How Can I Opt Out of the TSA Body Scanners?

"Reader Questions" are answered three days a week — Mondays, Wednesdays and Fridays — by TPG Senior Writer Julian Mark Kheel.

Everyone's a huge fan of the Transportation Security Administration — or the "TSA" as it's affectionately known — so perhaps it's a bit surprising that we received this Facebook question from Denis...

[pullquote source="TPG Reader Denis"]Is there a way to avoid going through the TSA scanners and instead go through an old-school metal detector?[/pullquote]

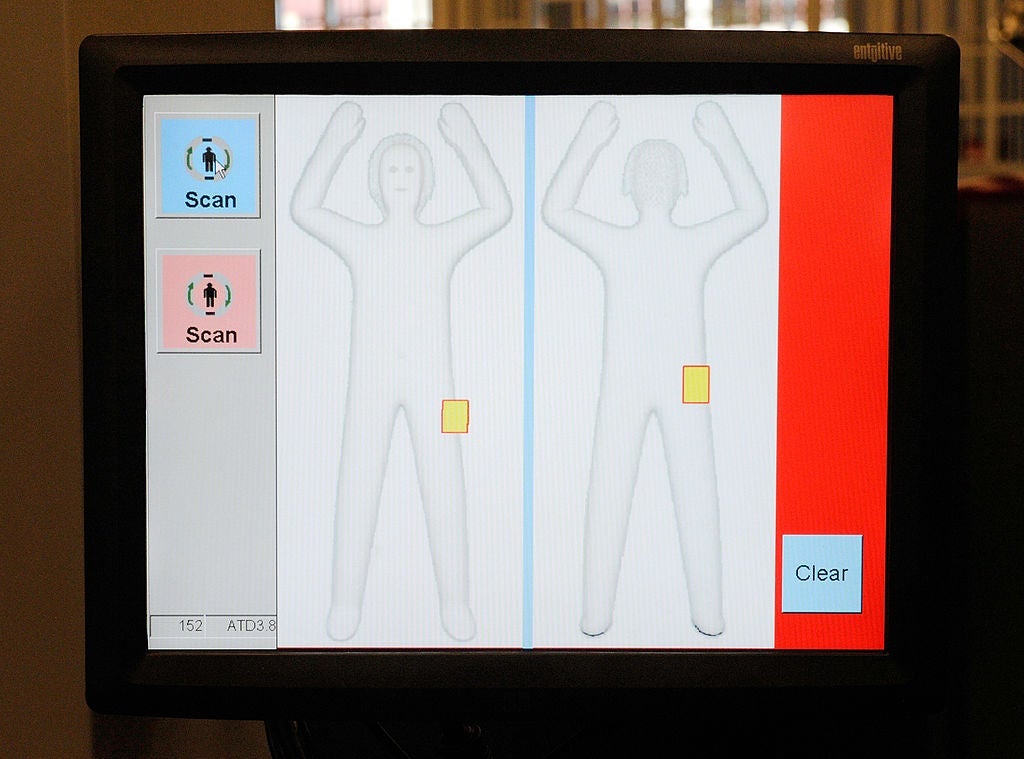

Well, Denis, I'm not sure why you wouldn't enjoy spending quality time inside a full-body scanner machine that's beaming radiation directly into your body in order to see underneath your clothing. In any case, whether you're comfortable with the technology or not, it's certainly valid to ask if this is your only option in order to get onto an airplane.

The good news is it's not your only choice. In fact, the TSA does allow you to "opt out" of going through the full-body scanner machines. All you have to do is inform the TSA agent at the checkpoint that you would like to opt out, at which point you will be welcomed into the departure area with a wave and a smile.

OK, maybe it's not quite that simple. You really do have the option to opt out of the body scan, but that does not excuse you from the security screening procedures, and you cannot choose to go through an old-school metal detector in lieu of the body scanners. Instead, if you opt out, you will be subject to a manual pat-down search of your person. In the past this meant the agent could choose from one of five different possible pat-down procedures, but earlier this month the TSA began implementing new rules that require a more comprehensive pat-down, one that is "more thorough and may involve an officer making more intimate contact than before."

So opting out is a bit like choosing between the frying pan and the fire, but it is at least an option. However, you should also be aware that if you are selected for "enhanced screening" — also known as the dreaded "SSSS" on your boarding pass — the TSA can still insist that you go through the body scanners. According to the official Frequently Asked Questions at tsa.gov...

"Generally, passengers undergoing screening will have the opportunity to decline AIT [Advanced Imaging Technology] screening in favor of physical screening. However, some passengers will be required to undergo AIT screening if their boarding pass indicates that they have been selected for enhanced screening, in accordance with TSA regulations, prior to their arrival at the security checkpoint. This will occur in a very limited number of circumstances. The vast majority of passengers will not be affected."

So even if you opt out, there's a chance you might not actually be able to opt out, although instances like that should theoretically be rare. Certainly if you see the letters "SSSS" on your boarding pass, you can assume you won't be getting the option to skip the machines. But in most other cases, you'll probably be able to select the pat-down option if you'd prefer.

Keep in mind that if you have TSA PreCheck, in most cases you'll be routed to an old-style metal detector anyway instead of the body scanning machines. So even if you do plan to opt out, wait until you're certain you'll be subject to the scanners before making your preferences known to the agents.

Thanks for the question, Denis, and if you decide to opt out, let us know how it goes and if you make some new friends at the TSA in the process. And if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy, message us on Facebook or send us an email to info@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app