United’s bringing back plated meal service in domestic first class

Premium-cabin passengers traveling with United this summer are in for a big (culinary) upgrade.

On Wednesday, United announced that it's bringing back plated meal service for domestic first-class flyers starting on June 15.

The new meals will include a choice of entrees, as well as a side dish and dessert. United teased some of the menu items in its announcement, including:

- Breakfast: Egg scramble with plant-based chorizo OR Belgium waffle with bourbon berry compote, served with a side of a peach-flavored Greek yogurt parfait.

- Lunch/dinner: grilled chicken breast with orzo and lemon basil pesto OR vegetarian enchilada with chile verde, served with a side of Spanish rice.

For dessert, United's partnering with Chicago-based Eli's Cheesecake on a chocolate pie flavor called "Pie in the Sky."

To minimize contact and promote safety, all meals will be served individually wrapped on one tray. First-class passengers can also enjoy a full selection of complimentary beverages, including new alcoholic options, like mango-flavored White Claw or Breckenridge Brewery Juice Drop Hazy IPA.

When the new meals launch on June 15, they'll exclusively be available in the forward cabin on domestic routes over 1,500 miles and on hub-to-hub flights over 800 miles or two hours or longer. United's seven domestic hubs are Chicago (ORD), Denver (DEN), Houston (IAH), Los Angeles (LAX), Newark (EWR), San Francisco (SFO) and Washington Dulles (IAD).

United didn't have any pictures to share of the new meals, but they'll almost certainly be an upgrade compared to the snack boxes and hot sandwiches that are currently offered on select routes.

These sandwiches have received poor reviews from both readers and TPG reporters alike. On a recent United flight from Chicago (ORD) to Bozeman (BZN), TPG's Zach Honig selected the 650-calorie carved chicken sandwich, only to find it filled with more cheese than chicken.

When United reintroduces first-class meals, it'll become the first of the Big 3 U.S. airlines to do so. American serves fresh snacks and light bites in the forward cabin, while Delta only offers pre-packaged snack boxes, though the Atlanta-based carrier is planning to offer fresh boxed meals beginning in early July, with more details to come.

Related: Here's what food and drinks you can expect on your next flight

First-class passengers aren't the only ones receiving a meal upgrade — United's also expanding its buy-on-board alcohol and snack program to even more domestic flights this summer.

Starting June 1, coach passengers on flights over 800 miles will be able to purchase any of the following:

- White Claw Mango ($8)

- Breckenridge Brewery Juice Drop Hazy IPA ($8)

- Kona Brewing Co. Big Wave Golden Ale ($8)

- Michelob Ultra ($8)

- Stella Artois ($8)

- Red, white and sparkling wine options ($9)

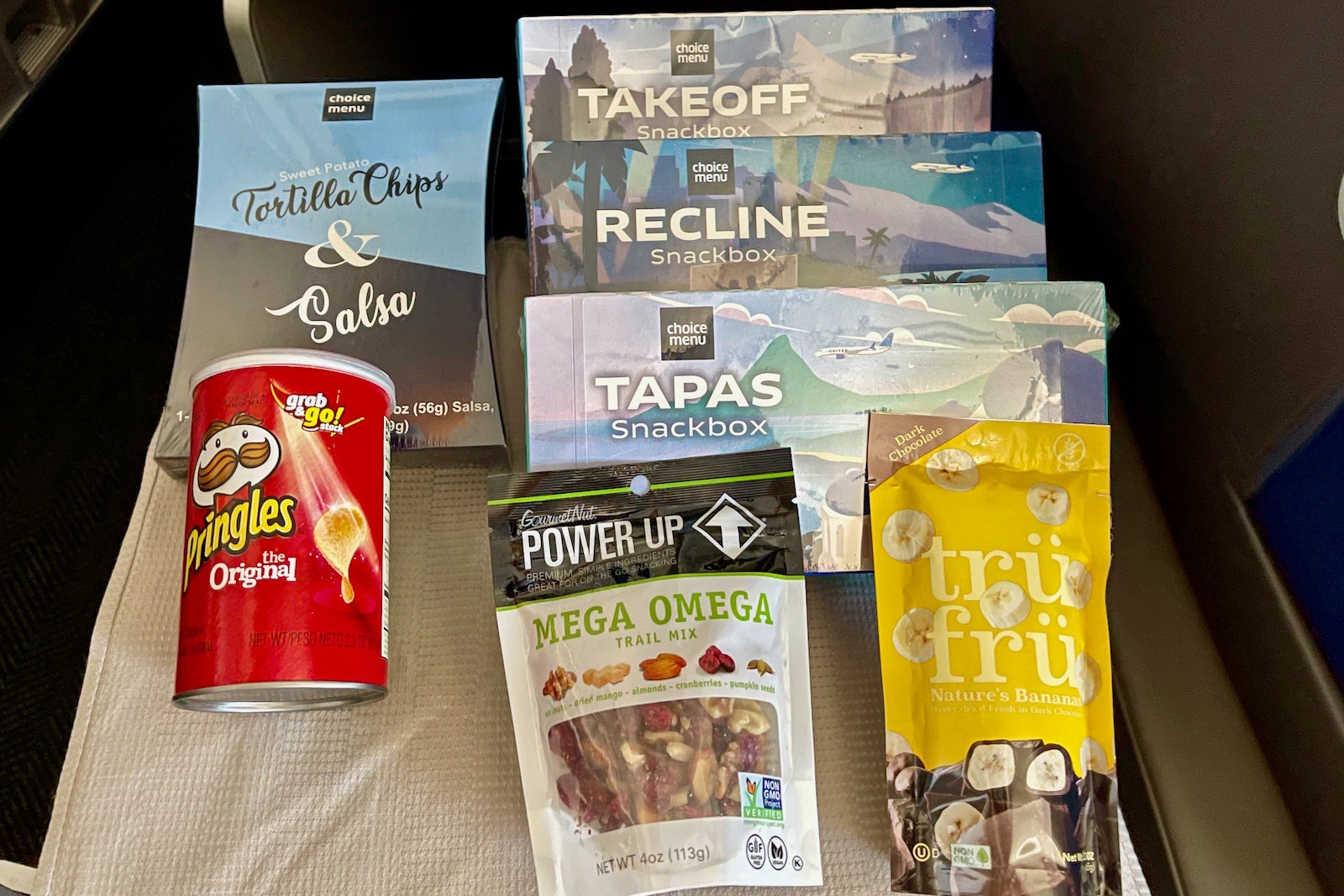

Roughly two weeks later, on June 15, United will then expand its for-purchase snack options for flights of similar length, including:

- Pringles ($4)

- Trü Frü Banana Bites ($5)

- Food Should Taste Good Chips & Salsa ($5)

- GourmetNut Mega Omega Trail Mix ($5)

- Tapas ($10), Takeoff ($10) or Recline ($8) snack box

Previously, these snacks and drinks were only available on select premium transcon routes and on flights to Hawaii.

As United expands its revamped dining offerings, the carrier will exclusively accept contactless payment through the United app.

When the flight attendant passes by your row, you'll be asked if you want to purchase a snack or drink. If you do, the crew will pull up your profile on a mobile tablet and charge your stored payment method. Receipts will be emailed, keeping the purchase process completely touchless — in line with guidance from the Cleveland Clinic.

Top-tier Premier 1K and invite-only Global Services members seated in coach will continue to receive a complimentary snack box and alcoholic drink, subject to availability.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app