Your complete guide to Capital One Entertainment: How to redeem rewards for events

Editor's Note

For your sports, dining and entertainment needs, Capital One has you covered.

With Capital One Entertainment, cardholders can purchase or redeem rewards for tickets to thousands of events worldwide.

The platform even offers access to presale events, as well as curated "Capital One Cardholder Exclusive" packages that include special experiences like meet-and-greet opportunities that are not available to the general public.

But is redeeming your hard-earned rewards for these events a good deal?

Let's discuss how the Capital One Entertainment platform works and provide some sample redemption options available for cardholders.

Who can access Capital One Entertainment?

Most Capital One cardholders with an eligible rewards credit card can access the platform by logging in on Capitalone.com. Keep in mind that your account has to be in good standing, you must be at least 18 years old and you must be the primary account holder.

Whether you carry one of the issuer's travel cards (like the Capital One Venture X Rewards Credit Card) or a simple cash-back card (like the Capital One Savor Cash Rewards Credit Card), you have the option to redeem your rewards for tickets to live events through Capital One Entertainment.

How Capital One Entertainment works

Capital One Entertainment is powered by Vivid Seats, an online marketplace for tickets to sporting events, concerts and theater performances. This platform replaced the issuer's previous entertainment platform, Capital One Access.

That means virtually all the tickets found on the Capital One Entertainment platform can also be found and purchased directly on Vivid Seats, with the exception of "Capital One Cardholder Exclusive" tickets that are curated by the issuer (more on that below).

How to search

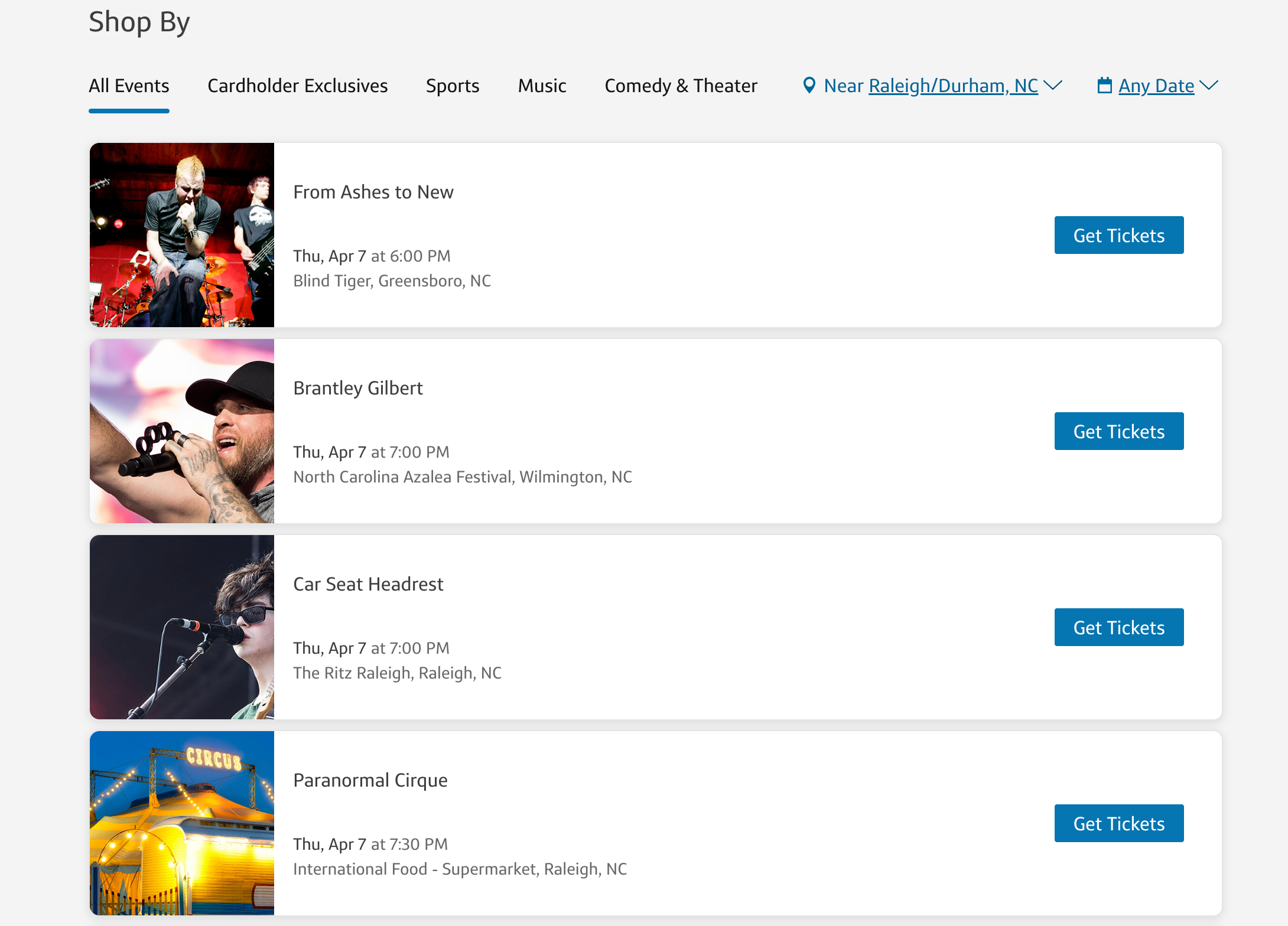

You can shop by category (cardholder exclusives, sports, music, comedy and theater) or search for events in your local area.

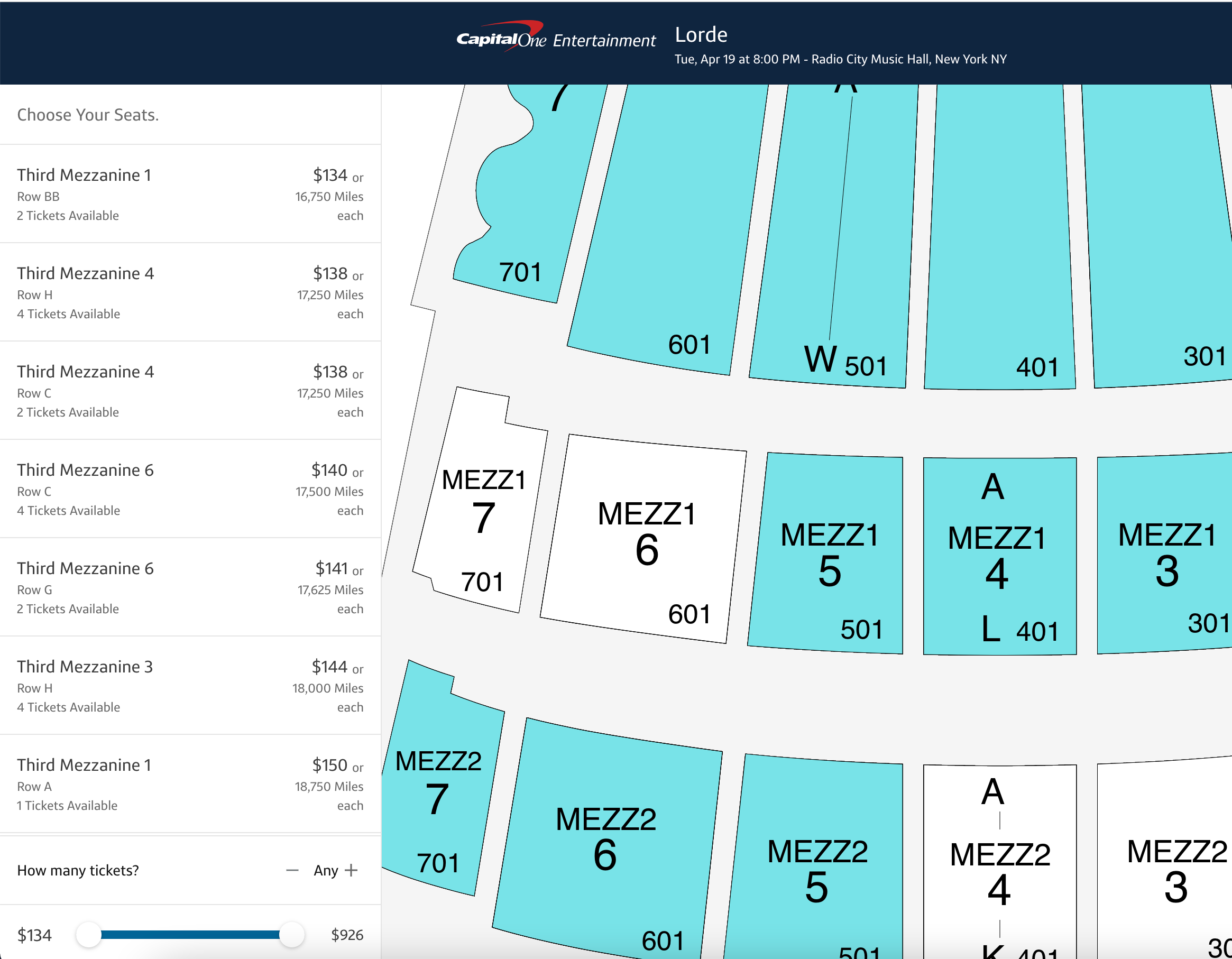

Once you find an event that interests you, you can narrow your search by section and ticket price, which is displayed both in cash and in rewards.

How to pay

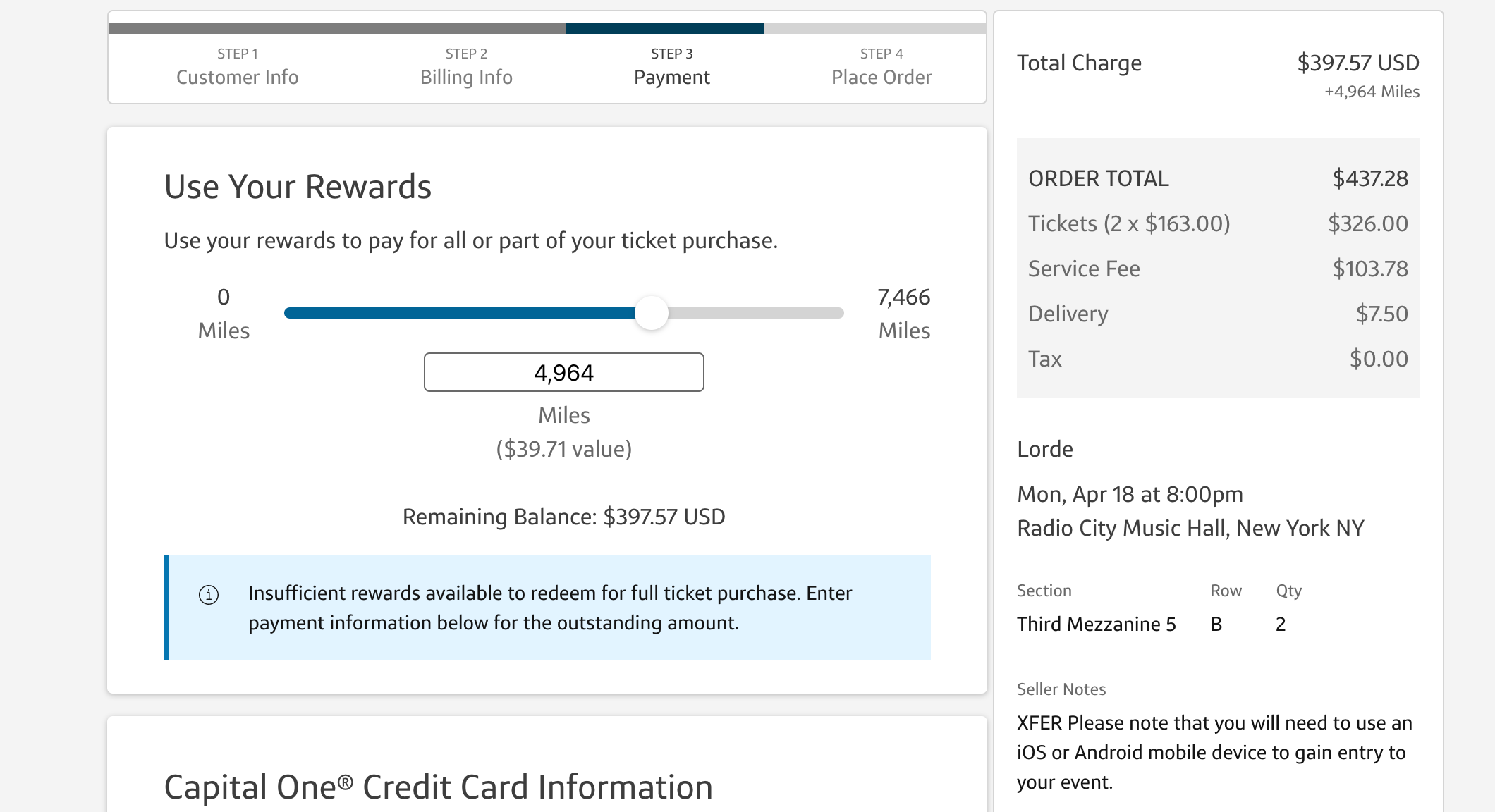

Once it comes time to pay for your ticket, you can pay with your eligible Capital One credit card or redeem your Capital One rewards. For some events, you may be eligible to use a combination of the two payment methods.

However, the redemption rate will depend on which Capital One card you carry in your wallet.

For cards within the Venture family (Capital One VentureOne Rewards Credit Card, Capital One Venture Rewards Credit Card and the Capital One Venture X Rewards Credit Card), you can use your miles at a rate of 0.8 cents each.

This is well below TPG's February 2025 valuation of Capital One miles at 1.85 cents each when you use the issuer's valuable transfer partners, so we generally recommend you avoid redeeming your rewards for Capital One Entertainment tickets — with the exception of some exclusive events.

However, if you carry any of Capital One's cash-back cards, you can redeem your rewards at 1 cent each (the same rate if you were to redeem your rewards for a statement credit), making this a good use of your rewards.

Additionally, the Capital One Venture X, Capital One Venture X Business, Capital One Venture Rewards and Capital One Spark Miles for Business now earn 5 miles per dollar spent on purchases made through Capital One Entertainment, making these the cards to use if you're looking to buy through that platform.

If you pay with the Capital One Savor Cash Rewards Credit Card you'll earn 8% cash back on Capital One Entertainment purchases.

The checkout process is easy. If the event is eligible, you can use the toggle feature to pick the number of miles you want to use (if any), then enter your Capital One credit card information to complete the transaction.

The ticket delivery method will depend on the event, but you may receive a mobile e-ticket, email delivery for instant download, a physical ticket in the mail or other options. Just pay careful attention to the confirmation screen and email you receive to figure out how exactly you'll get your tickets.

Can I cancel my Capital One Entertainment ticket?

It's worth noting that tickets are final sale, meaning you cannot cancel or resell them after placing the order. That's the major caveat I've found with this booking platform, so you may want to avoid Capital One Entertainment if you're looking for flexibility in your plans.

If your event is canceled by the organizer, you'll receive an email and a refund from Capital One. However, for postponed events, you'll get tickets for the new date, but you will still not be eligible for a refund.

Is Capital One Entertainment worth it?

Like entertainment tickets purchased elsewhere, the ones you buy through Capital One are usually nonrefundable (unless you purchase additional insurance or protection).

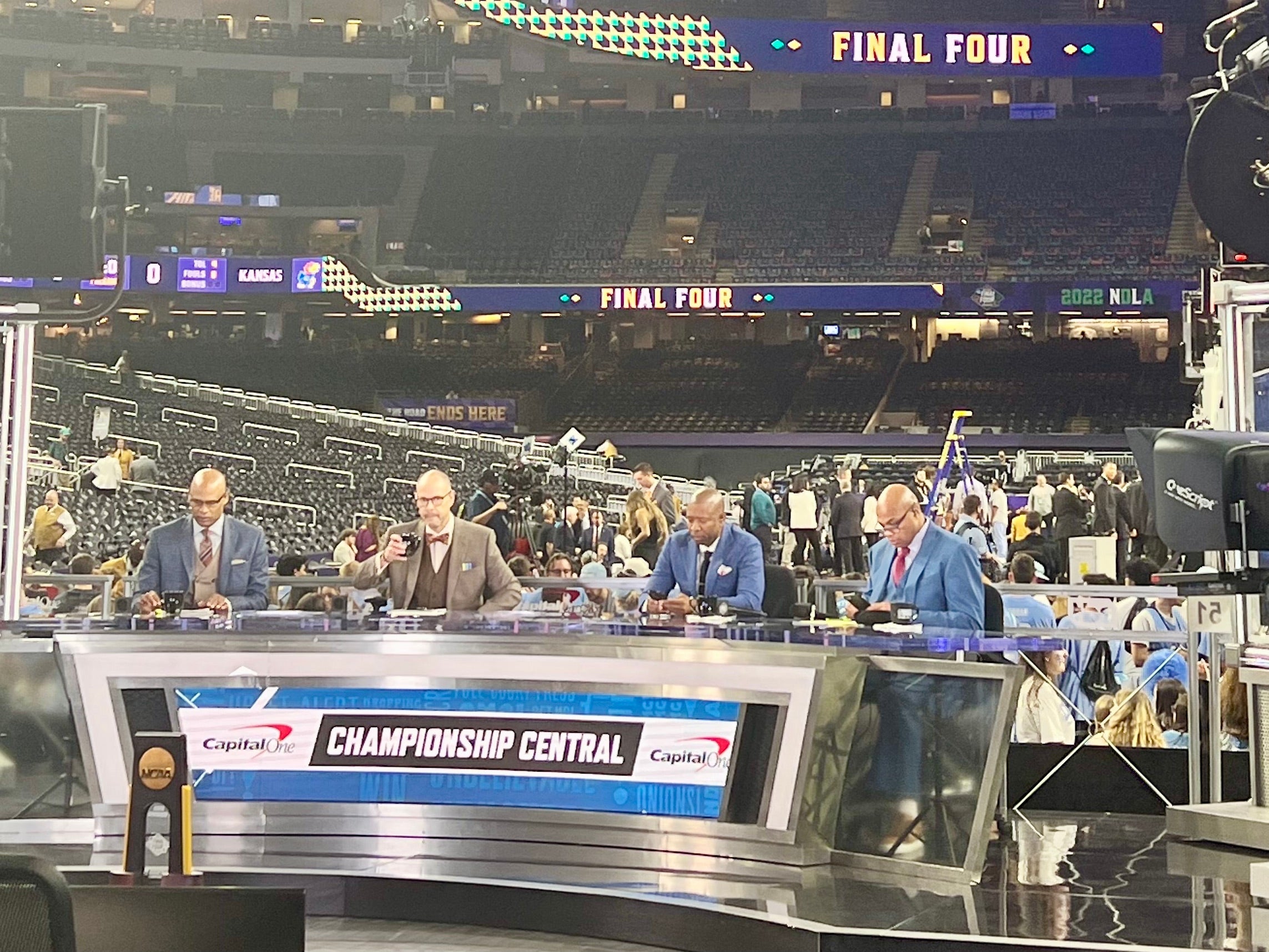

Despite this drawback, Capital One Entertainment offers terrific deals for cardholder-exclusive events. While the platform is currently dominated by MLB games, we've seen Capital One put together some exclusive packages for the NCAA Final Four, as well as dining and music events.

Still, before you finalize payment, be sure to crunch the numbers to determine whether you're getting a good value for your rewards.

Bottom line

Capital One Entertainment provides entertainment access for cardholders. Overall, having another redemption option for cardholders is always a win, especially for those who choose to take advantage of Capital One's cardholder-exclusive packages. Just be sure you're comfortable with the value you're getting for your rewards, as there may be better options out there.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app