How Do Planes Stop?

A commercial aircraft is on approach for landing. It's flying at around 145 miles per hour. The pilot flying pulls back gently on the control column to slow the sink rate and flare for landing. The wheels touch down in a cloud of burnt rubber. The landing gear and wheels absorb the impact of the massive aircraft.

And then, how exactly does it come to a stop? And how much of that braking action is performed by the pilots, versus an automated system built into the plane?

I checked in with Chris Brady, a longtime Boeing 737 and Airbus A320 pilot in Europe, who runs the Boeing 737 Technical Site and Facebook Page.

He explained that braking comes from three sources: ground spoilers, wheel disc brakes, and reverse thrusters.

Ground Spoilers

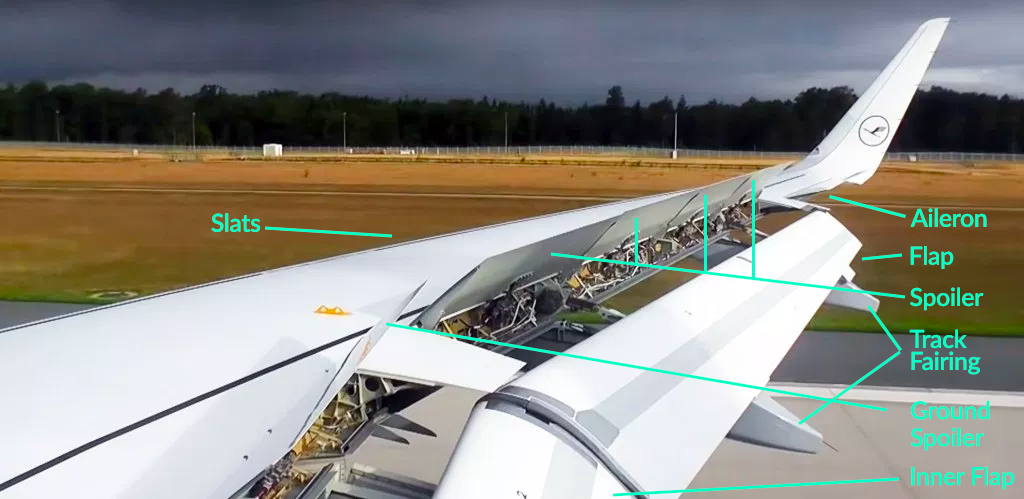

In general, when the wheels touch the ground, a set of spoilers raise up quickly, which kills the lift provided by the wings. (There are two sets seen in the image below: ground spoilers that only deploy on landing, and spoilers that are used in flight as speed brakes as well as on landing.) While the spoilers provide some drag, their primary purpose is to stop the plane from actually flying, putting all of the weight on the landing gear and in turn making the brakes that much more effective.

Before landing, when the landing gear is lowered, the pilots arm the ground spoilers to deploy automatically on touchdown.

"We could do it manually but it would involve moving the hands quickly during the landing roll which is never a good idea as you might accidentally move the wrong lever," Brady said. "Going back a long way there were incidents were pilots accidentally retracted the landing gear after landing, so the ground spoilers were made to auto-deploy to avoid this embarrassing scenario. Plus if the spoilers are armed to deploy automatically they will deploy faster and won't be forgotten."

Hit the Brakes

Aircraft have highly-engineered, multi-disc brakes made of a carbon-steel material. Manufacturers include Honeywell and Goodrich, part of Collins Aerospace. In general, the brakes are composed of discs that rotate with the wheel and separate discs that are fixed. When pressure is applied—and below you see pressure applied from the right fixed disc on all of the discs—the entire assembly compresses to create the braking action. Carbon brakes are standard today; they cool faster than steel brakes (their predecessor) and can weigh up to 700 pounds less. That represents a significant weight saving for airlines.

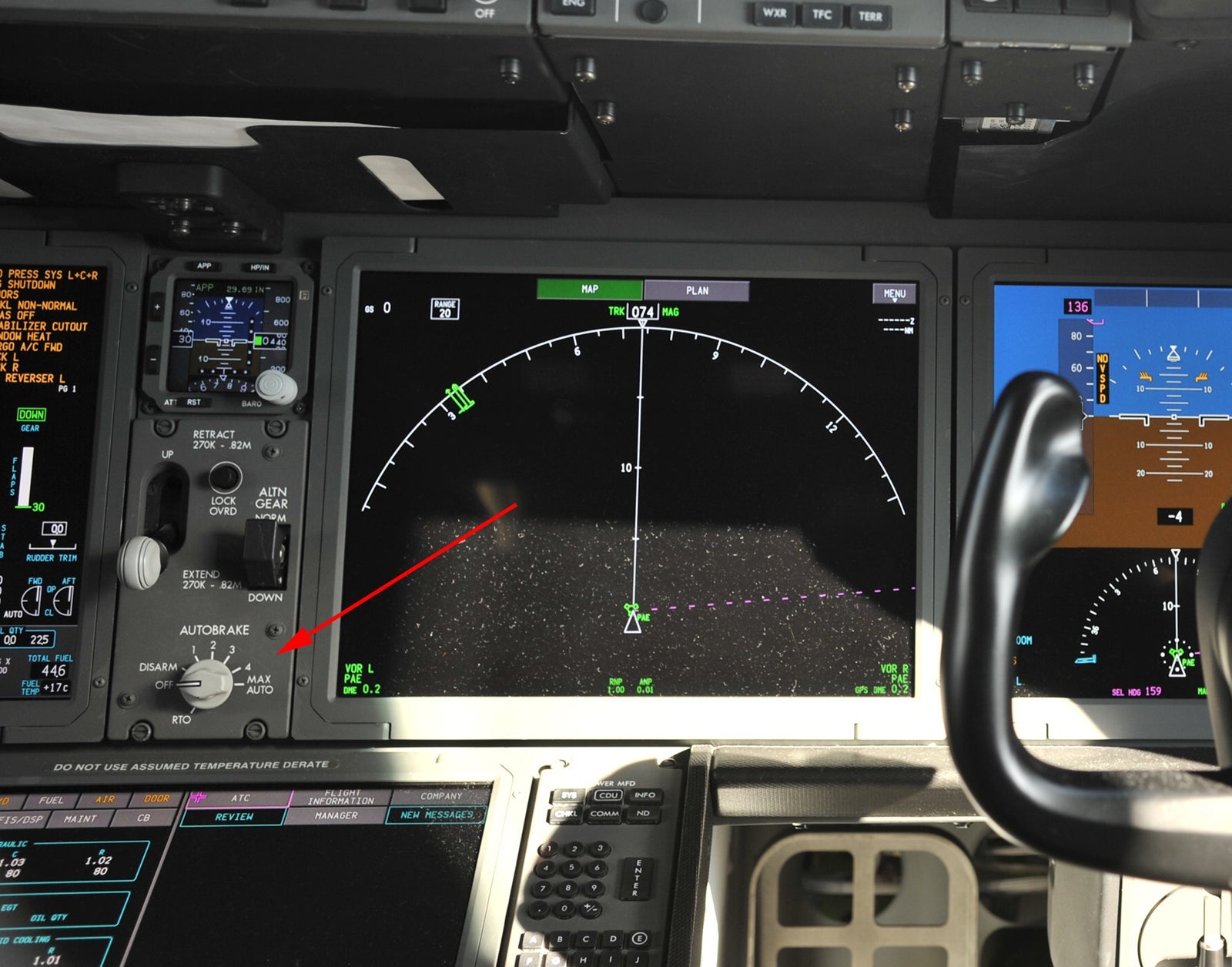

Autobrakes

Wheel brakes are usually selected to engage automatically after landing, Brady explained. These are called "autobrakes". Brady says that all airliners have several levels of autobrake "severity". The crew will decide which is the most appropriate to use for every landing depending upon factors like the length of runway, if it is wet or dry, or if the pilots want to exit the runway at a particular point. "For a short wet runway you might select autobrake 3, or MED on the Airbus. For a long dry runway you might select autobrake 1 or LOW on the Airbus," Brady says.

"For the initial part of the braking, say down to around 70 knots, we let the autobrakes do the job, but after that we have to come onto the toe brakes to disengage the autobrake," Brady says. Accordingly, at the outset, the pilot flying doesn't step on the top of the rudder pedals — which are used to operate the aircraft's rudder or, when pressed with the toes, the wheel brakes.

"This transition from autobrake to manual brakes can be quite difficult to do smoothly especially in a crosswind, as you will be steering the aircraft with the rudder pedals and then have to press down on the tops of the rudder pedals evenly to deactivate the autobrakes and start manual braking," Brady said.

As a passenger, you can sometimes feel a jolt as this happens, if the pilot has not been able to do it smoothly.

Reverse Thrust In Action

The final element of braking action is the thrust reversers. In a modern high-bypass turbofan engine, a full 90 percent of the air passing through the engine is simply sucked in, sped up and pushed out the engine without mixing with fuel. In these engines, ducts on the side of the engine open up and direct that air out and nearly forward, opposite the direction of travel. This is called a cold-stream reverse thrust, and is part of the engine design of most modern engines. (You may have also seen clam-shell style reverse thrusters on older aircraft, which cup the back of the engine.)

"Reverse thrust is always selected manually," Brady says. "We pull the thrust levers back and then lift the reverse thrust selector. We can then control the amount of reverse thrust that we apply appropriate to the landing conditions."

He explained that nowadays, where possible, pilots try to bring the reverse thrust to idle, which is less noisy, quieter in the cabin — which helps avoiding nervousness in some passengers — and uses less fuel and is thus environmentally friendly. However, if necessary, the pilot can spool up the engine anew to offer full reverse thrust—that is to say, have the engine generate more power and the fan to spin faster, but with the effect of directing that force forward to arrest the roll. (Quite counter-intuitive, stepping on the gas to slow down.)

The Orange Glow of an Aborted Takeoff Roll

Aircraft manufacturers test the braking action as part of the certification process. For example, here is footage from Boeing testing the brakes on a fully-fueled Boeing 747-8 at its maximum takeoff weight. The pilots throttled up to full power and proceeded to roll down the runway, but then aborted the takeoff. The carbon brakes alone stop the roll, with no reverse thrusters deployed. The braking action heats the brake pads up to 1,400 degrees Celsius, or 2,550 Fahrenheit, which is quite toasty. You can see the brakes heated to bright orange in the gif below. The tires were melted, the brakes were destroyed, but the plane came to a complete stop, just as intended.

Mike Arnot is the founder of Boarding Pass NYC, a New York-based travel brand, and a private pilot.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app