What is Citi Entertainment? Get access to concert presale tickets, VIP events and more

Editor's Note

Credit card issuers are all vying for our business, one way or another. Whether it's credit card rewards or a travel portal, issuers want to keep us locked in to their ecosystem.

Beyond rewards and travel benefits, issuers like Citi have another perk to entice cardholders. Citi Entertainment provides access to presale tickets and exclusive experiences to music, sports, arts and cultural events. Cardholders may find this just as valuable as bonus-earning categories or travel credits.

Here's what Citi Entertainment has to offer and how to use it.

What is Citi Entertainment?

Citi Entertainment is available to all eligible Citi cardholders at no additional cost. The program offers early or preferred access to hundreds of live events each year, ranging from concerts and comedy shows to sports competitions, special events and theater performances.

Events found on Citi Entertainment can be booked online or via phone. Some types of events may only be bookable through a phone call, so expect to put in some effort when trying to secure sought-after tickets.

How Citi Entertainment works

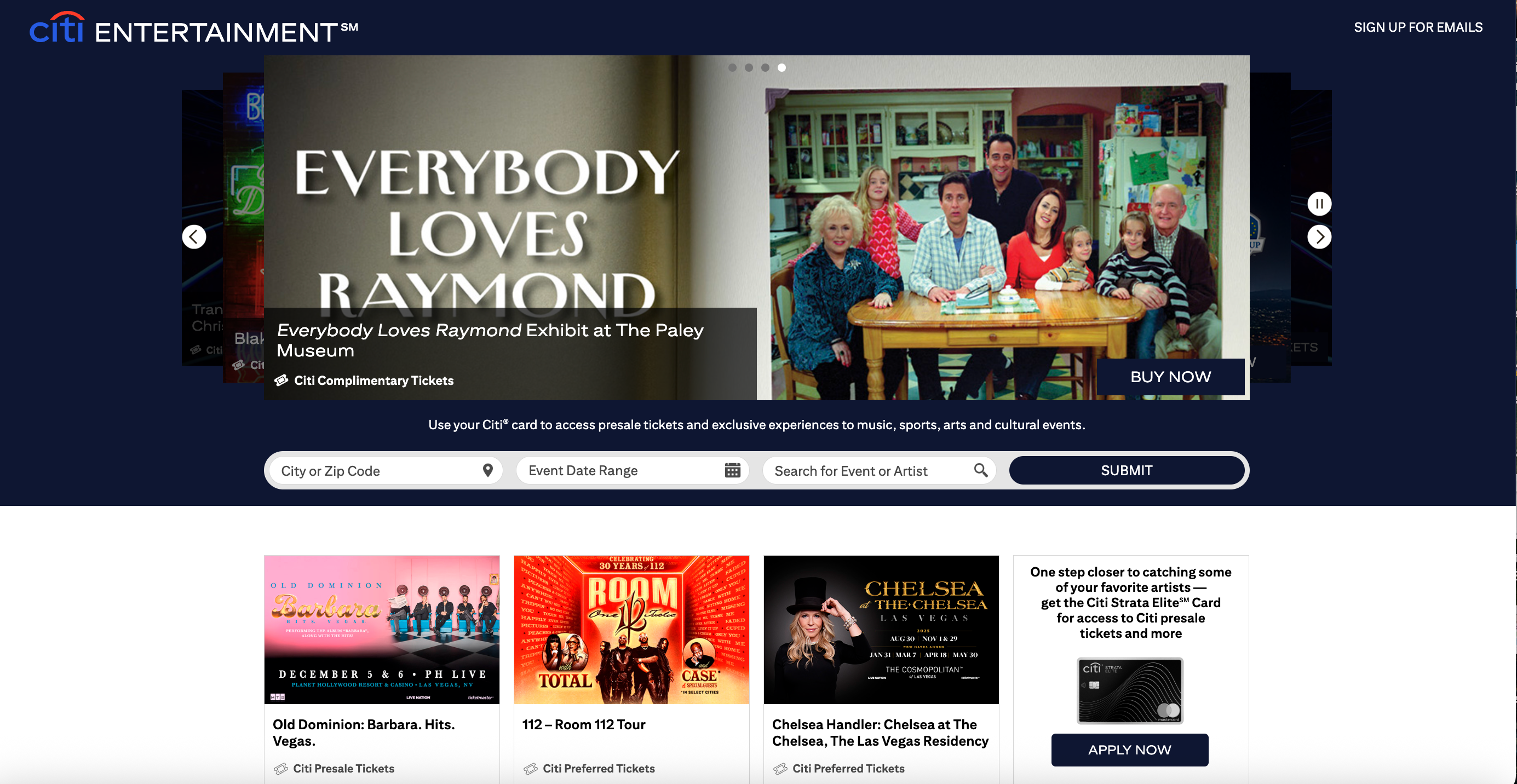

Visit citientertainment.com to access the portal. The site does not require a login or entering your Citi card number for confirmation. You can search for an event or artist using the search box; otherwise, search by city, ZIP code or event date range.

Citi Entertainment allocates tickets exclusively for Citi cardholders. These can include:

- Presale tickets: Early access to event tickets

- Preferred tickets: Access to special reserved seats

- VIP packages: Access to unique experiences, including suite/lounge access, meet-and-greets and other perks

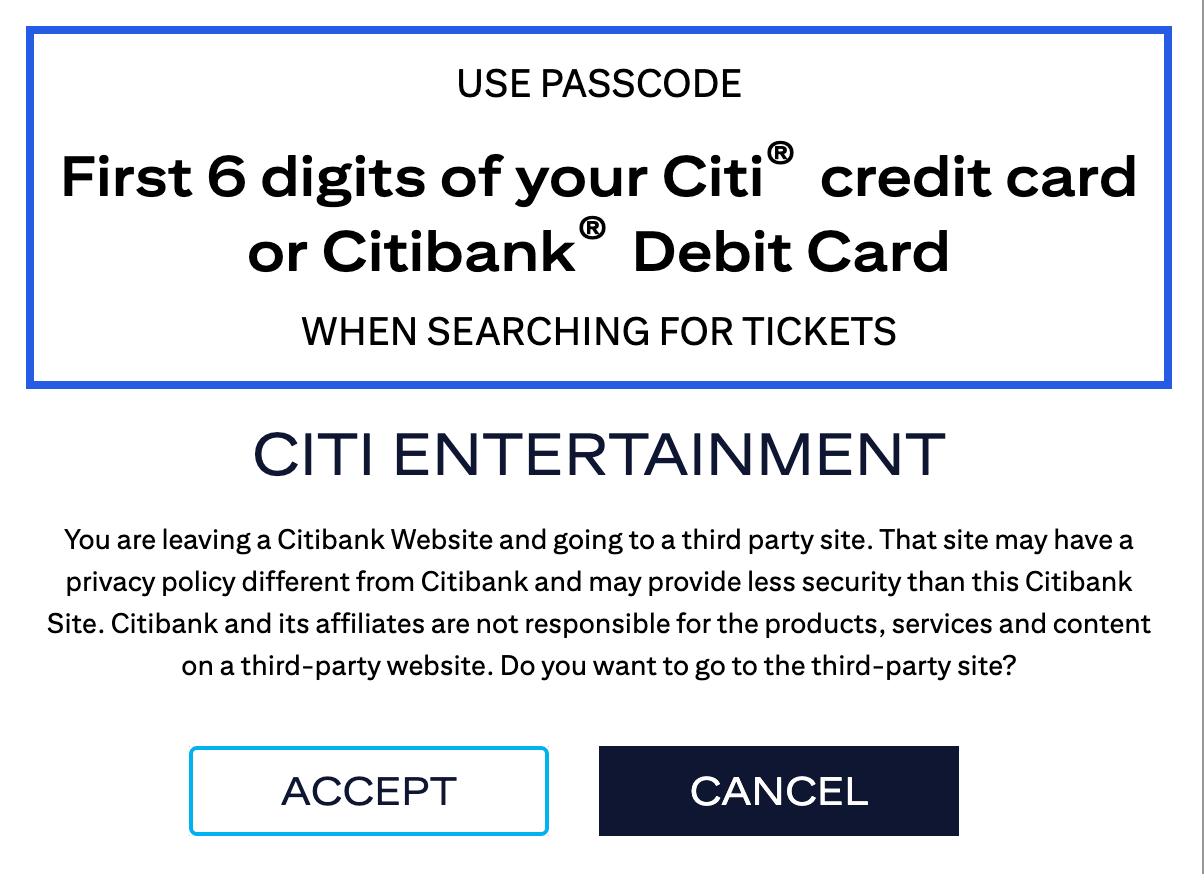

In order to book, you may be required to call Citi event offers at 1-800-301-3327 or use a passcode for online purchase. In most instances, the passcode will be the first six digits of your Citi card; otherwise, Citi will provide you with a passcode before directing you to a vendor's website.

The downside to Citi Entertainment is that you can't directly use your Citi ThankYou Rewards points on the website to cover or split the cost of entertainment purchases. You can, however, apply your ThankYou Rewards points as a statement credit to the purchase after it's posted, but you'll only get 1 cent per point in value.

How to search

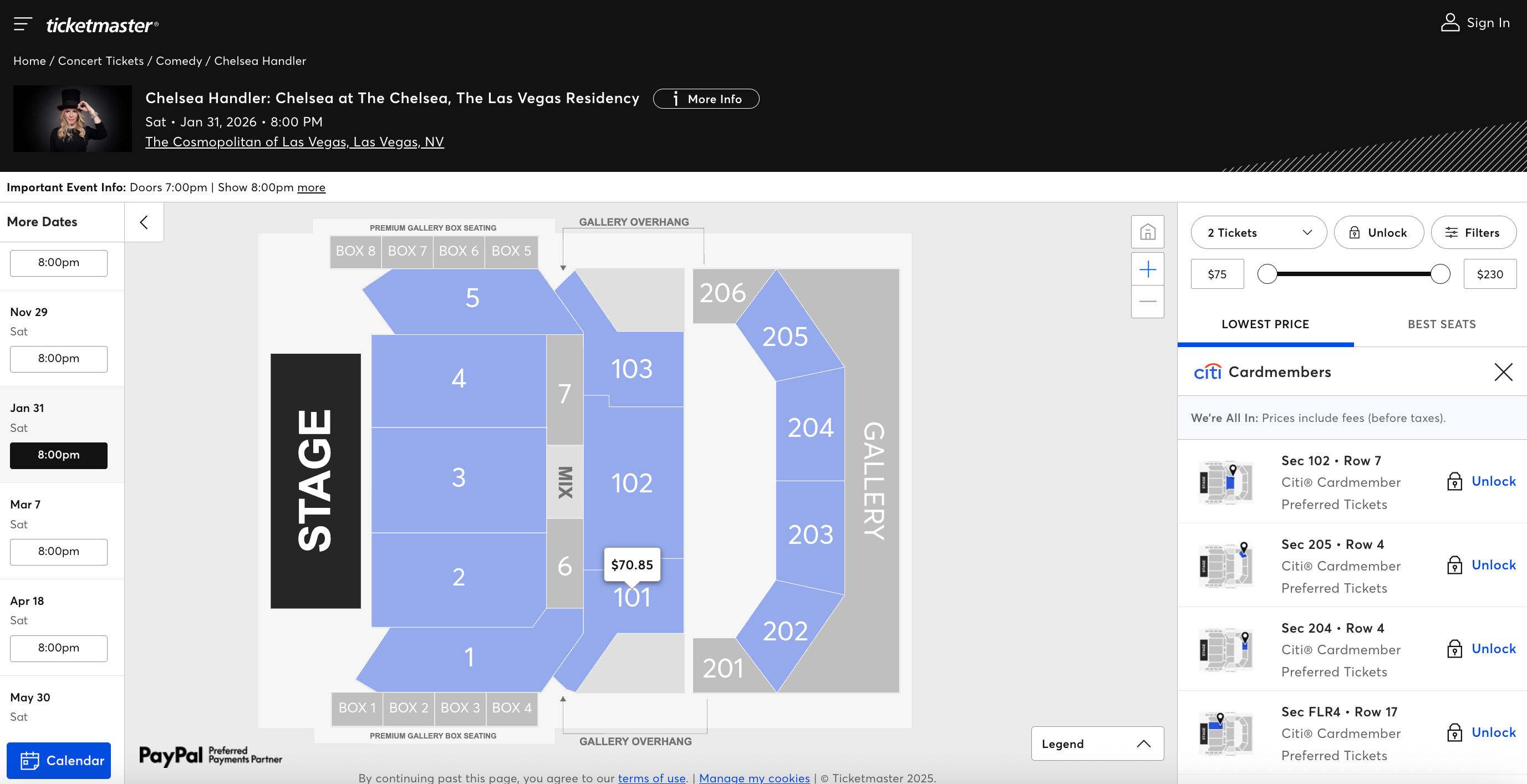

Search for your event based on preferred dates, city or event name. Purchases for events found on Citi Entertainment are not made on the website; instead, you're routed to a ticketing partner, such as Ticketmaster. If a preferred ticket event or VIP event is not bookable online, you must call Citi.

For example, a Chelsea Handler show in Las Vegas, found on Citi Entertainment, routes you to Ticketmaster, where you can unlock access and pricing for preferred seating as a Citi cardholder.

Which cards to use on Citi Entertainment purchases

Citi offers a full suite of credit cards, starting with cobranded cards like the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees), cash-back cards like the Citi Double Cash® Card (see rates and fees) and premium travel cards such as the Citi Strata Elite℠ Card (see rates and fees).

I recommend using the following cards to earn maximum rewards on your Citi Entertainment purchases:

- Citi Strata℠ Card (see rates and fees): Earn 3 points per dollar spent on entertainment purchases (must choose live entertainment as the self-select category).

- Citi Double Cash Card: Earn 2% cash back (1% when you purchase and 1% when you pay off the card). Note that to earn cash back, you must pay at least the minimum due on time.

- Citi Strata Elite Card: Earn 1.5 points per dollar spent on all purchases.

Related: The best time to apply for these popular Citi credit cards based on offer history

How to maximize Citi Entertainment

To better maximize your access to Citi Entertainment, here are some steps to take:

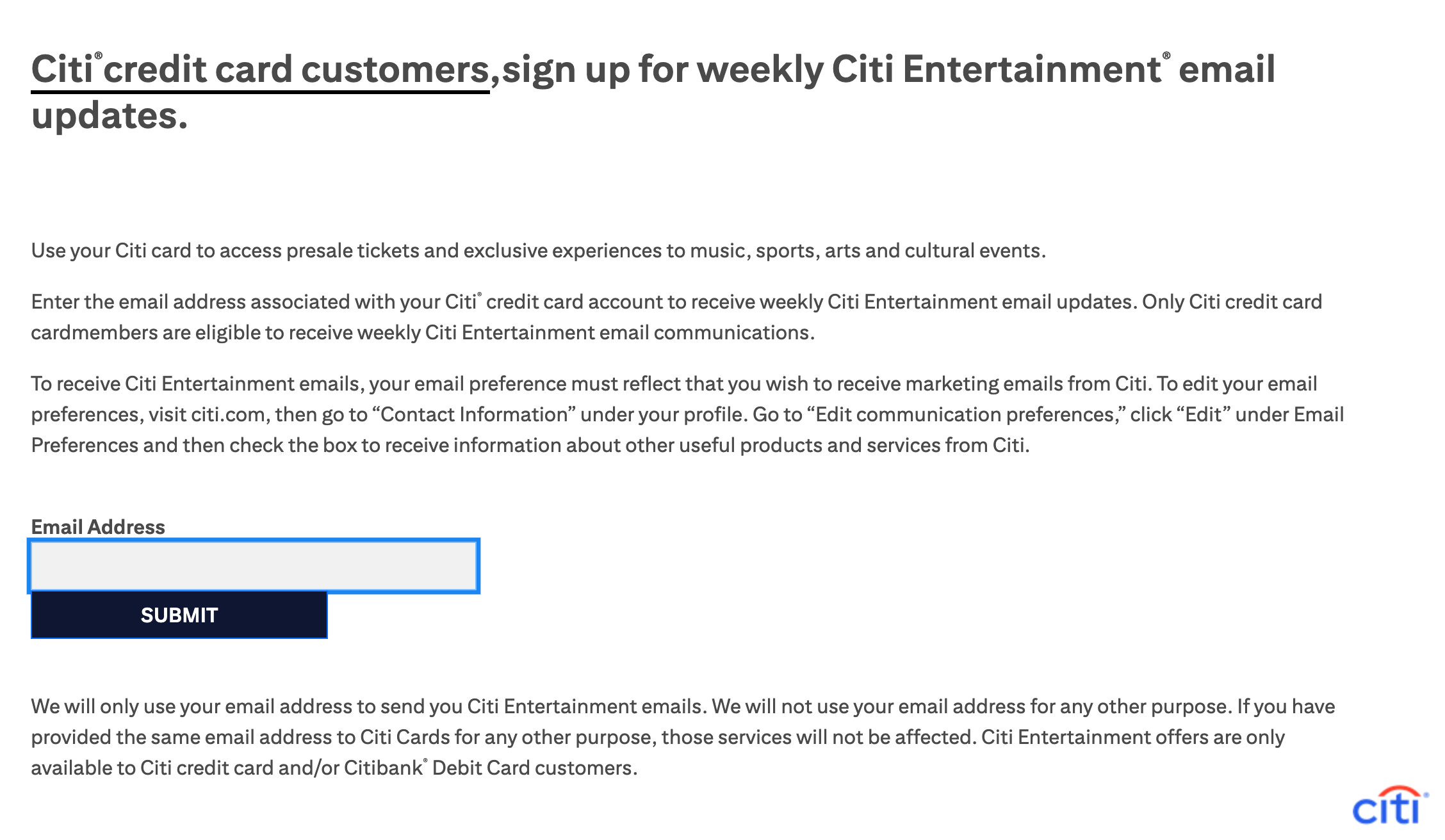

- Sign up for email updates: Receive weekly updates on presales and upcoming events.

- Link your accounts: Link your Citi account with Ticketmaster for a faster checkout experience.

- Be diligent: Act fast for presale or preferred tickets, and check back multiple times in case tickets are released in waves.

Related: Comparing flat-rate with bonus-category cash-back credit cards

Bottom line

Citi Entertainment can be an overlooked perk of being a Citi cardholder, and you should take advantage of it because it doesn't cost you anything extra. From presale tickets to securing sold-out concert tickets and access to VIP experiences, Citi Entertainment can unlock moments to help you create unforgettable memories.

If you have a Citi card, keep an eye on Citi Entertainment events. Your next move could be securing the best tickets for you and your loved ones.

Related: Best Citi credit cards

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app