Is Saver Level Award Availability Improving or Disappearing?

The best thing about earning points and miles is getting to use them, but too often airlines make redeeming for award travel more difficult and costly than it should be. Today TPG Senior Points & Miles Correspondent Jason Steele looks again at several routes where low-level awards are scarce, to see if conditions have improved.

Two months ago, I wrote about Award Flights that Don't Exist at Saver Level, and exposed five flights that had either zero award seats, or so few seats that they were effectively unavailable. The award travel landscape has changed since then, as the merger between American Airlines and US Airways has moved forward, and Delta has done away with its award charts altogether. It seems worthwhile to revisit the hard data and see what has changed for better or worse.

In this post I'll re-examine award availability on those five flights, and offer my explanations for the differences.

1. United - Los Angeles to Melborne, Australia

On its daily 787 flight between LA and Melbourne, Australia, I found in January that there were only three days where one could book this flight in business class (all on the return leg). There now seems to be slightly more business class saver award space, with availability on 6 days going to Australia, and 5 days on the return.

2. American - New York-JFK to London-Heathrow

The change in award availability on this route has been radical. When I looked in January, I found zero award seats in both business and first class out of over 100,000 total seats on multiple flights daily. There are now several days each month when both business and first class saver awards are available, a change I noticed in early February.

3. American - Raleigh-Durham to London-Heathrow

On the Raleigh to London flight, the award situation has improved significantly, but not as dramatically as the JFK to London flights. There are now a few days in the summer (and more in the fall) when you can book business class awards at the saver level. In the Winter, flights to London appear to be available almost every Monday, Tuesday, and Wednesday, and with return flights available Monday through Thursday.

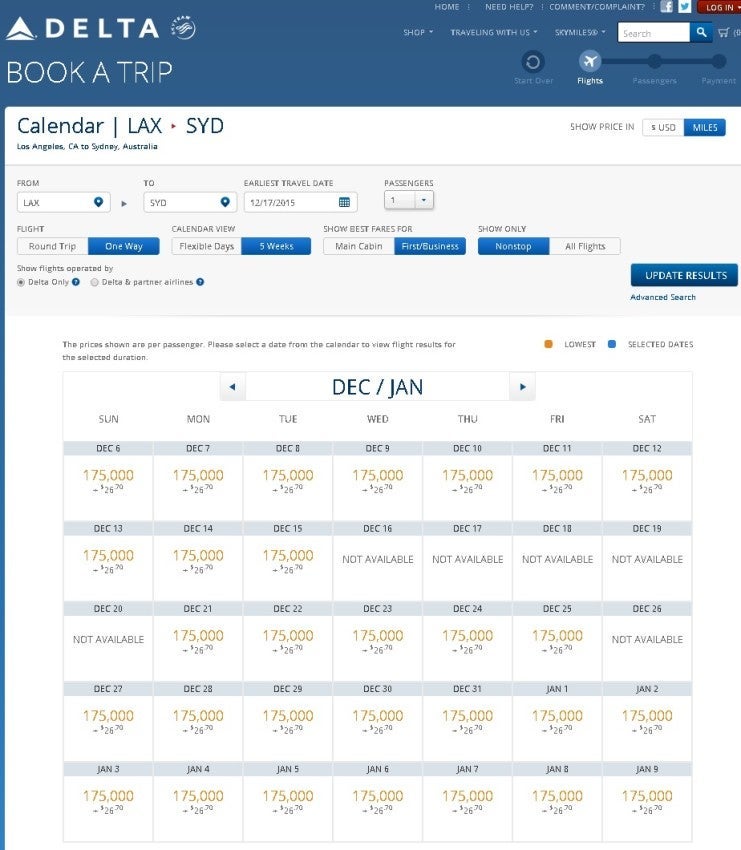

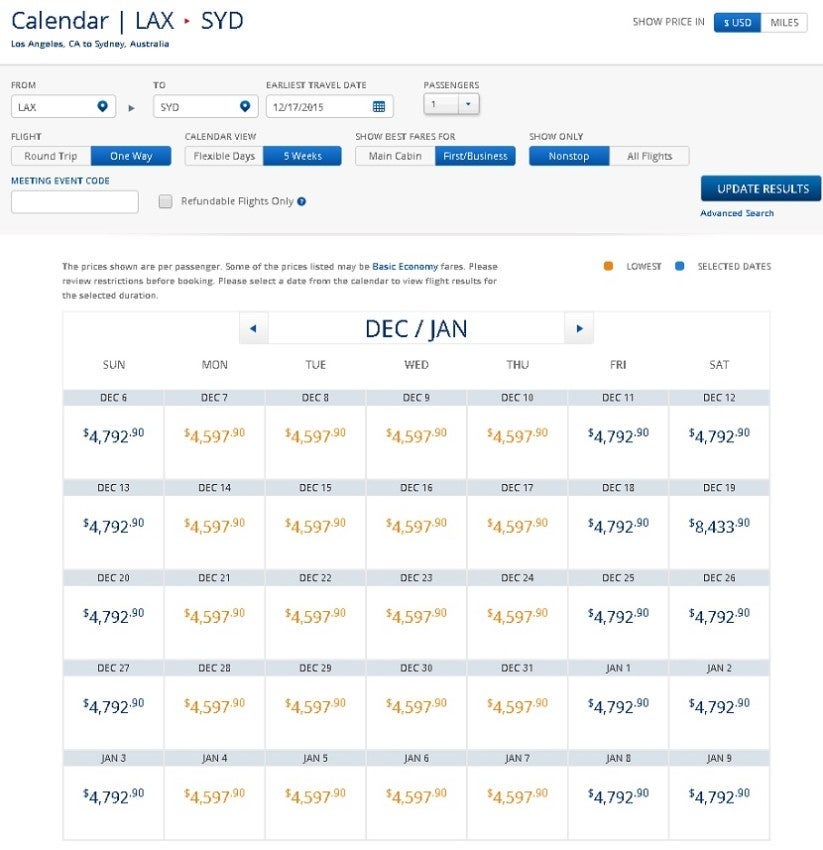

4. Delta - Los Angeles to Sydney, Australia

The most curious case has been with this Delta flight, which in January showed zero business class award seats available on Delta's flights between Los Angeles and Sydney, Australia at the (then) published award levels 1,2, and 3. There were just a handful of business class seats at level 4, but well over 99% at level 5 for 175,000 SkyMiles each way.

Yet to my surprise, the situation got even worse for this award. Business class awards are now 175,000 miles almost every day, with only a few exceptions. There was one day (April 4) with a single seat for 80,000 miles from LA to Sydney, and another day (May 12) with a single seat for 120,000 miles from Sydney to LA.

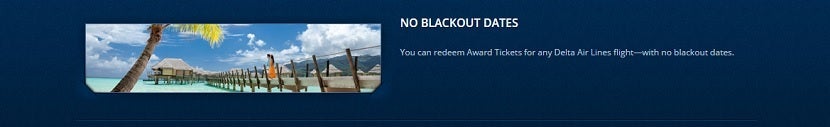

Blackout Dates On Delta

To make matters worse, there are now several days around the holidays when no award seats are being offered in business class at any price, but revenue tickets are still being sold.

From LA to Sydney, those dates are December 16-20 and December 26, while there were no business class awards from Sydney to LA on January 1-5.

This would seem to directly contradict Delta's published policy of "No Blackout Dates," which states "You can redeem Award Tickets for any Delta Air Lines flight—with no blackout dates."

5. Delta - Atlanta to Johannesburg, South Africa

When it comes to Delta's non-stop flight from Atlanta to Johannesburg, the situation is also largely the same as it was in January. Like before, there are currently no business class award seats below the highest mileage level (175,000 miles each way) except for six days on the Johannesburg to Atlanta flight, when the award cost is 147,500 miles.

What has changed on Delta?

Delta made one momentous change to its SkyMiles program since January. On Friday, February 6th, Delta removed all of its award charts from its own website with no notice or announcement. Travelers must now use Delta's online award search calendar with no frame of reference or other expectation of award travel prices. Apparently, the price is whatever Delta says it is. The surprise move occurred just 5 weeks into the "2015 SkyMiles" program, and a mere 11 days after I exposed that some award flights didn't exist at the saver level.

Analysis

Award availability in general has been fluctuating more wildly than ever in recent months. Just a few years ago, it wasn't hard to gauge award availability on a certain route for a given amount of time in the future. Then, after you earned the necessary miles, you had a reasonably good chance of finding those awards so long as you were flexible and booked your tickets far in advance. Today, however, airlines seem to be frequently releasing and withdrawing huge swaths of saver award inventory at once, with no pattern that I can discern.

United is the only one of these three airlines that has largely stayed the course, opening up just about the same scant business class saver award space as before on the route that I sampled. On the other hand, American has since opened up so much premium class, saver level space that the word plentiful might even come to mind.

Delta's actions remind me of an old political story. During his 1932 presidential campaign, Franklin Roosevelt promised a crowd in Pittsburgh that he would balance the budget and cut the government by 25%. Four years later he was concerned about voters holding him to this pledge that he hadn't kept, and his speechwriter suggested "Deny you were ever in Pittsburgh."

Likewise, it seems that Delta's best defense for offering abysmally low award availability at the lowest levels of its award chart was to simply remove the chart. By doing so, Delta effectively invalidated my findings that some awards at the published "Saver" level didn't exist, simply by not publishing any chart at all!

Award availability and the law

I spoke to attorney, frequent flyer, and consumer advocate Ben Edelman, who is on the faculty of the Harvard Business School. He suggested there might have been some legal reasons why Delta needed to remove its award chart. According to Edelman, "Advertising an award that is literally never available, zero, was found to be a violation of DOT regulation."

For example, Edelman directed me to this 1994 letter to then American Airlines chairman Bob Crandall, in which the DOT wrote that:

"The Department's deceptive practices prohibitions preclude airlines from imposing unreasonable capacity restrictions and/or unannounced blackout dates for the use of frequent flyer awards. To the extent airlines offer their frequent flyers awards for service to destinations, that traditionally are subject to high consumer demand, they must include in their promotional materials adequate disclosure that seats are limited—at times severely—and may not be available on every flight, if in fact that is the case."

Much more recently, the DOT fined Southwest Airlines $100,000 for advertising a fare sale and not offering seats at those prices. According to Edelman, the same rules should apply to frequent flyer awards.

Bottom line

We seem to have entered a transitional period in this industry and in our hobby, where airlines are pushing the boundaries of what the DOT and its customers will accept when it comes to award availability. It's my hope that DOT regulations can compel airlines to offer reasonable amounts of award seats, but that any government action won't be so severe as to spur the airlines to eliminate the current award travel system altogether.

Of course, not every award is so difficult to find, and there are plenty of awards that offer great value and have reasonable availability.

For more, check out these posts:

- Last Minute Travel: Finding Award Availability & More

- 8 Airline and DOT Rules Every Flyer Should Know

What experiences have you had recently searching for business and first class saver level awards?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app