How to Earn and Maximize the Southwest Companion Pass

Update: Some offers mentioned below are no longer available. View the current offers here.

The Southwest Companion Pass is one of the most lucrative benefits of any airline loyalty program. This pass allows you to designate a companion that flies for free (just pay 9/11 taxes) on any flight that you are on - even if you use points for your ticket. This benefit can save you serious amount of money and the best part is that there is no award "availability" on Southwest - if there's a ticket for sale in the same ticket fare that you purchase/used points for, then your companion can fly as well for free. Also, once you qualify for the pass you get to enjoy it for the rest of the current year plus the entire next calendar year. So if you were to qualify for the pass in January 2012 you'd enjoy the benefits until December 31, 2013!

How to Qualify

There are two ways:

1) Fly 100 one-way flights within a calendar year

2) Accrue 110,000 points in a calendar year (every January your qualifying points reset to 0) - this includes flights, credit card - including credit card sign-up bonuses like the current 50,000 points for the Southwest Plus card after first purchase) and partner activity like hotel stays/transfers and rental cars.

Relevant Rules (Full list here)

1) Your companion can only board with their zone. For example, if you are a top elite, your companion cannot board with you unless they have the same elite status.

2) You cannot use your companion for an extra seat for yourself unless you are a Passenger of Size.

3) You can change your designated Companion and request a new Companion Pass up to three (3) times within the validity period of the Pass.

4) Companion Pass and reward travel is subject to a government-imposed September 11th Security Fee of up to $10 roundtrip

My Tips

If you've already gotten one of the 50,000 point Southwest cards this year you can try getting the 50,000 point Business Credit card. I haven't done this myself but other TPG readers have reported getting both 50,000 point bonuses (if you have any experience, please report it in the comments).

If you got the 50,000 point Premier card earlier this year, it might be possible to also get the new 50,000 point Plus Card bonus that was launched this week. The rules state that you can't, but other people have gotten multiple Chase airline card bonuses in the past as long as they were different products. We won't know for sure until we hear from anyone who has tried, but if you are within striking distance of the Companion Pass and you don't want to go for the Business Card, it could be worth a shot - however I cannot vouch for this method until we hear more real-time reports.

If you really want a companion pass and currently have 0 points, I'd recommend getting the Plus and Business cards and then activating them in January so the points count towards your 2012 qualification. You could also wait until January to apply, but as with all good deals- its very possible these sign-up bonuses will drop. Either way, the benefit of waiting to accrue your points until January 2012 is that your Companion Pass will be good until December 31, 2013. If you were to get a Companion Pass today it would only be good until December 31, 2012. As mentioned above, you can also transfer hotel points to Southwest to help you get to 110,000.Unfortunately Southwest left the Membership Rewards program and they are not currently transfer partners of the Ultimate Rewards Program (though I wouldn't be surprised if they were added in the future since Chase issues all of their credit cards).

As far as hotel transfers, unfortunately neither Starwood or Priority Club allow point transfers to Southwest, however here are the main hotel program ratios.

Choice Privileges:

| Points | Rapid Rewards Points |

|---|---|

6,000 | 1,800 |

12,000 | 3,600 |

18,000 | 5,400 |

24,000 | 7,200 |

30,000 | 9,000 |

| for | SWA Points | HHonors Points |

|---|---|---|

-> | 1,200 | 10,000 |

Exchange in increments of 10,000 points |

FYI: *Effective January 1, 2012, the Hilton HHonors program will no longer offer Southwest Airlines Rapid Rewards® Points for stays at hotels & resorts within the Hilton Worldwide portfolio.

Hyatt: Receive 1 mile for every 2.5 Hyatt Gold Passport points you convert, starting with a minimum of 5,000 Hyatt Gold Passport points.

Earn 5,000 Bonus Miles when you convert 50,000 Hyatt Gold Passport points.

Convert

50,000 Points→Receive

20,000 Miles+Earn

5,000 Bonus Miles=Total

25,000 Miles

Hyatt Gold Passport Point conversions can be made in 1,250 increments.

| 2,000 Rapid Rewards Points | 10,000 | View |

|---|---|---|

5,000 Rapid Rewards Points | 20,000 | |

10,000 Rapid Rewards Points | 30,000 | |

25,000 Rapid Rewards Points | 70,000 | |

50,000 Rapid Rewards Points | 125,000 |

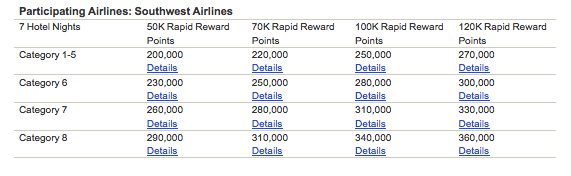

Marriott also has Hotel & Air Travel Packages, which can be great values. If you redeemed their top packages, you'd get enough Southwest points for the companion pass, which in itself can make that redemption more than worthwhile.

Marriott Hotel + Southwest Point Packages

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app