Japan Airlines Making Changes to Mileage Bank Award Program

Last night, Japan Airlines (JAL) sent an email to all members of its Mileage Bank award program encapsulating several changes that will be going into effect on April 1, 2017, and July 1, 2017. Some of these changes we touched on last week in our guide to Japan Airlines Mileage Bank, while others haven't been covered yet. None of these changes are earth-shattering and some of them are actually positive, but it's important to know what to expect if you're booking award flights on JAL after April 1.

Even though the bigger changes are on the domestic side, let's start with the changes that affect international flights since that's probably of greater interest to US-based travelers:

Award Redeposit Fee Now Cash-Only

If you want to cancel a completely unused Japan Airlines award ticket, JAL not only has a reasonable award redeposit fee of only 3,100 yen (~$28) but has allowed the fee to be paid with 3,100 miles instead of cash. However, starting April 1, the option to pay the fee with miles will go away and you'll only be able to pay cash to get your miles back.

That being said, if you assume JAL Mileage Bank miles are worth more than 1 cent each, paying the fee with miles wasn't a great idea in the first place. And since Japan Airlines isn't raising the cash price for redeposits, you'll still have a lot of flexibility in canceling a ticket right up until almost the last minute, as long as you haven't used any portion of it yet.

Increase in Cost to Upgrade to Premium Economy

If there is space and you upgrade from Economy to Premium Economy at the airport, the mileage and cash co-pay charge for doing so will be increasing.

The amount of the increase depends on what route you're flying, but for flights between the US and Japan, you'll see an increase of 10,000 miles each way from 30,000 to 40,000 miles, and a jump of $50 in the co-pay from $300 to $350 when departing from the US, or an extra 10,000 yen (~$90) from 30,000 to 40,000 yen when departing from Japan to the US.

Deadlines Now Tied To Japan Time

When booking award reservations, deadlines tied to award tickets such as changes at least one day before departure have been based on the business hours of each regional Mileage Bank office.

But starting on April 1, all Mileage Bank deadlines will be standardized to Japan time, with midnight in Japan being equivalent to 10am EST or 7am PST. Since Japan is on the other side of the International Date Line, this means you'll have an earlier deadline for award changes than you may have dealt with before.

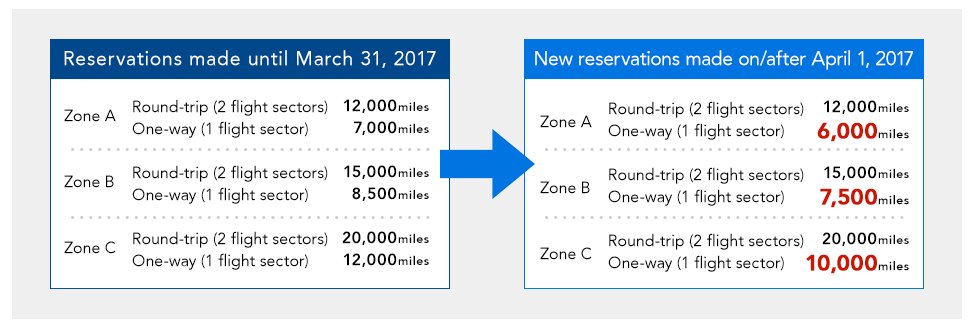

Decrease in One-Way Price For Domestic Japan Flights

While one-way international flights on JAL have routinely cost half the amount of a round-trip, domestic flights within Japan had a slight premium if you only wanted to go in one direction. Depending on route, round-trip Japan domestic flights have ranged from 12,000 to 20,000 miles, but taking those flights one way cost slightly more than half the round-trip amount.

Now, those domestic flights will cost half the round-trip price, meaning customers will see a discount of 1,000 to 2,000 miles off the old price. This change affect reservations made after April 1, so if you're planning to book a domestic Japan flight, you may want to wait one more week to get the lower price.

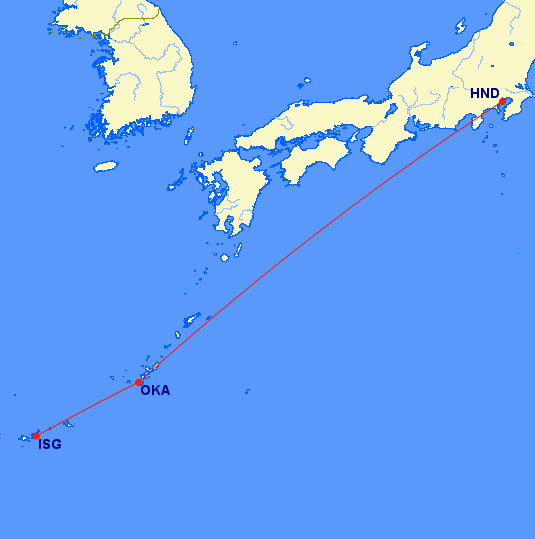

Increase When Combining Intra-Island Legs

The country of Japan is made up of almost 7,000 islands, although only around 430 are inhabited. As a result, a lot of JAL flights involve short hops between islands.

In the past, if you were booking a round-trip between Hokkaido/Honshu/Shikoku/Kyushu and Okinawa and wanted to add a round-trip hop to the Ryukyu island group on one award ticket, you could get the second round-trip for just an extra 5,000 miles. But starting April 1, that second round-trip ticket will no longer be discounted — you'll have to pay the full round-trip price, even if booked together with the first leg.

Miles Refundable When Downgrading From Class J

JAL offers a product on its domestic flights called Class J that it refers to as "business class," but is really more of a premium economy or "economy plus"-type product with extra legroom and a little more armrest space.

In the past, if you booked a Class J ticket with Mileage Bank miles and then later wanted to change the flight, but only regular economy space was available on the new flight, you couldn't get the excess mileage back. But starting April 1, JAL will refund the extra mileage if you can't rebook into Class J as long as the miles haven't otherwise expired and you didn't originally book with a discount mileage promo. The only caveat is you'll now have to make those rebookings by phone — online rebookings from Class J to regular economy will no longer be possible.

Return Flight Confirmation No Longer Available

JAL has had a somewhat complicated service called Return Flight Confirmation in which, under certain circumstances, if you book an outbound flight with a return flight at the same time, the return flights can be booked even before they go on sale. However, beginning July 1, this service will no longer be available on domestic Japan Airlines award flights.

Third-Party JAL Member Card Check-In No Longer Allowed

Finally, when you booked a domestic Mileage Bank ticket for yourself and another person, previously that person could check-in for the flight using your card as long as you were with them. Starting April 1 you'll instead have to present one of the following:

- Your own JMB membership card or JALCARD

- Mobile device containing the JAL IC app

- e-ticket itinerary/receipt

- Two-dimensional barcode

- 8-digit order number

Bottom Line

Most of these changes will only affect folks who travel within Japan on a regular basis. But if you do travel on Japan Airlines internationally, you'll want to make sure you meet all deadlines based on the time in Japan and the extra costs of potentially upgrading to Premium Economy at the airport.

H/T: TPG Reader Raj Thanabal

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app