4 travel insurance mistakes to avoid that almost cost this reader $2,999

Charles and Linda Stricker made four common but disastrous travel insurance mistakes before, during and after their last vacation. Those easily avoidable errors put nearly $3,000 of the couple's cash in peril.

The Strickers' problems began when they purchased a comprehensive travel insurance policy but neglected to read it. That oversight caused a cascade of additional missteps after Linda was injured on the first day of their trip, culminating in a complete denial of her travel insurance claim.

Six months later, Charles was still angry over the situation. His wife's experience had left him with the false impression that travel insurance is a waste of money. He felt duped. So he shared his tale with TPG and asked that we warn readers of "the travesty called travel insurance."

Unfortunately, his skewed view of travel insurance isn't uncommon. However, most travelers holding that opinion, including Charles, have formulated it based on negative experiences created by their travel insurance misunderstandings.

Ultimately, we couldn't grant Charles's initial wish, but we could do something much better. I'll get to the good news in a moment. But first, here's what you should know about the travel insurance mistakes this couple made so you don't do the same.

Travel insurance mistake No. 1: Not reading or understanding the policy

The Strickers began planning their Globus tour of Croatia nearly one year in advance, and they purchased a comprehensive travel insurance policy from Tin Leg to protect themselves.

With airfare included, the cost of the 10-night trip was just under $12,000. The Tin Leg Gold travel insurance policy cost the couple an additional $1,024.

Tin Leg Gold includes a free 14-day lookover period.

Customers are encouraged to use that time to carefully review the travel insurance policy to ensure they understand it. It is crucial to note what the policy does and doesn't cover and how to access the benefits. If the customer determines the policy doesn't meet their needs before the end of the lookover period, it is fully refundable.

Unfortunately, the Strickers, like many travelers, didn't read through their travel insurance policy during the lookover period. Months after Tin Leg denied Linda's claim, the Strickers were still unfamiliar with many aspects of their policy.

"When I purchased Tin Leg Gold, I was confident that we had full protection for our trip," Charles told me. "I also didn't think we would even need it."

He was correct on the first point. The Tin Leg Gold policy is a comprehensive plan that provides up to $500,000 in medical and evacuation coverage, among other benefits.

But the couple didn't get far on this adventure before Charles was proven very wrong on his second point. Linda would need that travel insurance policy.

Travel insurance mistake No. 2: Not calling Tin Leg for guidance

A few days before the land portion of their Globus tour began, the couple flew from Phoenix to Zagreb, Croatia.

Unfortunately, the Strickers faced problems almost immediately.

"There were multiple delays and then an extra leg was added to our itinerary en route," Charles recalled. "On the third part of our trip, Linda collapsed as she came out of the bathroom."

Charles scooped up his wife and guided her back to her seat. When they landed in Zagreb, they headed to an emergency care facility.

In the translated medical notes that Charles shared with me, the doctor who examined Linda observed that she was experiencing intense back pain. He prescribed muscle relaxants and advised bed rest. He also recommended that if the pain persisted or worsened, she should go to an emergency orthopedic doctor.

The Strickers received a copy of the doctor's notes and a receipt and returned to their hotel.

The next day, the couple had a decision to make. The bus tour of Croatia was about to begin, and Linda's pain had not subsided.

"The last thing she wanted to do was sit for hours on a bus," Charles explained. "We decided she should fly home to see our doctor."

They made that decision without involving Tin Leg. That was a mistake.

Travel insurance mistake No. 3: Not asking for covered expenses or benefits

Like most travel insurance providers, Tin Leg offers an easily reachable 24-hour helpline for customers needing assistance. When a traveler needs to return home because of an injury or illness, Tin Leg agents can make flight arrangements and even include a medical escort, if a doctor deems it necessary.

Unfortunately for Linda, the couple didn't call Tin Leg or involve the company in their decision-making. That made her trip home unnecessarily complicated, uncomfortable and expensive.

However, because the Strickers had never read their policy, they were unaware of the 24-hour helpline and the benefits available to Linda.

Travel insurance mistake No. 4: Asking for things the policy doesn't cover

Linda flew home from Zagreb independently, arranging for a wheelchair at each stop. Charles continued with the tour of Croatia.

"As a doctor, I was confident that when Linda got home, she would get competent treatment," Charles told me. "I continued with the trip to minimize our loss."

When Linda finally arrived back in Arizona, she headed to Urgent Care. The doctor sent her home with recommendations similar to those she had received in Zagreb. After about a week of bed rest, Linda was back to normal, and Charles soon returned.

Together, they gathered all the documentation they needed to file their travel insurance claim.

The couple asked for everything they assumed would be covered by their travel insurance policy, including:

- Gratuities for Linda's wheelchair attendants at each airport

- Reimbursement for the missed Croatian tour

- Reimbursement for her medical evaluation in Arizona

But within weeks, the couple received the bad news. Except for a prepaid Viator tour that the couple missed when Linda was at the emergency care facility in Zagreb, Tin Leg completely denied her claim.

In the denial, the adjuster explained that personal tips or gifts made voluntarily to service providers would never be reimbursed by travel insurance. Additionally, travel insurance covers medical treatment during your trip, not after you arrive home. As soon as Linda left her tour and landed back in Arizona, her medical coverage from Tin Leg terminated.

However, the worst part of the rejected claim was the $2,999 reimbursement request for the missed Croatian tour. That was denied because nowhere in the medical report did the physician specifically recommend that Linda not continue on the tour.

Had the couple read their policy, they would have known that before Linda could press the eject button on the trip and qualify for reimbursement through Tin Leg, she needed an official note from a medical doctor deeming her unable to travel.

"So I paid $1,058 for a travel insurance plan that provided nothing," Charles said. "I had no idea that the physician had to advise her to discontinue the trip, as I am sure this was hidden in the fine print of the many pages of the policy."

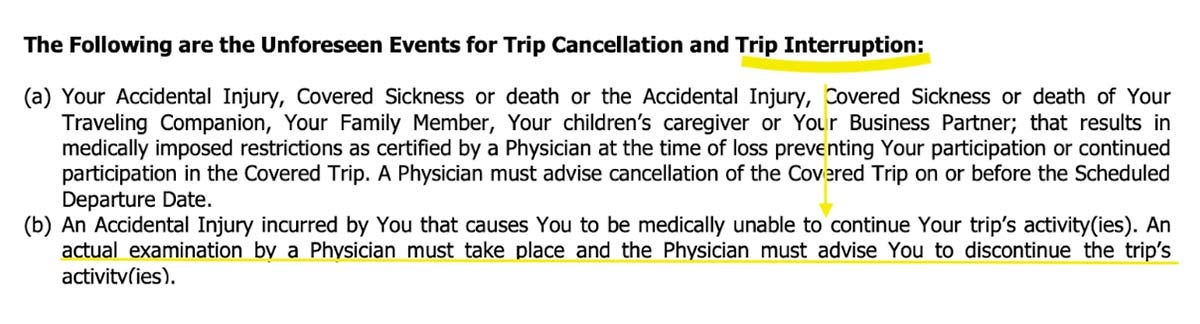

I explained to Charles that the clause is not hidden or in fine print. It is a primary part of the Trip Interruption section. Every travel insurance policy lists the events covered (named perils) and under what circumstances those events are covered.

Here is the clause in the Strickers' policy that they needed to familiarize themselves with before Linda returned to the U.S.

Charles predicted that the doctor in Croatia wouldn't have given this recommendation even if they had requested it. However, I suspect he would have done just that if Linda returned the next day with the same painful symptoms. It seemed that the doctor had already implied that Linda wasn't suitable for traveling when he recommended bed rest.

The good news

Although Charles had only contacted TPG to raise awareness of his wife's awful experience and warn others, I hoped we could do something different for the couple.

The doctor in Croatia did essentially recommend that Linda not continue her travels. After all, it's tough to participate in a walking and bus tour when your doctor says you should be in bed resting and taking heavy medication.

So, six months after Linda and Charles received their travel insurance denial from Tin Leg, I contacted Squaremouth, its parent company, with my theory.

The good news for the Strickers is that not all travel insurance mistakes are irreversible. Even if a traveler doesn't ask for guidance from TPG, there are other options to pursue:

- File a formal appeal with the travel insurance company.

- Make a complaint with the insurance regulator in their state. (Here's how to locate your state's insurance regulator.)

Ultimately, Squaremouth and the underwriter of the couple's Tin Leg policy, Starr Indemnity Insurance Company, agreed with my theory. The Strickers' claim was reevaluated and approved for the tour reimbursement: $2,999.

The couple is thrilled, and one thing is for sure: They will go over their next travel insurance policy with a fine-tooth comb. Charles recommends you do the same.

Bottom line

Travelers must always review their travel insurance policies carefully. A comprehensive travel insurance policy can provide many benefits, but if you don't acquaint yourself with your policy, you won't know. Make sure you understand:

- What is covered (named perils)

- What isn't covered (exclusions)

- The coverage limits (monetary)

- Under what circumstances are you covered

- The steps you must take to successfully file a claim (take careful note of the filing deadline)

Travel insurance is only a "travesty" if you don't take the time to read through your policy and make sure you understand it.

If you have a problem with your travel insurance company and you're unable to reach a fair resolution despite your best efforts, send your request for help to ombudsman@thepointsguy.com, and I'll be happy to review your case and help you, too, if I can.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app