Delta Diamond "Charter Member" Credentials Arrived

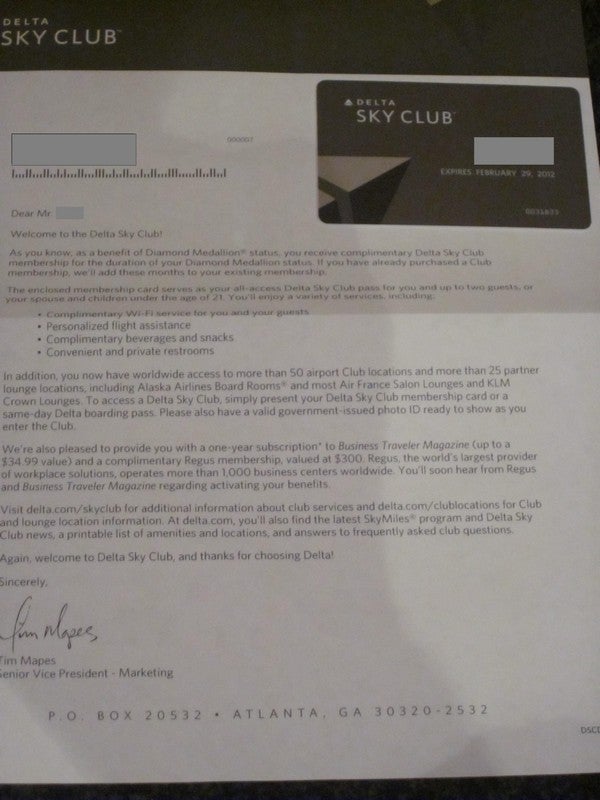

So last year I hit about 135,000 MQMs on Delta, which qualified me for Diamond status. In addition to the main benefits, which I'll sum up below, I also received a free Skyclub membership, Diamond Brag/Bag Tags, drink coupons (for those dreaded times I need to fly in coach) and Job Well Done certificates to award to the Delta employees that go above and beyond. Beyond these token gifts, my membership card also bestowed upon me the title of "Charter Member" of the Diamond Medallion club. While flattered, I almost feel unworthy since this is the second year the program has existed. Did they truly mean to include me as a Charter Member, or are they simply using leftover cards? As much as I'd like to deny it, my bet is on the latter.

Beyond these token freebies, I value Diamond status for the following reasons:

1) I got 4 choices benefits. In the end I received 50,000 miles, a $200 Delta gift certificate, and gifted Gold status to a friend for 13 months. While this was somewhat of a fluke, I'll continue to receive two of these choices every year I requalify.

2) Almost 100% upgrades on domestic tickets. As a Platinum I was near 90%, so I imagine as a Diamond I'll be even higher. I mostly purchase cheap tickets, so this is an amazing benefit to me. As a Platinum I got upgraded 6 days out from each flight and as a Diamond it should be 7.

3) Upgrades on award tickets. I can book an award ticket at 6 days out and get a confirmed upgrade- this works well since Delta releases a ton of award space at the last minute and doesn't charge a last minute redemption fee. No other airline (that I know of) does this

4) Unlimited free changes to award tickets- this is needed when booking crazy Delta awards since they release a lot of space at the last minute

5) Good customer service- the Delta Diamond line reps do aim to please

6) Free same day confirmed changes and even sometimes with the flexibility to change flights to a co-terminal (this is huge with having the ability to fly out of/ from JFK/LGA/EWR)

7) Escort service when flying into JFK internationally- reps meet the plane and take you through immigration. A very nice touch and a service provided even when you fly coach

[card card-name='Gold Delta SkyMiles® Credit Card from American Express' card-id='22034414' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app