Earning Elite and Award Miles with American, Delta and United

Update: Some offers mentioned below are no longer available. View the current offers here.

In light of news that American will change the way customers earn bonus miles and status in the AAdvantage program, TPG Contributor JT Genter takes a look at how the three major US carriers stack up.

Last November, American Airlines revealed plans to change to a revenue-based mileage program. Earlier this week — almost 7 months after the announcement — we finally found out when the switch will be made: August 1, 2016. Once that change is implemented later this summer, all three US-based legacy carriers will have revenue-based programs.

With this latest announcement, the other shoe dropped: Spending requirements were added to the AAdvantage elite status program. In addition to the other requirements already in place, travelers will have to meet certain spending thresholds to qualify for American Airlines elite status in 2017. This move also follows in the footsteps of Delta and United — and on January 1, 2017, all three US-based legacy carriers will have spending requirements to qualify for elite status.

How do the programs compare now that American is moving to a revenue-based system?

Mileage Requirements

| Miles Required for Status | American | Delta | United | |||

|---|---|---|---|---|---|---|

Top-tier | 100,000 | Executive Platinum | 125,000 | Diamond | 100,000 | Premier 1K |

Upper-tier | 75,000 | Platinum Pro | 75,000 | Platinum | 75,000 | Platinum |

Mid-tier | 50,000 | Platinum | 50,000 | Gold | 50,000 | Gold |

Lowest-tier | 25,000 | Gold | 25,000 | Silver | 25,000 | Silver |

American calls them Elite Qualifying Miles (EQMs), Delta calls them Medallion Qualifying Miles (MQMs) and United calls them Premier Qualifying Miles (PQMs). No matter what they're named, the main qualifiers for elite status are based on "butt in seat" miles — how many miles you fly on a plane.

The approach used to be "a mile is a mile" regardless of the cabin when it came to this requirement, but the situation shifted a few years ago as airlines tried to entice travelers to book paid fares in premium cabins.

In the past year, it's been a race to the top on which airline can make paid first/business-class flights earn qualifying miles the fastest. In November, American Airlines made a big jump as part of its changes to the 2016 AAdvantage program and United countered a month later. Delta has yet to match American and United in applying the same bonus multiples.

In order to calculate your qualifying miles, you need to apply the following multiples to your flight miles:

| Qualifying Miles per Mile Flown | American | Delta | United |

|---|---|---|---|

Full-Fare First/Business | 3 | 2 | 3 |

Discount First/Business | 2 | 1.5 | 2 |

Full-Fare Economy | 1.5 | 1.5 | 1.5 |

Discount Economy | 1 | 1 | 1 |

Winner: American Airlines and United Airlines (tie). Both have identical mileage requirements and premium cabin multiples.

Segment Requirements

| Segments Required for Status | American | Delta | United | |||

|---|---|---|---|---|---|---|

Top-tier | 120 | Executive Platinum | 140 | Diamond | 120 | Premier 1K |

Upper-tier | 90 | Platinum Pro | 100 | Platinum | 90 | Platinum |

Mid-tier | 60 | Platinum | 60 | Gold | 60 | Gold |

Lowest-tier | 30 | Gold | 30 | Silver | 30 | Silver |

As an alternative to the mileage requirements listed above, travelers can qualify for elite status based on the number of segments they fly. This is especially nice for those who fly a lot, but only for short distances.

United rewards full-fare economy, business and first-class paid fares with 1.5 Premier Qualifying Segments (PQSes) per flight segment flown. However, this segment bonus incentive hasn't been adopted by American or Delta.

| Qualifying Segments per Flight | American | Delta | United |

|---|---|---|---|

Full-Fare First/Business | 1 | 1 | 1.5 |

Discount First/Business | 1 | 1 | 1.5 |

Full-Fare Economy | 1 | 1 | 1.5 |

Discount Economy | 1 | 1 | 1 |

Winner: United Airlines. While American and United require the same number of segments, United will let you earn status faster for any full-fare or business/first-class travel.

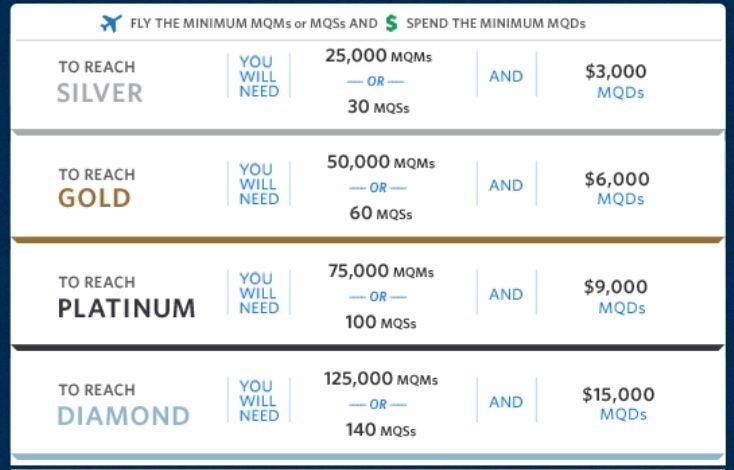

Spending Requirements

| Spending Required for Status | American* | Delta | United | |||

|---|---|---|---|---|---|---|

Top-tier | $12,000 | Executive Platinum | $15,000 | Diamond | $12,000 | Premier 1K |

Upper-tier | $9,000 | Platinum Pro | $9,000 | Platinum | $9,000 | Platinum |

Mid-tier | $6,000 | Platinum | $6,000 | Gold | $6,000 | Gold |

Lowest-tier | $3,000 | Gold | $3,000 | Silver | $3,000 | Silver |

*Effective for earning elite status after January 1, 2017

Now the newest — and most dreaded for many frequent flyers — qualification requirement: spending. Delta was the first to announce that flyers would need to spend a certain amount to qualify for elite status. United quickly matched this requirement, making the change effective on the same date as Delta: January 1, 2014.

Up until yesterday's announcement, American Airlines was the sole holdout to this requirement — a haven for those of us who fly discount international economy fares. Effective January 1, 2017, this haven will be no more.

Worst of all, American Airlines hasn't announced any waivers to its new spending requirements. But, we hope that AA will add a credit card spending waiver similar to Delta and United — the carrier said it's considering this option but currently has no announcement to make.

| Spending Wavier Available | American | Delta | United | |||

|---|---|---|---|---|---|---|

Credit Card Spending | Foreign Residence | Credit Card Spending | Foreign Residence | Credit Card Spending | Foreign Residence | |

Top-tier | ** | N/A | $25,000 | Yes | N/A | Yes |

Upper-tier | ** | N/A | $25,000 | Yes | $25,000 | Yes |

Mid-tier | ** | N/A | $25,000 | Yes | $25,000 | Yes |

Lowest-tier | ** | N/A | $25,000 | Yes | $25,000 | Yes |

**Credit card spending waiver under consideration by American Airlines at this time.

Winner: Depends on your situation. Both American and United have the lowest spending requirements for top-tier status, but the spending requirements for elite status are identical across all three airlines for the other tiers. While United allows spending waivers for some elite tiers, only Delta allows you to waive the spending requirements for top-tier status via credit card spending. If you're not a US resident, Delta and United clearly beat out American, as you get a waiver of the spending requirements.

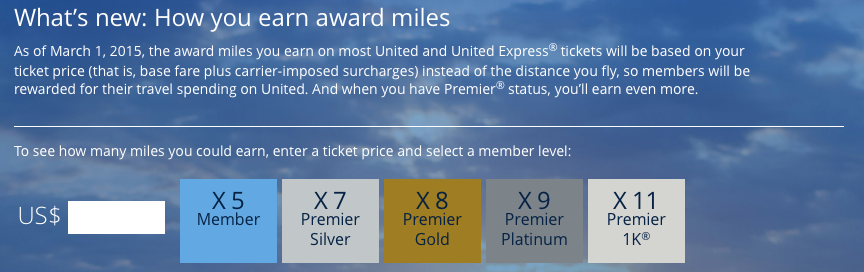

Award Mileage Earning

| Award Mileage Earning Rates | American | Delta | United | |||

|---|---|---|---|---|---|---|

Top-tier | 11x | Executive Platinum | 11x | Diamond | 11x | Premier 1K |

Upper-tier | 9x | Platinum Pro | 9x | Platinum | 9x | Platinum |

Mid-tier | 8x | Platinum | 8x | Gold | 8x | Gold |

Lowest-tier | 7x | Gold | 7x | Silver | 7x | Silver |

No status | 5x | Member | 5x | Member | 5x | Member |

For flights departing on or after August 1, American Airlines flyers will earn award miles based on the airfare paid, rather than miles flown. American chose to adopt the exact same earning multiples for general and elite members that Delta and United already have in place.

Winner: None (tie). All airlines have adopted identical mileage-earning multiples.

The Best Program for You

As you can see in the above charts, there will be remarkable similarities in the elite and award mileage earning programs for American, Delta and United. If you're deciding on where to send your loyalty in 2017 — and won't have elite status earned in 2016 — there aren't major benefits to choosing one mileage program over the other. While partner and redemptions benefits do vary some, you're otherwise free to pick an airline based on schedule, onboard product and operational performance.

That said, there are some situations where a certain program wins out:

- Travelers who fly many short-distance flights in business/first class or full-fare economy: United is the only program that offers a 1.5 multiple, meaning you have to fly "just" 80 segments in business/first class or full-fare economy to reach top-tier status — assuming you spend at least $12,000 on these flights.

- Travelers who pay for long-haul business/first class: American or United would be best, as both programs award a higher multiple of qualifying miles for business/first class.

- Travelers who can earn 125,000 qualifying miles for cheap and spend >$25,000 on a credit card: Delta is the only program that allows a credit card spending waiver for top-tier status. As an additional bonus, you can earn qualifying miles from meeting this required credit card spending: 10,000 Delta qualifying miles for spending $25,000 on the Platinum Delta SkyMiles® Credit Card from American Express (up to 20,000 MQMs for $50,000 spend) or 15,000 Delta qualifying miles for spending $30,000 on the Delta Reserve® Credit Card from American Express (up to 30,000 MQMs for $60,000 spend)

- Travelers who live outside the US: Delta and United are the only airlines that don't require a certain level of spending for non-residents. You just need to meet the mileage or segment requirements.

Have you chosen your airline loyalty for 2017?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app