These Are the Worst Airlines for Losing Your Luggage

We've all been there: The baggage claim area, just a while ago filled with tired travelers, has cleared out. You stand bagless, staring frustrated as the carousel comes to a halt. Losing a bag can be a nightmare, and while no airline can guarantee your baggage makes it safely 100 percent of the time, a recent study ranked the airlines most likely to lose your bags.

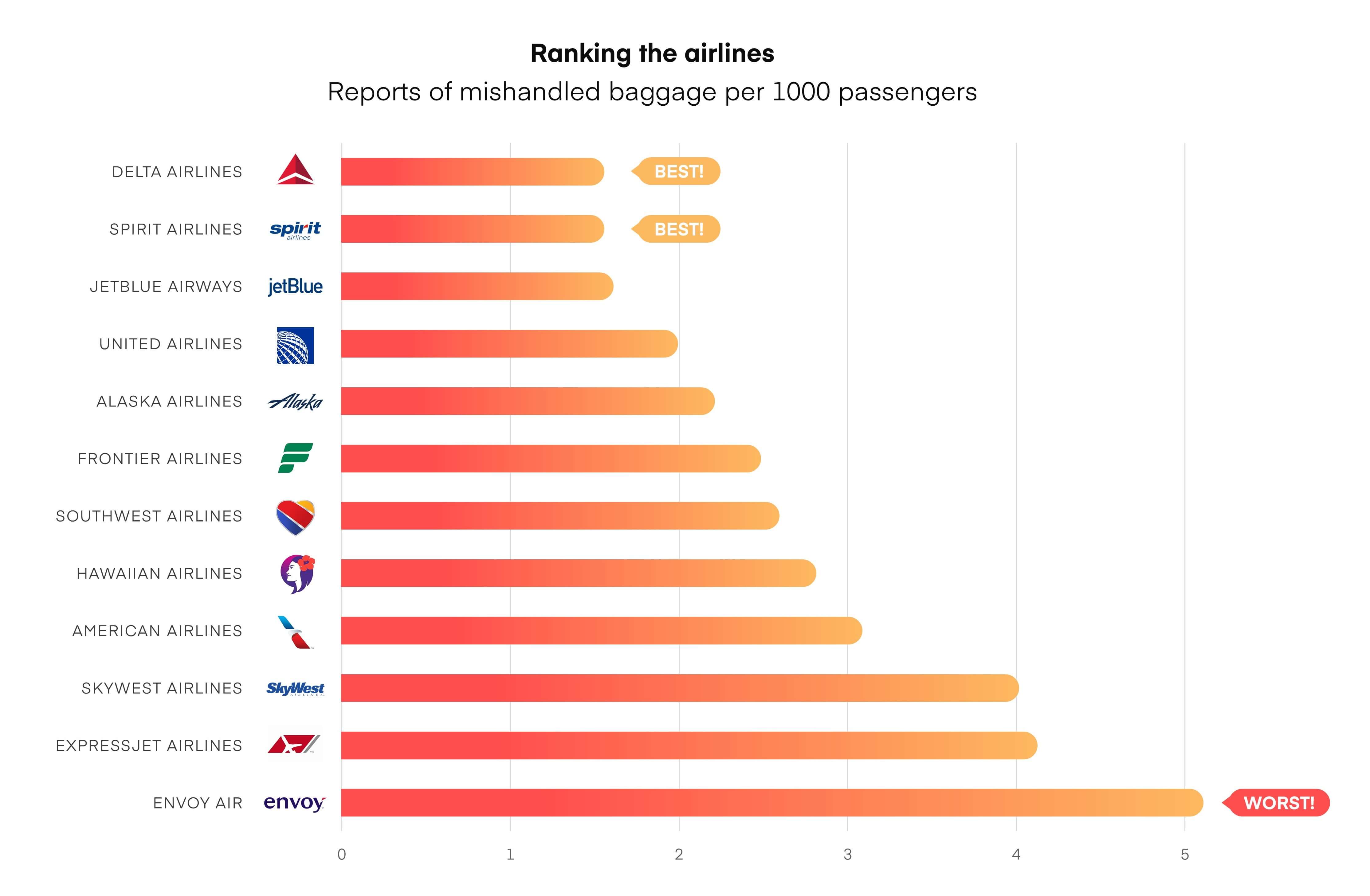

Research conducted by LuggageHero showed that Delta and Spirit Airlines reported the fewest mishandled bags among the 12 prominent carriers in the study. At the bottom of the list: Envoy Air.

According to LuggageHero, Envoy has received double the complaints of those at the top of the list.

LuggageHero expects to see 568,000 mishandled bag reports filed this summer alone, while around 228 million passengers will travel on the airlines observed in the study.

Figures from the US Department of Transportation show that while over half a million pieces of baggage are projected to be lost, damaged, or misdirected on domestic flights this year, these mishaps are declining.

Since 2012, complaints have dropped by 27%, and no major US airline is performing worse, which is a promising sign. In September of 2017, US airlines reported 1.99 mishandled bags per 1,000, the lowest this number has been in the past 30 years.

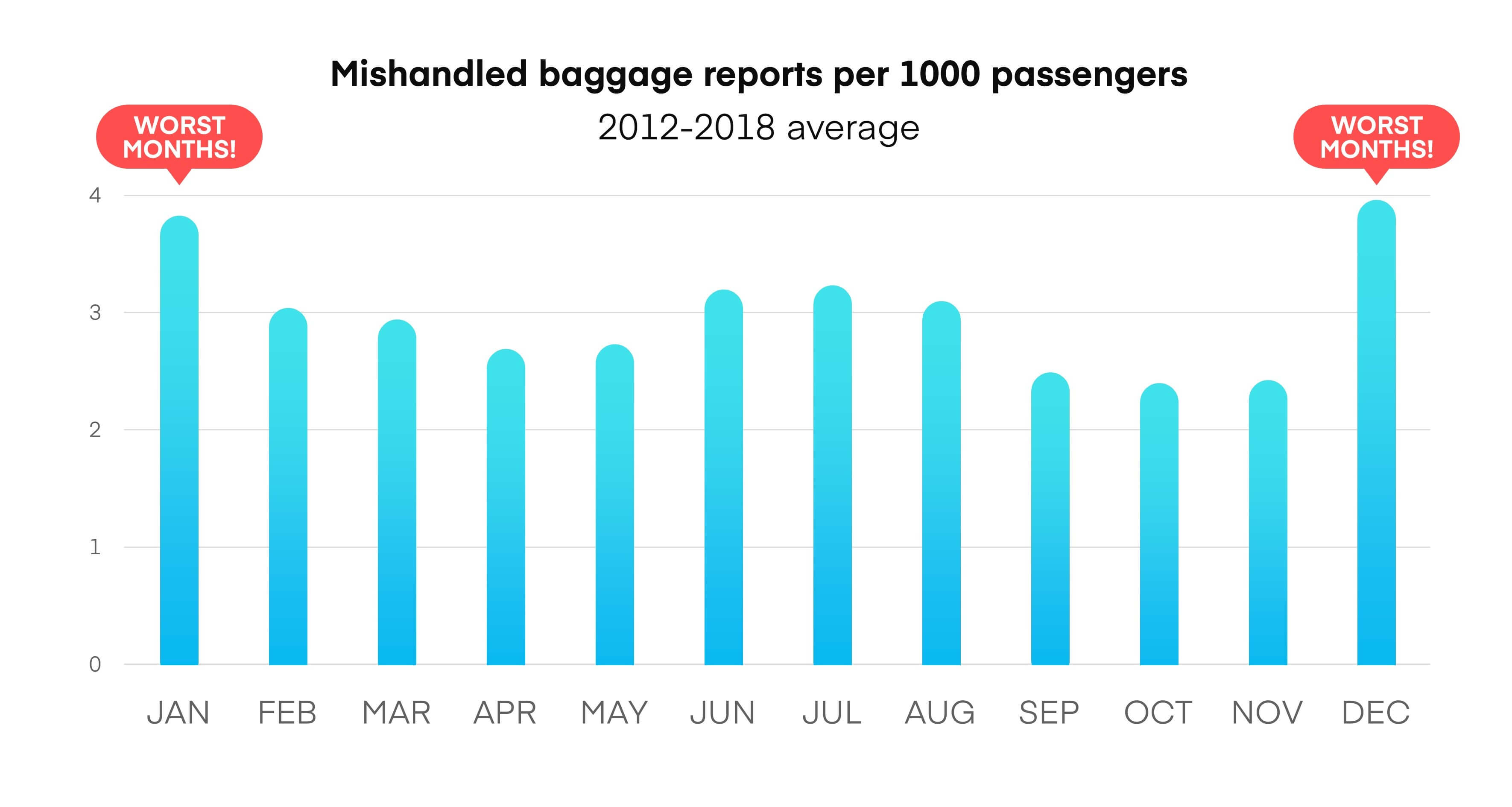

At the end of the day, there isn't much you can do to prevent the loss of luggage once in the hands of the airline. Between 2012 and 2018, the worst months for mishandled baggage were January and December, with October having the fewest reports.

LuggageHero recommends that if you lose a bag, don't waste any time. Be sure to document the contents of the bag — or the damage, in case your bag is returned damaged — as much you can, and file a report with the airline.

The US Department of Transportation rules say that your baggage is insured up to $3,500 domestically, but to collect this money, all of the necessary forms need to be filled out, and there has to be clear proof of the loss.

Otherwise, cover your bases by locking your bags (with a TSA-approved lock) and keeping things like medications and car keys in your carryon.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app