Uber's Upfront Pricing Can Be Way Off, But You May Get Around It

We've known for a while now that Uber has been charging riders based on what it thinks they will pay, not a fare based on distance and time. Uber confirmed that it had been overcharging riders with its "upfront pricing," which uses machine learning to estimate how much customers are willing to pay for a ride.

A report from The Rideshare Guy explains more how this practice is being used on frequent riders, and also shares a few techniques on how to avoid it.

The report explains that Uber calculates its rates in the San Diego market based on miles traveled and time in the car. The author was making frequent UberX trips, on the same days of the week, between the airport and his home for business travel. After what used to be a $55 to $60 ride, the prices jumped from $70 to $80. There appeared to be no surge pricing in effect.

"I was always given an upfront fare 10-30% more than what the actual fare ended up being. I did this for a total of about 20 rides in San Diego and Sunnyvale, and the result was always the same," Will Preston of The Rideshare Guy writes.

Preston also had his wife test the price of the same trip to the airport. She was offered a fare $10 less on the exact same route.

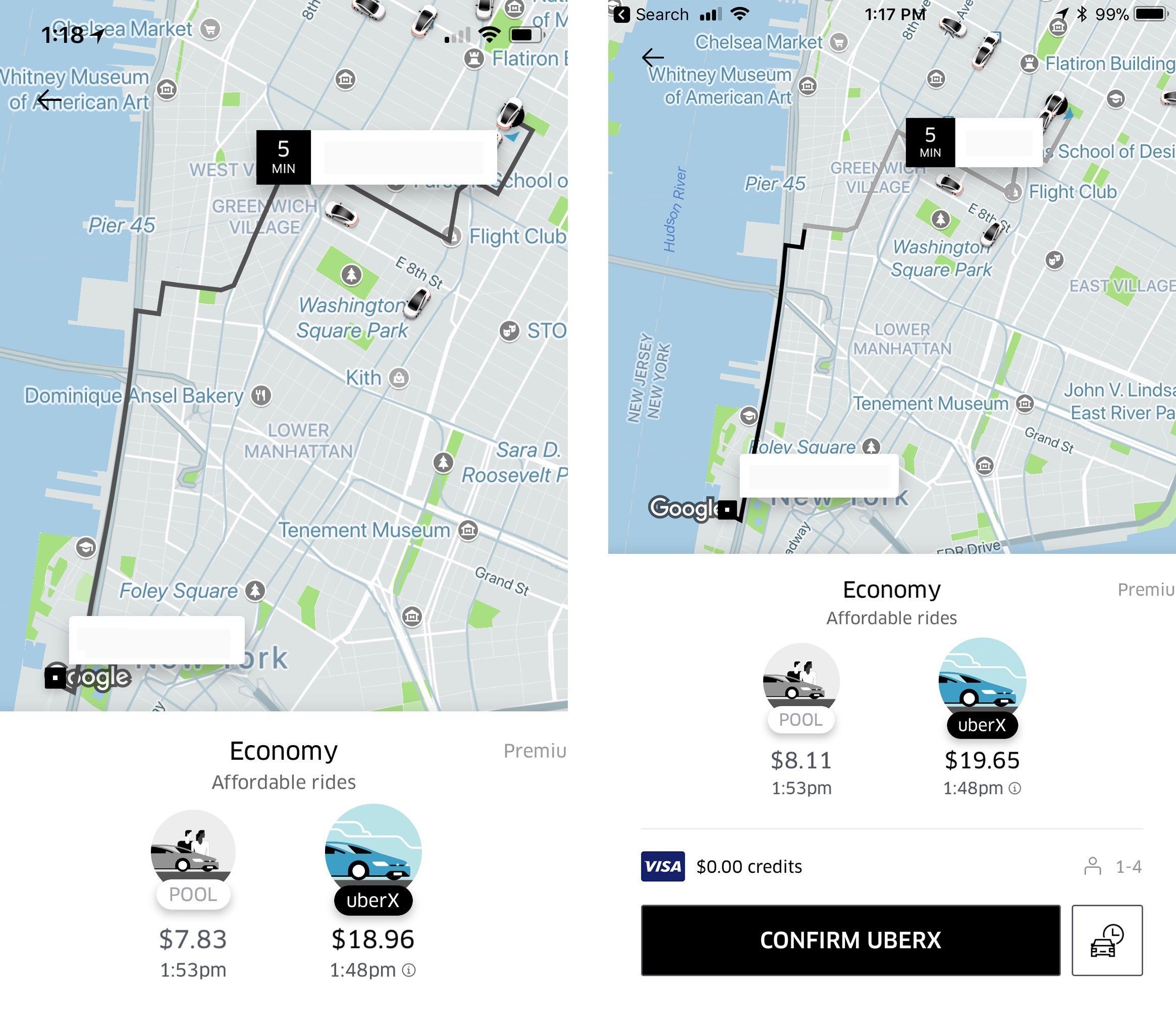

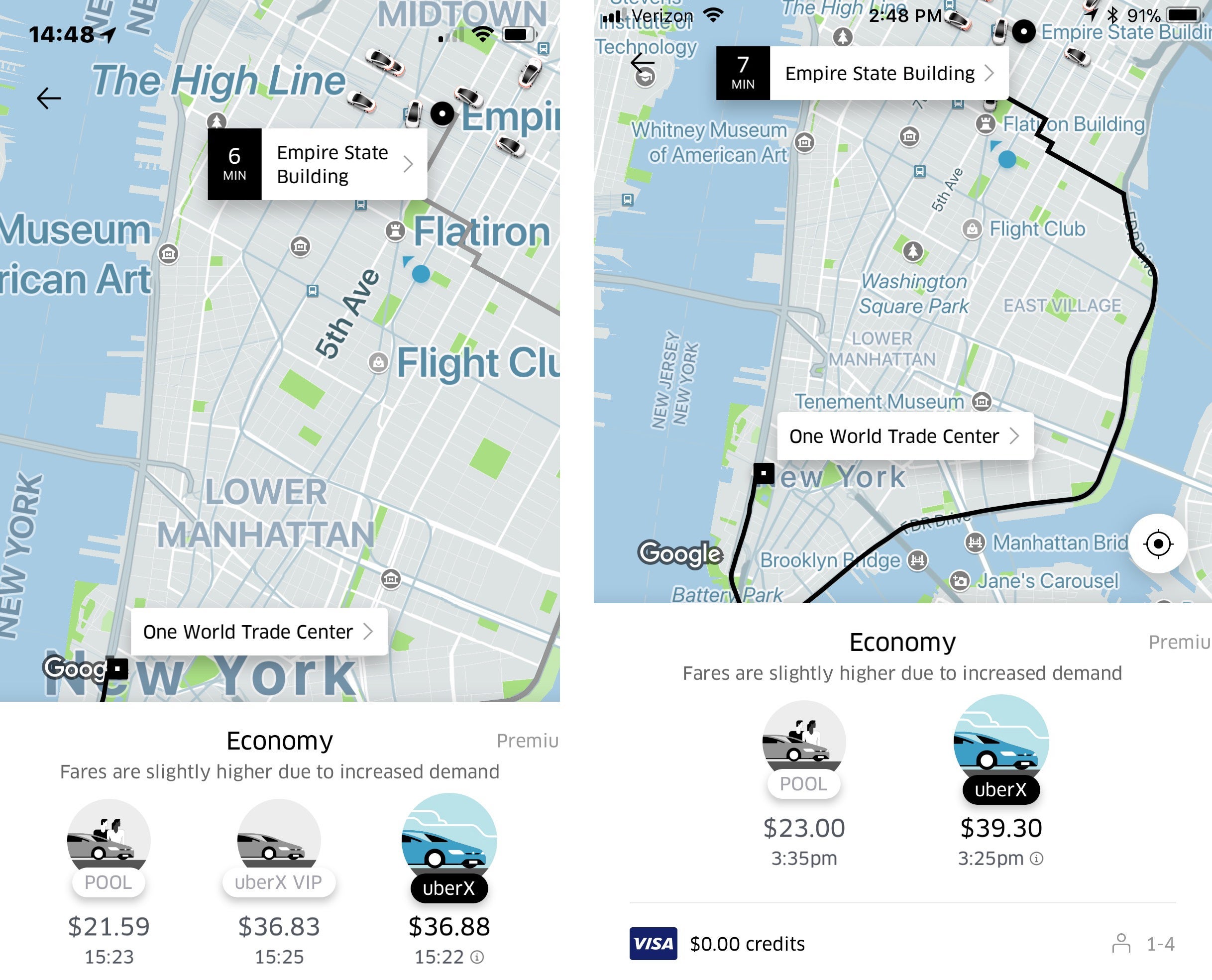

We tested this predictive pricing too. On a ride from the office to my apartment, I was quoted a higher price ($0.69 more) for the same UberX route than TPG Reviews Editor Nick Ellis. We opened up our app at the same time and entered the pickup and drop-off destinations simultaneously.

I tried it on a couple different routes with different coworkers' accounts, and usually the price differences were minimal, less than a dollar, although we did find one time where the price was a few dollars more than the other. We also noticed that we were quoted different time estimates for each trip. Sometimes they were the same while at other points it could take five minutes longer for an Uber to get us to our desired destination.

So, how can you avoid this? According to The Rideshare Guy, there are a few ways. First, you can set your destination to an address in the relative vicinity of your actual destination and then, once you are in the car, you can update the address to your true destination. This should kick in the rates based on mileage and distance, not what Uber thinks you're willing to pay.

The second way is enter a non-existent address when ordering a ride and then hit "Enter destination later." Once you're in the Uber you should be able to input your desired address and be charged by time and distance.

When Preston tested these methods he saved serious cash. Upfront pricing quoted him $79.82 for a ride to his house. When he entered his address mid-ride, the fare ended up being $63.83 or 20% less than he was originally quoted. As mentioned before, Preston tried this on about 20 rides and was usually quoted a price 10-30% higher than what he actually ended up paying.

Within Uber's FAQ for drivers on upfront pricing it actually states that if riders make destination changes or multiple stops, that drivers will be switched "to the normal time and distance calculations. Your earnings will still include any applicable surge." This suggests that the same will go for the riders.

We tested the methods ourselves and the results varied. Disclaimer: these were all on different routes, so we didn't match the methods employed in The Ride Share Guy's story, who was testing it on the same routes. UberX rides were taken in all cases and the method of entering a non-existent address and inputting the destination once the ride started was used in almost every test:

| Quoted Price | Actual Price | Price Difference | Uber Fare Estimate Tool |

|---|---|---|---|

$18.85* | $18.85* | 0* | $15-$21 |

$6.01 | $10.46 | +$4.45 | $7 - $9 |

$35.74 | $34.33 | -$1.41 | $22 - $30 |

$10.10 | $12.03 | +$1.93 | $7 - $9 |

$14.73 | $12.20 | -$2.53 | $13 - $17 |

$14.96 | $12.40 | -$2.56 | $10 - $14 |

$45.63 | $41.24 | -$4.39 | $33 - $42 |

$29.94 | $25.29 | -$4.65 | $19 - $25 |

$10.42 | $8.29 | -$2.13 | $8 - $10 |

So while our results aren't conclusive, we do know that fares tended to be lower than what Uber was quoting riders at with its upfront pricing. It's possible that Uber's upfront pricing may actually save you money, especially considering that the upfront price is locked in. If you enter your destination after you've started the ride you may have to pay more because of unsuspected traffic or route changes. Uber's fare estimate tool usually can't be relied on, especially factoring in surge pricing. Granted, the end fare was sometimes even lower than the low end of the estimate.

What we know is that Uber has dynamic pricing, it's admitted that it's charging some riders based on what it thinks they will pay and that upfront pricing can work against or in favor of riders' wallets. Uber's upfront pricing algorithm will surely evolve and it's only a matter of time before the company announces another pricing scheme.

*This was the only time when we tested entering an address in the relative vicinity the actual destination then updated the address to the true destination once the ride began.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app