TPG staffer mistake story: The rental car misstep that cost me big time

Update: Some offers mentioned below are no longer available. View the current offers here.

Today, I want to share one of my own rookie mistakes that ended up costing me when I rented a car.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

Renting a car is always a stressful proposition for me. I've lived in New York and San Francisco for most of my adult life, and most of that time I didn't have a car or really even need to rent one very often. Once the pandemic hit, and I was staying out west at my father's ranch, I've been renting a car more and more often. I do not have personal car insurance, and I've always booked my rentals with my Platinum Card® from American Express to make sure I have primary coverage.

Related: Best credit cards for rental cars

Frankly, I've always worried that an accident might leave me vulnerable to damages that any car I rented caused, but that wasn't what bit me this time.

Related: How secondary insurance works for those without car insurance

It was bridge tolls! I meant to ask the clerk at Hertz in Santa Rosa where I picked up the little economy car about tolls, but they were not very friendly and I totally forgot. No one mentioned it when I checked out either. It would have been nice because there are not only several bridges that require tolls in the Bay Area, but there are an increasing number of toll lanes now as well.

I had to cross the Golden Gate Bridge, and I realized there was no way to pay cash for the $8 toll as I approached San Francisco after crossing the famed bridge. It's FasTrak only on the Golden Gate (in fact, right now because of COVID-19, no Bay Area bridges are accepting cash). That's when I realized I was likely to be getting a ticket or charged a fee of some kind.

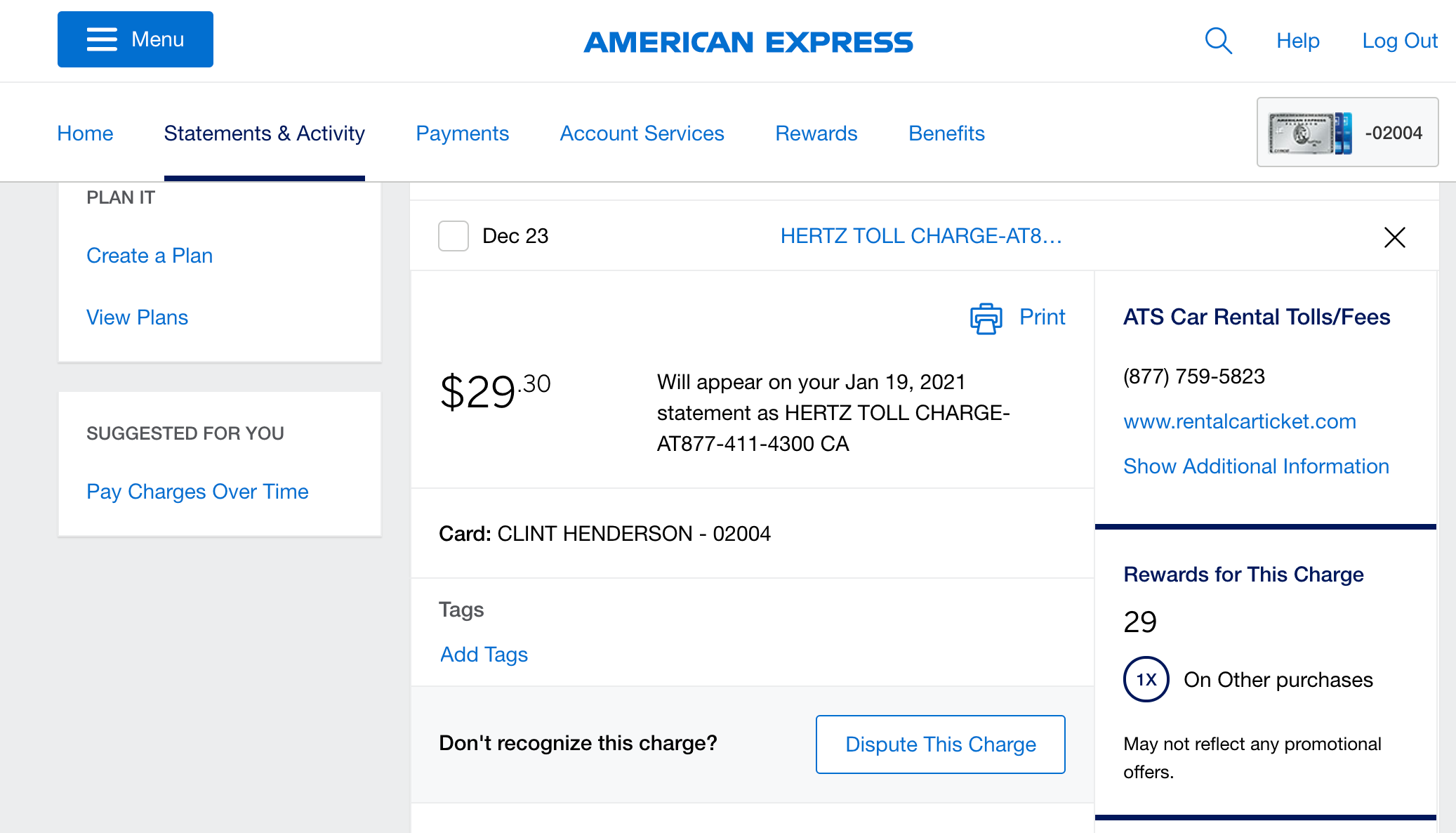

A system of cameras tracks license plates as they cross the bridge, and sure enough a few days later, I got an alert from American Express that a charge was added to my card. Instead of the $7.70 if I had used FasTrak, however, it was a whopping $29.30!

That's a more than 300% increase. Ouch.

I tried to figure out how the company that services tolls and tickets came up with that number, but I could not for the life of me figure out the website.

The third-party company that does the charge is called ATS and here is how they describe themselves:

"ATS Processing Services, LLC is an affiliate of American Traffic Solutions, Inc. (www.atsol.com), a leading provider of traffic safety, mobility and compliance solutions for state and local governments, commercial fleets and rental car companies. ATS' products include: photo-enforcement programs, electronic toll enforcement management, violation processing services, fleet violation management, and fleet title and registration services (www.atsol.com/solutions)."

I tried multiple ways to track my bill with absolutely no luck no matter how I tried to input the data.

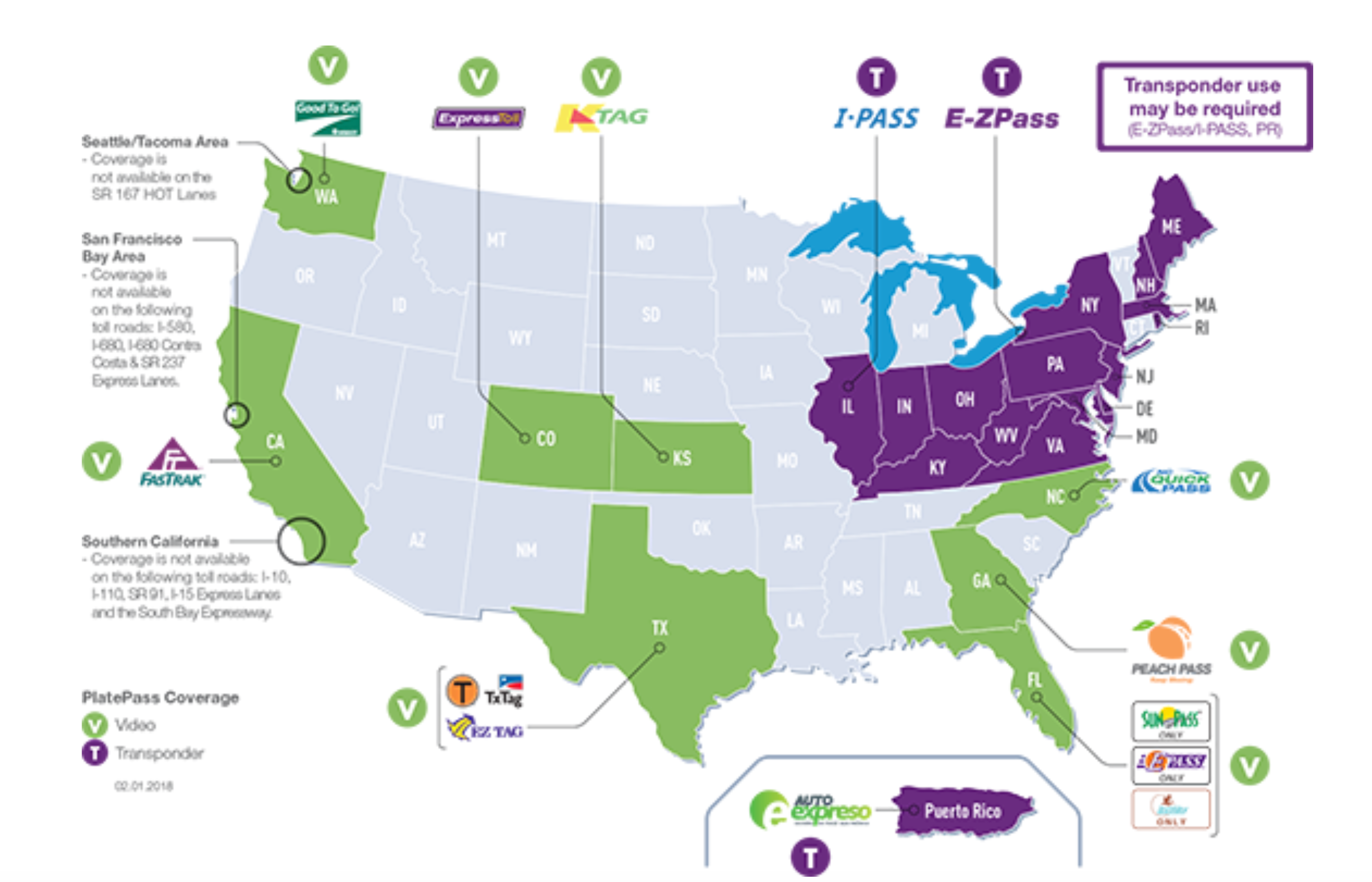

Hertz does have a way to escape the most onerous of the up-charges involved in tolls, but it's not exactly easy to find or understand. Their "PlatePass allows you to use cashless lanes or all-electronic tollways without using a personal transponder or paying the toll authority directly."

But as you can see from the image below it doesn't work on some Bay Area roads and express lanes. It also comes with extra fees. Not only will you be charged the toll, but you'll need to pay a $5.95 fee each day that you use it. That can add up quickly. Not as quickly, though, as the extra fees charged by any third party as I experienced.

I really feel like I got ripped off by Hertz in this case. They didn't offer the PlatePass at checkout even though they likely know most drivers in the Bay Area will need to be crossing toll bridges or roads at some point in their journeys. Nor did they tell me some bridges no longer accept cash.

I hope you can learn from my mistake. Be sure to ask your next rental car company about tolls. Sign up for the rental car company's toll program or better yet sign up for the area transponder service in advance. FasTrak, for example, has a special program for rental cars. You can sign up ahead of time and add your rental car. That would have been the cheapest option for me.

Please email your own travel mistake stories to info@thepointsguy.com, and put "Reader Mistake Story" in the subject line. Tell us how things went wrong, and (where applicable) how you made them right. Offer any wisdom you gained from the experience, and explain what the rest of us can do to avoid the same pitfalls.

Feel free to also submit your best travel success stories.

Due to the volume of submissions, we can't respond to each story individually, but we'll be in touch if yours is selected. I look forward to hearing from you, and until then, I wish you a safe and mistake-free journey!

Featured image by Clint Henderson/The Points Guy.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app