Stop at this vending machine in the Orlando airport to save on car rental fees

It's no secret that a car rental can be expensive. It's not just the rental rates themselves that can sting — once you pile on all the added fees, the true sticker shock can really sink in.

Some of those car rental fees can't be easily avoided, but others can. One fee that is actually pretty easy to avoid — at least if you are heading to Orlando — is the daily toll convenience fee.

On a recent trip to the Central Florida area, I found myself hit with almost $18 in toll convenience charges from the rental company for the three days I drove around in a car rental on a few toll roads. Those charges, for the sake of absolute clarity, are an entirely separate item from the tolls themselves.

I go to Orlando enough for both work and pleasure that I decided I'd had enough of the added $5.95-per-day "toll convenience fee" tacked on by the rental car company and I looked for a better solution.

Luckily, there is a solution to avoid this fee. The Orlando area's Visitor Toll Pass allows you to use the large number of area toll roads without being hit with an added fee from the car rental company just for that privilege.

Here's how the Visitor Toll Pass works — and whether I think it's worth your time.

[table-of-contents /]

What is the Visitor Toll Pass?

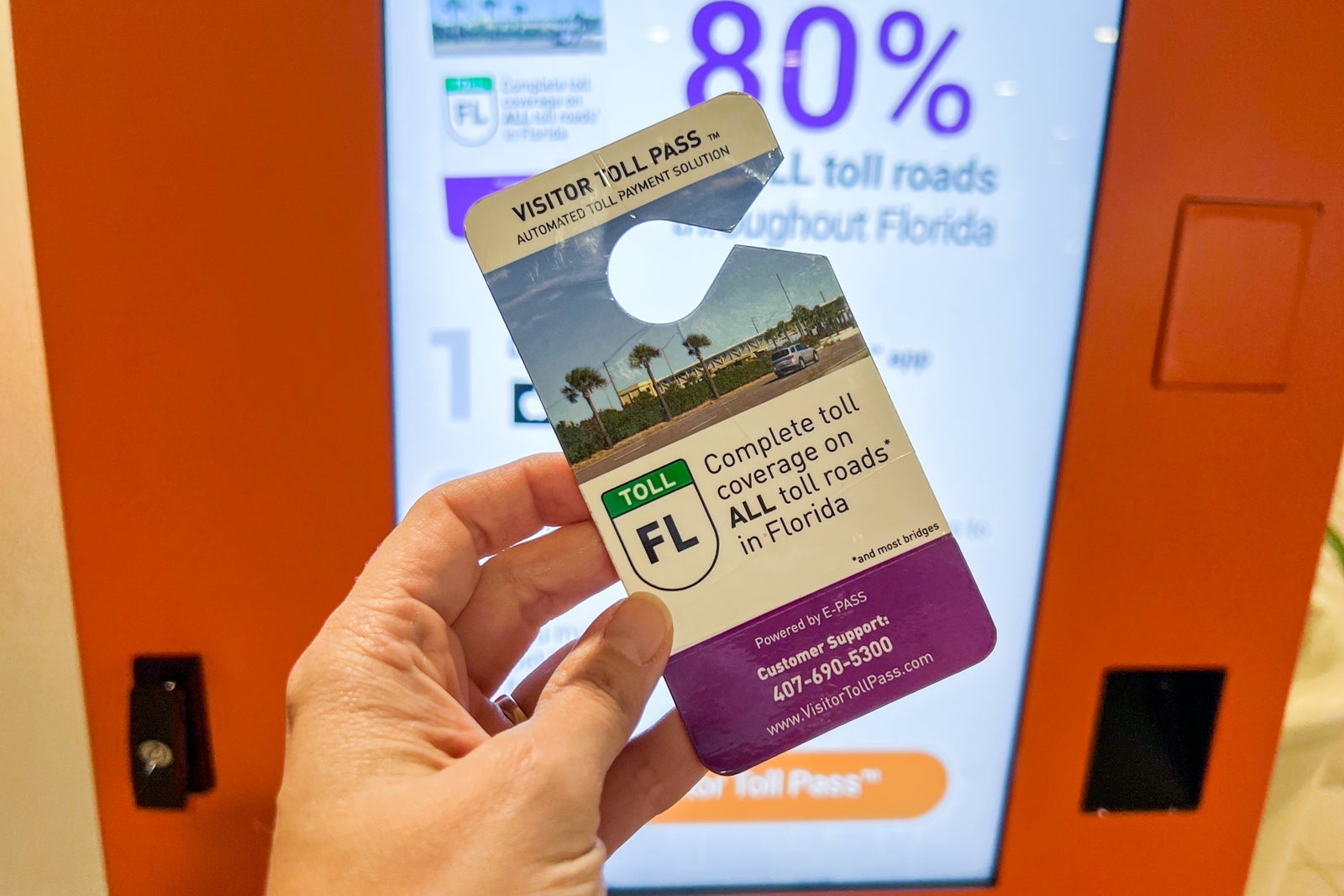

The Visitor Toll Pass is a way to use the Florida toll roads without having to pay any extra fees to do so. It's a physical tag that hangs on your rental car's rear-view mirror that you can pick up and drop off in the Orlando International Airport.

How to use the Visitor Toll Pass

I signed up for the Visitor Toll Pass on my phone while eating a snack in the food court at the Orlando airport. You do need the app, but then you simply input your identifying information, a credit card, which rental car company you are using and the dates and time of your trip.

It probably took no more than two minutes to enter that information. Then, as you are on your way to pick up the car rental in the Orlando airport, just stop by the Visitor Toll Pass vending machine. It's located in Terminal A, on Level 1 near all the car rental desks. At the vending machine, you scan a barcode from your app and out pops a toll tag to hang on your rental's rearview mirror.

There were two Visitor Toll Pass employees on hand to assist when I was there.

With the pass in hand, head to your car rental. Once you know which car is yours, enter its license plate into the Visitor Pass app so that the system can tie your toll road use to the car you are in. The instructions also indicate you need to decline the toll option with your car rental company or risk getting double-billed.

At the end of your trip, just drop the pass back in one of the mailbox-like containers as you leave the car rental area and head into the terminals. If you forget that step, you will be hit with a $10 fine, so try to remember.

Related: How to avoid waiting in car rental lines

Is it worth it?

On this trip, for the two days that I was on toll roads in Orlando, I was only charged the $4.74 in tolls we utilized instead of spending that amount plus almost an extra $12 in convenience fees from the car rental company. Note that the program bills $10 initially to your card but then refunds any difference if you don't spend all $10 on tolls.

Getting and using the Visitor Toll Pass added no more than 5 minutes to my trip, and at least half of that was on the initial app set-up — something I won't have to repeat next time.

I have no problem spending extra money for things that are worth it — but I also have no problem spending a couple of minutes of my time visiting a vending machine to avoid another rental car fee while in Orlando.

For me, the Orlando Visitor Toll Pass was both easy to use and totally worth it.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app