2015 Updated Mileage Bonuses for Fidelity Brokerage Accounts

When it comes to earning points and miles, lucrative credit card sign-up bonuses aren't the only way to score big. Online brokerages frequently offer airline miles as incentive to earn your business.

I've personally been able to take advantage of two 50,000 mile bonuses offered by Fidelity Investments for new brokerage accounts, boosting both my Delta SkyMiles and United MileagePlus balances, and I'm going for it again this year.

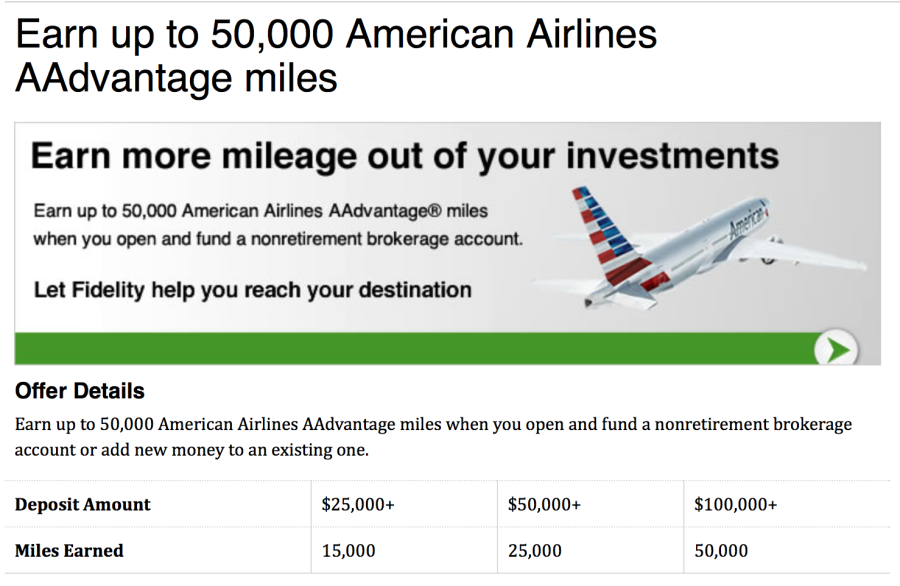

Through March 31, 2015, Fidelity is awarding bonus American, Delta, or United miles when you open and fund a non-retirement brokerage account or add to an existing one.

| Deposit Amount | $25,000+ | $50,000+ | $100,000+ |

|---|---|---|---|

Miles Earned | 15,000 | 25,000 | 50,000 |

The terms are similar for each offer, and you can use the links below to earn bonus miles in whichever program you prefer:

- American Airlines AAdvantage Fidelity Offer

- United MileagePlus Fidelity Offer

- Delta SkyMiles Fidelity Offer

My Thoughts

If you've got cash to invest, you can rack up a ton of frequent flyer miles by opening Fidelity Brokerage accounts; however, I recommend reading through the complete rules first. Going for 50,000 miles could be worth it, especially since the miles have posted quickly when I've done this before, however you do have to keep the money in the account for 9 months, so keep that in mind.

Using my most recent monthly valuations, 50,000 Delta SkyMiles is worth $650, 50,000 United MileagePlus Miles is worth $750, and 50,000 American AAdvantage miles is worth $850, so there's value to be had with these offers.

Check out this Flyertalk thread for more anecdotal evidence from others who have participated in these offers from Fidelity before.

Terms and Conditions

This offer is valid for new or existing Fidelity customers. In order to receive miles, you must open and fund or deposit net new assets into an eligible joint or individual nonretirement Fidelity Account®. Deposits of $25,000 to $49,999 will receive 15,000 miles, deposits of $50,000 to $99,999 will receive 25,000 miles and deposits of $100,000 or more will receive 50,000 miles. Net new assets means external new money in minus money out, including distributions and transfers, during the qualification period.

This offer expires March 31, 2015, and it is not transferable or valid in conjunction with any other Fidelity promotional offer. Fidelity Investments reserves the right to modify, change, or alter the terms and conditions of the promotional offer in its sole discretion at any time. Fidelity Investments may terminate this promotional offer at any time. Other terms and conditions, or eligibility criteria, may apply. Offer is limited to one per individual per rolling 12 months and may not be combined with other offers.[card card-name='Chase Sapphire Preferred® Card' card-id='22125056' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app