6 things to do to improve your credit score

Editor's Note

A low credit score can have a serious impact on your life. It can keep you from getting some of our favorite credit cards and affect your ability to get a home or auto loan.

Fortunately, no one is doomed to have a low credit score forever. There are several things you can do to bring your score up and keep it where you want it.

Here's how to improve your credit score.

Take inventory of your credit

First, check your free credit report across all three bureaus (Equifax, Experian and TransUnion) to see what might be dragging down your score. Check to make sure everything is accurate and dispute any errors that you see.

If you see a specific area that is bringing your score down, focus on whatever you need to do to improve that area. For instance, if you have had several late payments that are bringing down your score, you'll want to focus on setting up a system to ensure you pay all your bills on time. This is the simplest way to improve your credit score.

Related: How to check your credit score for free

Make the most of your checking account

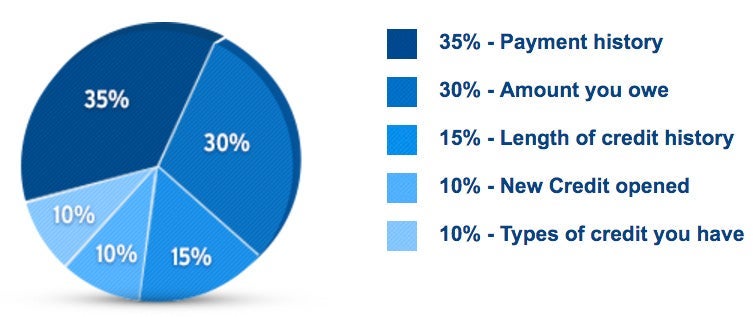

Your bank is your best friend if you want to improve your credit score. Use your checking account to set up automatic minimum payments on every account you have. Remember, payment history makes up about 35% of your credit score, which makes it the most important factor.

Mistakes linger on credit reports, and the best thing you can do for your credit score is to avoid them. Many banks offer budgeting tools to help track spending and saving as well.

Related: How to set up autopay for all your credit cards

Keep credit use low

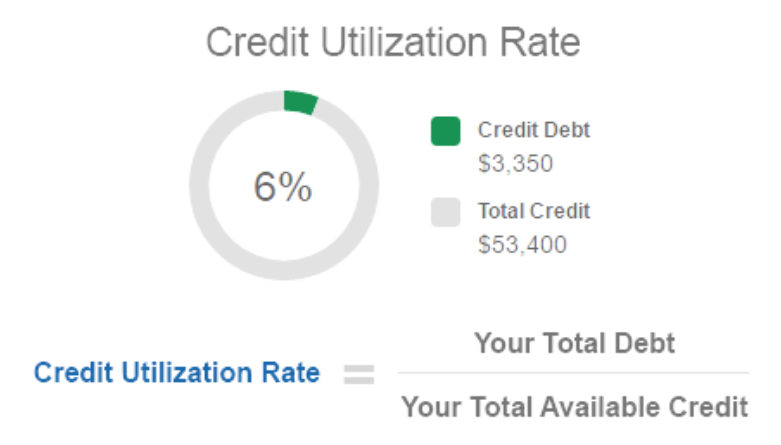

The amount of available credit that you use affects your credit score. Aim to keep it as low as possible, but certainly work to keep it below 30%.

If you need to adjust your credit utilization, consider paying down high account balances before they're due. You can also call your bank to request a credit increase. Either of these actions will lower your credit utilization and help improve your credit score.

Related: Here's why you should never turn down a credit limit increase

Earn credit for paying your bills and maintaining bank balances

If you don't have a strong credit history, consider Experian Boost, a free service for adding utility and telecom payments to your Experian credit file to build a payment history.

If you're a saver and have a history of healthy bank balances, UltraFICO may be an option for you. UltraFICO takes checking and savings information into account when calculating scores.

Become an authorized user

If you know someone who has a high credit limit, ask if they're willing to add you as an authorized user on one of their credit cards. They can do this without even having to give you the card.

As an authorized user, your name is added to the account and it contributes to your credit reports. As a result, the main cardholder's good credit will positively impact your credit score.

This is one of the easiest things you can do to improve your credit score.

Avoid canceling credit cards

The age of your credit lines matters when it comes to your credit score. Because of this, you want to keep credit lines open to increase your credit age.

If you find that you are no longer using a credit card enough to justify its annual fee, opt to downgrade to a card with a lower or no annual fee rather than close the account.

For instance, if you have the Chase Sapphire Reserve® (see rates and fees), you could request to downgrade it to the Chase Sapphire Preferred® Card (see rates and fees), which carries a much lower annual fee, or to the Chase Freedom Flex® (see rates and fees), which doesn't carry an annual fee at all. This would allow you to increase your credit age and improve your credit score while also reducing your annual fee costs.

Related: Should I cancel my credit cards if I don't use them anymore?

How long does it take to improve my credit score?

It takes a while to fix a damaged credit report. Delinquencies — generally reported to credit bureaus after two consecutive missed payments — remain on your report for seven years. Inquiries can stay on your credit report for up to two years.

Since this takes some time, it's important to stay consistent with good credit habits. By regularly implementing as many of these tips as you can, you'll be on a solid path to having and keeping a better credit score.

Bottom line

If your low credit score is negatively affecting your life, you aren't alone. However, you can and should take steps to improve it.

Follow our recommendations for how to improve your credit score outlined above, and you'll be well on your way to having and keeping a good credit score.

If you want to learn more about credit scores, check out these links:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 2X miles | 2 miles per dollar on every purchase |

| 5X miles | 5 miles per dollar on flights and vacation rentals booked through Capital One Business Travel |

| 10X miles | 10 miles per dollar on hotels and rental cars booked through Capital One Business Travel |

Pros

- The Capital One Venture X business card has a lucrative welcome offer.

- In addition, the card comes with many premium travel perks such as an annual $300 credit for bookings through Capital One Business Travel.

- Business owners are also able to add employee cards for free.

Cons

- The card requires significant spending to earn the welcome offer.

- Another drawback is that the annual travel credit can only be used on bookings made through Capital One Business Travel.

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you'll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

- Top rated mobile app