Traveling to Hawaii just got a whole lot easier; TPG was among the first to try it out

It's been a monumental day in Hawaii's COVID-19 journey. The state today dropped all its remaining coronavirus travel restrictions, and TPG was there to see what it was like to travel to the Aloha State paperwork-free for the first time in two years.

"The end of Hawai'i's Safe Travels program and indoor mask mandate, which are the last of the pandemic-related requirements for travelers arriving from the U.S. and its Territories, signals the start of a new chapter for the Hawaiian Islands," said John De Fries, President & CEO of the Hawaiʻi Tourism Authority, in a statement to The Points Guy.

Indeed, it is again easy and frictionless for visitors.

[table-of-contents /]

Preparing for Hawaii and the end of "Safe Travels"

I've visited Hawaii four times during the pandemic, and I absolutely love the state. But as I wrote last August, I decided I wouldn't be going back anytime soon.

Part of that was the onerous rules around COVID-19.

For one trip, I got no less than four COVID-19 tests to take part in the Kauai Resort Bubble program (and then a fifth to leave).

Every trip also required filling out a predeparture "Safe Travels" form. One of the visits even included a test on arrival. Each time it was stressful and left me with days of anxiety ahead of time.

Not this time.

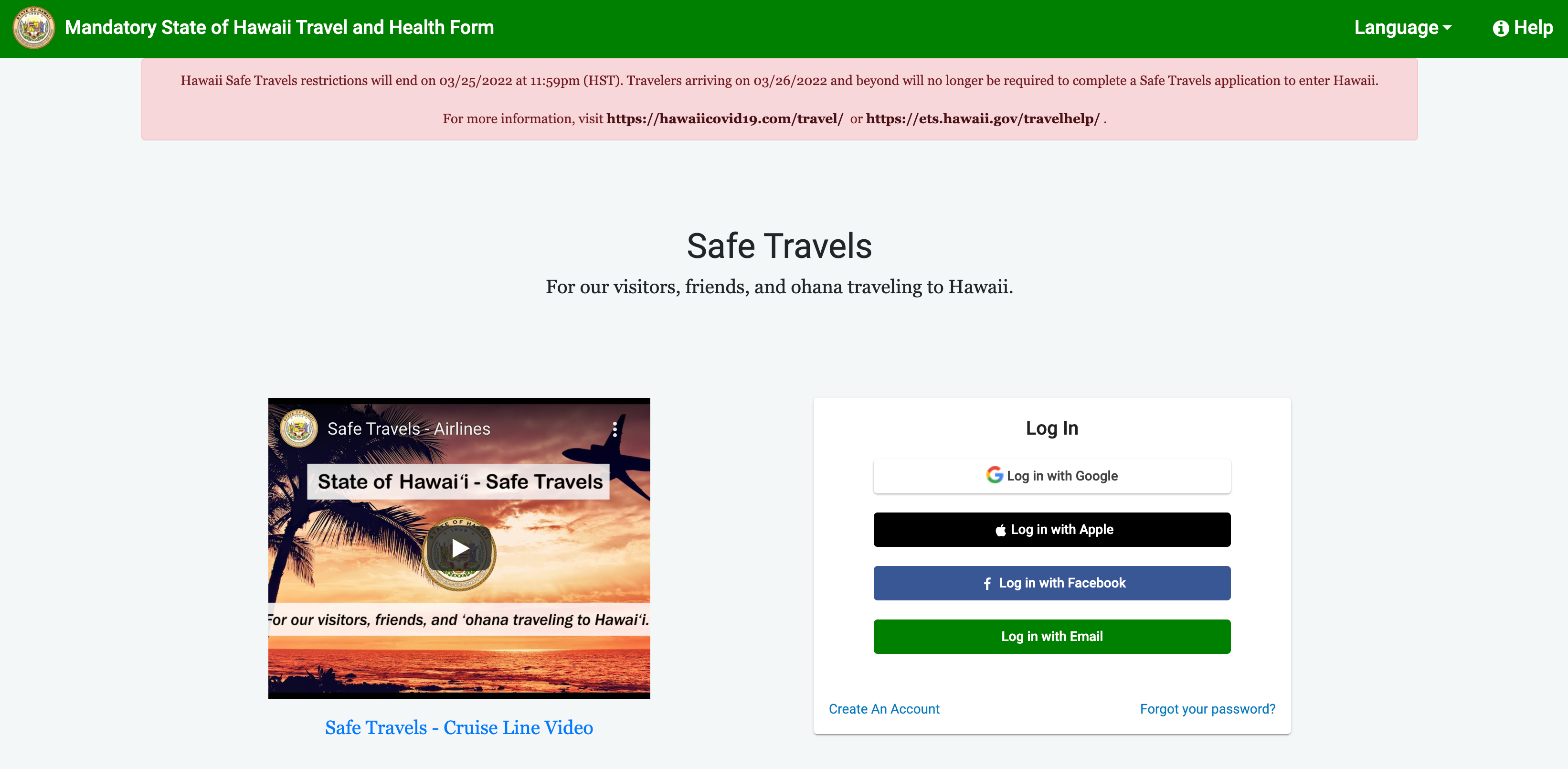

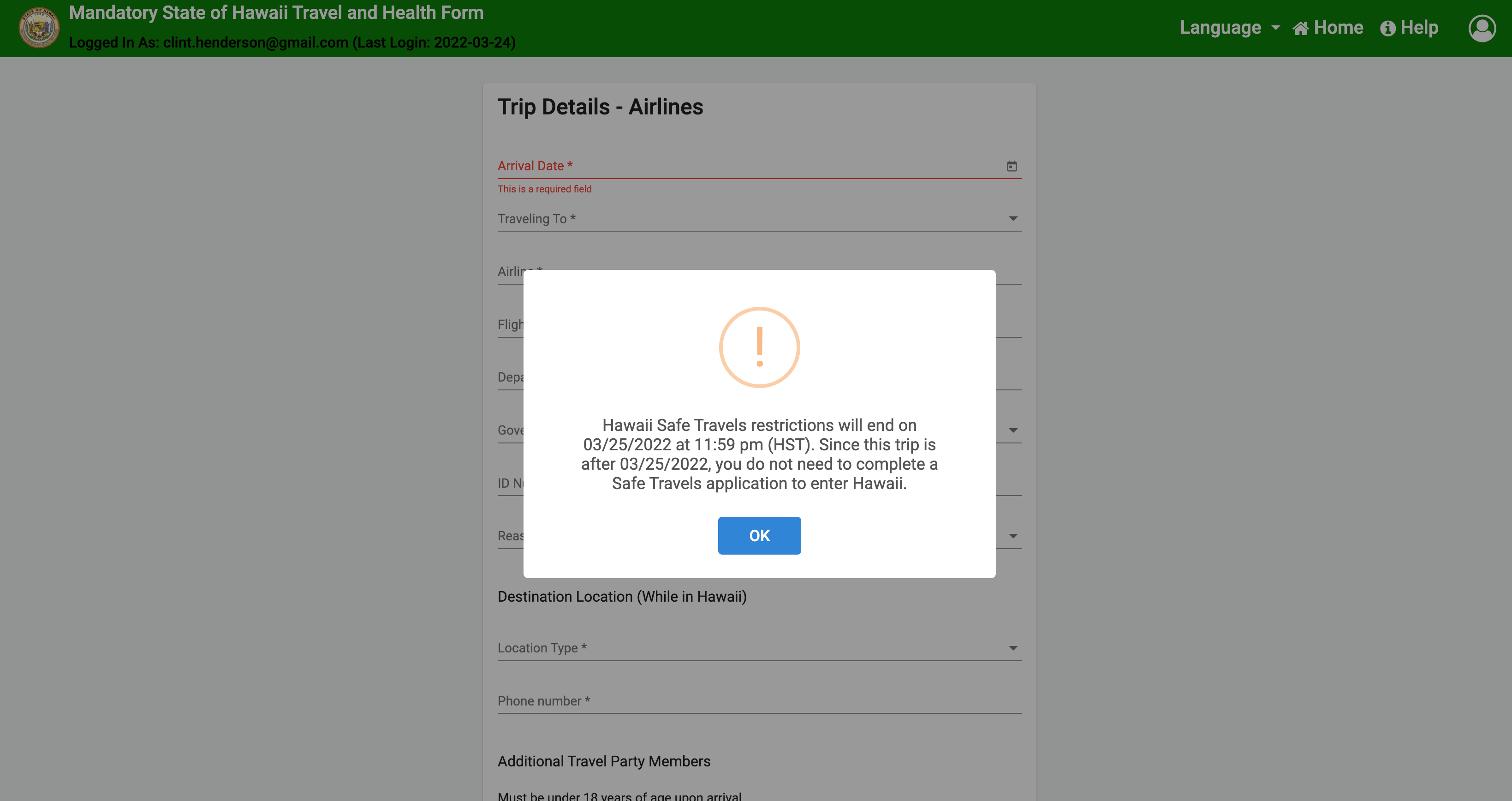

You no longer have to fill out the Safe Travels form at all. In fact, I tried to go to the website just to see what it said and it gave me an error message saying, 'Hawaii Safe Travels restrictions will end on 03/25/22 at 11:59 pm (HST). Travelers on 03/26/2022 and beyond will no longer be required to complete a Safe Travels application to enter Hawaii." Hallelujah!

In fact, if you try to fill out the form it won't let you.

Even if you are unvaccinated, you no longer need to fill out the Safe Travels form, and you are no longer required to quarantine on any of the islands.

Mask mandates lifted

County restrictions are now lifted across the Big Island, Oahu, Kauai and Maui.

Related: Proof of vaccination or recent test no longer required to access indoor spaces in Maui

Even the mask mandate is gone. Hawaii was the last state with an indoor mask mandate, but it also expired last night.

Hawaii Governor David Ige thanked the people of Hawaii for their diligence in combating the COVID-19 pandemic. In a statement the governor said:

"Together, we have reduced COVID-19 in Hawai'i to the point where most of us will be safe without masks indoors. Right now, hospitalizations are trending down. Case counts are falling. We are better at treating people who are infected. Booster shots are saving lives. And the CDC has rated the state's COVID-19 community level as low."

Note that masks are still required in some settings. De Fries told me: "While domestic travelers no longer need to provide their vaccination status or a negative test result on arrival, they should be aware that federal law still requires mask-wearing on an airplane or in an airport, and some businesses and venues throughout the islands may still require the use of masks for everyone's safety and well-being."

And the governor did say mask mandates and other coronavirus prevention measures like the Safe Travels program could come back in case of another virulent variant and a spike in cases.

On the plane

Gone are the days of filling out forms on your airline app or getting a wristband preflight for Hawaii. In fact, there is no indication at all during your predeparture or during the check-in process to suggest you are going to a state that had strict requirements as of one day ago.

I vividly remember the anxiety of making sure I had my paper bracelet from Alaska Airlines that indicated my papers were in order on my last trip to Hawaii.

This time there wasn't even a mention of any COVID-19 rules before or during the flight. The only thing you have to do is fill out and hand in your agricultural declaration form to the flight attendants. No mention on that form of COVID-19.

Arrival in Honolulu

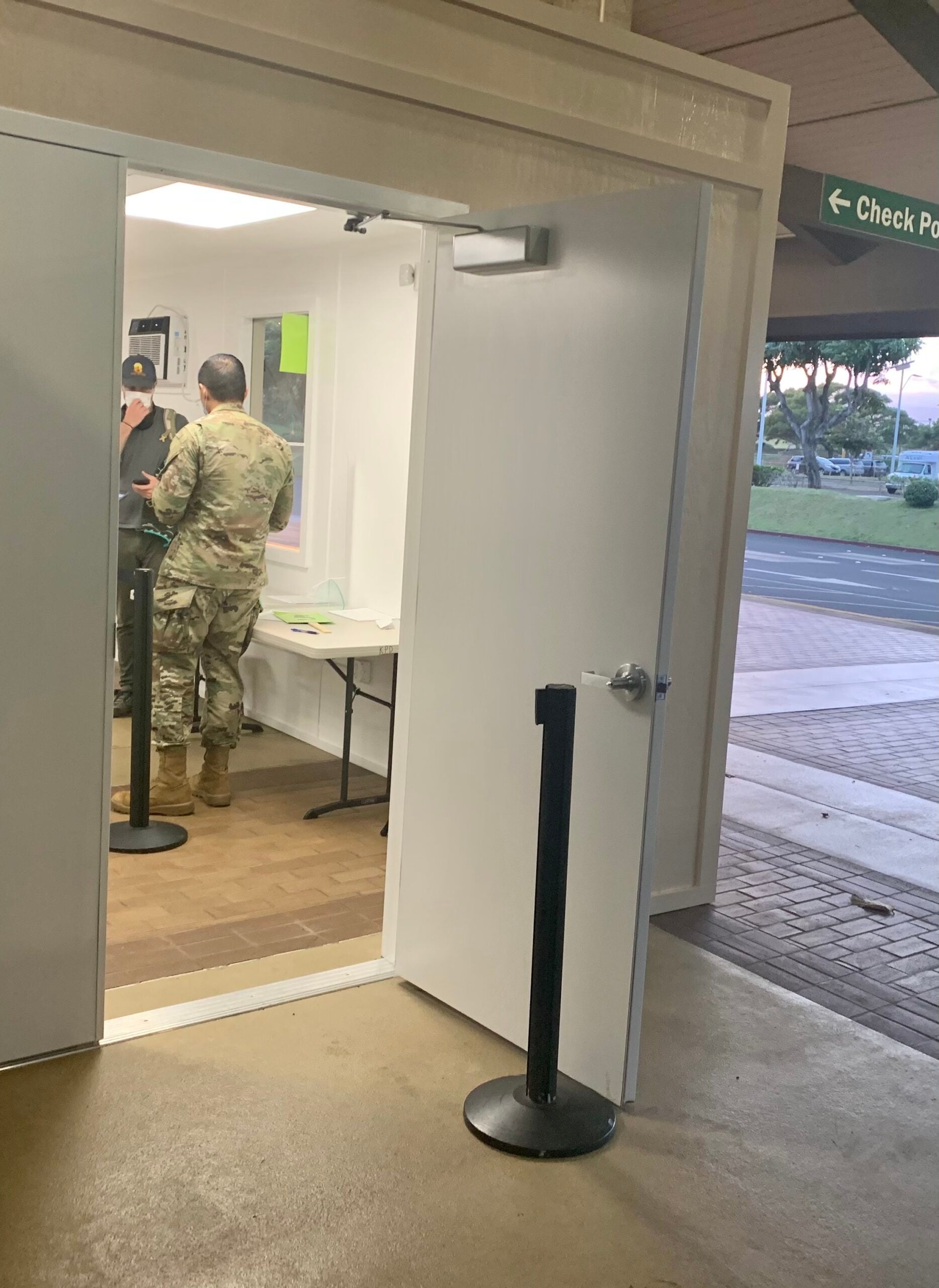

Again, getting off the plane in Honolulu was just like getting off the plane in any other state. No screenings or questions from employees and certainly no testing. Contrast that with my trip to Kauai in January of 2021 where I was greeted by workers in full PPE, rigorous questions and even National Guard soldiers.

Once you deplane, you are good to go. Talk about easy! The whole process was so much simpler this time. Each time I've been to Hawaii during the pandemic, it's gotten easier and this time was just like pre-pandemic. In fact, there was no signage or warnings about the pandemic at all.

Off the plane and into paradise.

What does it mean for tourism?

The return of easy access for tourists will no doubt be a huge boost to the state of Hawaii's coffers. It got a majority of its private income from tourism, including more than $2 billion in tax revenue in the pre-pandemic days of 2019.

Related: Fair warning: Hawaii is crowded again

Betsy Carlson was my seatmate on my Delta Air Lines flight from Atlanta to Honolulu. She was headed to Hawaii for spring break and said when she decided to come that any restrictions wouldn't stop her from coming. "I did think about them, but I didn't think it would stop me."

"It just makes travel there so much easier," she said. "Travel to Hawaii has been hard because of COVID. Now that there's no restrictions, people will be more inclined to go there."

"We are encouraged to see overall travel confidence growing and anticipate tourism's steady return," said De Fries.

But he also had a request for tourists, "As visitors come back to our shores, we ask that they travel mindfully and with intention to mālama (care for) our people and place. That means staying on maintained hiking trails, wearing reef-safe sunscreen, keeping a far distance from protected wildlife on land and in the ocean, supporting our local businesses, and celebrating our island way of life by participating in regenerative tourism activities."

He hints at some of the problems I found in Hawaii during my many visits too.

Why it's not all good news

One of the most popular articles I ever wrote for TPG was the one I mentioned in the intro about why I wasn't planning to return. Unfortunately, not all the problems I mentioned have gotten better. Prices are still high, staffing is limited, the crowds are likely to get even worse, and the tensions between Native Hawaiians and tourists remain. But one of the major barriers to entry for me and for many other tourists has now been lifted. I'm happy to report I'm back in Hawaii.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app