Venice's entry fee launches in April — here's what you should know

Editor's Note

After lengthy delays, Venice, Italy's daytripper tourist tax will finally come into force April 25.

This tourism tax has been in talks for several years. It will be followed by a cap of 25 people for tour groups in the summer.

Here’s what you need to know about each regulation.

5-euro daily tourism tax

On April 25, Venice will begin a pilot run of its daytripper tourism tax after it was previously delayed by the city council.

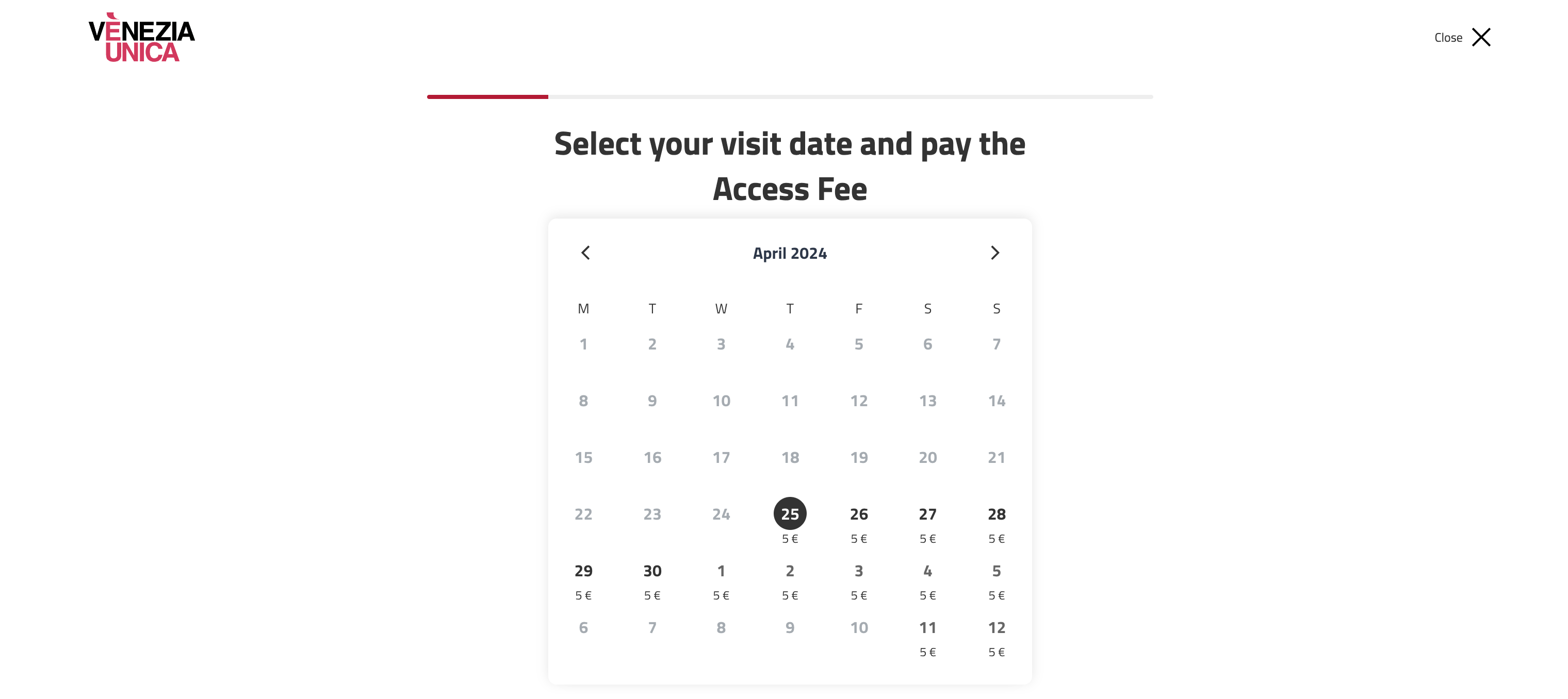

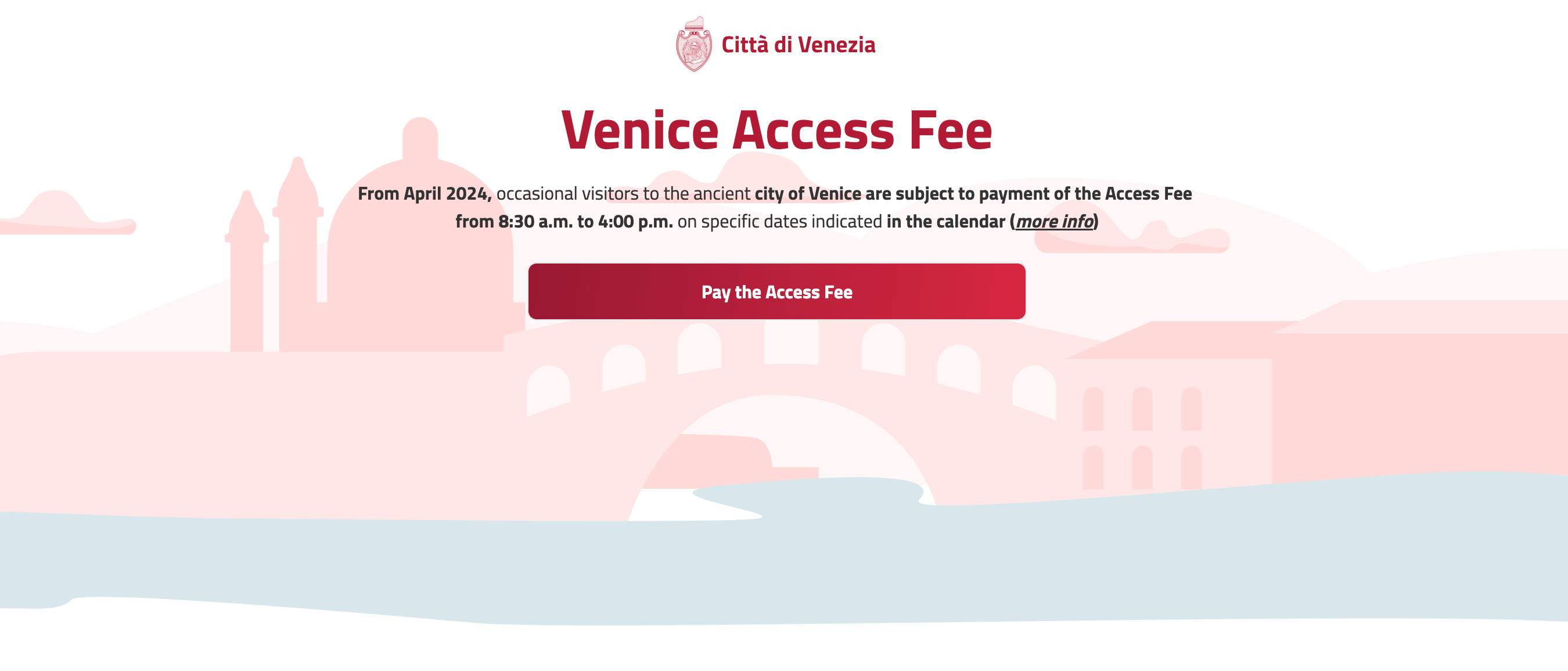

Initially, the “entry fee” is due to only be in place on certain days between April 25 and July 14 and will cost 5 euros (about $5.45). The tax can be paid prior to entry by visiting the online booking platform.

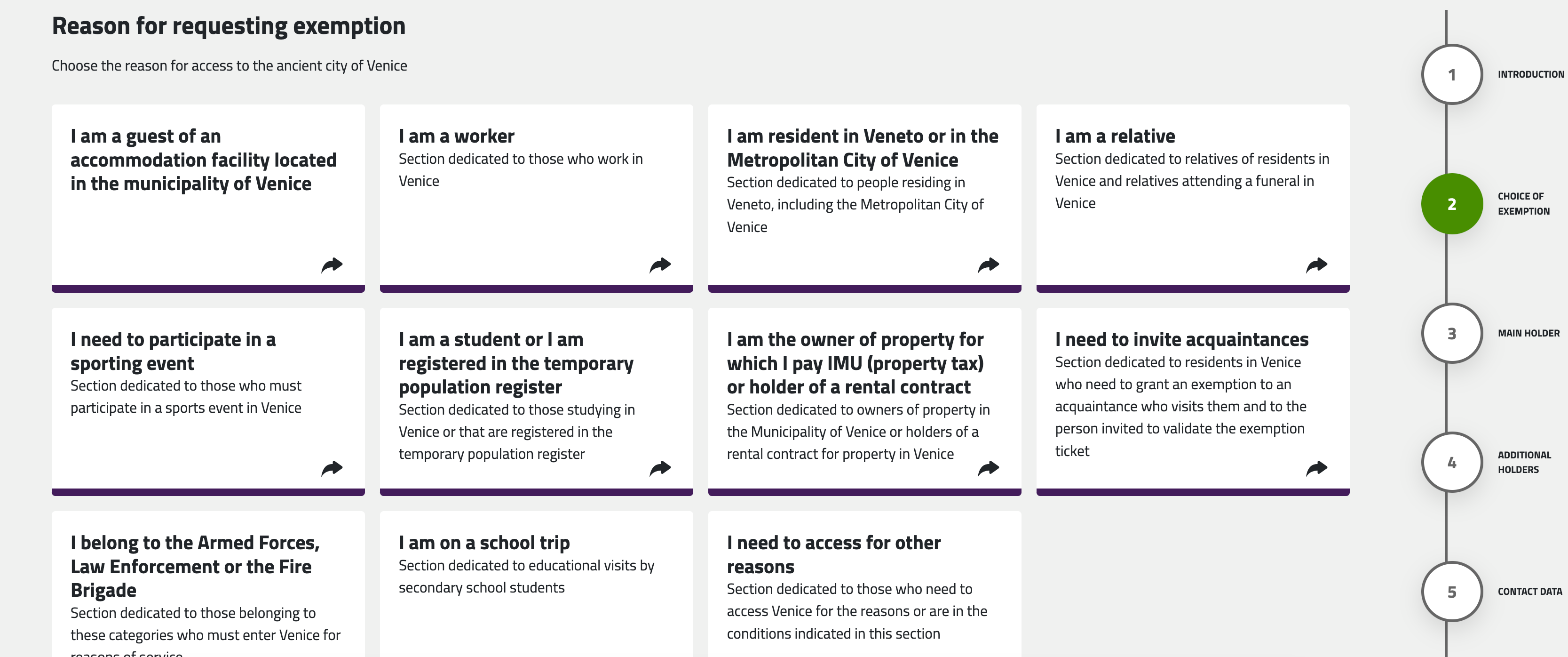

Currently, the Venice tourism tax won't apply to hotel guests or the city’s many workers, commuters and students. Visitors traveling to Venice’s lagoon islands — including Murano and Burano — will also be exempt. However, if you’re arriving at these locations via vaporetto ferries from the city center, you will still be required to pay the fee.

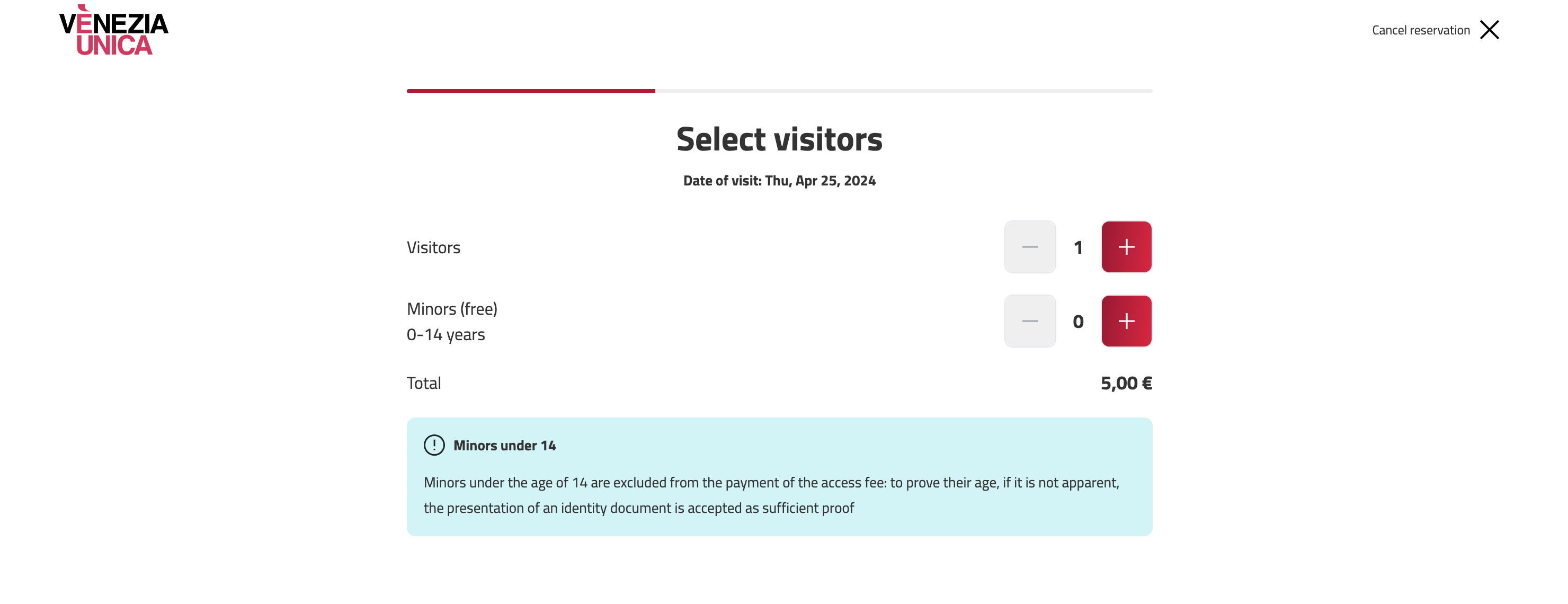

Children under 14 will also not be required to pay the tax, nor will those visiting residents of the “Old City” historic center of Venice.

Those transiting through the Piazzale Roma bus terminal, Tronchetto or Stazione Marittima dock will also be exempt if they’re not passing into the Old City.

Additionally, visitors with certified disabilities (along with any caregivers) or those traveling to the city for a sporting event or medical treatment will also be exempt.

Eligible visitors will need to register for exemption on the same website linked above.

What dates will the Venice tourist tax be in force?

In 2024, visitors will be required to pay the fee on the following dates between the hours of 8:30 a.m. and 4 p.m.:

- April 25-30

- May 1-5

- May 11-12

- May 18-19

- May 25-26

- June 8-9

- June 15-16

- June 22-23

- June 29-30

- July 6-7

- July 13-14

How to prepay the daytripper tourist tax if you’re visiting Venice

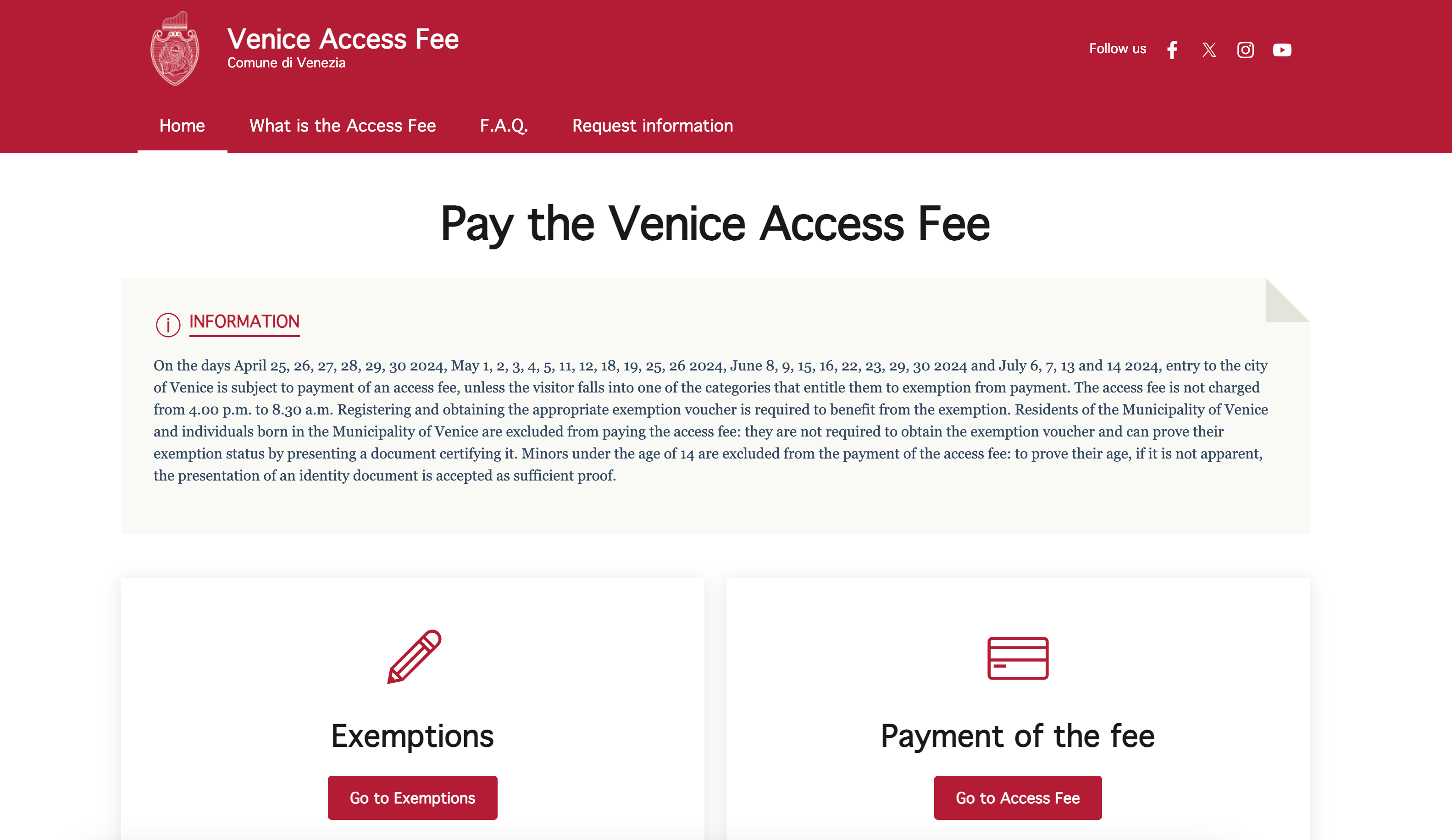

You must book your visit via the Venice city council’s online booking platform.

Once you’re on the site, you need to click “Pay the Access Fee,” which will take you to a site signposted by Venezia Unica. This is the official tourism site for Venice, and you should not pay this fee anywhere else.

Once you’ve accessed this area of the website, you’ll be able to select your travel dates and the number of people you are traveling with, including children — though, as noted above, kids younger than 14 won’t be charged.

You’ll then be asked to enter the names of any travelers who are not exempt before paying the fee. Once paid, you’ll receive an email with your booking details and also a QR code to show authorities should you be asked during your visit.

In “exceptional” circumstances, you will also be able to pay on arrival at the Piazzale Roma bus terminal or the Venezia Santa Lucia train station. However, you're advised to pay prior to your visit.

Should you need to cancel your visit, you can do so up to 11:59 p.m. the day before you’re due to arrive.

How to register for exemption from the Venice daytripper tourist tax

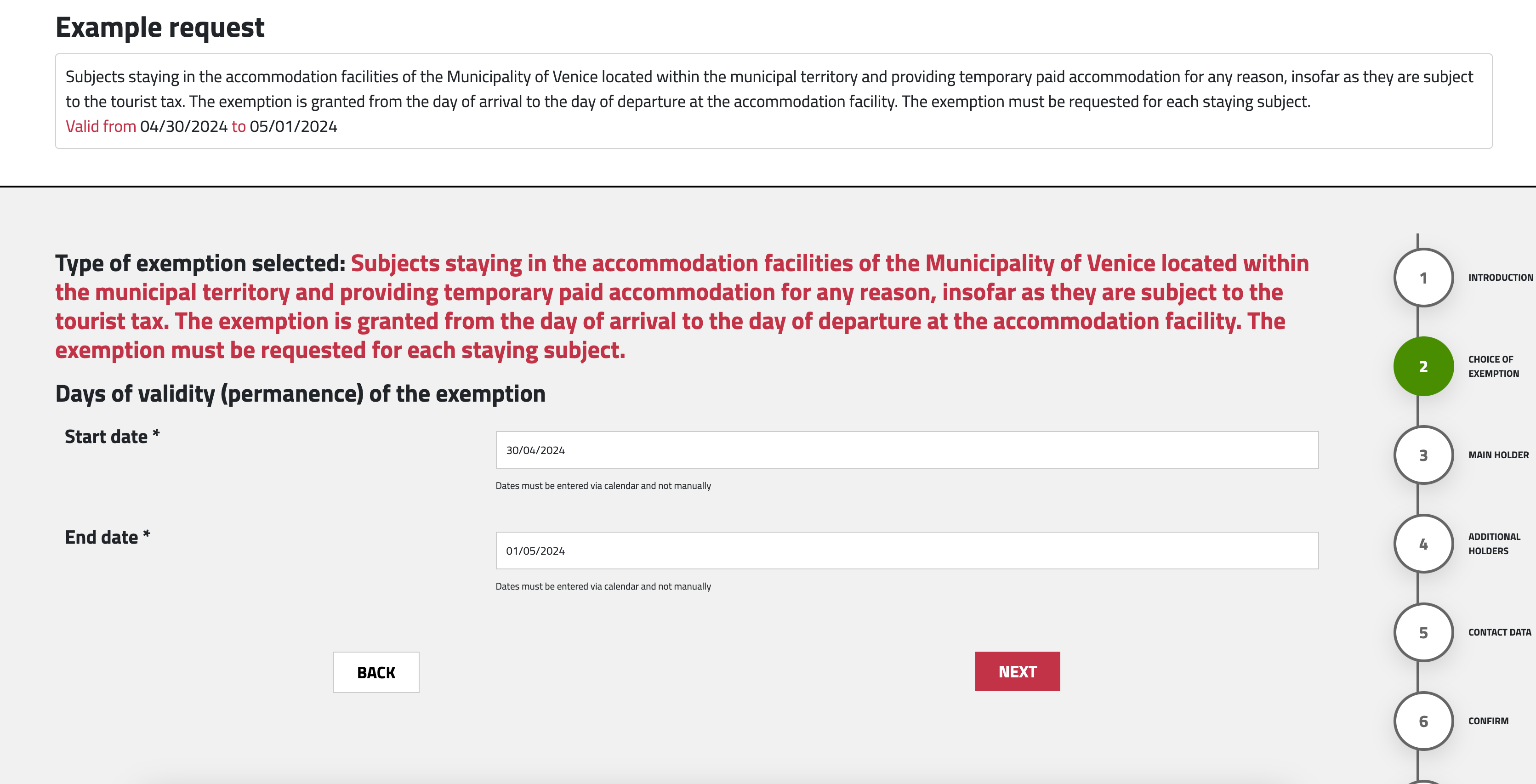

Those staying overnight in Venice, as opposed to visiting as part of a daytrip, will not have to pay the entry fee provided they have a confirmed reservation. They will instead pay an overnight tax as part of their hotel or rental costs.

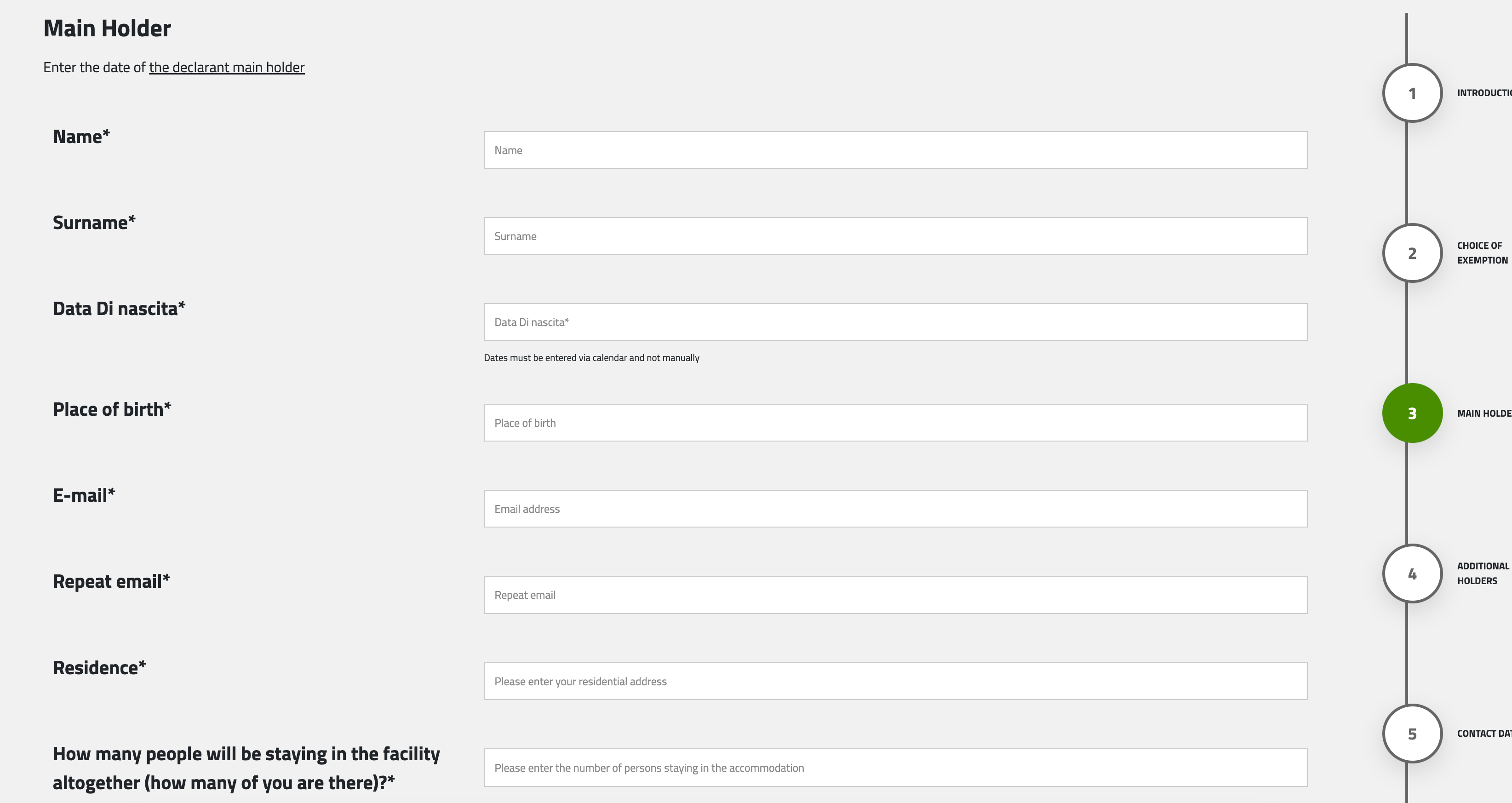

Visitors can register for an exemption on the city council website. It'll ask you for an exemption reason before you give the dates of your visit, personal details and contact information.

If successful, you will receive a QR code to show to authorities if asked during your visit.

25-person tour group cap

The aforementioned tax for daytrippers is just one of several fees and other measures the city plans to implement to curb the effects of immense tourism.

A new municipal resolution will cap tour groups at 25 people (i.e., half the passengers on a tourist bus). It'll also ban loudspeakers “that may cause confusion and disturbance.” Both rules are effective June 1. This measure will also apply to groups in Murano, Burano and Torcello.

“It is a provision that is part of a broader framework of interventions aimed at improving and better managing tourism in Venice,” tourism councilor Simone Venturini said in a statement Dec. 30, 2023. “A limit was therefore introduced on the number of participants in tourist groups and the use of amplifiers and parking in narrow streets, bridges or places of passage was prohibited. The number of 25 people was also decided to give homogeneity to what already happens for visits to the city’s civic museums.”

Bottom line

Venice is the latest popular tourist destination to add or bolster tourism-related fees in recent years. From Europe to New Zealand, leaders have grappled with the dual effects of immense tourism spending and tourists' toll on the environment and infrastructure. These impacts have been particularly potent as travel surged leading up to the pandemic and in the most recent couple of years.

Last summer, UNESCO recommended putting Venice on its list of endangered heritage sites, citing — among other factors — the impacts of tourism, severe weather and climate change.

Related reading:

- The best travel credit cards

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- Everyone is going to Sicily — try these 7 underrated places in Italy instead

- Inside Six Senses Rome, a wellness sanctuary in the heart of Italy’s capital city

- Insider tips for eating and drinking your way through Italy

- United will send its poshest plane on a new flight to Italy

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.