Southwest's new enhancement to tracking Travel Funds

Although Southwest Airlines makes canceling and changing a flight easy, its technology hasn't always been customer-friendly when it came to keeping track of refund vouchers. Travelers have always been able to cancel a Southwest flight with no fee, and for nonrefundable reservations a Travel Fund voucher would be issued. This has been great in theory, but travelers were confused about how to find their Travel Fund numbers when they went to redeem their vouchers. Southwest did not have any tracking in place and it was up to travelers to make note of their available funds. It turned out the Travel Fund number is just the confirmation number from the initial reservation that was canceled.

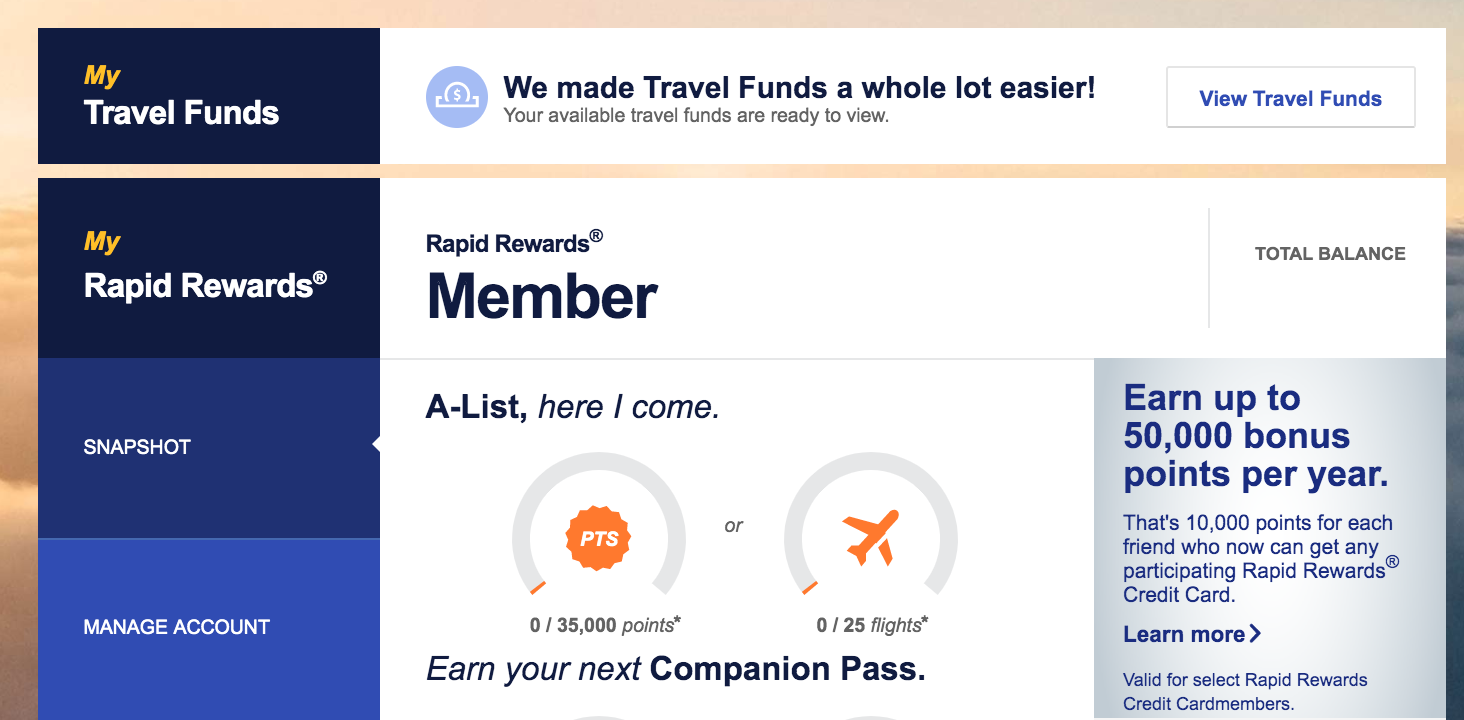

That all changed for flights canceled on or after Dec. 3, 2019. According to Deals We Like, Southwest will now keep track of your Southwest Travel Funds for you. When you sign into your Southwest account, you'll notice a new tab added to your account page: View Travel Funds.

Related: The best Southwest credit cards of 2019

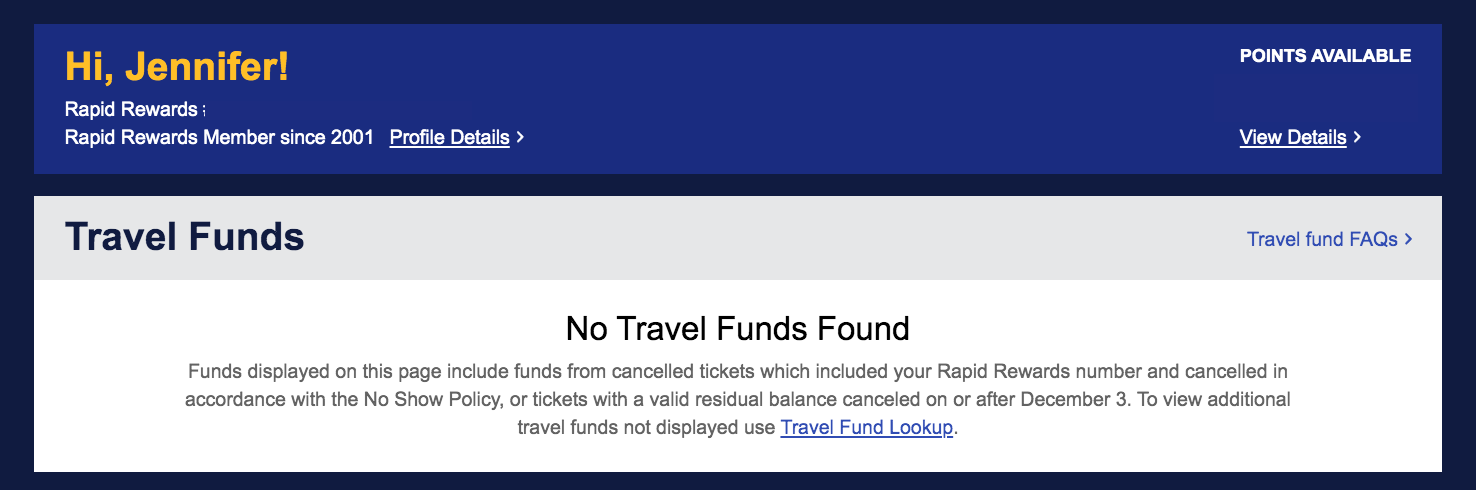

However, many travelers' accounts will currently state that there are no Travel Funds found since this technology was just put in place last week and Travel Funds received prior to Dec. 3, 2019 still need to be tracked manually. You can still check your balance on Southwest's Travel Fund lookup page. As of now, there is no way to add them to the account tracker.

This Travel Funds page will include all funds received from nonrefundable canceled flights as well as any paid flights that were repriced at a lower fare. Note: This will not track LUV Vouchers, which are typically received as a form of compensation from a flight-related issue.

Related: How to reprice a flight when the fare decreases

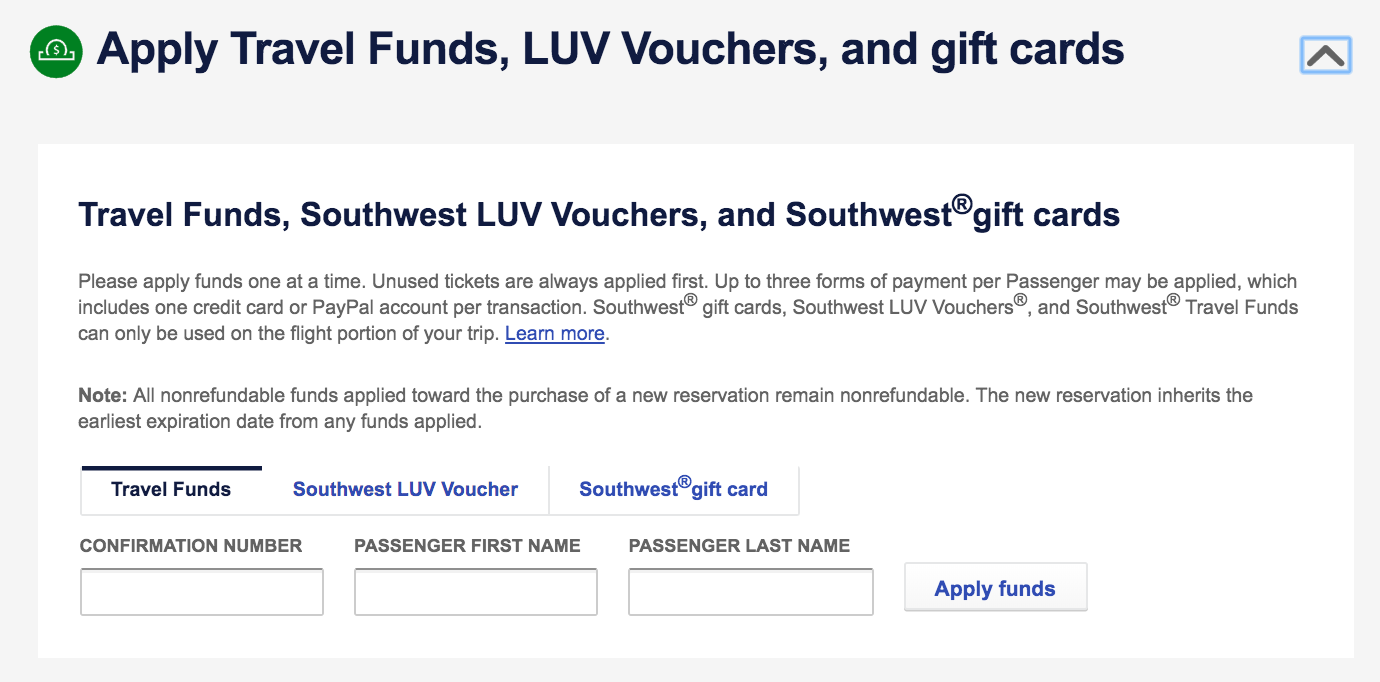

When you go to pay for your flight, you'll still have to manually enter your Travel Fund information. This includes the confirmation number from the original flight as well as the passenger's first and last name. Keep in mind that Travel Funds, unlike LUV Vouchers, aren't transferrable.

Travel Funds expire 12 months from the date the original flight was booked — not from when the flight was canceled and the Travel Funds issued. This expiration date is also a "must-fly-by date" not a "book-by date." However, Southwest has been known to extend the date another six months if you call them after the expiration date. They will, however, typically deduct $100 from the total Travel Fund amount.

Also know that when combining a Travel Fund with another form of payment, if you cancel the latest reservation, the entire amount paid will inherit the earliest expiration date. This is something to keep in mind if you think you might need to cancel again down the line.

Related: Southwest Travel Fund reader mistake story

Bottom line

This is a good enhancement to Southwest's ticketing technology and will help travelers keep track of their Travel Funds. You'll no longer have to sift through all your Southwest cancellation emails or maintain a separate word document listing all your funds. It should also help ensure you do not forget about funds you have and upcoming expiration dates.

Related: Battle of the Airlines: Why I think Southwest Airlines is the best

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app