Here Are Copa's Star Alliance Earning and Redemption Charts

Star Alliance member Copa Airlines has just released a new partner earning chart and award chart for their new frequent flyer mile program, ConnectMiles.

Copa was previously using United's MileagePlus program, but in March of 2015, the airline announced it would be launching its own new program, ConnectMiles. ConnectMiles made it a point to explain that at least one mile is awarded for each mile flown, and you won't need to meet any revenue requirements to earn elite status (they call it the Prefer Program, which offers four levels: Silver, Gold, Platinum and Presidential Platinum).

In fact, in an email they sent out back in March, Copa stated that it thinks revenue-based earning structures (ahem, Delta and United) are complex and not right for ConnectMiles, so they created a program they feel is a bit simpler.

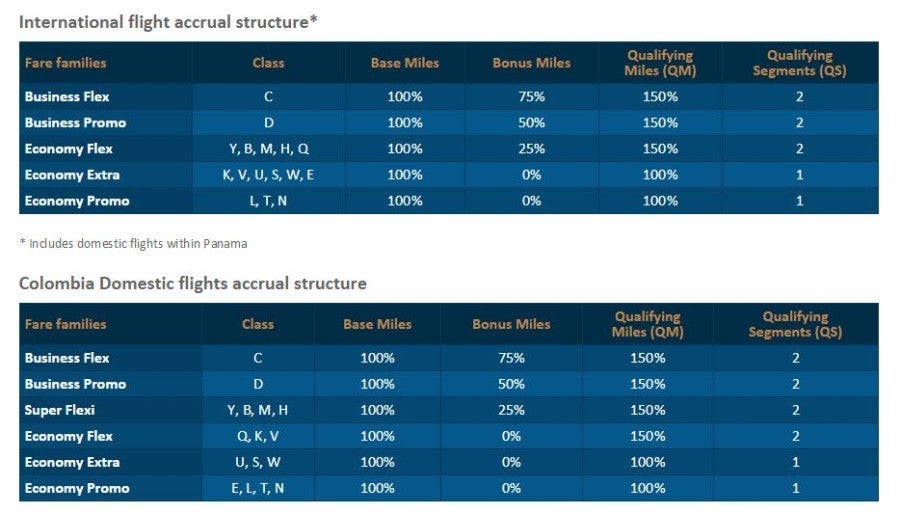

Here is the mileage earning chart for Copa flights, and it does seem to be true that you will get at least one mile for mile flown, regardless of fare class, at least for Copa flights.

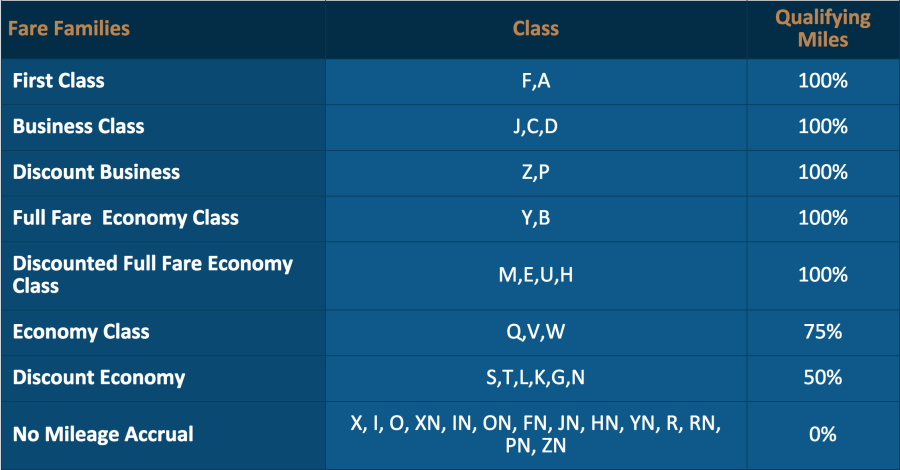

United flyers out there who don't like United's revenue-based program can now look into ConnectMiles as another option. Here is the new partner mileage earning chart showing the Copa ConnectMiles you can earn when flying on United.

As you can see, whereas the ConnectMiles mileage earning on United flights isn't based on revenue, you won't get 100% for discount fares (so with partner airlines, the one mile per mile flown isn't necessarily true). Don't worry too much about the "No Mileage Accrual" category — those are either award or upgrade fare classes (if you're upgraded, you should receive miles based on the fare class you paid for).

In general, the fare classes that offer 100% of the miles flown would be quite expensive to book, so it's unlikely that crediting your flights to ConnectMiles would earn more miles than United's MileagePlus revenue-based program.

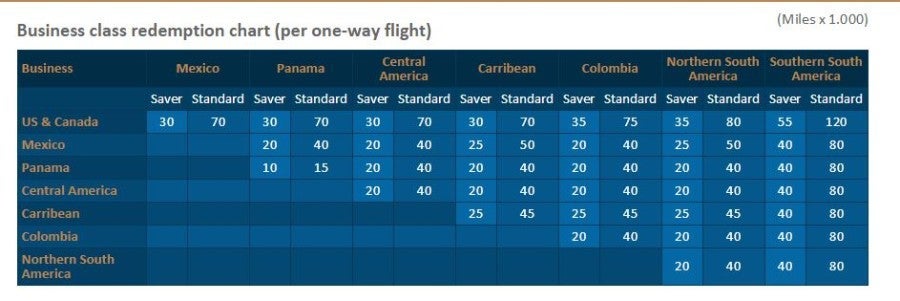

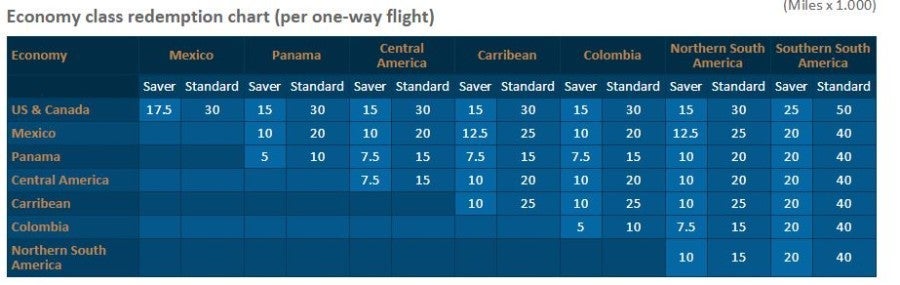

Here are the award charts for redeeming Copa miles (they don't offer first class, just business and economy):

And here is a link to the one-way Star Alliance award chart. Note that you can redeem for first class on Star Alliance airlines. Redemption rates are nearly identical to United's MileagePlus program, so don't expect any steals here.

You can sign up for the program now if you haven't already, and starting July 1, 2015 you can begin to earn Copa miles, so make sure to add your ConnectMiles number to any flight reservations you have for July 1 or after. Another perk if you are aiming for Prefer Program elite status is that travel between July 1, 2015 and December 31, 2016 will count towards 2017 status, so you actually have 18 months instead of the standard 12 months to qualify. For more information on the Prefer Program, click here.

H/T: View from the Wing

TPG readers, what do you think? Will you be crediting your United flights to Copa's new ConnectMiles program?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app