My Permanent Bluebird Card Is Active... and the Points Are Flying!

Update: You can no longer purchase Vanilla Reload cards using a credit card and Vanilla Reloads are no longer available in Office Depot.

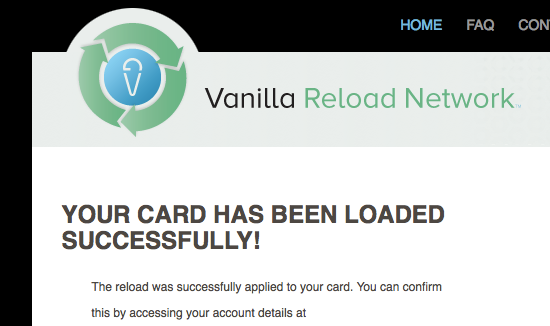

As I mentioned in my original post about the huge potential of the American Express Bluebird card, you need to wait until you get a permanent card in the mail before you can start loading it with Vanilla reload cards. So, I was very excited to see a nice thick envelope from Amex when I got home this week from an unexpected week-long trip. I immediately activated the card within minutes online and from that point on I was ready to get it loaded with Vanilla reloads.

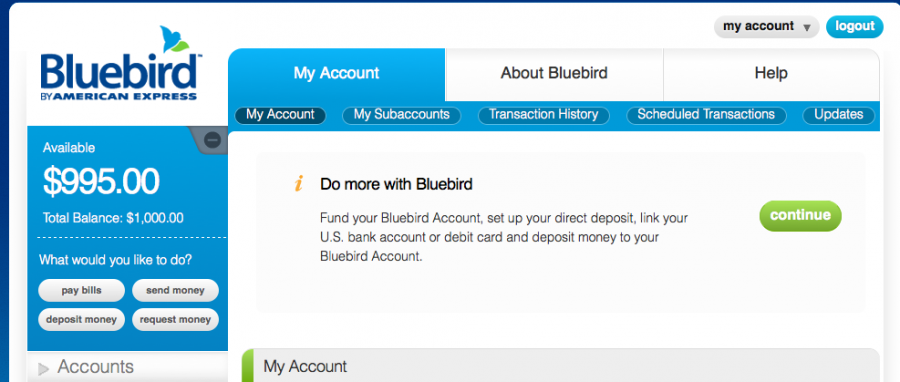

There's a $1,000 per day load limit, so I immediately scratched off the PINs of two $500 Vanilla reload cards that I had purchased a week prior at the Office Depot in Doral, Florida (near MIA for anyone who has time to kill on a layover!).

Once I loaded the $500 from each card (which cost me $3.95 in fees) the funds were instantly in my Bluebird account.

To test out the "powers" of Bluebird, I decided to pay back TPG Managing Editor Eric for $10 he lent me when I was in Los Angeles last week (I hate using cash, but needed valet tip money - they should really start carrying Square so I can tip with credit card!). I used the Send Money function and it asked me for an email and amount and once I entered my PIN the funds were sent. Eric instantly received the following email, stating that he'd need to create a free Bluebird account to accept the funds.

"Brian Kelly has sent you the following funds:

Amount: $5.00

Message:

Transaction: XXXXXXXX

Please click here to sign up for a free Bluebird Account. You will then be able to select the Updates link from the My Accounts tab. Locate the Send Money Notification awaiting action and click on the See Details link. Then choose one of the following options:

Accept this amount;

Suggest a new amount; or

Cancel this transaction

If you do not open a Bluebird Account and accept this payment within 7 days of this email, this transaction will be voided and you will not be able to accept this payment thereafter.

If you already have a Bluebird Account and this email address is not associated with it, please log in to your account and go to Account Settings to add this email address so that you can accept these funds into your existing account.

Thanks,

Bluebird"

If you want to send money to someone who doesn't have Bluebird, all you need to do is click "Pay Bills" and then add whoever you'd like as a payee. You'll need their address and name - but no social security number or EIN - very simple.

If you want to withdraw your Bluebird account at ATMs, you can witdhraw a maximum of $500 a day (3 transactions) and $2,000 per calendar month. The bill-pay/vendor setup is potentially a cheaper/quicker way to take out large amounts since there are no fees. You can use Walmart ATMs for free, but there's a $2 Amex fee, unless you link a direct deposit to your Bluebird account (no government payroll/payments can be setup as qualifying direct deposits).

So to say that I'm impressed with Bluebird would be the understatement of the century. The real kicker is that I can now pay things like my mortgage company, car payment and condo association with no fee- all bills I used to pay directly from my checking account or by check. The only fee I pay is $3.95 per $500 Vanilla card.

Too Good To Be True?

Now, it's not as easy as paying $158 for 100,000 points as there are limits. Chase maxes out the office supply (any Office Depot purchase) at $50,000 per calendar year. However, I have both the Ink Plus and Ink Bold (snagging 50,000-point sign-up bonuses for each), so my real maximum is $100,000 in spend, or 500,000 Ultimate Rewards points a year. I can only load $1,000 per day onto my Bluebird, but if I wanted to get access to more daily spending, I could also purchase Amex Prepaid cards (and use them for everyday spend) and they only cost $4.95 per $500 card.

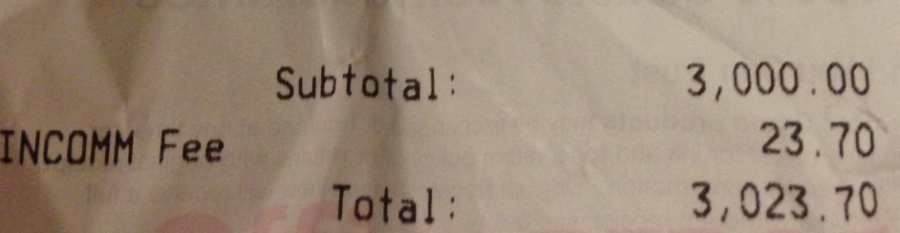

Some people have reported Office Depot's getting rid of Vanilla cards or being questioned by managers, but I've never had an issue at Miami area Office Depots and there have been plenty of Vanilla cards for sale. In fact, just yesterday (November 4), I bought $3,000 in Vanilla Reloads at my Office Depot and no one batted an eyelash.

Will this all come to an end? Probably at some point, so you should get in while the getting is good! Here are the useful links you'll need:

Ink Plus 60,000-point sign-up after $5,000 spent within 3 months, $95 annual fee

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app