Paying Taxes on Points: Citibank Sends Tax Forms For Some Checking & Savings Sign-up Bonuses

New TPG Contributor Series: Financial and travel writer Jason Steele investigates recent reports that Citibank is sending tax forms to customers who received American Airlines miles for opening bank accounts last year.

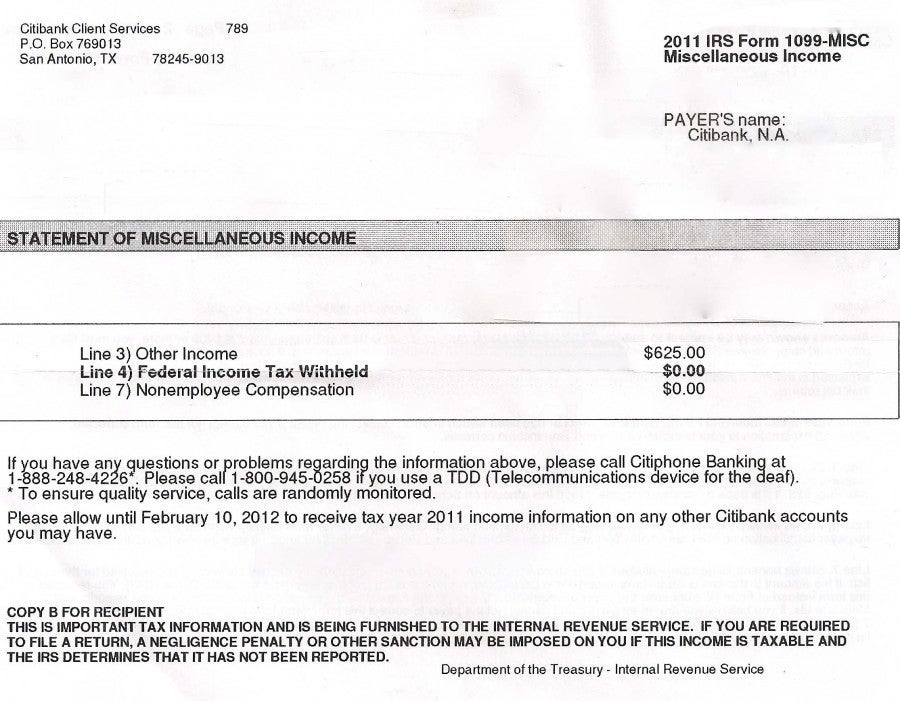

Are miles going to be taxable? Citibank raises the alarm among customers by sending them 1099 forms for bonus points earned by opening checking and savings accounts.

Update: Check out the bottom of this post for an important update from the IRS that came out after this original post was written.

The Taxation of Points and Miles

This time of year, most of us are opening our mail boxes to discover tax forms showing our income earned from employers and investments as well as any tax deductible contributions to home mortgages and student loans. What we don’t expect is a form from an airline or a bank saying that the points or miles that we earned are taxable income. Yet this is exactly what happens to some Citi customers each year, and each time it does, it sends shock waves throughout the close-knit community of serious points and mileage collectors as well as amateur enthusiasts looking to collect a few extra miles through savvy personal finance.

Beware The 1099

Fears were stoked yet again earlier this month when Citi sent out IRS 1099-INT forms to banking customers who earned American Airlines miles when they opened checking or savings accounts. It’s important to note that it did not send 1099’s to customers who’d earned miles by opening credit cards. However, this tax grab seems a bit sleazier since the folks who were solicited to open new accounts were Citi AA cardholders.

According to this report in the Los Angeles Times, Citi is claiming that these miles are the equivalent of prizes, and as such, are subject to taxes. Worse yet, it claims that each mile should be valued at 2.5 cents.

Granted, the AAdvantage program has some great domestic and international award redemption possibilities, but 2.5 cents per mile is seen by most as an excessive valuation. For instance, you could easily receive more than $2,500 dollars in value if you redeem 100,000 miles for a business class ticket to Europe, but barring a last-minute redemption, it is difficult to find a 25,000-mile domestic coach award that could not have been purchased for less than $625. That highlights the very nature of points—that their value is extremely difficult to pin down. So why should individuals be on the hook for them?

The IRS Version

With the exception of some executives at Citi, there seems to be unanimous agreement that loyalty points and miles do not represent taxable income. Except for points that are converted to cash or other income, the IRS considers promotional points and miles to be in-kind promotional benefits and treats them as rebates, unlike Citibank, which considers the miles it distributes to be prizes, so the agency has stayed out of the points game.

In its official position on points, the IRS says that due to the administrative murkiness of valuing points, whether they’re used for business or personal benefits, and a host of other unresolved issues, it has not pursued a taxation policy on points, and for the time being, has no plans to do so. Nor will it go after taxpayers who do not declare points and miles on their income tax forms. That said, it could develop such a policy at any time, so consumers should be aware of any rule changes.

In the meantime, Ohio Senator Sherrod Brown, the chairman of the Senate Banking Subcommittee on Financial Institutions and Consumer Protection wrote an open letter to Citibank earlier this week telling them to stop reporting frequent flyer miles as taxable income arguing that it’s putting even more of a strain on financially strapped families in our down economy, and says, “given the IRS's ruling, why is Citibank sending its customers 1099 tax forms? Reporting frequent-flier miles as taxable income is inconvenient to consumers, raises their anxiety unnecessarily, and is not required by law.” So at least consumers have some powerful friends on their side.

What Can Should Do

The first thing you should do is consult a licensed tax adviser. I am not one, so this post is merely a roundup of information to get you thinking about options.

Here are some things you research further:

-Call Citi and dispute the amount at which they value the points. They may relent. Even if you didn't get a 1099, let Citi know you are not happy with this - they have gotten a lot of bad press around it, so their customers need to keep up the heat.

-If they do not, you can call the IRS and get a form from them disputing the valuation of the points and send it to Citi. They will have to respond, and might drop the 1099 altogether.

-If that doesn’t work, when you pay your taxes, only include the amount you value the points at along with a letter of explanation to the IRS, but keep the original 1099 for your records in case the IRS notes the discrepancy.

What Is Citi Thinking?

This year and in years past, Citi is only sending out 1099 forms to those who earned 25,000 miles or more by opening a checking or savings accounts, not those who have taken advantage of one of their numerous AAdvantage credit card offers, most of which far exceed 25,000 miles. Not only is Citi the only institution that reports bonus miles as taxable income, but it is unclear why Citi seems to only find bonus miles awarded to checking and savings account holders taxable, but not miles received from credit card sign-up bonuses or spending. However, this kind of inconsistency on Citi’s part is nothing new to mileage seekers.

In short, if Citi can’t even enforce their own terms consistently, it is unsurprising that it would have problems properly complying with IRS regulations. For now, Citi AAdvantage credit cards still offer some great sign-up bonuses, but without the prospect of receiving an IRS 1099 form. As for their sign-up bonuses on checking and savings accounts, those who don’t enjoy wrangling with the IRS should pass on these offers for now.

Tell Us About It

Did you receive a 1099? Have you contacted Citibank or the IRS? Tell us about your experience and what happened in the comments below.

Update: This morning the Los Angeles Times published a follow-up by the same writer, David Lazarus, with some more (and more unsettling) answers from the IRS.

IRS spokeswoman Michelle Eldridge dropped this bombshell: “When frequent-flier miles are provided as a premium for opening a financial account, it can be a taxable situation subject to reporting under current law.” But she also said that miles received for using a credit card or credited to a passenger by an airline for taking a trip would be classified as rebates, and so not taxable.

There are a few disturbing leaps in her statement, the biggest of which is her use of the term “financial account,” which opens up the door beyond just the checking and savings accounts that Citi customers were 1099-ed for, but also to investment funds like Fidelity and TD Ameritrade that award bonuses, as well as possibly credit card sign-up bonuses.

The other troubling implication has to do with the value of these points since, Eldridge says, “the amount of income to the taxpayer is the value of the property received, not the cost that the business paid to acquire the property.” So despite the fact that Citi probably paid a fraction of a cent per mile it purchased from American Airlines to distribute to customers, it can claim each mile is worth 2.5 cents on the 1099’s. How they came up with that number is a mystery, but certainly the tax deduction at this value that the bank is able to claim is part of the equation.

That just might be the saving grace for taxpayers, though, since points valuation is so murky and they can be redeemed for any number of items or benefits and wildly varying values. It’s going to take the IRS a long time to figure out just what to do about taxing these points and whether it’s worth the administrative and legal hassle.

Lazarus and the CPAs he talks to all admit that this issue is confusing even for tax professionals and the IRS, so there are still no definitive answers and there likely aren’t going to be for a long time to come. (Updated by TPG Editor Eric Rosen)

[card card-name='Citi® / AAdvantage® Platinum Select® MasterCard®' card-id='22144516' type='javascript' bullet-id='1']

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.