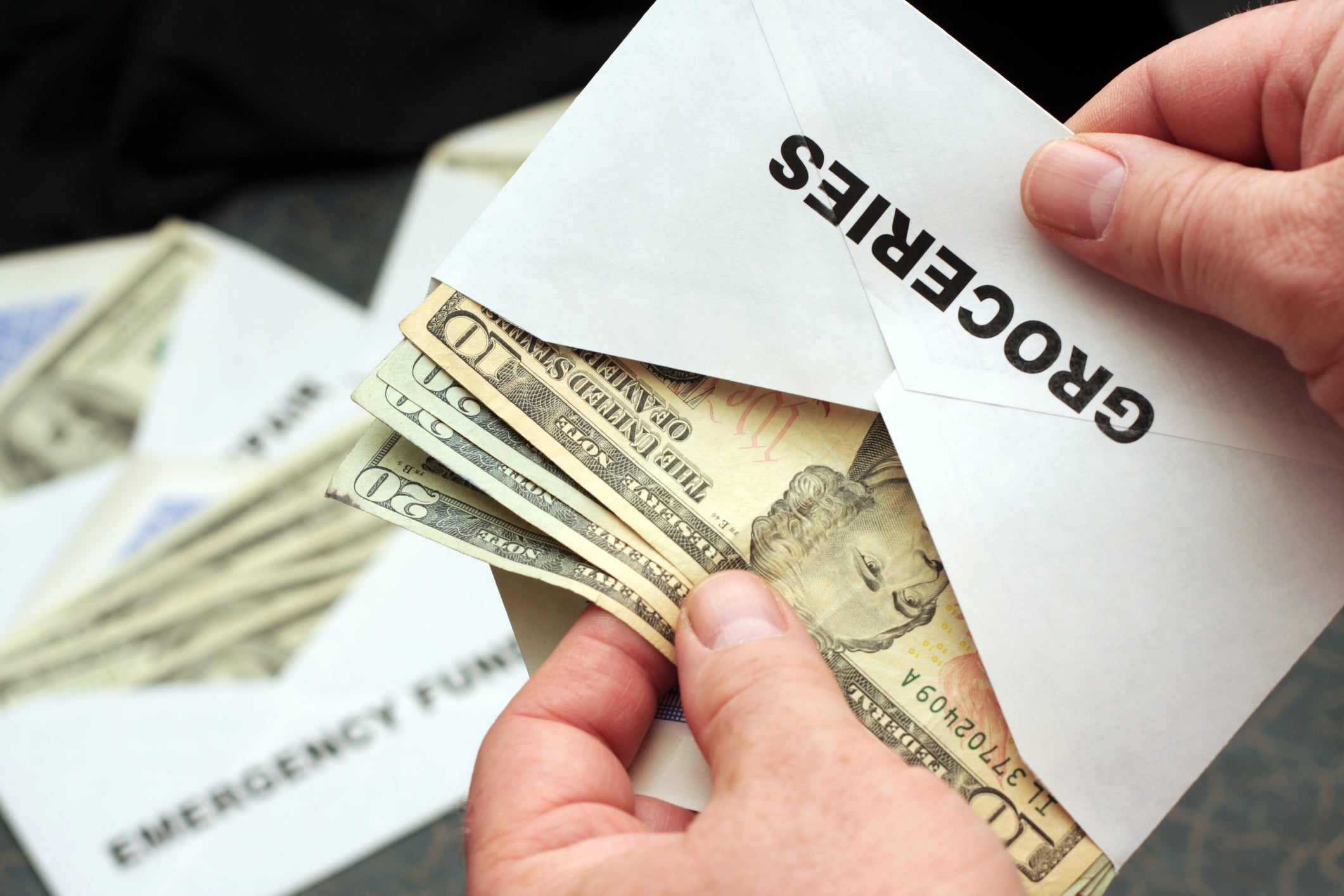

The Dave Ramsey envelope system

In case you're unfamiliar, Dave Ramsey's envelope system works like this:

- Create envelopes for all of the spending categories in which you'd normally swipe a credit card, such as groceries, gas and dining.

- Evaluate your budget and decide how much you can afford to spend in each category.

- Label each envelope and include your budget for that particular category.

- Use your paycheck to fill each envelope with the amount of cash written on the front of the envelope.

You can do this by month, paycheck by paycheck or whatever else works for you. For example, a monthly envelope system may look something like this:

- Groceries - $500

- Restaurants - $300

- Entertainment - $250

- Gas - $100

- Maintenance (car, house, whatever) - $150

- Emergency - $100

You probably won't include things like rent, utilities, insurance, etc. Those shouldn't vary by much, so figure out your budget after those expenses.

Now for the tough part: Commit to yourself that the cash in those envelopes is all that you will use for the month. Don't touch your debit card and don't withdraw more money from the bank. Provided you can stick to it, this can be a great method to help you from spending more than you're earning. The problem is that you don't earn valuable travel points when you pay for things with cash or your debit card.

The secret: Use your credit cards like cash via gift cards

Here's a way to stay within budget with the envelope system and earn a load of points simultaneously. Instead of using your credit card for all your purchases, use it to buy Visa gift cards at the store in the amount of each expense and place those in each envelope. For example:

- Groceries - $500 Visa gift card

- Eating out - $300 Visa gift card

- Entertainment - $250 Visa gift card

In other words, you're buying gift cards for the same amounts you'd typically spend — and no more.

Visa gift cards can be used for purchases at any merchant that accepts Visa. After you've purchased your gift cards, pay off your credit card statement with your paycheck once your transactions post. You'll be charged no fees since you don't have an overdue balance, and your credit score's health should increase because you'll have a track record of paying off your cards on time.

I suggest keeping a small tally on the back of each gift card with the amount that's left. If you do it immediately after paying, it's not an inconvenience at all.

A big caveat here is that gift cards often come with a fee of around $5 to $7 each — though there are frequent promotions that lower this figure. Retailers sell them with no fees, at discounts, or even offer statement credits. Paying $40 per month for gift cards isn't ideal, but I'll show you why it's still better than using cash. You could even earn up to 5 points per dollar for the vast majority of your expenses.

Best cards to use with the Dave Ramsey envelope system

Many credit cards have generous spending categories that help you earn points quickly. If you play your cards right, you can buy gift cards that fall into each of these categories. It'll help you budget and earn points. For the below examples, we'll assume you have the monthly budget of $1,400 we estimated above.

Ink Business Cash Credit Card

Welcome bonus: $750 bonus cash back (75,000 Chase Ultimate Rewards points) after you spend $7,500 on purchases in the first three months from account opening. That's by far the highest bonus this no-annual-fee card has ever had.

We estimate Chase points' value to be 2 cents each. That makes this bonus worth $1,500 in travel. Just note that to get the best value for your points, you'll also need an Ultimate Rewards earning card like the Chase Sapphire Preferred Card. Read our post on the best ways to use Chase points to learn more — and understand the power of Chase points.

Earning rate: The Ink Business Cash Credit Card earns...

- 5% cash back (5 Chase points per dollar) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet, and cable TV services each account anniversary year (then 1% back)

- 2% cash back (2 Chase points per dollar) on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year (then 1% back)

- 1% cash back (1 Chase point per dollar) on all other eligible purchases

How to maximize this card: If you use your card to buy Visa gift cards at an office supply store like Staples, you will earn 5% cash back (or 5 Chase points per dollar if you have an Ultimate Rewards card). Staples gift cards come in the following denominations:

- $25

- $50

- $100

- $200

- $300

With the sample monthly budget of $1,400, you'll probably end up buying six gift cards. You're paying ~$42 in gift cards monthly, but you're earning 7,000 Chase points. And again, you can stock up on these gift cards when office supply stores run their fee-free gift card sales — which now happen to occur just about every week between Staples and Office Depot/Office Max.

Sticking to this budged, you'd earn $840 in cash, or 84,000 Chase points, over the course of a year. Remember, we estimate Chase points value to be 2 cents each, so that's like getting $1,680 in travel each year if you have an Ultimate Rewards-earning card. And they can be worth much more if you know how to redeem Chase points for maximum value.

Yearly value (including welcome bonus): $1,590 in cash, or $3,180 in travel. Unbelievable for a card with no annual fee.

Read our Chase Ink Business Cash review to learn everything you need to know about the card.

American Express® Gold Card

Welcome bonus: 60,000 Amex Membership Rewards points after spending $4,000 on purchases in the first six months of card membership. We estimate Amex points value to hover around 2 cents each toward travel, making this bonus worth $1,200.

Earning rate: The American Express® Gold Card earns...

- 4 Amex points per dollar at restaurants

- 4 Amex points per dollar at U.S. supermarkets (on up to $25,000 per calendar year; then 1 point per dollar)

- 3 Amex points per dollar on flights booked directly with airlines or through the Amex Travel Portal

- 1 point per dollar on other eligible purchases

- Terms apply

How to maximize this card: Head to a supermarket in the U.S. with the Amex Gold. You can buy gift cards up to $500 to stuff in your envelopes while getting 4 points per dollar (up to $25,000 in spend annually). With our $1,400 monthly budget, you'll earn 5,600 Amex points per month or 67,200 points per year. The card has a $250 annual fee (see rates and fees).

Yearly value (including welcome bonus): $763 in cash or $2,544 in travel.

It's not a good idea to redeem Amex points for cash, as you'll only receive a value of 0.6 cents per point. Much better to use them for travel. Read our post on the best ways to use Amex points. And take a look at our Amex Gold review, too. It tops our list of the best cards for dining (at restaurants).

Chase Freedom Flex

Welcome bonus: $200 bonus cash (or 20,000 Chase points) after you spend $500 on purchases in your first three months from account opening.

Earning rate: The Chase Freedom Flex earns...

- 5% cash back (5x Chase points) on grocery store purchases -- not including Target or Walmart -- on up to $12,000 spent in the first year (technically part of the card's welcome bonus)

- 5% cash back (5x Chase points) on up to $1,500 in combined purchases in rotating bonus categories each quarter (you must activate each quarter)

- 5% on travel purchased through Chase

- 3% on dining at restaurants and drugstores

- 1% on all other eligible purchases

How to maximize this card: As mentioned above, part of this card's welcome bonus is earning 5x Chase points at grocery stores in the first 12 months of card membership for up to $12,000 in spending. Many grocery stores sell Visa or Mastercard gift cards in denominations of up to $500.

Once you max out this introductory 5% back on $12,000, you'll have earned $600 cash or 60,000 Chase points. You could then begin purchasing from drug stores and still get 3% back. Since we value Chase points at 2 cents each towards travel, you should earn enough points for around $1,500 in travel in the first year.

Yearly value (including welcome bonus): $944 in cash or $1,888 in travel. Again, not bad for a no-annual-fee card.

Read our Chase Freedom Flex review for more info on this card. Also, note that the Chase Freedom Unlimited has the exact same welcome bonus (and yes, you can have them both).

Bottom line

Dave Ramsey is correct — for the average American that may not have healthy credit habits down pat — credit cards probably do more harm than good. It's easy to lose track of your spending if you aren't fiercely self-disciplined.

However, credit cards can coexist with a cash-only approach. If you buy Visa/Mastercard gift cards with a travel credit card at a merchant that gives you bonus points — and then throw the credit card into your sock drawer until next month — you accomplish the following:

- You force yourself to stay true to your budget. Once the gift cards run out, you have no more money to spend.

- You can earn multiple credit card points for every single dollar you spend — more so than if you actually used your credit card with different merchants.

For rates and fees of the Amex Gold card, click here.