Calling all ‘Money Heist’ fans: Netflix brings an immersive escape-room style experience to New York

If you live in New York City and love escape rooms, there's a new "Money Heist" themed experience you should check out.

Netflix and event company Fever have teamed up for an "immersive superproduction" that allows ticket holders to participate in the action of a simulated heist — all based on the series "Money Heist."

Want more from TPG? Sign up for our daily newsletter.

If you're unfamiliar, the Spanish show follows a group of criminals as they attempt a massive heist at the behest of "The Professor." It's become an international hit since it first aired in 2017.

While the experience doesn't follow the exact same plot of the show, fans of the series will definitely see similarities — including the red jumpsuits you don to pull off the job. However, you don't have to be an avid watcher of "Money Heist" to enjoy the experience.

When we first read about the experience, I knew I had to try it, and TPG social media manager Mimi Wright graciously offered to go with me.

Booking tickets

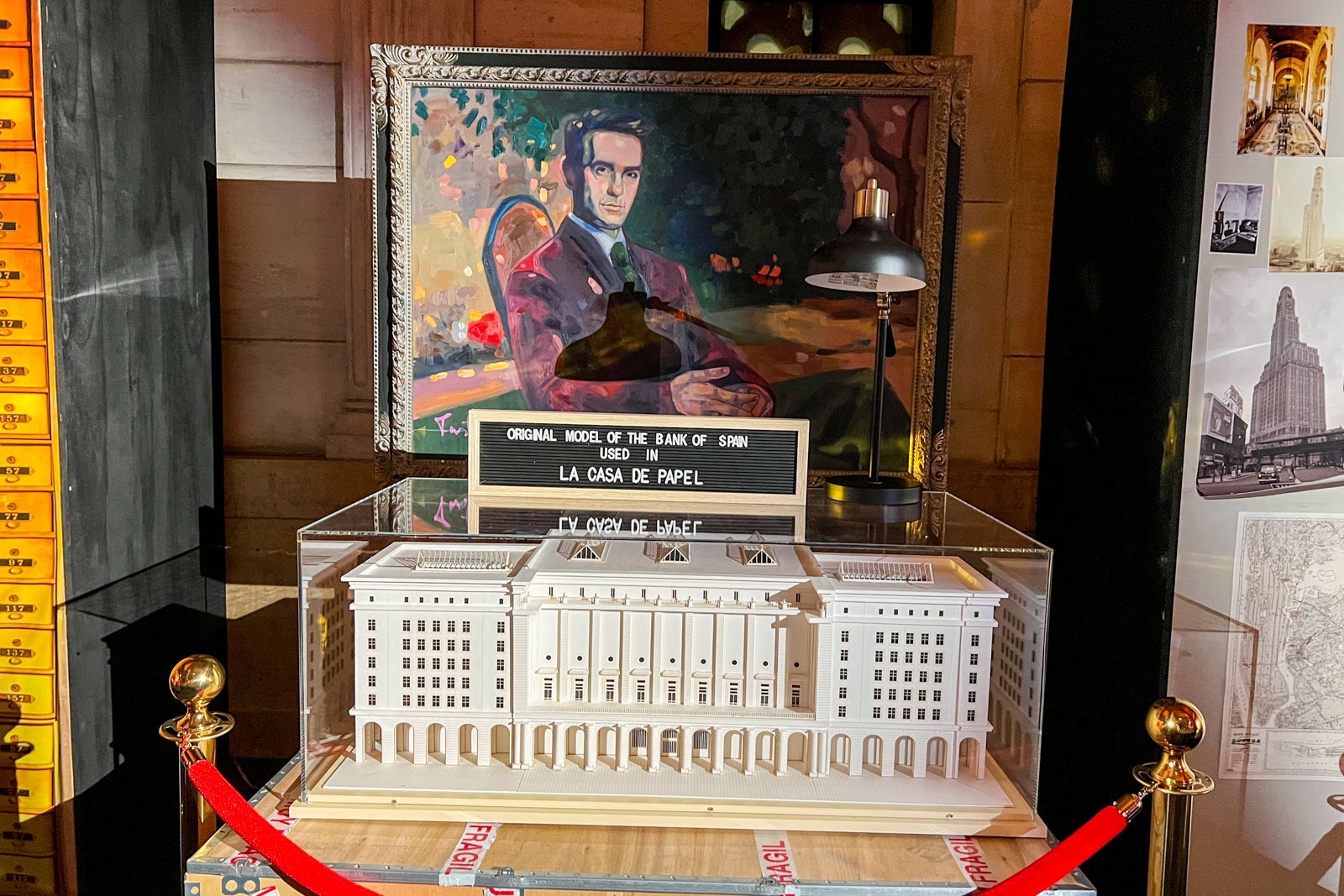

You can book the experience on Fever's website for dates throughout January and February 2022, located at 1 Hanson Place in Brooklyn (a stunning building that used to be the Williamsburgh Savings Bank Tower, an important detail that they use in the experience itself).

Tickets are available Thursday to Friday from 4 p.m. to 9 p.m. and Saturday and Sunday from 11 a.m. to 9 p.m. The experience lasts around an hour, but you'll want to arrive 20 minutes early and plan to stay after for pictures and the bar.

Tickets start at $49 per person, but prices vary depending on the date and time. Including taxes and fees, our two tickets were $136 in total.

It's slightly more expensive than your average escape room (which usually hovers between $35 and $50 per person depending on the venue and type of escape room), but this is also a much more involved production.

You do have to be a minimum of 14 years old to participate, but the recommended age is 16 and older.

You'll also need to bring proof of vaccination and wear your mask over your nose and mouth throughout the entire experience.

Related: How to travel to New York City on points and miles

Pulling off a heist

When we booked our tickets, we truly didn't know what to expect. I'd never watched the show (though I've now added it to my list), and the website is understandably a little vague about what exactly the experience entails.

It has the bones of an escape room: A group of individuals working together to complete tasks, riddles and more. But, this experience goes much further.

When you walk in, you go through security, sign in and hand over your coats and purses. I recommend keeping your phone and a card with you — you can't record video to take photos during the experience itself, but you'll want both after you finish the mission and have access to the photo and bar areas.

Once we were squared away, we were instructed to wait in a sectioned-off area for the rest of our group. You're asked to come up with a city, state or country as your code name (a nod to the show — Mimi and I chose Berlin and Manila, respectively). We mingled with the others in our group before being led downstairs to where the action begins.

I won't give away the plot — where's the fun in that? — but there are a few things to note about the experience as a whole.

This is a professional production where you get to play a role in the plot of a heist. Actors in costumes guide you through the different sets with sound effects and fight sequences and realistic weapons. You'll be yelled at by actors playing the role of hardened criminals, and you'll interact with them, some allies and some enemies.

Personally, I was delighted throughout most of the evening. But if you're sensitive to loud bangs, flashing lights, yelling or uncomfortable with realistic-looking weapons, this may not be the experience for you. No weapons are fired and the fight sequences are staged with ample distance away from participants, so it's all very safe, but it could be a bit jarring for kids or even some adults.

Once you've completed your mission, you get to celebrate with drinks from a concession-style bar. The bar was a bit disappointing (expensive drinks that weren't that great, in my opinion), but the pictures were fun and the overall experience was excellent.

Bottom line

The evening surpassed my expectations. The plot seamlessly integrated hand sanitization and other COVID-19 safety into the experience, and the actors were extremely entertaining. Plus, how often do you get to say you spent a Sunday evening in a red jumpsuit stealing fake gold from an old bank in Brooklyn?

It does mimic an escape room atmosphere in some ways, so if you aren't a fan of those, you likely won't enjoy this. However, if you're like me and are willing to suspend your disbelief for an evening of fun while you pretend to rob a bank in Brooklyn? It's definitely worth trying with a group of friends one weekend.

This is a temporary event that only lasts through February 2022, so if you're interested, you'll want to grab your tickets soon. At the time of writing, there was pretty open availability on the website, but that could change in the coming weeks.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.