TPG reader question: How do I turn my Freedom and Ink cash back into Chase Ultimate Rewards?

Update: Some offers mentioned below are no longer available. View the current offers here.

Editor's note: This article is part of a weekly column to answer your toughest credit card questions. If you would like to ask us a question, tweet us at @thepointsguy, message us on Facebook or email us at info@thepointsguy.com.

I vividly remember my early days in the points and miles hobby: A cache of points from my first credit card sign-up bonus (it was the Chase Sapphire Preferred Card, by the way), with little idea how best to use them.

There are seemingly endless details to learn about credit card rewards. Not just how to use them, but how to earn them, too. Reader Garrett recently inquired about the difference between the rewards earned by "Ultimate Rewards" earning cards and "cash back" earning cards:

[pullquote source="Garrett Groebner"][T]he Ink Business Cash Credit Card offers 5% cash back on internet, cable, phone etc., which is perfect for my business. You also write "5x Ultimate Rewards" in your earning description.

I thought the Ink Business Cash only gives you 5% back on those purchases, but it feels like you are implying that you get 5x Chase Ultimate Rewards points for these purchases. Any advice or knowledge on this would be so helpful! I'm new to Chase so maybe once these cards are open, it would make more sense.[/pullquote]

Garrett correctly suspects that there is more to Chase's "cash back" credit cards than meets the eye. If you know what you're doing, you can receive significantly more value for your cash back than Chase advertises.

Chase labels cards "cash back" when they're really not

You've probably seen commercials or online advertisements of cards like the Chase Freedom Flex or the Ink Business Cash, touting the extraordinary cash back earning rate each card offers. For example, the Ink Business Cash earns:

- 5% cash back on the first $25,000 you make in combined purchases each account anniversary year at office supply stores and on internet, cable and phone services.

- 2% cash back on the first $25,000 you make in combined purchases at gas stations and restaurants each account anniversary year.

- 1% cash back on all other purchases.

While this is an impressive cash back return, the rewards you're earning are not cash back -- they're actually Chase Ultimate Rewards points. However, you can only use those rewards for cash back unless you have one of the following cards:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Ink Business Preferred Credit Card

If you're a Chase Ultimate Rewards collector, these "cash back" cards are some of the absolute fastest ways to accrue points.

Related: Your ultimate guide to family points pooling

How to unlock the power of Chase's cash back rewards

If you're unfamiliar with Chase's Ultimate Rewards portal, read our post on the Chase Travel Portal.

Here's how to instantly convert your cash into treasured Ultimate Rewards points. If you've ever transferred points to one of the many Chase airline and hotel partners, you'll find the process quite familiar. Again, this will not work unless you have the Sapphire Preferred, Reserve or Ink Business Preferred.

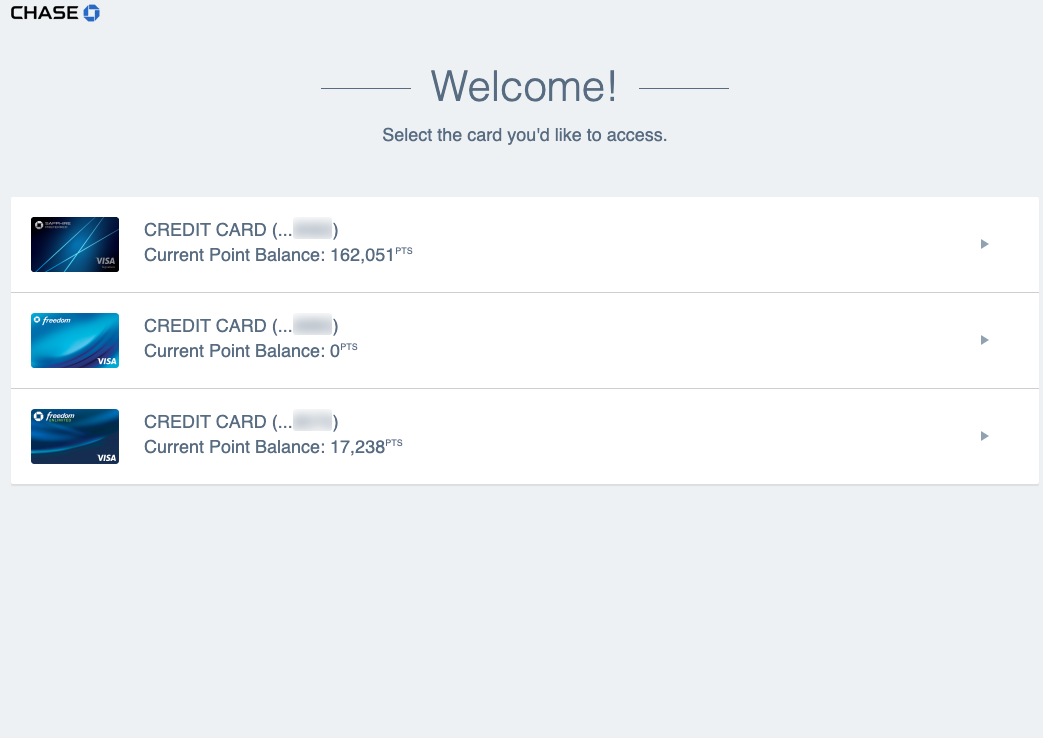

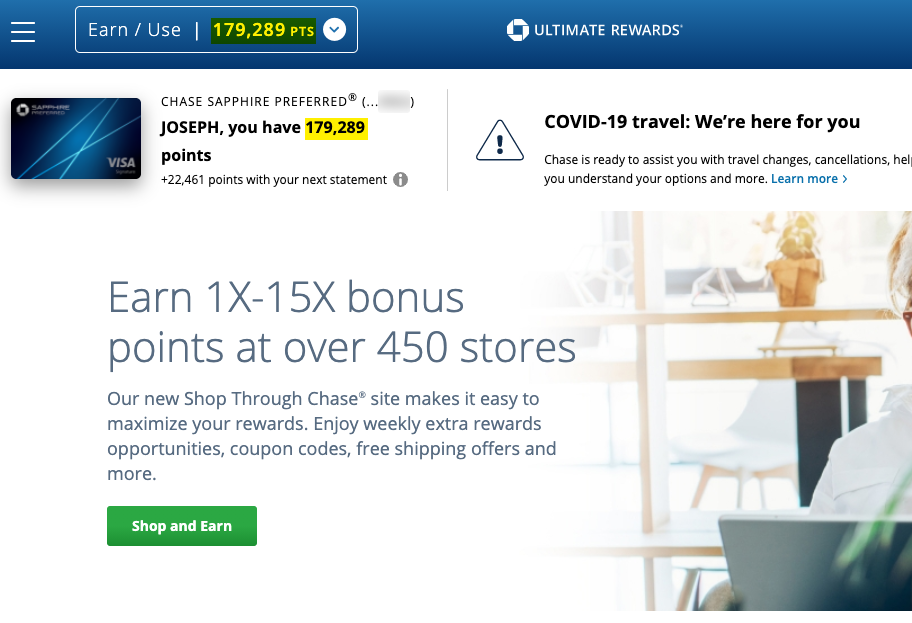

First, log into Chase Ultimate Rewards. You'll immediately see all your Ultimate Rewards-earning cards listed. Click on the card possessing the "cash back" you want to turn into Ultimate Rewards. At the bottom of my list below is the Chase Freedom Unlimited. It's got 17,238 points, valued at $172.38 in cash.

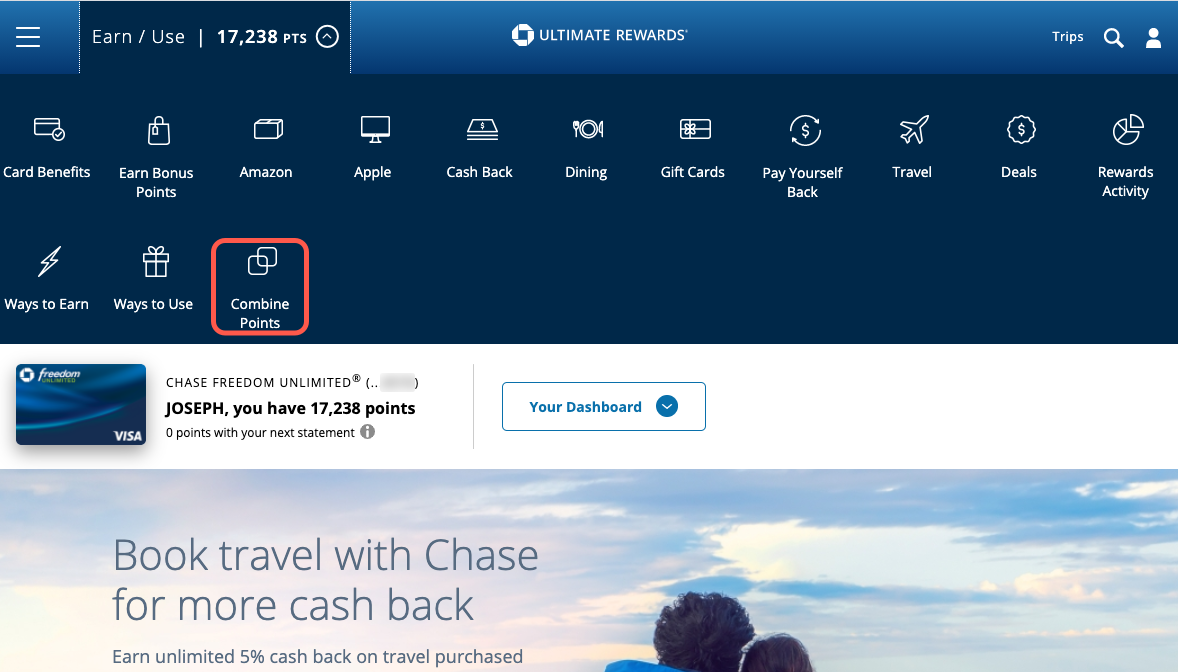

I'm now on the landing page for my Freedom Unlimited. Within the menu at the top of the page, find "Combine Points."

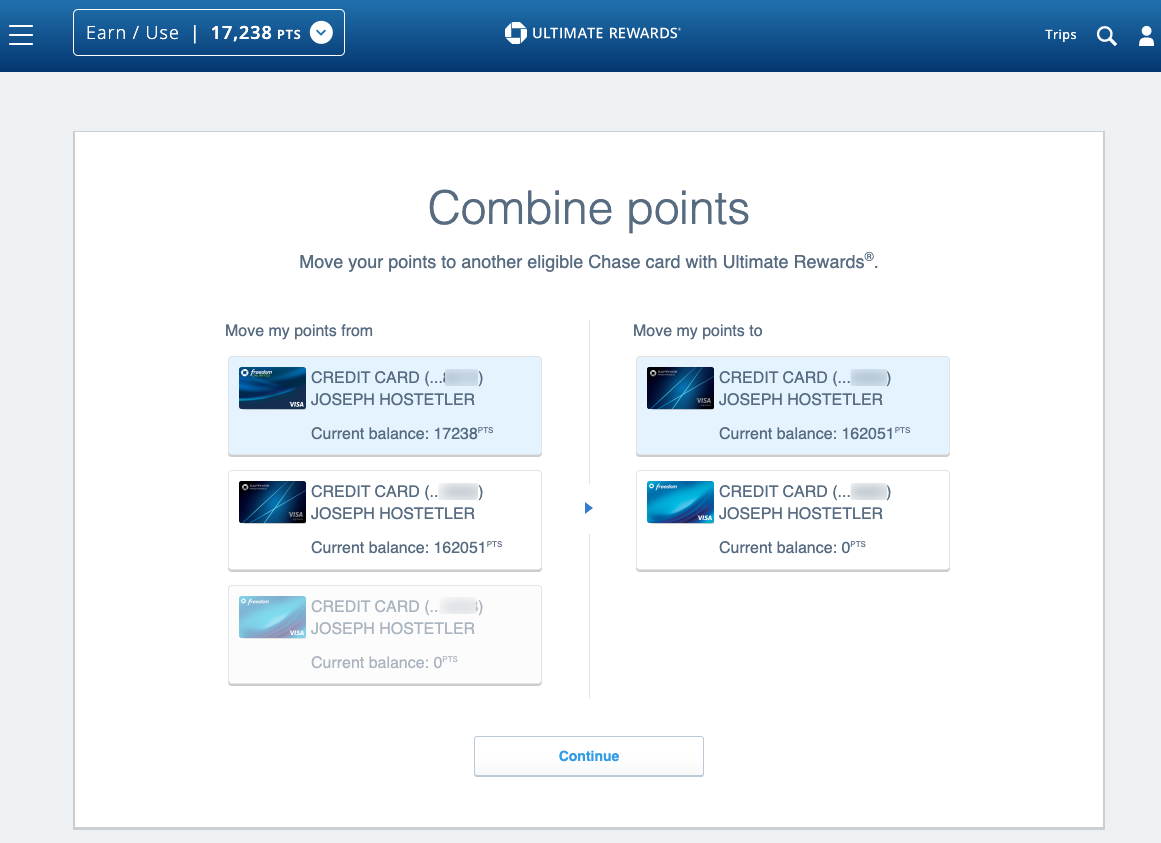

Here you'll see all the Ultimate Rewards cards to which you can freely transfer your points. Select the card you want to transfer from (your no-annual-fee Ultimate Rewards earning card) and the card to which you want to move your points (Chase Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred). I've got the Chase Sapphire Preferred, so I'll select that card and click "Continue."

You can move any amount of points at once -- and you can move your points back to another card if you change your mind (though I can't think of a good reason to keep any points on your no-annual-fee cards).

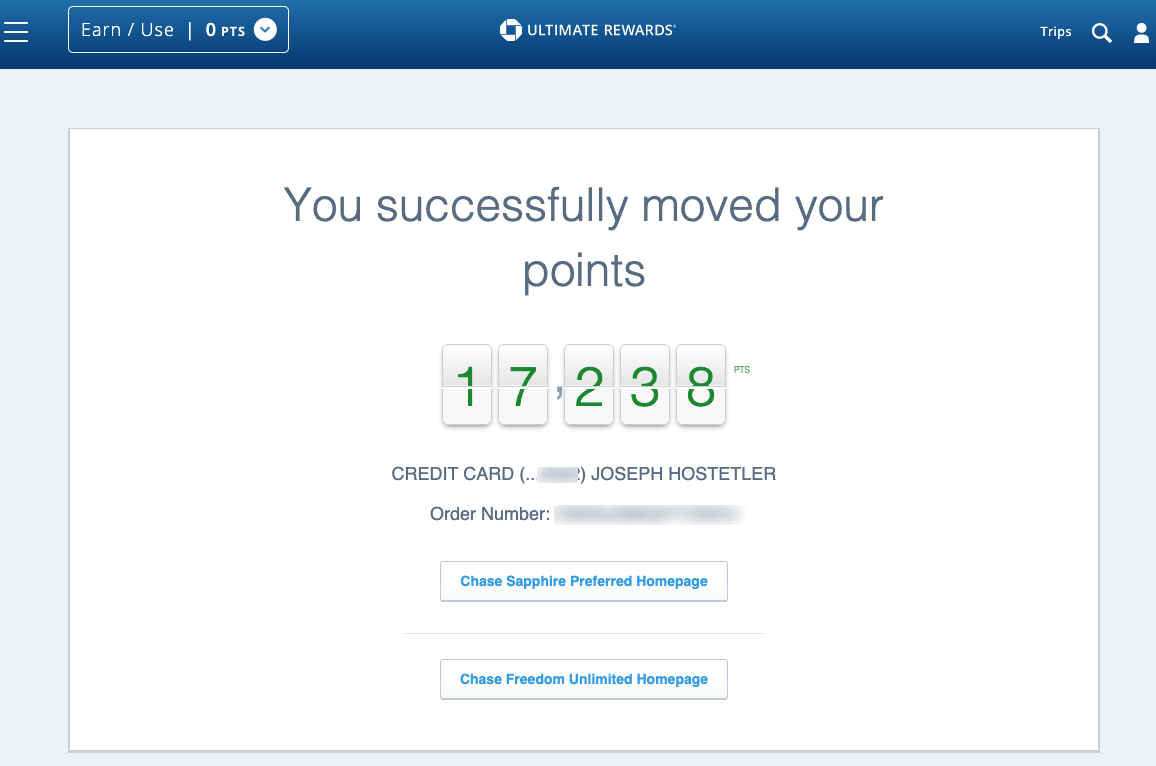

This message appears after transferring the full points balance from my Freedom Unlimited to my Chase Sapphire Preferred.

I can now head to the landing page of my Chase Sapphire Preferred to see that the new balance is immediately reflected. I've just turned boring cash back into dynamic and valuable Chase Ultimate Rewards!

You can also transfer points between accounts from other Ultimate Rewards cardholders in your household. For example, if your partner has any points on their Chase Freedom Flex, they can transfer those points to your Chase Sapphire Preferred.

Related: How to transfer Chase Ultimate Rewards points between accounts

Bottom line

Any rewards you've earned on the following cards are effectively cash back cards, as their rewards (with slight exception) are worth a maximum of 1 cent each:

- Chase Freedom Flex

- Chase Freedom Unlimited

- Ink Business Cash

- Ink Business Unlimited Credit Card

However, you can instantly boost the value of those rewards by transferring them to one of the following cards at a 1:1 ratio:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Ink Business Preferred Credit Card

We estimate the value of the rewards on these cards to be 2 cents each. That's like doubling your value with zero effort!

Read our post on the best ways to maximize Chase Ultimate Rewards to understand the possibilities.

Let us know if you have any head-scratchers you'd like answered for our weekly reader question series. You can tweet us @thepointsguy, message us on Facebook or email us at info@thepointsguy.com.