How to use Amazon to avoid credit card shutdowns

Editor's note: This post has been updated with the latest information.

One of the big mistakes in the credit card hobby is having an old credit card account closed for lack of use. This may have a negative impact on your credit score — both from an average age of accounts and a utilization perspective.

Credit card issuers don't want to keep a cardholder around who doesn't spend money on his or her card. Even if you don't use benefits from a card, there's a cost for issuers just to maintain your account, which is why credit card companies may eventually shut down inactive accounts.

Want more credit card news and travel advice from TPG? Sign up for our daily newsletter!

Strategy for "sock-drawered" cards

The easiest way to prevent this is pretty obvious: spend on the credit card. But or cards that you have "sock-drawered" — or stashed somewhere, since you don't have room in your wallet — cycling through all of the unused cards via day-to-day purchases can be a hassle.

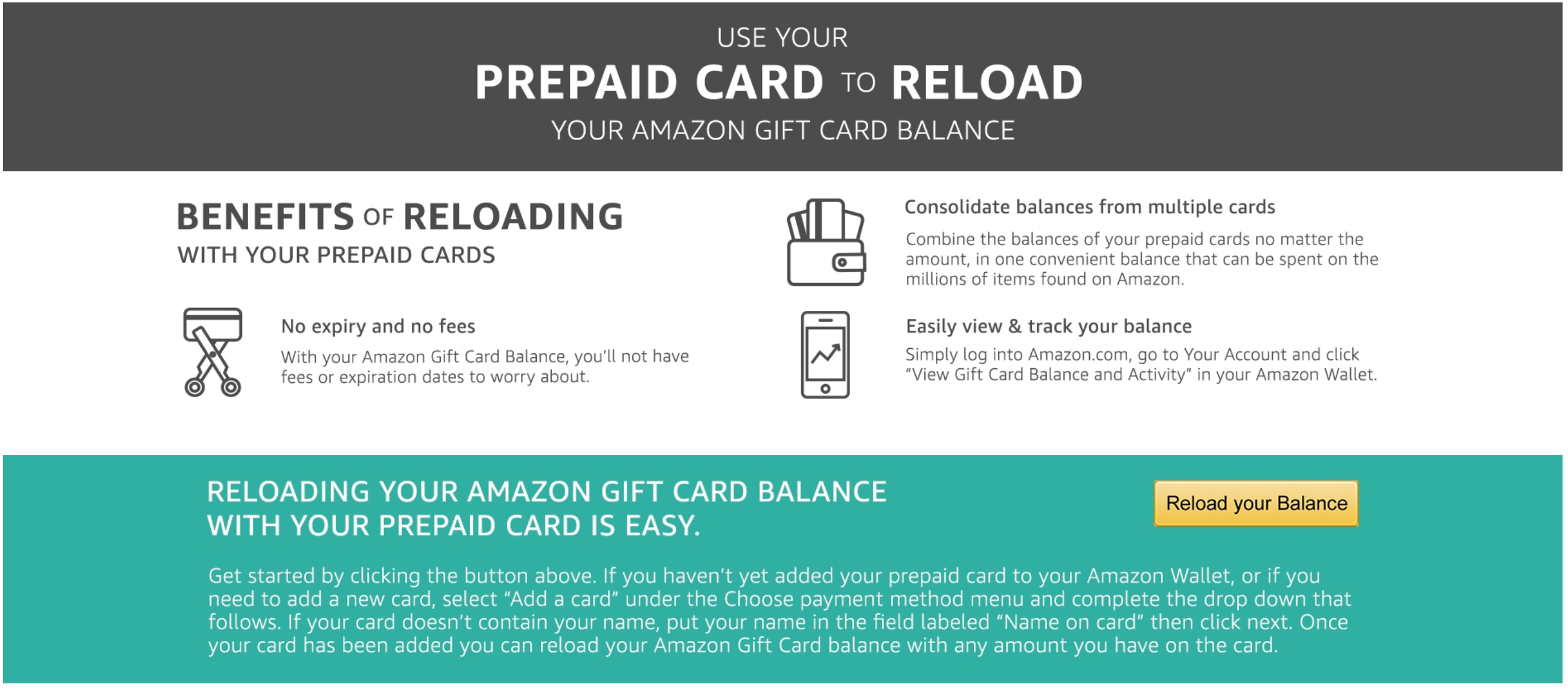

Enter Amazon's Reload Your Balance option, through which the e-tailer will let you use a credit card to reload your balance. You can reload any amount above $0.50, and Amazon doesn't care how many cards you use. Case in point: I have 38 cards in my Amazon profile.

Related reading: Ordering from Amazon? You could earn 5x bonus points on your next purchase

About every six months, I review the credit cards that I haven't used recently and load $5 from each one onto my Amazon Gift Card balance:

You could do less than $5, but some issuers won't bother to bill you for smaller purchases. For example, I've had a $0.99 Amazon reload waived by Barclaycard. Not wanting to tempt fate and have these smaller purchases not reset the inactive account clock, I use $5 reloads.

(While we're on the topic, Amazon Reload Your Balance is also a great way of getting rid of any Visa or American Express gift cards you may have received. Amazon doesn't mind taking prepaid gift cards — whether it's a brand-new one that you got as a gift or the last $2.46 that you have on a card that you just can't figure out how to use.)

You might be wondering what to do with all of this money you're accumulating in your Amazon account. If you're like me, you still want to get good purchase protection and price protection on goods you buy, as well as excellent travel insurance for flights you book. So, you'll still want to use your credit card for most purchases. The best use of these funds is for general household items, either purchased through Amazon or by buying a gift card through Amazon for stores like Bed Bath and Beyond, Whole Foods and others.

For me, since I'm on the road all the time, I usually end up buying Airbnb gift cards on Amazon with my balance. Unfortunately, this means that I miss out on 3x earnings on my Chase Sapphire Reserve, but it's an easy way for me to use up the funds.

Related reading: Should you redeem Amazon Prime Card rewards for travel?

Additional reporting by Chris Dong.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app