Guide to Maximizing Bonus Categories — Hotel Stays

Update: Some offers mentioned below are no longer available. View the current offers here.

Every purchase is an opportunity to earn travel rewards, and in order to boost your loyalty account balances, it's important to maximize your return on each dollar. Today, TPG Contributor Richard Kerr explains how you can rack up points and miles on hotel spending, and offers other strategies to make your next stay more lucrative.

In a perfect world, you would always have enough points for a free hotel night. In reality, even the most enthusiastic award travelers have to pay for a hotel stay every now and then. The good news is that a hotel bill (like most of your other spending) is also an opportunity to get you closer to your next award redemption. In this post, I'll continue my series on maximizing bonus category spending by looking at how you can get the greatest return for your paid hotel stays.

Credit Card Strategy

To start with, there are a few core principles that apply to almost any paid hotel stay — first and foremost, it's important to use the right credit card. Paying with one card versus another can make the difference in earning thousands of bonus points. Since hotel cards tend to offer particularly lucrative bonuses for spending within that brand, these co-branded options are the obvious choice. Here are some of my favorites:

Starwood Preferred Guest Credit Card from American Express — Earn 2 points per dollar spent at SPG properties. SPG Gold and Platinum status members already earn 3 points per dollar, while non-elites earn 2 points per dollar. This means you can earn a total of 4-5 points per dollar on your paid Starwood hotel stays as an SPG member. While this card only earns 1 bonus point per dollar on all other spending, Starpoints are the most valuable loyalty currency out there, so even that low earning rate represents a decent return. That's why this card is one of TPG's favorites for non-bonus spending.

Hilton Honors Surpass Card from American Express — Earn 12 points per dollar spent at Hilton hotels; 6 points per dollar at US restaurants, US supermarkets, and US gas stations; and 3 points per dollar for everything else.

Marriott Rewards Premier Credit Card — Earn 5 points per dollar at Marriott locations; 2 points per dollar on airline ticket purchases made directly with airlines, and at car rental agencies or restaurants; and 1 point per dollar elsewhere. There is currently a sign-up bonus of 50,000 points after you spend $2,000 on purchases within 3 months of account opening.

The Hyatt Credit Card — Earn 3 Hyatt points per dollar spent at Hyatt properties; 2 points per dollar on airline tickets, restaurants and car rentals; and 1 point per dollar elsewhere. Earn 2 free nights at any Hyatt property worldwide after spending $2,000 within 3 months of account opening.

The Ritz Carlton Rewards Credit Card — I mention this card because of its ancillary benefits and the ability to earn 5 Ritz Carlton points per dollar spent at Ritz-Carlton or Marriott properties. Benefits include three Club Level upgrades on paid stays, a 10% bonus on earned points with the card, a $300 annual travel credit and lounge club membership. You can also earn Platinum status with $75,000 in annual spending, and receive a $100 credit for incidentals on paid stays of two nights or longer. This card has been known to offer a massive sign-up bonus of 140,000 points.

Club Carlson Premier Rewards Visa Signature Card — While this card took a huge hit when it lost the bonus award night benefit, it remains a good option for earning Gold Points quickly. You'll earn 10 points per dollar spent in eligible net purchases at participating Carlson Rezidor hotels worldwide, and 5 points per dollar spent elsewhere.

While all of these cards are great for hotel spending (within the respective brand), I don't necessarily recommend them for everyday spending. Apart from the Starwood card (and maybe the Club Carlson card), they offer a pretty dismal return on non-bonus categories.

If you aren't interested in a co-branded hotel card, look to cards that offer bonus points for travel purchases, especially one that belongs to a transferable points program. Good options include the Chase Sapphire Preferred Card (which earns 2 Ultimate Rewards points per dollar on travel) and the Citi Premier® Card (which earns 3 ThankYou points per dollar on travel).

Sign up for Loyalty Programs

Even if you think you'll never again stay at a given hotel or any other property in the chain, it's worth signing up for the loyalty program. Sometimes just being a member can get you free or faster internet, early check-in and late check-out, upgrades or other amenities. You'll end up kicking yourself if you make your way back to that same property without having taken the few minutes to sign up the first time.

I might be preaching to the choir, since the praises of mainstream programs are sung here at TPG on a daily basis. However, I have a co-worker who has spent over 3 weeks this year at the Hyatt Regency Guam. I asked him this week how many points he had earned, and was met with a confused look and some mumblings about how he didn't even sign up. A small piece of me died inside. Please, please sign up and collect your points.

Other Strategies

There are many different angles you can take when deciding how to maximize paid hotel stays. I have different approaches based on who is footing the bill. I'll briefly cover my own strategies for two different situations:

- Personal hotel stays — My main concern here is limiting the damage to my own wallet. I do everything I can to keep my bill as low as possible while maximizing my return on that small bill.

- Business trips — When my bill is covered by an employer, my aim is to maximize points and elite stay credits while staying within my allotted budget at the company rate.

Personal Hotel Stay Strategy

When I'm looking for good prices with maximum returns, my first stop is Rocketmiles or PointsHound. With bonuses routinely offered by Rocketmiles, I have collected thousands of airline miles on room prices that are usually competitive with publicly available rates. Last summer I scored 10,000 Virgin America miles from a paid stay at The Outrigger Fiji on the Lagoon. The Outrigger properties don't offer a loyalty program worth any salt, but there were some outstanding rates for the peak Fiji travel season. Rocketmiles allowed me to get a great deal and earn miles where I otherwise would have come up empty.

I signed up for Pointshound with a promo code that automatically placed me at Level 2, which earns more miles than normal new sign-ups for the site. These promo codes come around often enough, so keep your eyes peeled.

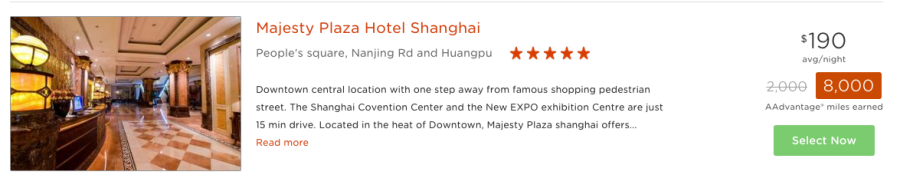

It's important to note that you won't earn points or elite stay credits when booking with Pointshound or Rocketmiles. However, I find the airline miles to be more valuable than what I would earn from a short 1-3 night stay. Two nights at the Shanghai hotel above would earn me 8,000 AAdvantage miles. According to TPG's latest valuations, that's worth $136. It would be difficult to get that value from any hotel loyalty program from a two-night stay at $190 per night.

If these sites don't offer competitive rates or worthwhile mileage offerings, or if there aren't any properties that interest me, my next step is to find a hotel where I can enjoy elite benefits at favorable rates that earn points and elite stay credits. I usually try to accomplish this through an easy double-dip strategy. Here's my two-step technique:

1. Use a Best Rate Guarantee — These guarantees can be tricky, but once you learn how they work, you can get a solid discount. Hyatt will take 20% off the lower rate, while Marriott will take 25% off the lower rate. IHG will give you the first night free (good luck getting these approved), and Hilton offers $50 off your room bill. I've had pretty good luck with Marriott and Hyatt. It takes practice to get good at submitting a claim, but you'll have a better chance if you follow these strategies.

2. Pay with hotel gift cards purchased at a discount — Hyatt gift cards can only be used with US properties, so if you plan on doing some domestic travel, use an Amex OPEN savings credit card to receive 5% off. Otherwise, you can search gift card exchanges or eBay for hotel chain gift cards being sold at a discount. You can also browse the gift card racks at local retailers; for example, if your local office supply store sells hotel gift cards, you can buy them with the Ink Plus Business Card to earn 5 Ultimate Rewards points per dollar.

If I'm not having luck with a best rate guarantee, I'll at least book through a cash-back shopping portal. Check EV Reward to see which portal is offering the greatest return. Any loyalty program points or elite benefits like free breakfast also add measurable value to my paid stay.

Finally, don't forget to check American Express Fine Hotels and Resorts (or the Visa Signature Hotel Collection) when looking for paid stays. Sometimes the rates offered are the same as publicly available rates, but they come with great benefits such as breakfast, late check-out, upgrades and more. You also earn elite stay credits and loyalty points with these rates, so you get the best of both worlds.

Business Trip Strategy

If you travel for work, hopefully you have some say in where you stay. My current strategy for business trips is to find a Starwood property, pay with my Starwood Preferred Guest Credit Card from American Express and use Uber for all my local rides (to earn 3 Starpoints per $1 spent during my stay). If I'm traveling in a large group, I'll try to negotiate a group rate that saves my company money, usually gets the group breakfast or club access and allows me to earn Starpoints and elite stay credit via the SPG Pro program.

If a Starwood property isn't available, I search for Hyatt hotels. I'll pay with my Hyatt Credit Card, which I renew each year for the anniversary free night.

My focus during company trips is on earning Hyatt or Starwood points and elite stay credits, since those are the most valuable options. However, if you're more invested in another program, you can apply these strategies to any of the major hotel chains.

Bottom Line

When it comes to personal hotel stays, my goal is to earn airline miles or double-dip for savings to keep costs down. For business stays, I try to boost my balances in the most valuable loyalty programs while staying at some of my favorite properties.

As I've stated in my guide to maximizing grocery spending, your strategy should be goal-oriented. Points and miles are a bad long-term investment, so you should earn them and burn them rather than allowing them to stagnate. Have a purpose in mind for your points earned via hotel stays, as this will also help you decide where to stay in large cities with dozens of options.

What strategies do you use to earn points and save money on hotel stays?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app