6 truths and myths about 'cancel for any reason' travel insurance

In the uncertainty of the pandemic-era travel world, purchasing travel insurance is becoming an essential part of any trip. In the past two years, people have purchased travel insurance policies in record numbers. Travel insurance comparison site Squaremouth reported insuring 300% more travelers in 2021 than 2020, and 70% more than in 2019. With ever-changing travel rules and regulations, frequently delayed or canceled flights and cruises, border closures and the omnipresent risk of COVID-19, travel insurance should continue to be a consideration.

Given the amount of pandemic-related exceptions and exclusions in regular travel insurance policies, more travelers have been considering "cancel for any reason" travel insurance. CFAR policies allow travelers to get reimbursed in the event they choose to cancel their trip out of caution, fear or other personal reasons unrelated to illness or accident. The Seven Corners travel insurance company told TPG it had seen a 180% increase in CFAR product sales from 2019 to 2020 as the pandemic brought chaos into the travel world.

But is CFAR travel insurance right for you? How affordable and reliable are such policies? TPG spoke with industry experts about the truths and myths of CFAR travel insurance.

[table-of-contents /]

You can really cancel for any reason, at any time

Myth: This is insurance — of course there are exceptions. While CFAR travel insurance is much more comprehensive than regular travel insurance, every policy has particular rules (and some exclusions) around reimbursement for cancellation. As with all insurance policies, it's critical to review the details and read the policy fine print prior to purchase.

According to Angela Borden, product marketing strategist at Seven Corners, the company's CFAR policies do not refund trip expenses if a tour operator cancels a trip because the policyholders should be able to get their refunds from the operator. Also, most CFAR policies have specific required timing for purchase and cancellation, or the policy is invalid. Insurance companies typically require you to purchase the policy within a couple of weeks of booking the trip.

Also, a policy may only issue trip coverage if you cancel at least a certain number of days before a trip is set to begin (in Seven Corners' case, two days in advance). Every company's policy is going to be different, and many companies have several products within the CFAR category. Do your research in advance to be sure you get the coverage you're looking for. "CFAR policies have terms, conditions and exclusions just like any other insurance product," says Daniel Durazo, director of external communications at the Allianz Partners insurance company.

Related: Harsher cancellation policies return for cruises

CFAR is outrageously expensive

It depends: The value of CFAR depends on the style of your trip, your budget and your cost-benefit perspective. CFAR policies typically cost about 40-50% more than other standard travel insurance policies. A sample pricing search on the Travelers Insurance website generated a quote for $575 to cover a $10,000 trip value, while adding CFAR to the policy upped the rate to $828. (Note: Prices and coverage vary widely by firm and coverage.)

A survey of TPG readers revealed that many people don't mind the surcharge, as it provides peace of mind. Some travelers' personal situations may make it more likely they'll cancel a trip for a reason not covered under a typical policy, so the anticipated benefit matches the cost. However, several TPG readers consider CFAR policies "a big waste of money" and "way too expensive." Readers have reported satisfaction with the pricing and coverage of more traditional travel insurance policies that now include expanded health coverage.

Related: Key reasons you want to buy travel insurance

Anyone can buy CFAR insurance

Myth: While CFAR is widely available, it has historically been prohibited to residents of New York. The state's Department of Financial Services had declared that "CFAR benefits in the travel context do not technically qualify as insurance because the cancellation of a trip 'for any reason' does not depend on the occurrence of fortuitous event." However, in March 2020, the department issued an Insurance Circular Letter to revise the rule, stating that CFAR benefits can be sold by an insurer in New York if "necessary or incidental to its travel insurance business." The revision also mentions that non-insurers can sell CFAR benefits "if they are not sold as an insurance product."

At the time of the ruling, six insurance firms announced plans to issue CFAR policies in New York. However, Seven Corners and many other firms still do not offer CFAR policies in New York, and for those who might offer the product, their CFAR policy rules and structures may be different than those offered in other states. It is recommended to speak directly with an insurance agent if you're looking to buy CFAR insurance as a resident of New York.

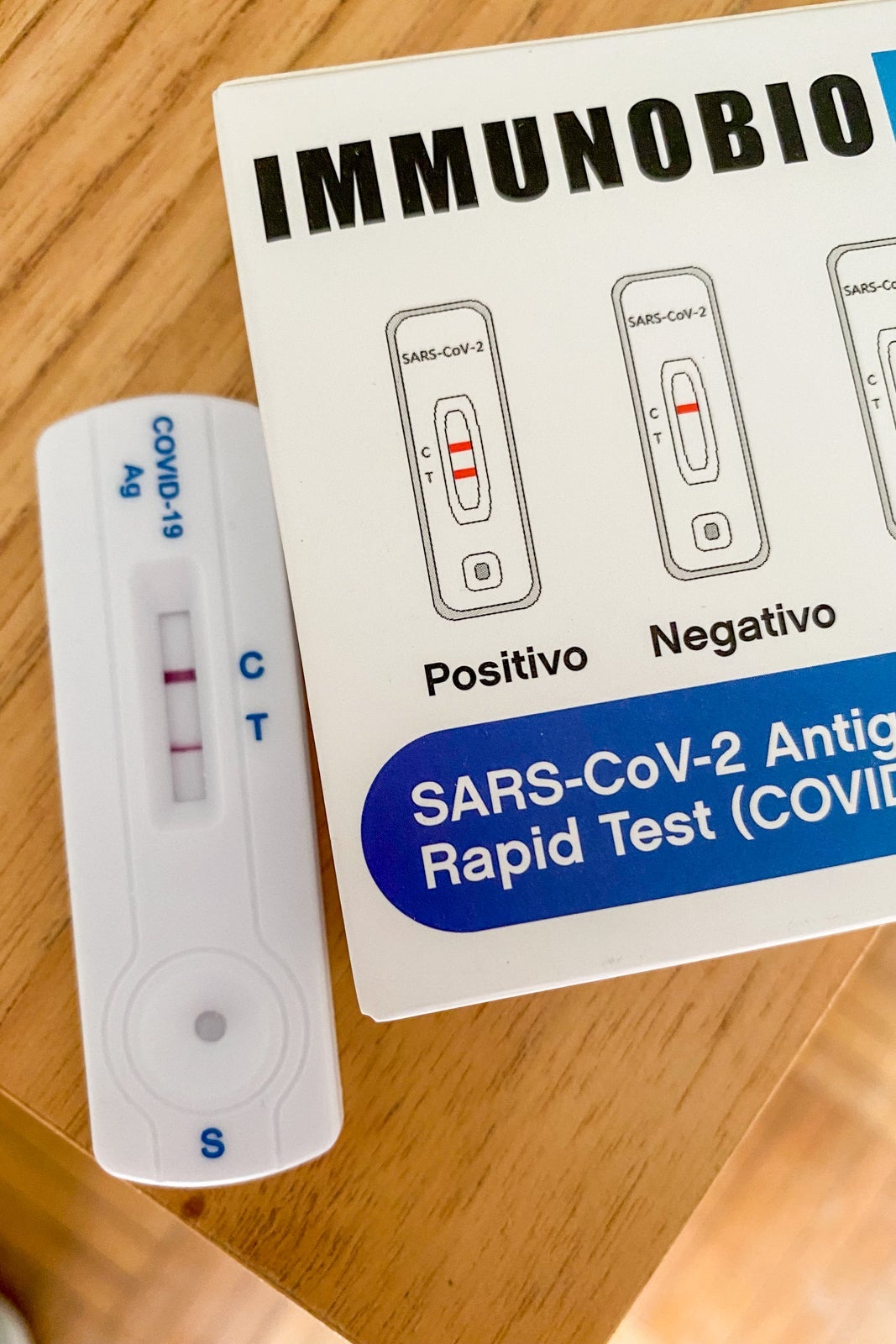

Only CFAR covers COVID-19-related cancellations

Myth: Many new travel insurance products have been created specifically with COVID-19 in mind, and many older policies have been modified to include COVID-19 coverage. "We've found that the epidemic enhancements we've made have met most travelers' needs," Durazo said in regard to his company Allianz Partners. "Our standard products now cover cancellations and interruptions due to serious pandemic illnesses, as well as medical emergencies, denied boarding due to suspected illness and mandatory personal quarantines."

TPG readers have reported that they've found medical-only travel insurance to be "a cheap and wise option." Borden, from Seven Corners, added that although a medical policy includes coverage for travelers who contract COVID-19 and consequently cancel their trips, "it will not cover your cancellation of a trip due to your fear of catching COVID-19." Such a cancellation reason would require a CFAR policy.

Related: Airbnb ending refunds for guests who get COVID-19

CFAR insurance covers your trip expenses in full

Myth: CFAR policies typically cover 75% of the specifically insured trip cost, with some policies refunding just 50% of the initial travel booking. "CFAR policies only cover a portion of prepaid expenses, so consumers have considerable 'skin in the game' if they have to file a claim," Allianz's Durazo said. "Consumers should weigh the costs and benefits of purchasing a CFAR policy versus a standard travel insurance policy that may meet their needs for a lower cost." Still, many TPG readers reported feeling satisfied after receiving a bulk of their trip refunded thanks to CFAR policies.

'My dog is sick' is covered under CFAR

Truth: TPG reader Sally McCormack had to cancel a trip because her dog had a serious illness. She contacted her CFAR insurance company and it did indeed refund 75% of her trip cost. Borden, from Seven Corners, confirmed this would be an acceptable reason for someone to cancel a trip under her company's CFAR policies, and those customers would be entitled to the specific product's stated refund payout. Multiple TPG readers also said they had "no issues" getting refunds when using their CFAR policies, and most were thankful they didn't lose too much money after canceling trips due to personal reasons that would not have been covered under a typical travel insurance policy.

Bottom line

CFAR travel insurance can provide peace of mind and financial coverage for travelers planning trips during these uncertain times. While CFAR does add costs (and does have certain exclusions, terms and conditions like any other insurance plan), many customers have been happy with the product. However, more travel insurance companies now offer affordable medical travel insurance products with pandemic-specific coverage, so many people have been selecting that option as a more cost-efficient alternative. Individual travelers should carefully review their anticipated risks and costs and always, always read the fine print on any insurance product.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app