Have teddy bear, will travel: Southwest goes above and beyond for young passenger

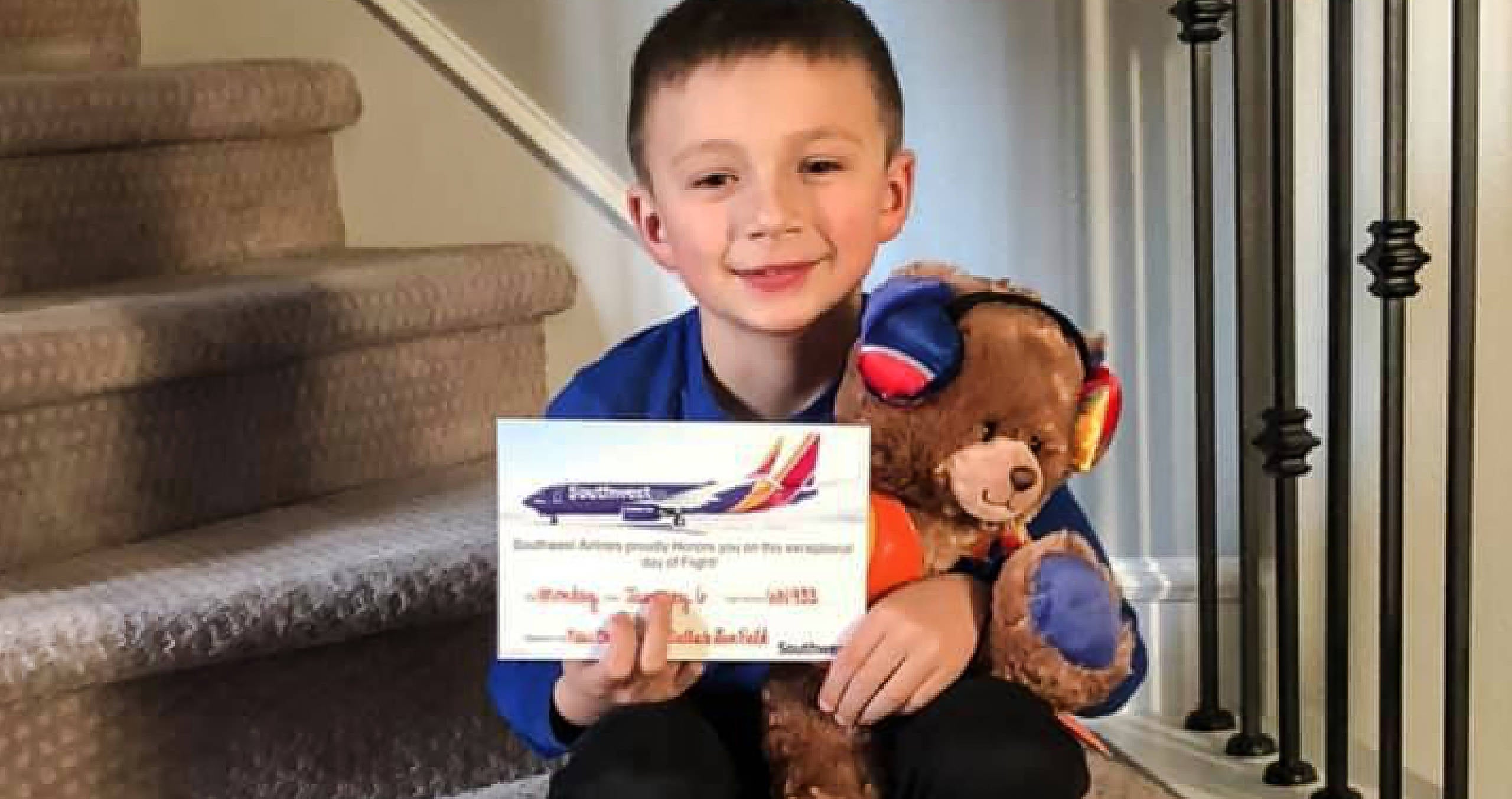

As the beloved Toy Story franchise suggests, a child's best friend often is a favorite toy. But when seven-year-old Grayson walked off of Southwest Airlines Flight 933 over Thanksgiving 2019, he left behind his beloved teddy bear.

"I know this is a long shot request," Grayson's mother, Chrissy Mulligan, wrote on Southwest's Facebook page, but "If anyone finds this bear could you message me? Again, I know this is a crazy request, but I promised my little guy we'd try to find him."

Sadly, Grayson's original bear was nowhere to be found despite everyone's best efforts — and a whopping 21,000 Facebook shares.

"There was a gray area from when the flight attendant found Teddy to when she gave him to someone at the New Orleans airport," Chrissy said on Facebook. "Teddy was never turned in to the lost and found."

The story did, however, grab the attention of Southwest's corporate headquarters, who directly reached out to Chrissy to share an update on Teddy's situation.

"We're so sorry" wasn't good enough for Southwest's legendary customer service representatives, who asked Chrissy if they could send Grayson a special surprise: A new teddy bear named Jack. "Mom said YES," Southwest proclaimed on Twitter.

But that's not all Southwest did for Grayson. Jack turned out to be no ordinary plush toy. Before boarding his flight to Grayson's home, Jack made a tour of Southwest's aviation facilities and documented his adventures in a customized storybook, which was also delivered to Grayson.

"Hi, Grayson!" Jack says in the picture book. "It's been a busy holiday season here at Southwest Airlines, and I'm almost done with my work here. Guess what?! I get to come live with you! I'm so excited about meeting my new best friend. I wanted to share some pictures of what I do at Southwest, and my trip to meet you!"

The book goes on to depict Jack directing planes, visiting the cockpit, tidying up the cabin, booking his own flight to meet Grayson, printing out his boarding pass and even pouring himself a cup of "cran-beary" juice before putting on his seatbelt.

"Thank you, Southwest!" Chrissy wrote in a now-viral Facebook follow-up post. "You made this little boy who lost his Teddy... one very happy little guy today."

The project was the brainchild of Southwest employees Adam Scott and Adrienne Butcher, part of Southwest's Social Care team, who worked with a number of colleagues to make things right for young Grayson.

"You have some very special people who work for this airline, with some of the kindest hearts," Chrissy said in her Facebook post to Southwest Airlines. "This story alone is adorable! I know Teddy was never found, and we know there were so many people involved in finding him, and our other post was shared over and over again to try and find him. We were very overwhelmed with the response it received. Keep doing what you do! You're [sic] customer service goes above and beyond any other out there!"

Judging by the comments on Chrissy's post, many customers, young and old, agree with her sentiments. "That's why I fly Southwest — their flight crews are the best," one commenter responded. "Thanks for all you do." "Southwest is a [sic] airline that cares," another said. "I always fly Southwest always, and feel comfortable when I am in their care. I am in my 80s and smiling."

Southwest senior specialist Derek Hubbard told TPG that Southwest is "proud to have played a small role in bringing Grayson and Jack together."

"We love connecting people to what's important in their lives," Hubbard said, "and our employees put their servants' heart on display to help make Grayson's day."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app