Insider Series: Does TSA Security Screening Really Work?

New to our Insider Series is TPG Contributor "Patrick Down," presently employed as a TSA officer at a US airport. In this installment, he takes a look at the technology used by TSA to screen you and your baggage, and offers his commentary on whether it's effective ... or not.

In the same week that Homeland Security announced that it will be reassigning the head of the TSA and revising airport screening, a report was posted by TSA showing that our that our internal testing department, known as the Red Team, was able to successfully sneak some type of weapon past TSA security screening 67 out of 70 tries — which actually doesn't surprise me.

I've seen the Red Team come through when I was working several times and each time they were successful in sneaking a small, dissembled, derringer type of handgun past the checkpoint. The reason that this was able to happen is two-fold:

1. The Red Team is extremely familiar with TSA Standard Operating Procedure (SOP), which is meant to test for vulnerabilities in screening. (It bears mentioning that in each instance of successful gun-sneaking that I witnessed, I also saw that the on-duty officers who were ultimately given corrective action had properly followed our SOPs.)

2. TSA has trained its officers through a process of repetition to look for a broad list of prohibited yet abundant items (e.g., water bottles) that are in reality largely harmless. I personally find that despite my best efforts as an officer, it can be difficult to stay vigilant while doing the extremely repetitive task of screening, especially when most of what I do is ask passengers to throw out their contraband water bottles.

The TSA believes that its screening measures act as deterrents, and I agree. It's important to note, though, that this in part due to the US population's general belief that these screening measures work, rendering them unlikely to attempt anything illegal. Possibly the most effective deterrent shaping public opinion about TSA security is the fact that all passengers are screened through at least one government database — and if you signed up for TSA Precheck or Global Entry, then you've been through significantly more.

This said, I also think that some of our equipment is extremely effective, and even downright amazing. For instance, those hand swipes we do with the little wand allow us to check for explosives, and they really work. (On a side note: Always ask your TSO to change gloves and run a sample swab. There are some common chemicals [like glycerin, a common ingredient in hand soaps and lotions] that can cause false alarms.)

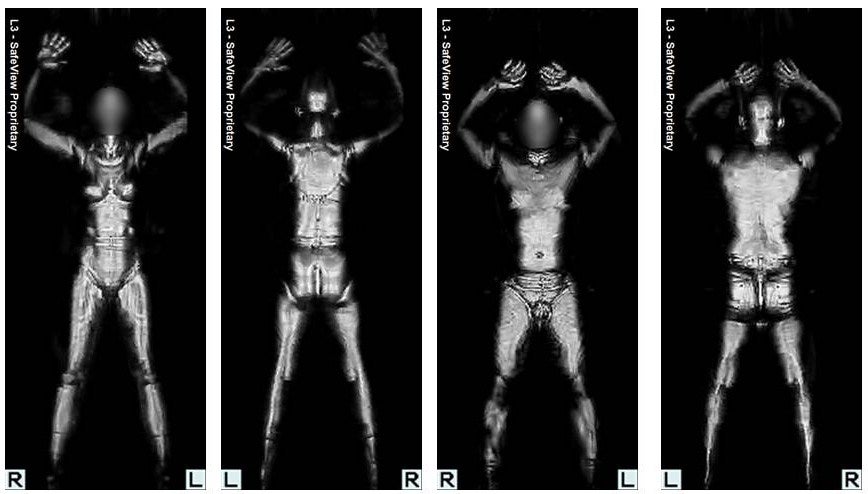

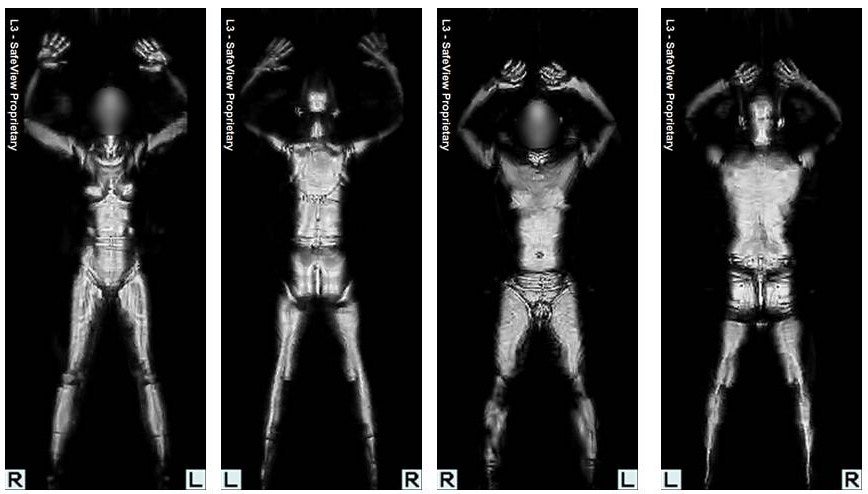

The millimeter wave body scanners, though sometimes unreliable, work the vast majority of the time and can/do detect items as small a Tic-Tac. That's why, when we ask you to get everything out of your pockets, we mean everything. Metal detectors are old technology, but they still work very well. I run tests on them daily and have never been able to figure out how to get a gun through one. Our X-ray machines are awesome; I can see the individual gears in a watch, and recent updates allow the X-ray itself to scan for prohibited items independent of an officer.

The screening your checked luggage undergoes is even cooler. It's mostly automated, and your property gets sent through SUV-sized machines that can view bags in 360 degree X-ray vision and automatically clear 95 percent of bags. The system then sends images of the remaining bags to a baggage officer who can view the weight/density and sometimes the chemical makeup of individual items. In this way, a baggage officer can clear somewhere between 60 to 80 percent of bags sent their way without even having to open them.

In addition to all these precautions, we're currently in the process of rolling out Vapor Wake bomb dogs into all major airports, which are extremely successful at detecting explosives hidden on a human being. Overall, TSA does a pretty good job of doing what they purport to do.

On the other hand, the plain truth is that anyone with enough determination and time could sneak something onto a plane — and I'm not sure what we can do about that. Despite all of our technology, we don't (and shouldn't) perform cavity searches. Millimeter wave body scanners can be unreliable for detecting hidden items under clothes and cause a lot of unnecessary screening of passengers. Behavior Detection Officers (the guys who walk around and watch to see if you look creepy) are useless, and there are widespread rumors within TSA that the BDO program won't be around for much longer. Walk-through metal detectors only detect metal, and it's easy to make a bomb entirely out of organic items. Our bomb-sniffing dogs work well, but some types of IEDs can fool even them.

With almost no exception, the few times that TSA has caught terrorists, it has been through intelligence-gathering rather than airport security. That said, I do believe that we at least act as a deterrent. It's "Security Theater" in the sense that an extremely diligent and careful person could get something through without us detecting it — but I'm okay with that. The fact that people are forced to research and plan attacks gives the intelligence community more to work with.

Plus, worst case scenario, it's a comfort to know that these days, passengers seem to be getting better at beating in-flight hijackers senseless ... or at least into submission.

[card card-name='Barclaycard Arrival Plus™ World Elite MasterCard®' card-id='22089567' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app