Spirit Airlines unveils big Philadelphia expansion with 7 new routes

Spirit Airlines is growing its Philadelphia network in a big way beginning early next year.

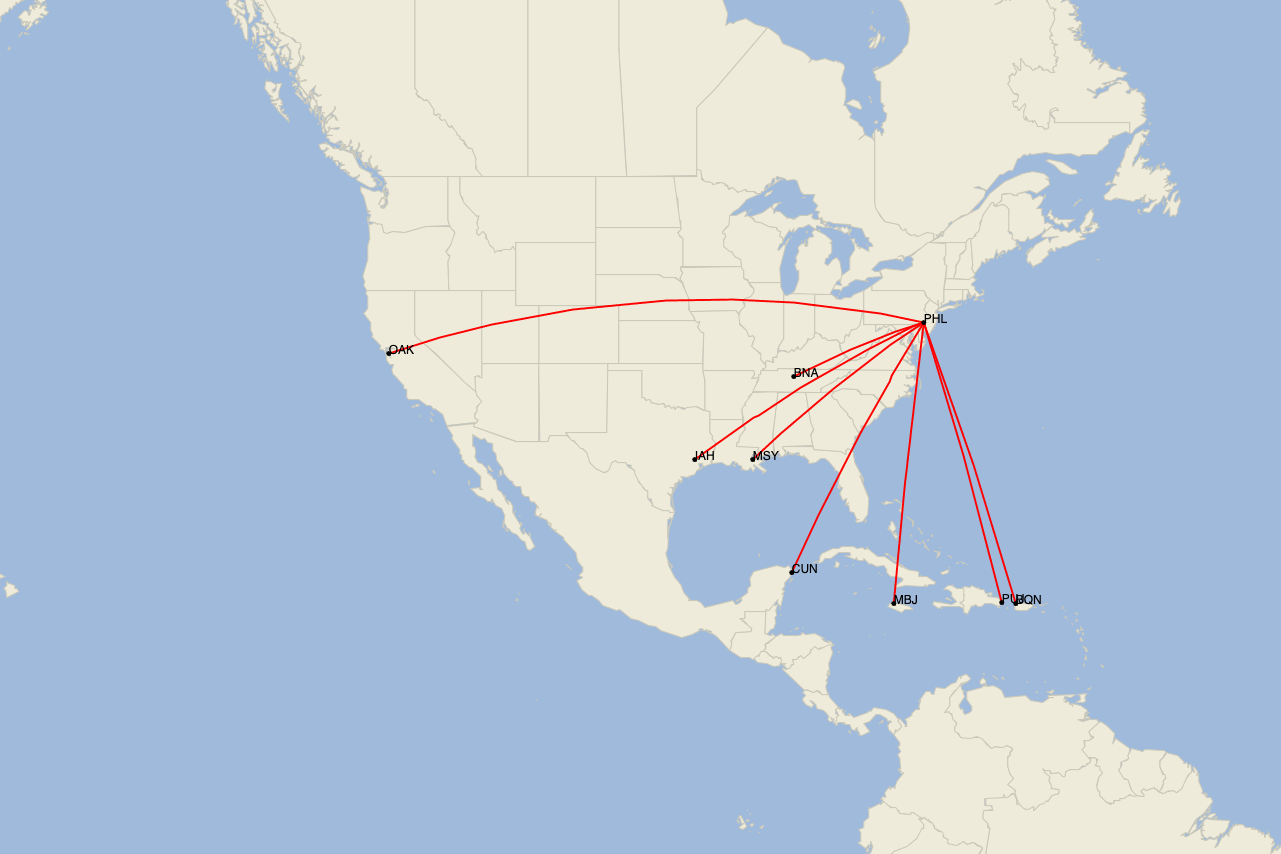

The Miramar, Florida-based carrier is adding seven new routes from Philadelphia, as well as increasing existing service to Cancun (CUN). The expansion begins on Feb. 16 and continues throughout the first few months of 2022.

You'll find the full list of new routes at the bottom of the post, but highlights include tapping into two unserved markets from Philly through a big growth spurt in terms of airport real estate.

2 unserved markets from Philly

While the expansion is noteworthy for Spirit, it's also a big deal for the airport as a whole: two of the seven routes are to previously unserved destinations from PHL.

This includes Aguadilla, Puerto Rico (BQN); and Oakland, California (OAK). "How often do you get a chance to go into brand-new markets from a fortress hub," John Kirby, Spirit's vice president of network planning, told TPG in an exclusive interview about the expansion. American Airlines is the largest carrier in Philly, with over 350 daily departures. The second-largest carrier in Philly (either Delta or Frontier, depending on the month) has just over 50 daily departures.

As for adding connecting Philly with Aguadilla, Kirby explained that there's "a very large Puerto Rican population in the area."

Even so, the airline will seemingly need to stimulate lots of demand to make its new route work. In 2019, there were under ten daily passengers flying between Philly and Aguadilla, according to Department of Transportation data analyzed by Cirium. (Spirit's smallest aircraft, the Airbus A319, seats 145 passengers.)

Kirby isn't worried, though. "We serve Aguadilla today [from Fort Lauderdale and Orlando], and it is a very strong market for us. A lot of people going to Puerto Rico... their family and their friends are from the western coast [closer to Aguadilla]. If they have to, they'll fly into San Juan. But this is offering them an alternative to maybe go closer to where they want to go."

There were over 530 daily passengers flying between Philly and San Juan in 2019 on average. If a chunk of that market could be convinced to fly to Aguadilla instead, then Spirit's new flight might be successful.

A similar story is true in Oakland. Department of Transportation data analyzed by Cirium shows that only 39 passengers on average flew between Philly and Oakland per day in 2019.

But again, Kirby believes he has good reasoning for flying to Oakland. "People have to use San Francisco today because there is no Oakland service [from Philly] or they have to go on a connection," he said. "We think the market is much bigger than it appears to be in the Cirium data," he added.

He may be correct. Southwest last flew between Philly and Oakland in October 2007. At the time, there were over 100 passengers per day on Southwest's nonstop according to Department of Transportation data — which bodes well for Spirit's Oakland ambitions.

Doubling Spirit's footprint at PHL

Spirit's Philly expansion has "been in the works for a while," according to Kirby.

As for why the airline waited until now, it largely boils down to getting space at the airport. Kirby cited what he described as the tireless effort of his long-time friend Jim Tyrrell, PHL's chief revenue officer, and Chellie Cameron, PHL's CEO, for working to facilitate Spirit's expansion.

To support the new flights, Spirit will be taking over two additional gates in the airport's Concourse E, bringing the total number of gates that Spirit uses to four.

The airport didn't build new gates for Spirit. Rather, "the airport took back two Southwest gates because they had seven gates, and they only had eight operations. The airport is willing to make moves if they feel like there's an opportunity and resources being underutilized," according to Kirby.

In addition to doubling the number of gates, "we're also going to be expanding our ticket counter space in the beginning of the year. We're going to double the size with double the number of kiosks there," Kirby said.

This is about growth, not competition

Perhaps the biggest network-focused story this year from Spirit Airlines is the launch of service from Miami — historically a fortress hub for American Airlines. With 31 routes, Spirit is poised to become the second-largest airline in Miami after American.

Though the Philly expansion shares a similar strategy — growth in an incumbent carrier's fortress hub — Spirit views this one differently. In Kirby's mind, this is less about competing with American (and to an extent Frontier), and more about the natural growth trajectory for Spirit's Philly station.

"A lot of it is how we do in the markets that we're going to," Kirby answered when asked about his perspective on the expansion.

"We do really well in Cancun and Punta Cana and Montego Bay. So those are natural destinations, and they fit our model. And we think that there's an opportunity to drive fares even lower and fill our airplanes... It's as much about growing in Philly as it is growing in some of these destination markets that we do very well in," he continued.

Other than the new flights to Aguadilla and Oakland, Spirit will be going head-to-head against American and Frontier on its five other new flights. Plus, Southwest also flies between Philly and Nashville, and United flies between Philly and Houston.

It'll be interesting to follow the performance of Spirit's Philadelphia expansion, but one thing is for certain: there's going to be more competition than ever for the City of Brotherly Love.

Full list of Spirit's new and expanded Philadelphia service

| Origin | Destination | Launch date |

|---|---|---|

Philadelphia (PHL) | New Orleans (MSY) | Feb. 16 |

PHL | Aguadilla, Puerto Rico (BQN) | April 20 |

PHL | Nashville (BNA) | May 11 |

PHL | Houston (IAH) | May 11 |

PHL | Punta Cana, Dominican Republic (PUJ) | May 18 |

PHL | Montego Bay, Jamaica (MBJ) | May 18 |

PHL | Oakland (OAK) | May 18 |

PHL | Cancun (CUN) | Increasing service April 20 |

PHL | Atlanta (ATL) | Existing service |

PHL | Dallas/Fort Worth (DFW) | Existing service |

PHL | Detroit (DTW) | Existing service |

PHL | Fort Lauderdale (FLL) | Existing service |

PHL | Fort Myers (RSW) | Existing service |

PHL | Las Vegas (LAS) | Existing service |

PHL | Los Angeles (LAX) | Existing service |

PHL | Miami (MIA) | Existing service |

PHL | Myrtle Beach (MYR) | Existing service |

PHL | Orlando (MCO) | Existing service |

PHL | San Juan (SJU) | Existing service |

PHL | Tampa (TPA) | Existing service |

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app