Flying Blue 50% Off Promo Awards Announced and a Guide on How to Book Them

Update: Some offers mentioned below are no longer available. View the current offers here.

I find Flying Blue (the frequent flyer program of Air France, KLM, and some other Skyteam carriers) to be generous with award availability. They even run "50% off" promo awards all year long, which means you can fly roundtrip from certain North American cities to Europe and beyond for as low as 25,000 in coach and 50,000 in business. Flying Blue is a 1:1 transfer partner of American Express Membership Rewards, so it's a great way to stretch the value of your Amex points. Note: Flying Blue taxes on awards are pretty high – for example a 25,000 roundtrip award to Europe may have $450 in taxes. If you can buy that same ticket for $650, it makes sense to just purchase it and earn miles. However, there are some expensive routes – especially in business class, that can be unbelievable values.

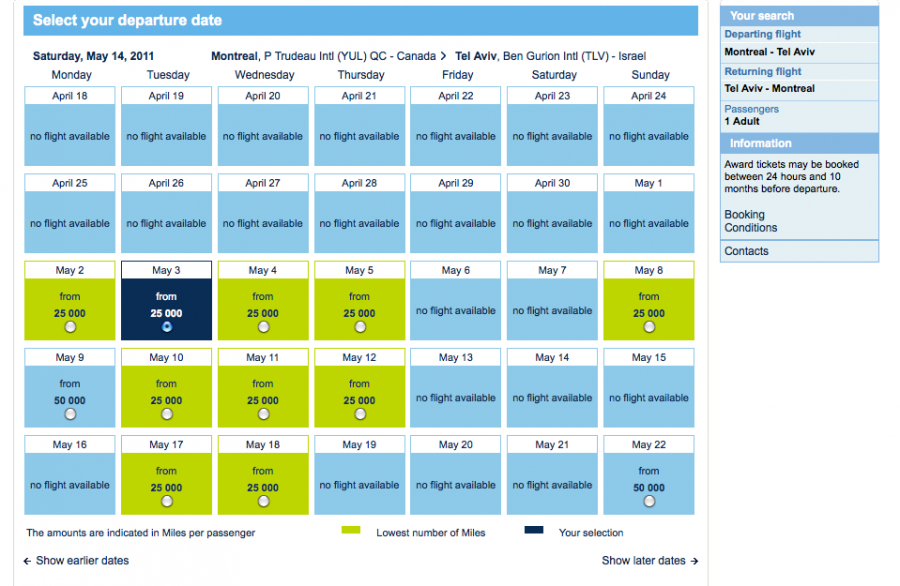

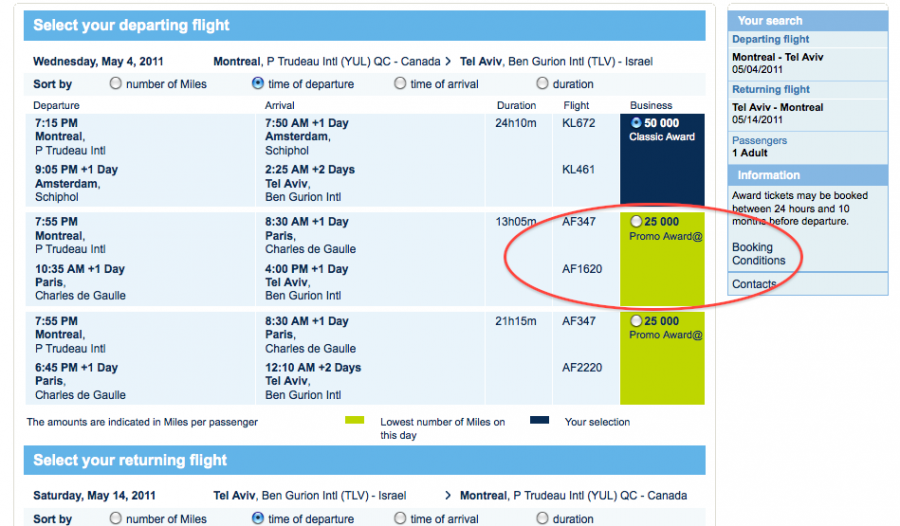

The May/June awards can be booked until June 28, 2011 and are valid for travel May 1- June 30, 2011. One of the great things I learned this past weekend from frequent flyer legend Steve Belkin (beaubo on Flyertalk), is that Israel is included in Europe 3. So in essence, you can transfer 50,000 Amex points to Air France and then book a business class roundtrip award to Tel Aviv- an amazing deal, even if it does require a stop in Paris or Amsterdam. Remember, promo awards are only eligible on Air France and/or KLM flights.

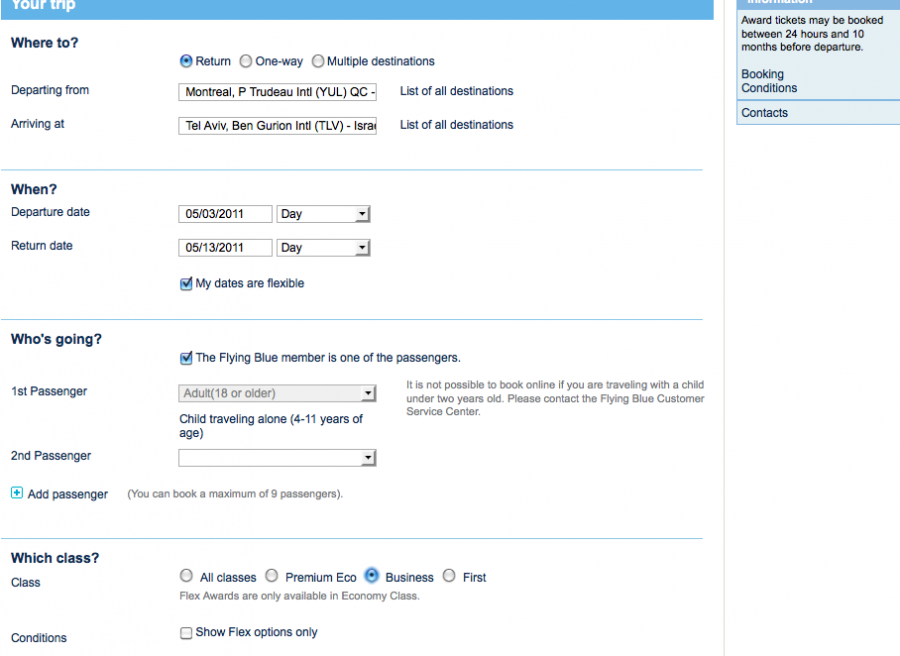

Before you get too excited and start transferring Amex points, make sure your awards are available. To check award availability, create a Flying Blue account and then once you are logged in click the "Show" button to get a drop down menu and then select "Book my award ticket".

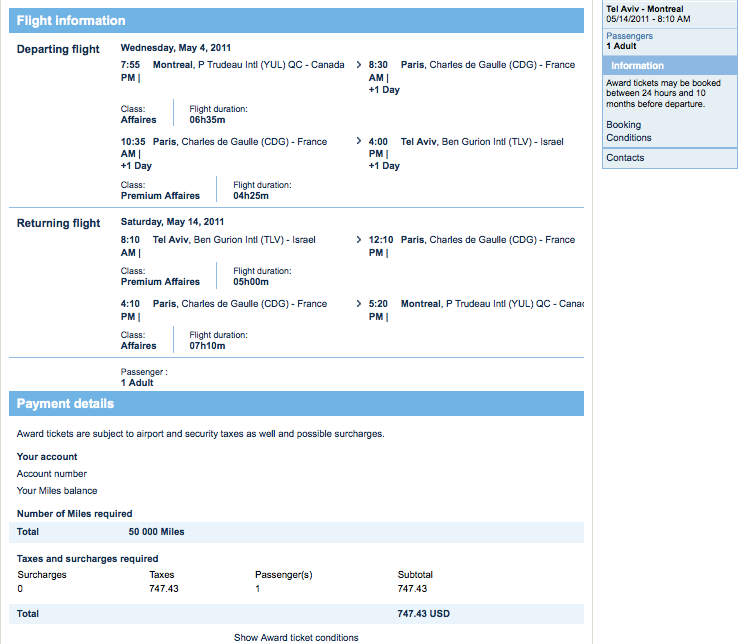

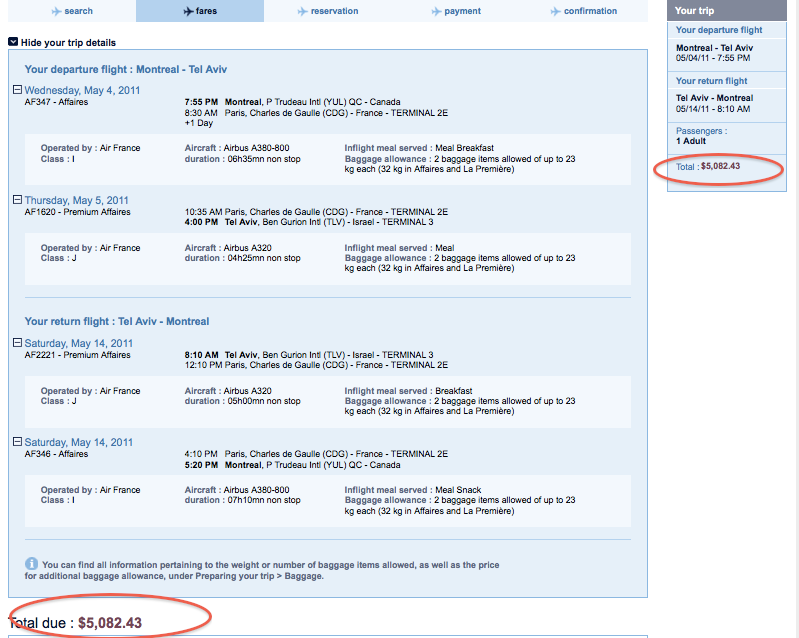

$747 in fees is pretty steep, but it's not so bad considering this exact itinerary would cost $5,082 to purchase. So $5,082 - $747 = $4,335 saved for using a measly 50,000 points. Thus, each Amex point saves you 8.7 cents. Granted, you should factor in the fact that you wouldn't earn any miles on the award redemption, but the point is that Amex points can save you a ton of money and allow you to book into business class for half of what you'd pay for coach (I checked and the coach fare for these flights was $1,515 total roundtrip).

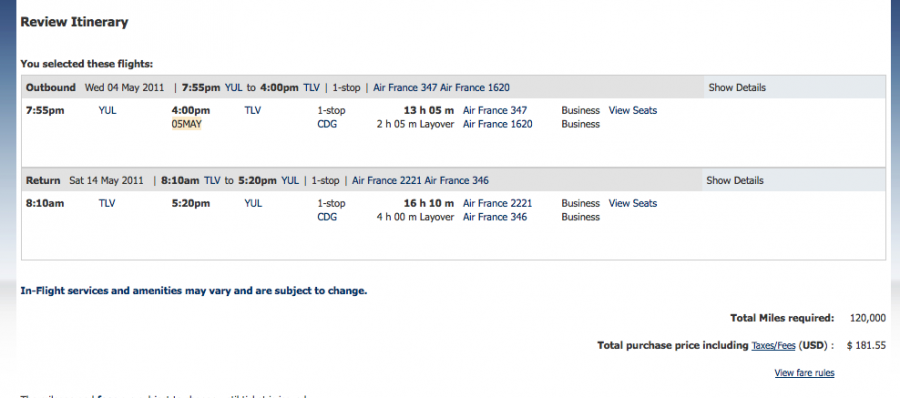

Since Delta and Air France are in the same alliance and these are classic awards, I knew this same flight would be bookable using Delta miles as well, so I pulled up delta.com -> Skymiles -> Use miles -> Award ticket reservations and entered in the same search criteria. With no hassle whatsoever, the exact flights popped up, albeit at 120,000 miles for business class because Delta does not consider Israel part of Europe. A 70,000 mile difference is pretty extreme, however, Delta is currently running a 50% transfer bonus on Amex transfers, so you'd only need to transfer 80,000 points.

Delta's fees are much lower; coming in at $181. So let's do the math - if you go the Flying Blue route, you are getting 8.7 cents per point, whereas Delta gives a return of $5,082 - $181 = 6.1 cents per point. Not bad, but I'd still go the Air France route unless I was short on cash and flush with points.

If you don't currently have an American Express card that allows you to earn Membership Rewards points and want to get in on these Promo Awards, I highly recommend the Platinum card. Amex is currently offering 25,000 Membership Rewards points when you spend $1,000 within three months and perhaps one of the best aspects of this card is that you can immediately advance yourself up to 60,000 points as long as you've been an Amex customer for at least 6 months (otherwise you have to wait 6 months to advance). That means you could get the card, advance yourself the 25,000-50,000 points needed for a Promo award and once your 25,000 sign-up bonus hits, you'd have a year to earn back the additional amount of points beyond 25,000 that you advanced yourself. The card has a $450 annual fee, but comes with a ton of other benefits like $200 in airline rebates, lounge access on Delta, US Airways, Continental (Until Sept 30), Alaska, Starwood Gold status and many more. If interested, check out my most recent review of the card.

[card card-name='Premier Rewards Gold Card from American Express' card-id='22035076' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app