How 5,000 credit card points saved me over $650 on a flight to London

While Virgin Atlantic is not always my go-to choice when it comes to award travel redemptions due to its incredibly high taxes and fees, the carrier is offering a 50% points discount on all flights to London. For bookings made through March 20 for travel between March 14 and June 30, Virgin Atlantic's Flying Club program will reduce the points needed for all Virgin-operated flights between the U.S. and the United Kingdom by 50% in all cabins.

Unfortunately, I still have to pay the fees, taxes and carrier-imposed surcharges, but this is still an excellent award deal, especially since I purchased an economy ticket. Keep reading to find out how 5,000 credit card points saved me more than $650 on my flights from New York's John F. Kennedy International Airport (JFK) to London's Heathrow Airport (LHR).

How I'm flying to London for just 5,000 points

Since I need to fly from New York City back to my home in London in April, this Virgin Atlantic promo deal came at the perfect moment and has helped me save money on my flight.

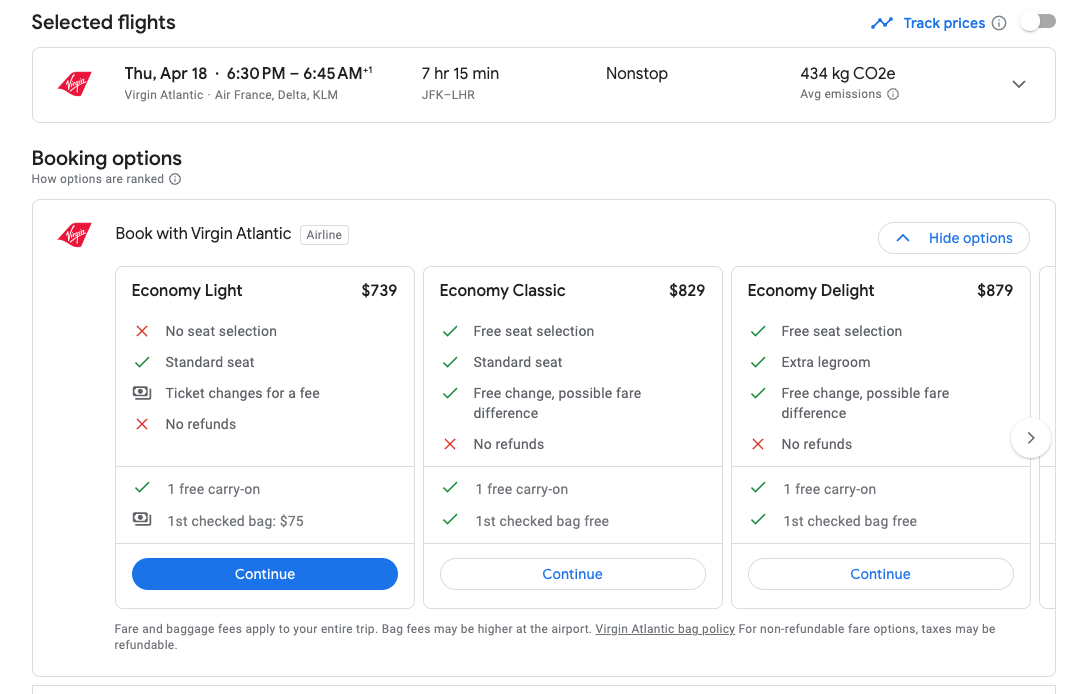

A one-way ticket flying in Economy Light (basic economy) on Virgin Atlantic on my travel dates was priced at $739 when I researched my options. A ticket for my preferred option, Economy Classic, which includes seat selection and a checked bag, was priced higher at $829.

Related: Is Virgin Atlantic premium economy worth it on the A330-900neo?

While you can find round-trip tickets to Europe for less than the cash price of a Virgin Atlantic ticket, these fares required a Saturday night stay, which didn't work for me.

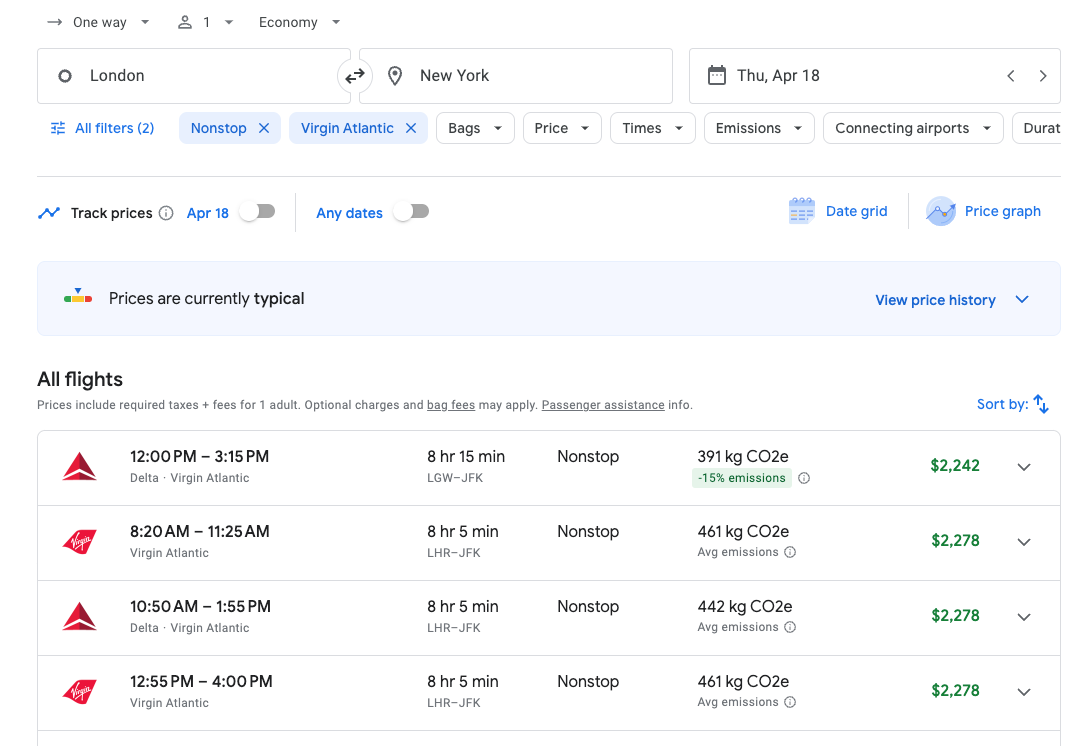

If you think spending more than $700 for a one-way flight to Europe in economy is expensive, take a look at what it costs to book a flight in the other direction. You can expect to pay three times this amount for a comparable itinerary in the opposite direction.

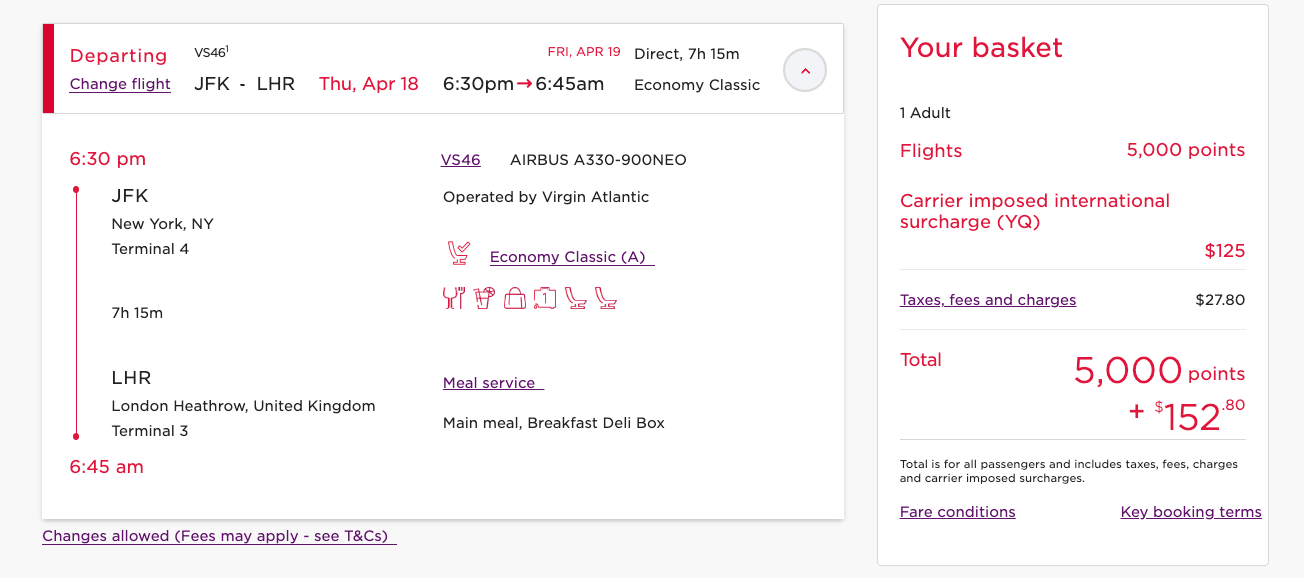

Luckily, Virgin Atlantic's Flying Club still operates using award charts, a rarity among loyalty programs. According to its award chart, Flying Club charges just 10,000 points plus $152.80 in fees, taxes and carrier-imposed surcharges for a one-way redemption from JFK to LHR on off-peak dates.

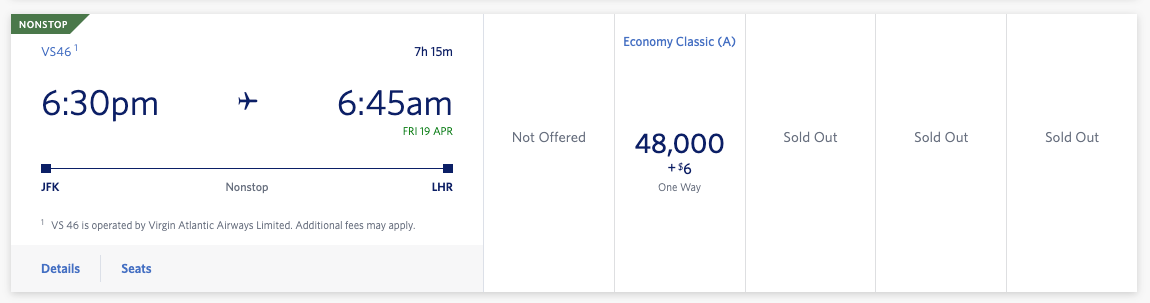

While other programs don't impose surcharges, other carriers use dynamic pricing, meaning you'll pay far more than 10,000 points. For example, Delta Air Lines' SkyMiles program is charging 48,000 miles for this Virgin Atlantic flight.

Knowing this, I couldn't ignore this great 50% points discount offer from Virgin. So, I booked my flight to London through Virgin Atlantic Flying Club for just 5,000 Virgin points plus $152.80 in fees, taxes and carrier-imposed surcharges.

Since Virgin Atlantic award redemptions book in Economy Classic, I'll be able to select a standard seat for free and check a bag in if I wish ahead of my flight in April. Because Virgin Atlantic is a full-service airline, I'll also enjoy inflight entertainment, plus food and drinks during the flight.

Related: TPG reviews all cabins on Virgin Atlantic's brand-new Airbus A330-900neo

After deducting the $152.80 out-of-pocket cost from the same Economy Classic cash fare of $829, I come to a savings of $676 by using 5,000 Virgin points to book the flight. This means I obtained more than 13 cents from each Virgin point I redeemed, which is almost 10 times TPG's current valuation of Virgin points.

How to earn and redeem Virgin Atlantic points

If you don't have Virgin points, don't fret. They are among the easiest of any currency to earn, as Flying Club is a transfer partner of every major transferable point currency, including:

- American Express Membership Rewards (1:1)

- Bilt Rewards (1:1)

- Capital One (1:1)

- Chase Ultimate Rewards (1:1)

- Citi ThankYou Rewards (1:1)

- Marriott Bonvoy (3:1 with a 5,000-point bonus for transferring 60,000 points and a 48-hour transfer time)

Keep in mind that Capital One is a transfer partner of Virgin Red, so you'll need to link the two accounts (i.e., Virgin Red and Flying Club) to transfer points from Capital One to Flying Club.

Many of these programs offer cards that feature terrific welcome bonuses. Here's just a sample of the travel rewards credit cards that earn these transferable points that can be converted to Virgin points:

- The Business Platinum Card® from American Express

- The Platinum Card® from American Express

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Preferred® Credit Card (see rates and fees)

- Chase Sapphire Preferred® Card (see rates and fees)

Bottom line

Virgin Atlantic's Flying Club has long been an underrated gem. It offers a great mix of airline partners, as well as various non-flying redemption options, including Virgin Voyages cruises. Plus, the program makes it easy to use points thanks to it being a transfer partner with every major transferable points currency.

While the taxes and fees can cost you a lot out of pocket, Virgin's latest award promotion is definitely worth considering. It's hard to argue the value of points and miles when you can transfer as few as 5,000 credit card points to Flying Club to redeem for an international flight that would otherwise cost an extra $676.

To take advantage of this excellent offer, you must book online by March 20 for travel between March 14 and June 30, 2024.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app