How to use Amex's expanded credit score tool to increase your credit score

Your credit score is an important part of your overall financial health. The higher your credit score, the better your approval odds are for mortgages, car loans, small-business loans, the best credit cards and more. Not only that, but your interest rates across all of these lines of credit are likely to be much more favorable when you have a high credit score.

New to TPG? Sign up for our daily newsletter and check out our beginner's guide!

All major credit card issuers do provide a free credit score tool for cardholders where you can check your score. But there are a number of factors that go into your credit score, and it can be tough to know where you should focus your efforts when trying to improve your credit score. Well, American Express has officially entered the chat.

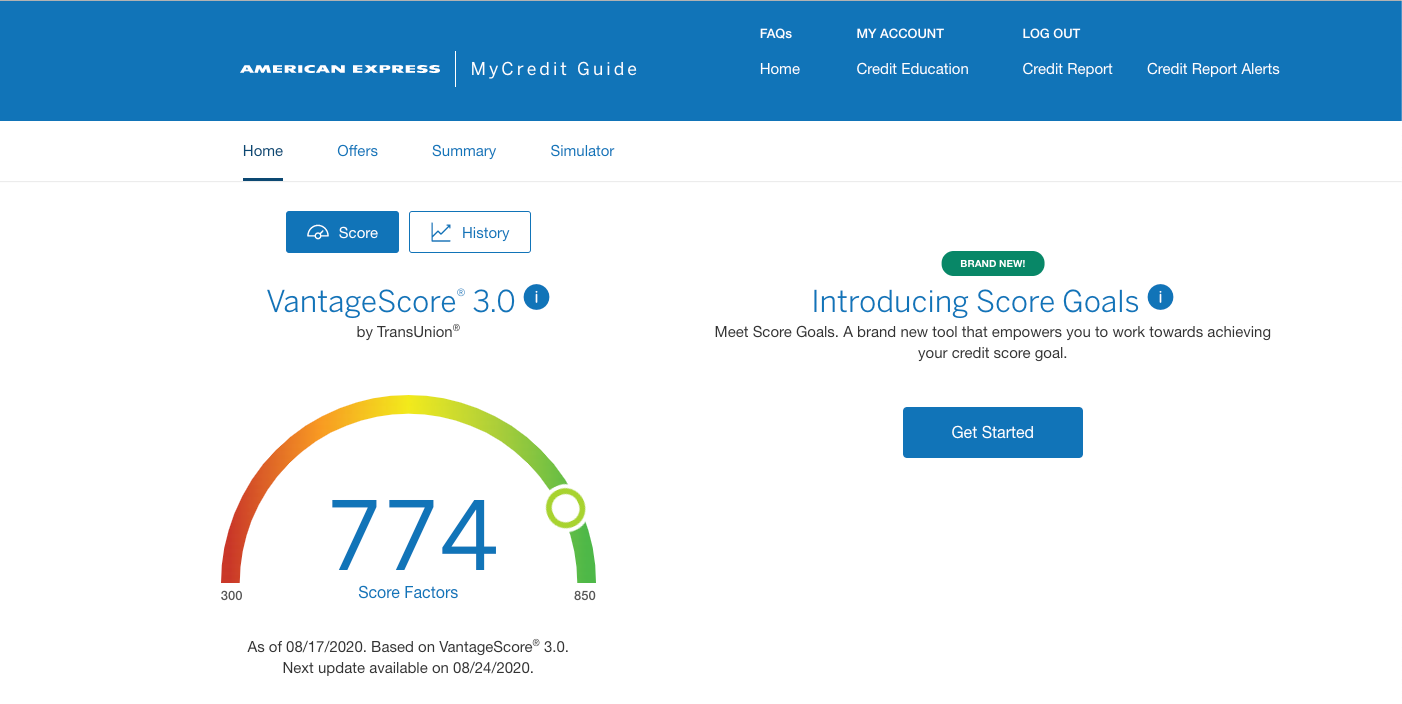

American Express has a free credit score tool (even for non-cardholders) called MyCredit Guide, which gives you access to your Vantage 3.0 score. Now, Amex has added a new capability called "Score Goals." Users can set a goal credit score and receive tailored recommendations on areas to focus on in order to hit that goal in a set recommended period of time.

This is the screen you'll now see when you log on:

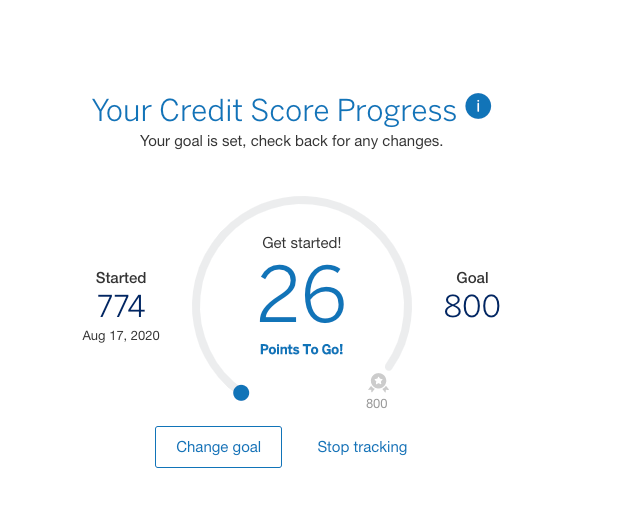

Hit "Get Started," to set your credit score goals. I set mine to 800.

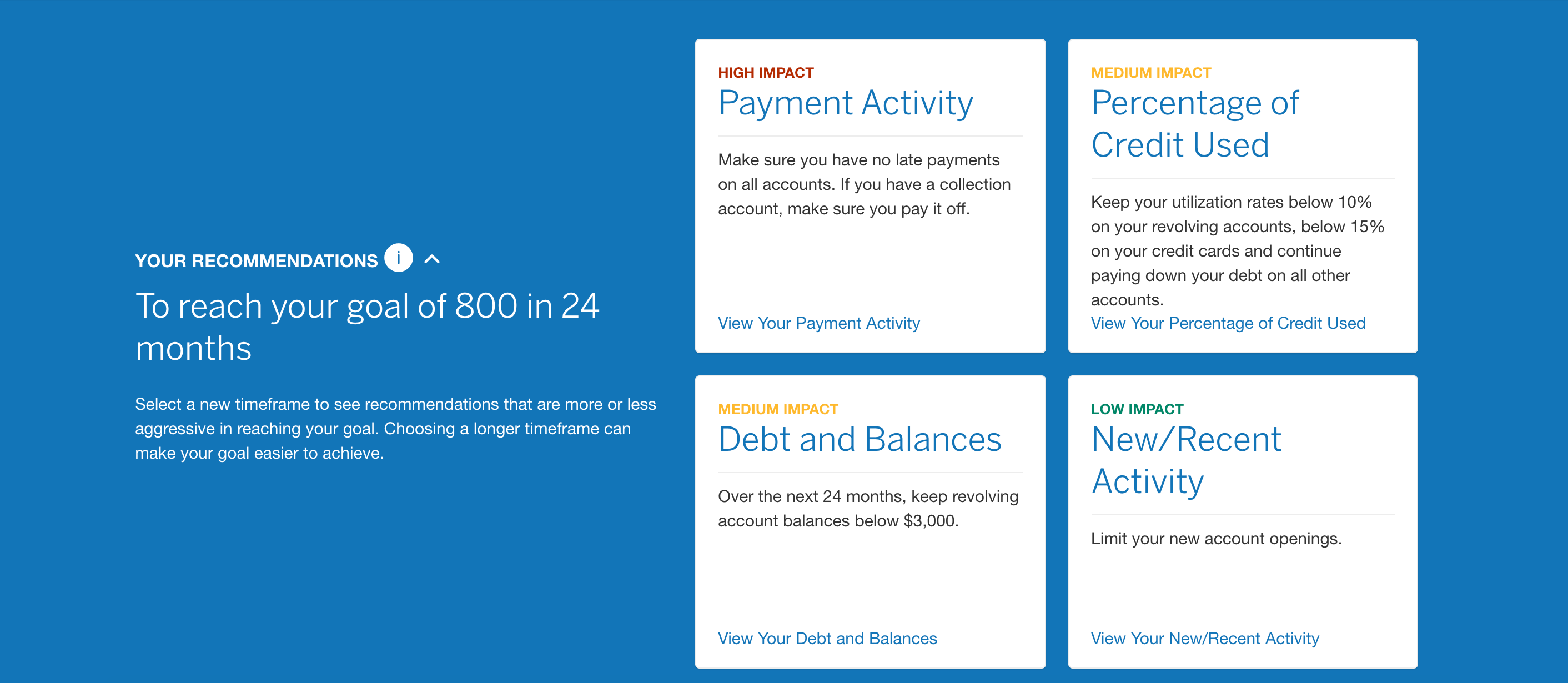

When I put in my goal of 800, Amex automatically suggested a goal time frame of 24 months. From there, you'll get a set of recommendations of specific factors to look at.

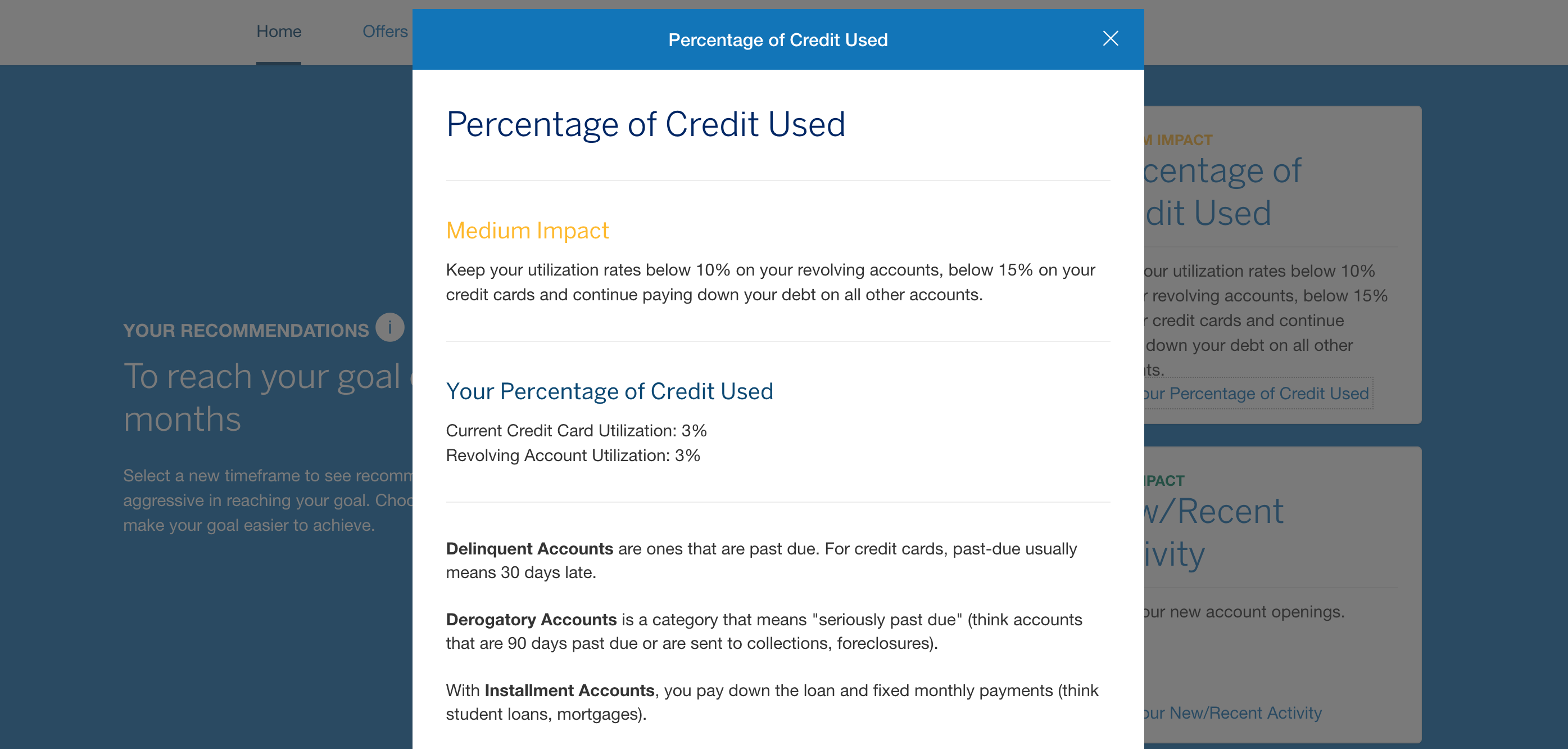

You can then click into these factors to see how you are measuring up to the recommended standards to help increase your credit score.

When is the Score Goals tool worth it?

I'll be honest: If you already have a high credit score, there probably isn't much you're going to get out of this tool. Even my goal of hitting 800 will really just be dependent upon me keeping up my current responsible credit habits until I have a longer history. I've only had credit cards since college — about five or six years total. I recognize that my payment history and length of accounts will be key for me to hit that 800 score goal.

However, if you are just getting started on your credit journey, or if you are looking for ways to take your score from "average" to "good" or "excellent," this tool could help you figure out the factors you'll need to pay the most attention to over time while giving you a snapshot of how your current credit report stats measure up.

The best part is that this tool is available to non-cardholders as well. If you already have four Amex credit cards and a 770+ credit score, you probably don't need a ton of guidance to increase your score over time. But there are plenty of beginners who are trying to build credit for the first time, as well as people looking to repair their credit after financial hardships. In those cases, an Amex credit card may not be an option for them right now.

This tool is free to anyone who signs up with an account — no Amex card needed. And it can help guide you with general credit best practices so that you can make a plan to increase your score so that you can potentially apply for a credit card later on (or get a better rate on a car loan or hit some other financial goal).

Related reading: How to build credit without a credit card

Bottom line

This is a free tool that anyone can take advantage of. While those with 770+ credit scores may not find a ton of useful data in this tool, it could potentially be quite valuable to beginners and those trying to raise their credit score. If nothing else, it can give you more insights into the factors that are impacting your credit score.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app