Maximizing Ultimate Rewards Points With Chase Ink Category Spending Bonuses

Update: Some offers mentioned below are no longer available. View the current offers here.

TPG contributor Jason Steele is back with another in-depth look at the Chase Ink family of credit cards and how you can maximize their category spending bonuses and gift cards.

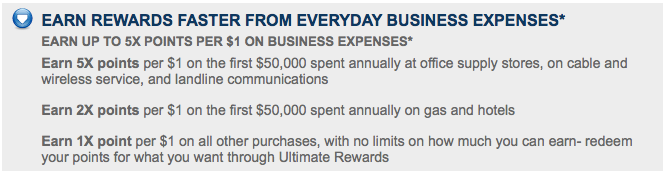

In part one of this series, I looked at ways that cardholders could utilize the complete line of Ink cards in order to earn the maximum number of Ultimate Rewards points as well as dispelling some common myths about the cards and their limitations. Today, I want to explore individual purchases that can help you to earn the most Ultimate Rewards points using the 5x and 2x category spending bonuses.

1. Charging Internet services. Don't forget that in addition to office supplies, Chase Ink's terms indicate that, "You will earn an additional 4 points for each $1 of net purchases made in any of the following categories: internet, cable, and phone services (excluding equipment purchases)." So you can earn 5 points per $1 in total on these services as well.

But few people realize how expansive these terms actually are. For example, I know businessmen who are spending tens of thousands of dollars a month on Internet services that earn 5x. In fact, one person discovered that some of his Internet services were in fact being categorized as office supplies. The point is that if you have large business expenses, it is worth trying to make a charge to your Ink cards, just to see if they might qualify for 5x category spending bonuses. Not all merchants categorize their charges in the categories that you might think and in the end, it can't hurt to try and see what you get.

Ink's terms state: "Even though a merchant or the items that it sells may appear to fit within a listed category, the merchant may not have a merchant code that falls within that category. Therefore, purchases with that merchant will not qualify for the stated rewards offer on category purchases." So conversely, a merchant you might not think is grouped in one of the bonus spending categories might actually be so it's worth double-checking your statement.

2. 2x opportunities. While not as good as 5x, Ink cardholders should not discount the opportunity to earn 2x Ultimate Rewards points at gas stations and hotels. For example, Vanilla Reloads are for sale at a variety of gas stations such as Valero, TA Travel Centers, and a variety of regional gasoline retailers. The trick is to search the Vanilla Reload site under Reload Locations. Even if the name doesn't sound familiar, click on it and see who the company represents. For example, the Circle M link takes you Clipper Petroleum which operates a number of BP and Shell branded gas stations throughout the North Georgia including the Atlanta metro area – so if you live around there, you could be in luck.

Finally, don't forget that charges at hotels (that must be made directly with hotels and not through third parties like Travelocity) earn 2 points per $1 with the Ink Bold, Ink Plus, and Ink Classic cards while Ink Cash cards earn 2x at restaurants, just like Sapphire and Sapphire Preferred. This bonus should be available to those paying for special events, conferences, or meals at a hotel, so long as the charge contains the hotel's merchant code. Be cautious when making charges at a separate business that operates on a hotel's property.

3. Gift card ideas at Office Max and Staples. Look beyond that particular large office supply retailer that you might have spent time on in the past, and consider the gift cards offered at some of its competitors. For example, both Staples and Office Max carry Amazon gift cards with no fees that can be used to purchase hundreds of thousands of items (although they cannot be used for Amazon Payments). In addition, Staples also sells Shell cards, allowing you to earn 5x on gas purchases there instead of just the 2x you normally would.

As for restaurants, both Staple and OfficeMax offer plenty of choices with which to maximize miles. For example, business travelers could earn 5x for purchasing these cards for meals while traveling, and submit restaurant receipts for reimbursement just as if they had paid with their own credit card.

Staples Restaurants: Applebee's, Chili's, Coldstone Creamery, Red Lobster, Ruby Tuesday, Panera, PF Chang, and Subway.

Office Max Restaurants: Baja Fresh, Cheesecake Factory, Chili's, Ihop, Olive Garden, Outback Steakhouse, Panera, PF Chang's, Pizza Hut, Red Lobster, Red Robin, Starbucks, Subway, and TGI Friday.

These aren't exactly competing for Michelin stars, but some of them are decent and there's a good chance you'll find at least some of them pretty much anywhere you travel in the US. Plus those Starbucks cards give you a good opportunity to double dip with My Starbucks Rewards.

Though some other credit cards specifically exclude gift cards from bonus spending categories, the Ink terms only state: "You do not earn points on cash-like charges such as travelers checks, foreign currency, and money orders, overdraft advances, unauthorized or fraudulent charges, or fees of any kind." So gift cards are fair game.

Finally, revenue travelers can also earn 5x on Southwest Airlines gift cards purchased at Staples. Even those with plenty of Ultimate Rewards points might use these cards when Southwest offers a promo code that can't be used for bookings with points. Or, it can make sense to use these gift cards when making business trips that are tax deductible or reimbursed by a third party.

When you think creatively and experiment a little bit with your charges to see Chase categorizes certain merchants, there are plenty of ways to maximize the Ultimate Rewards points you earn with the Ink cards' category spending bonuses that don't involve spending beyond your means on goods and services you would still be purchasing otherwise.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app