Why Alaska Airlines is returning to its routes in the West

Alaska Airlines is doubling down on its routes in the western United States, focusing on the region where it does best.

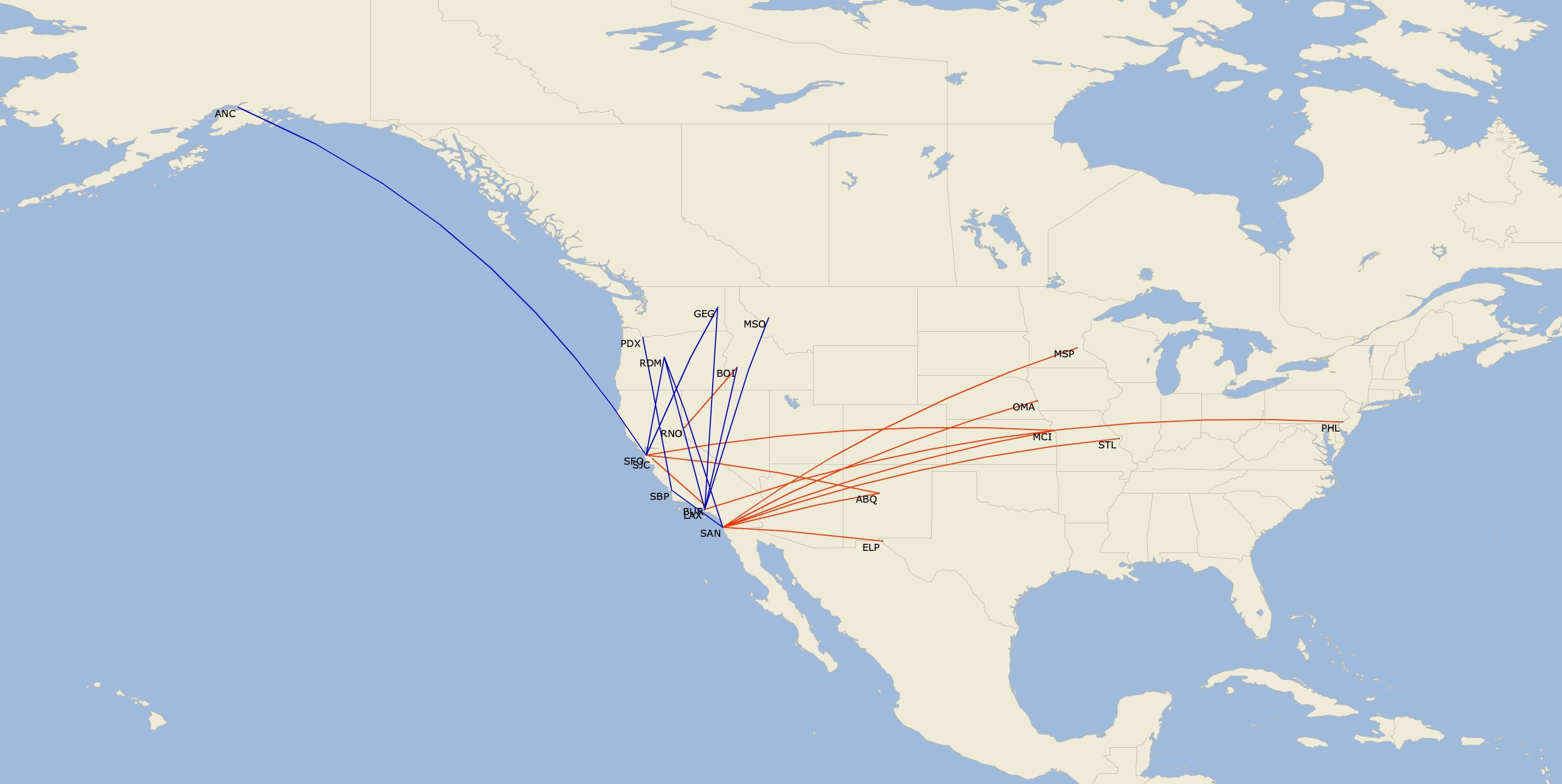

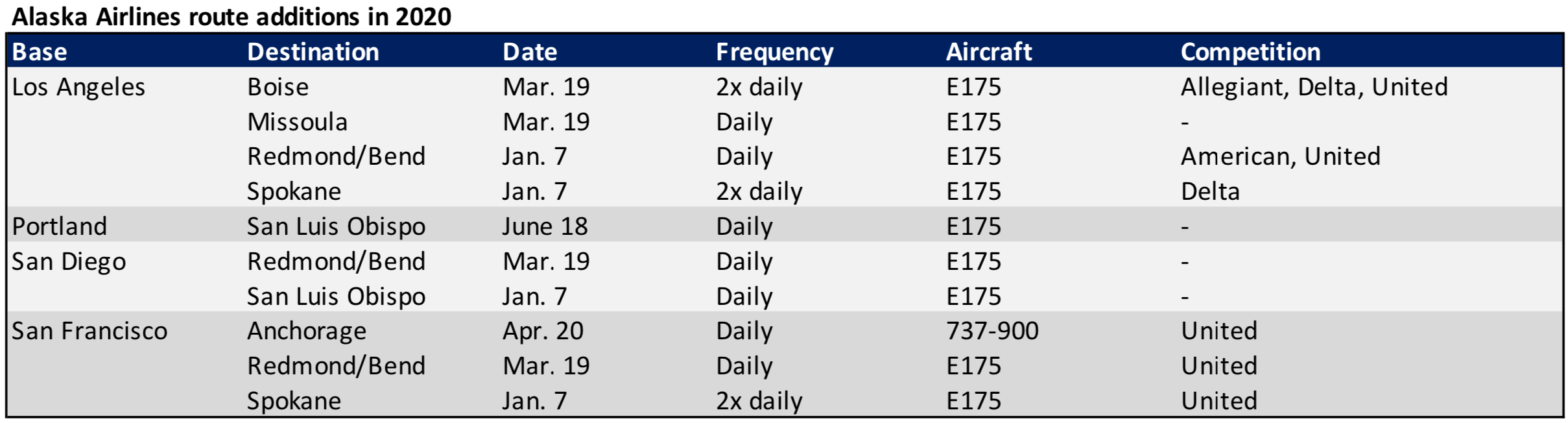

The expansion plan will add 10 routes along the West Coast and drop 11 routes connecting California to the Midwest and East Coast. The Seattle-based carrier wants to grow where it does well, so it is adding new nonstops to cities like Redmond (RDM) in Oregon and San Luis Obispo (SBP) in California. Alaska will serve those destinations from its bases in the Golden State -- Los Angeles (LAX), San Diego (SAN) and San Francisco (SFO).

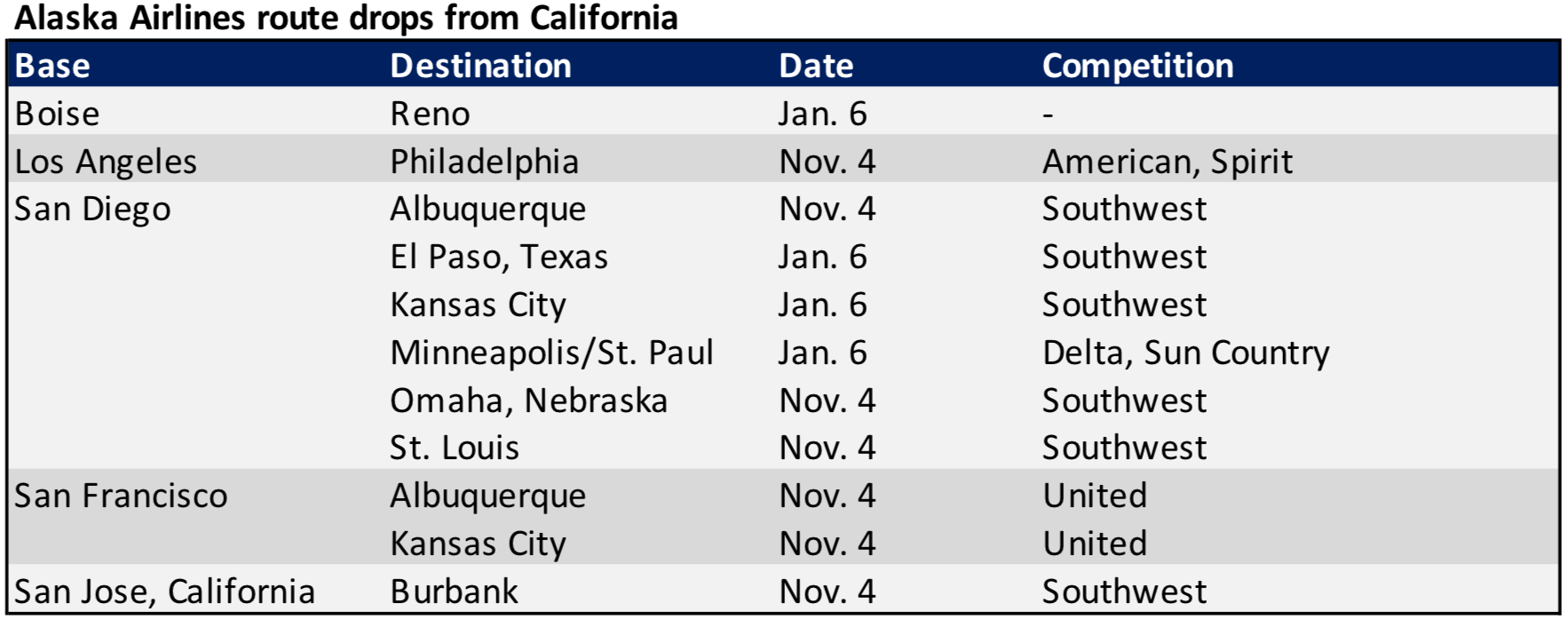

Alaska's nonstops from those same California bases to places like Kansas City (MCI), Omaha (OMA) and Philadelphia (PHL) will no longer fly.

Related: Alaska Airlines adds 8 routes, drops 11 in West Coast shake-up

Alaska will also shift five mid- or transcontinental routes to seasonal status, including four from San Francisco.

"There are so many places within the West where we're really good," said Brandon Pedersen, chief financial officer of Alaska, at a Cowen investor conference earlier this week. "We've got point-of-sale on both sides [of these West Coast markets], strong loyalty – that's a much higher profit potential use of the airplane," he added.

Alaska's new service from Paine Field in Everett, Washington, to Palm Springs (PSP) and Spokane are not included in the chart as the routes begin in November and not 2020.

Related: Why the new Paine Field airport is a passenger's dream

This network strategy makes a lot of sense for Alaska. Their 2016 Virgin America acquisition boosted their presence in California -- particularly in San Francisco -- but the combined network stapled Virgin's east-west, heavily transcontinental routes onto Alaska's majority north-south routes.

Alaska subsequently added several routes connecting its new California bases to primarily Midwestern and Eastern cities. But, unlike when it went into Nashville (BNA) or Omaha from Seattle, the new routes pitted the airline against the many carriers that already dominate markets from California to the Midwest and East Coast.

On 10 of the 11 routes Alaska will soon end, it competes with at least one other major carrier, including Southwest Airlines on six of them, according to Diio by Cirium data.

Dallas-based Southwest carried the most passengers within, as well as to and from, California in 2018, U.S. Department of Transportation (DOT) data shows. Alaska was fifth after United Airlines, American Airlines and Delta Air Lines, respectively.

Southwest is notably absent from the list of direct competitors on Alaska's new routes. Many of the routes connect second-tier cities where Alaska is already among the largest airlines in the market. Missoula and San Luis Obispo are the only two where it was not the dominant carrier in 2018, according to the DOT.

"It's better matching an airplane size into a market where we're successful," said Pedersen -- a strategy that Cowen analyst Helane Becker told TPG makes sense for Alaska.

Western Shift

"The first priority would be ... doing everything we need to do to sort of defend and grow markets out of the state of Washington, in the state of Alaska, the state of Oregon," said Alaska CEO Brad Tilden speaking on the company's 2020 capacity plans in July, 2019.

Capacity data for the first half of 2020, which includes many of the recent changes, underscores this. The airline will grow capacity in the West -- an area TPG defines as Arizona, California, Idaho, Montana, Nevada, Oregon and Washington -- by 8.7% compared to the same period this year, according to Diio data. This is nearly double the growth rate of system-wide capacity, which is scheduled to grow 4.6% in the period.

Alaska's capacity to the rest of the continental U.S. will grow by 3.6% year-over-year during the first six months of 2020, the data shows.

In the first half of 2019, the carrier grew capacity in the West by 4.7% and elsewhere in the continental U.S. by a negligible 0.1% year-over-year, according to Diio. System capacity at Alaska grew only half a percent over the same period.

Although service to the Midwest and East Coast remains a key part of Alaska's network, particularly out of its largest hub in Seattle, there is clearly an increased emphasis on the West occurring in 2020.

Related: How to earn miles with the Alaska Airlines Mileage Plan

The question is, if an expanded presence in California was a driver of the Virgin America deal, what will Alaska's utility be to Golden State travelers with a network that is slightly less national and more concentrated in the West?

Pedersen does not see this as much of a concern for Alaska because of the concentration of the world's largest technology companies along the coast, high travel demand within the region and ample disposable income for holidays, he said at the conference.

"We're really feeling good with the geography we have, not just Seattle but up and down the West Coast," said Pedersen.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app