Up to 100,000 Bonus Miles and 10% Off When Buying AA Miles

Update: Some offers mentioned below are no longer available. View the current offers here.

American Airlines has been making itself known for AAtrocious AAward AAvailability on its own flights recently. It seems that the airline has gotten the message and has re-launched its cheapest ever buy miles promotion, letting you boost your account for as little as 1.72 cents per mile.

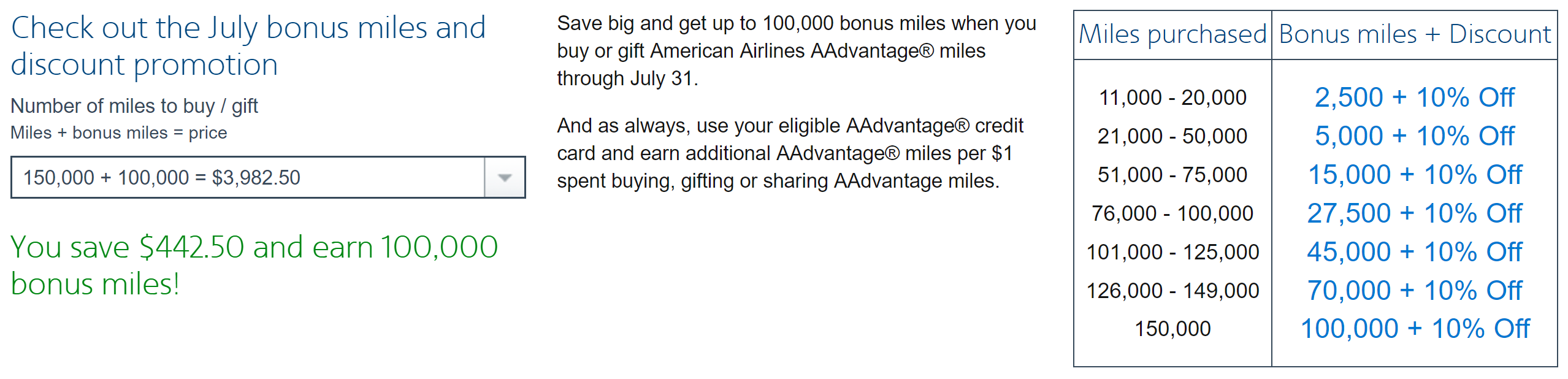

This offer is strikingly similar to the offer that just ended June 30, giving us further indication that AA understands AAdvantage miles' reduced value. Now through July 31, you'll get up to 67% bonus miles and save 10% off when you purchase AAdvantage miles.

The regular price for buying miles from American is 3.17 cents per mile ($29.50 per 1,000 miles plus a 7.5% Federal Excise Tax). With this promotion, your price will drop to 1.72 cents per mile if you max out this offer.

You'll get the maximum 67% bonus and 10% off — netting the 1.72 cents per mile purchase rate — when you purchase 150,000 miles. But, even at just 11,000 miles, you'll get 23% bonus miles and 10% off — dropping the rate to 2.5 cents per mile.

Here are the sweet spots of this promotion's bonus chart:

- 11,000 + 2,500 bonus miles for $344 total (2.55 cents per mile)

- 21,000 + 5,000 bonus miles for $629 total (2.42 cents per mile)

- 51,000 + 15,000 bonus miles for $1,486 total (2.25 cents per mile)

- 76,000 + 27,500 bonus miles for $2,199 total (2.12 cents per mile)

- 101,000 + 45,000 bonus miles for $2,913 total (1.99 cents per mile)

- 126,000 + 70,000 bonus miles for $3,626 total (1.85 cents per mile)

- 150,000 + 100,000 bonus miles for $4,311 total (1.72 cents per mile)

Still... Should You Buy AA Miles?

TPG's reduced valuation of AA miles is 1.4 cents per mile, but we know that some of you have even lower valuations. However, while AA's award availability is bad, we hesitated lowering our valuation of AAdvantage miles for a while as there are still some ways to get great value.

On AA flights, there are reduced mileage awards, getting you one-way award flights for as little as 5,850 miles after a 10% rebate. On some routes, using miles can provide outsize savings.

But, partner awards are where you're going to find the most value — from first class on Alaska Airlines to lie-flat business class to South America for 60,000 miles round-trip. If you maximize this promotion, you'll be paying ~$1,200 one-way for Qatar's amazing business class from the US to Doha (DOH) or beyond. If you can find availability, you can score QSuite from Doha (DOH) to London (LHR) for just $731 in miles.

It's obviously better if you're able to generate these points and miles for free using credit cards. And, if you haven't gotten them yet, the 60,000 sign-up bonus is still available for both the Citi AAdvantage Platinum Select World Mastercard and the CitiBusiness AAdvantage Platinum Select World Mastercard. However, if you're ineligible to get the bonus on these cards, buying miles through this promotion can make sense if you're able to redeem the miles for high-value options.

The information for the Citi AAdvantage Platinum card and CitiBusiness AAdvantage Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

How to Buy

To take advantage of the promotion, follow these steps:

- Visit American's Buy, Gift, and Share Miles page.

- Select Buy Miles or Gift Miles (the promotion is not valid on sharing miles).

- Log in to your AAdvantage account.

- Add your credit card details and click Continue.

- Review the information, check the box to agree to the Terms and Conditions and click Pay Now to finalize the purchase.

- Your miles should post to the designated account immediately.

Keep in mind that the usual restrictions for purchasing American miles apply to this promotion, including the following:

- Miles may be purchased in increments of 1,000 miles up to a maximum of 150,000 miles per year.

- Transactions are nonrefundable and non-reversible.

- Purchased miles don't count toward elite status or Million Miler status.

American Airlines processes mileage transfers and purchases directly (instead of going through Points.com), so this spending should count as airfare. That means you'll earn bonus points if you use a card with a travel or airfare category bonus. By far the best option in this category is The Platinum Card from American Express, which now earns 5x on airfare, and during American's December miles promotion, several TPG readers reported receiving this category bonus on their purchases. So that could make this a really great deal.

Other top credit cards to consider include the Chase Sapphire Reserve, with 3x Ultimate Rewards points on general travel; the Premier Rewards Gold Card from American Express, with 3x Membership Rewards points on airfare; the Citi Premier® Card and the Citi Prestige, with 3x ThankYou points on air travel; and the Chase Sapphire Preferred Card with 2x Ultimate Rewards points on general travel.

Are you going to take AAdvantage of this buy miles promo?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app