The State of Hotel Loyalty Programs: A Devaluation Story

President Obama gave his State of the Union address last week, and with all the hotel points program changes coming down the pike, I thought I'd give my own State of Hotel Points address - and the state of hotel points is...worsening!

Here's a recap of the news we've gotten so far:

Starwood

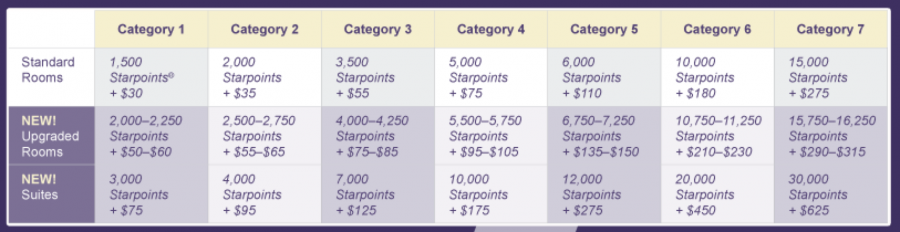

Back in mid-January, Starwood announced it would be changing its its Cash & Points redemption options starting March 5, 2013, as well as adding the ability to redeem Cash & Points for upgraded rooms and suites. You can find the current category breakdowns here, but for reference, here they are:

Starwood’s Cash & Points redemptions have historically been some of the best hotel point redemption values around, often yielding at least 3 cents per point in value, but often much more than that. That's going to be a lot harder to achieve consistently since these increases are 20% across the board.On the bright side, you can now make cash & points redemptions at all Category 1 and 2 hotels worldwide, not just in the US, Canada and Asia-Pacific, as is the case now; and you can use Cash & Points for suites, which is good if you value those bigger rooms, though possibly bad news for elites since it will make upgrades harder to come by.MarriottBoth Marriott and Ritz-Carlton announced major changes last week. The Marriott changes, which will begin May 16, include there will be a new top-tier category – Category 9 – which will cost members 45,000 points per night, as well as category changes for over a third of their properties around the world.

You can see from the full list of changes here, hundreds of hotels that are having their categories raised while just a few are having their categories lowered. In fact, only 1% of hotels are dropping a category while a whopping 36% are being elevated by at least one category. Marriott also points out: 73% of properties remain in its lower-run 1-4 Categories.

If you already have a Marriott redemption in mind and have collected the necessary points for it (or are close), you’d be wise to take a look at the revised category list in case the hotel or resort you’re thinking of is being upped a category and make your reservation now if possible rather than waiting until the redemption level goes up after May 16.HiltonAs I reported yesterday, Hilton has just announced a major devaluation of the HHonors program effective March 28, 2013 which include new (more expensive) tiers and seasonal (more expensive) pricing, but also a 5th night free benefit for elite members.

Key changes from the announcement page:

- Reward Categories – We will be expanding to ten hotel reward categories to account for all of the new hotels and resorts that have opened in the past few years. With 3,900 hotels and resorts in 90 countries you are sure to find the perfect place for your next reward stay.

- Seasonal Hotel Reward Pricing – For most of our hotels and resorts, we will introduce seasonal pricing for reward stays. The amount of points needed for a Standard Room Reward and a Points & Money Reward will vary during certain times of the year.

- 5th Night Free – Now members with Silver, Gold or Diamond elite status will get a free night* when they book a Standard Room Reward stay of five or more consecutive nights.

The new chart will have 10 categories. You can see what hotels will be in which category in this PDF.

| HOTEL CATEGORY | HHONORS POINTS REQUIRED FOR ONE FREE NIGHT |

|---|---|

1 | 5,000 Points |

2 | 10,000 Points |

3 | 20,000 Points |

4 | 20,000 to 30,000 Points |

5 | 30,000 to 40,000 Points |

6 | 30,000 to 50,000 Points |

7 | 30,000 to 60,000 Points |

8 | 40,000 to 70,000 Points |

9 | 50,000 to 80,000 Points |

10 | 70,000 to 95,000 Points |

There is no mention of how AXON (special award pricing for Hilton Amex cardholders) and GLON (discounts for elite member) awards will be affected.

A Cost Comparison

So taking these new rules into account, here's how much money you'd have to spend just at hotels in order to earn the points necessary for one free award night at a top-tier property in each chain at base earning levels.

Club Carlson: $2,500 for a free night at a top-tier Carlson property like a Radisson Blu (50,000 points earned at 20 points per dollar)

Hyatt: $4,400 for Hyatt (22,000 points at 5 points earned per dollar spent)

Marriott: $4,500 at Marriott (45,000 points at 10 points per dollar spent)

Priority Club: $5,000 at Priority Club (50,000 points at 10 points per dollar spent)

Hilton: $6,333 for a free night at a top-tier Hilton (95,000 points at 15 points earned per dollar spent)

Starwood: $15,000 for a Starwood Category 7 property (30,000 points at 2 points per dollar spent) or $7,775 for Cash & Points for 15,000 points (at 2 points per dollar) plus the $275 copay.

Top-tier redemptions at base-level earning are just a snapshot of what a hotel program is all about, but they do provide an accurate portrait of what it takes to get a decent return at each, and among others, Hilton went from middle-of-the-road to nearly the top of the pack in terms of how much money you have to spend to stay anywhere aspirational.

The real takeaway here, though, is that with a few exceptions like Club Carlson, no matter which hotel brand you give your loyalty to, you're going to have to spend a lot more money - whether it's in terms of the outlay just to rack up the points or the cash copay on a cash & points redemption - to earn enough points to stay at a hotel you want.

A Warning to Hotel Loyalty Programs

As you hack away more and more of the value proposition, I think you'll realize that consumers are actually pretty smart and will start shifting their spend towards chains that actually reward loyalty and not punish it. This may not come in the form of traditional points, but many boutique hotels offer far more enriching experiences with more amenities and at cheaper prices. This Hilton devaluation was so brazen that I do think it will hurt them dearly in the end when Amex and Citi cardholders reduce their spend or cancel their cards. In fact, if the impact is so negative, I could see those issuers coming after Hilton since there are likely clauses in the contracts that state that Hilton can't materially change the program (since the credit card companies are buying millions of dollars worth of points that their cardholders can use at a later time and date). I'll be complaining to both American Express and Citi about the Hilton changes and hope everyone else considers doing so as well if you don't like the changes.

Home rental/swap sites like Airbnb and VRBO are becoming more enticing as well. I'm currently typing this post from a 2 bedroom bungalow in Los Angeles that I rented for less than a small standard room at the W Westwood or Century City Hyatt. I'm here for a week, so I crunched the numbers and while I would have liked to have gotten the nights towards elite status, I had a friend coming with me and my new puppy, so having my own house made sense on so many levels. The way I envision it, is that I got a monster suite upgrade and saved a boatload of cash.

I don't mean to be so doomsday with this post, but I do feel that I'd be remiss to not remark that 2013 has been a remarkably bad year so far for devaluations in the hotel points industry.

Have the recent changes made you think differently about your hotel/lodging strategy in 2013 and beyond?

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.