Quick Points: How to use married airline segments to find more award availability

If you're struggling to find award availability for your next flight redemption, here's a trick to solve this issue.

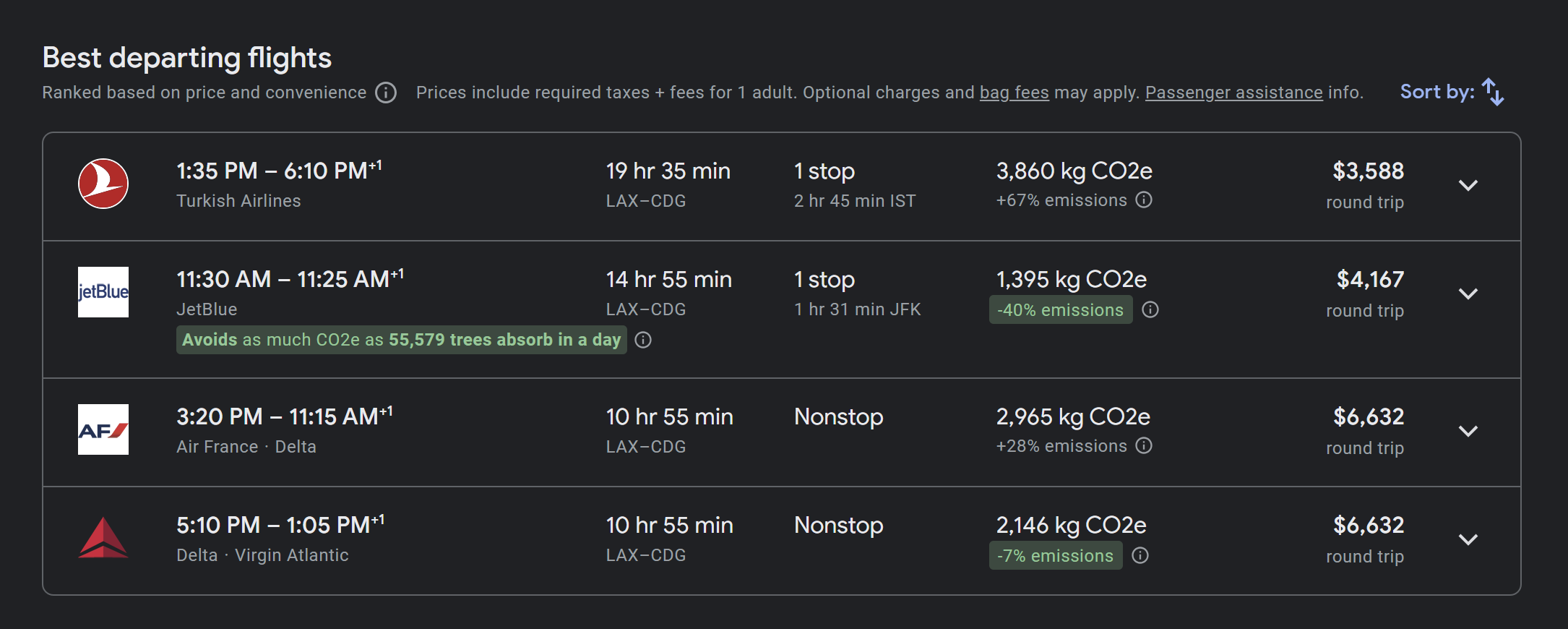

An increasing number of airlines are using the "married airline logic" concept when releasing and pricing award seats. Like cash fares, airlines believe passengers will pay a premium for nonstop flights compared to indirect flights. Therefore, a nonstop flight from Los Angeles International Airport (LAX) to Paris-Charles de Gaulle Airport (CDG) may be more expensive than having a layover stop on the East Coast.

If airlines don't believe they will sell an itinerary for a reasonable cash rate, the carrier may open more award availability. Given the popularity and price premium usually obtained for nonstop flights, connecting itineraries can be more available to book using points and miles.

Related: The best points and miles to use for last-minute award flights

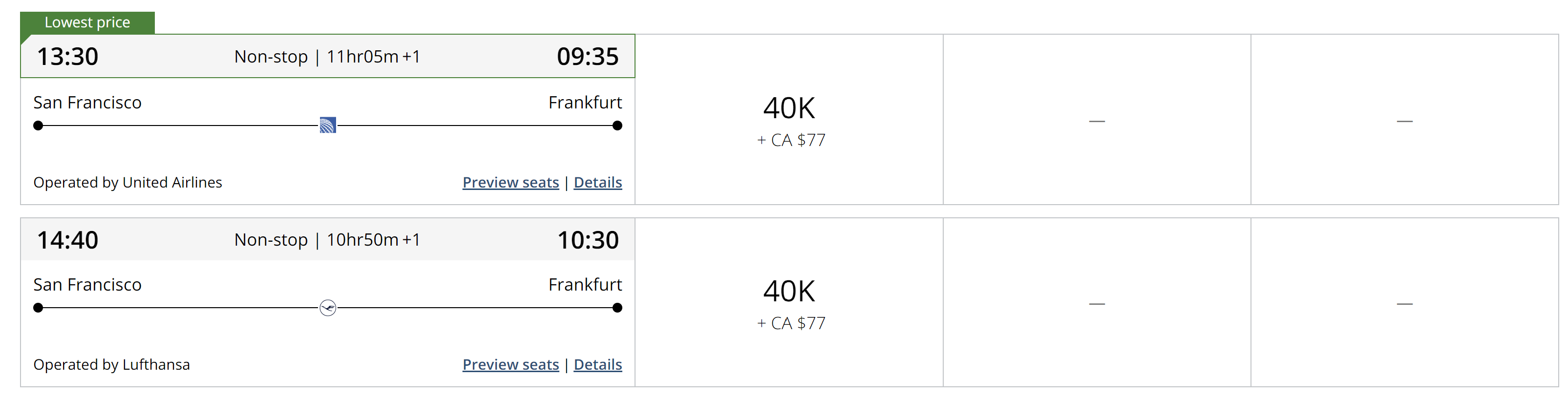

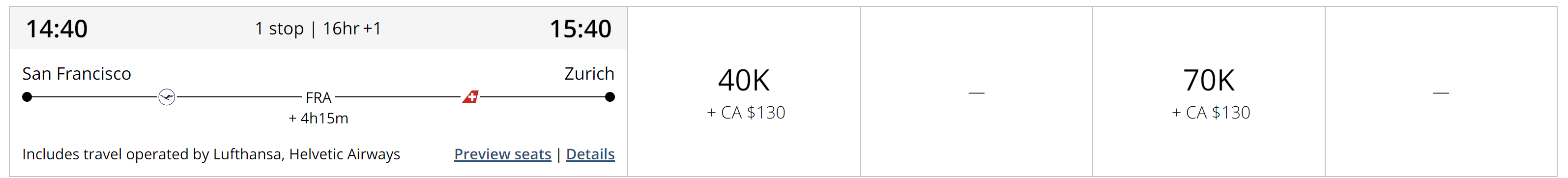

For example, if you search for a nonstop Lufthansa flight from San Francisco International Airport (SFO) to Frankfurt Airport (FRA) in March, you might find that no seats are available in business class through a partner program like Air Canada Aeroplan.

However, if you search from SFO to Zurich Airport (ZRH) in nearby Switzerland, you will suddenly find business-class seats for the excellent price of just 70,000 Aeroplan points. The first leg is on the same Lufthansa flight that was not bookable separately.

Here, Lufthansa may believe there will be less demand for a connecting itinerary via Frankfurt than a nonstop flight to Frankfurt. Therefore, by marrying the segments from San Francisco to Frankfurt and then Frankfurt to Munich, the airline released more seats to book with points and miles.

Related: 7 of the best airline award chart sweet spots

How to use married airline segments to find more award seats

If you cannot find award availability on nonstop services to your desired destination, consider widening your search of destinations. You can use an external tool like Seats.aero that can search for seats across entire continents. In the Lufthansa example above, you could filter the results for flights departing from San Francisco on a particular date to anywhere in Europe rather than searching every major European city airport you can think of on Aeroplan's site.

If you have lost hope of booking a lie-flat seat across the Atlantic, consider continuing to a different city. It may open up possibilities you hadn't considered before.

Understandably, if you widen your search, it may include flying to airports you had not intended to visit. It's important to note that just as an airline assumes you will fly to your destination when you purchase an indirect cash fare, there is the same assumption for an award redemption.

Airlines frown upon travelers dropping legs to try and save money, and while doing it once may not have any consequences, if you do this repeatedly, you risk your loyalty account being shut down and your points and miles being forfeited if you don't fly any leg of an itinerary, whether the first or last flight. The rest of the itinerary also will be canceled.

Using the Lufthansa example above, if a flight to Zurich is as close as you can get to Frankfurt using your points and miles, you could book a separate flight or train ticket to get to Frankfurt from Zurich.

Related: Your ultimate guide on how to search award availability for the major airlines

Bottom line

Airline revenue management departments use complex algorithms to ensure they can obtain the highest fares for anyone traveling between two destinations. The married segment logic is that there is less demand for connecting itineraries than nonstops, so additional award seats may be released for connecting "married" options.

If you're struggling to find seats to redeem your points and miles, especially on long-haul flights in premium cabins, consider widening your destination options. You may find that additional availability appears, including the original flights you were searching for.

Ensure you play by the rules to avoid your favorite loyalty program serving you divorce papers.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app